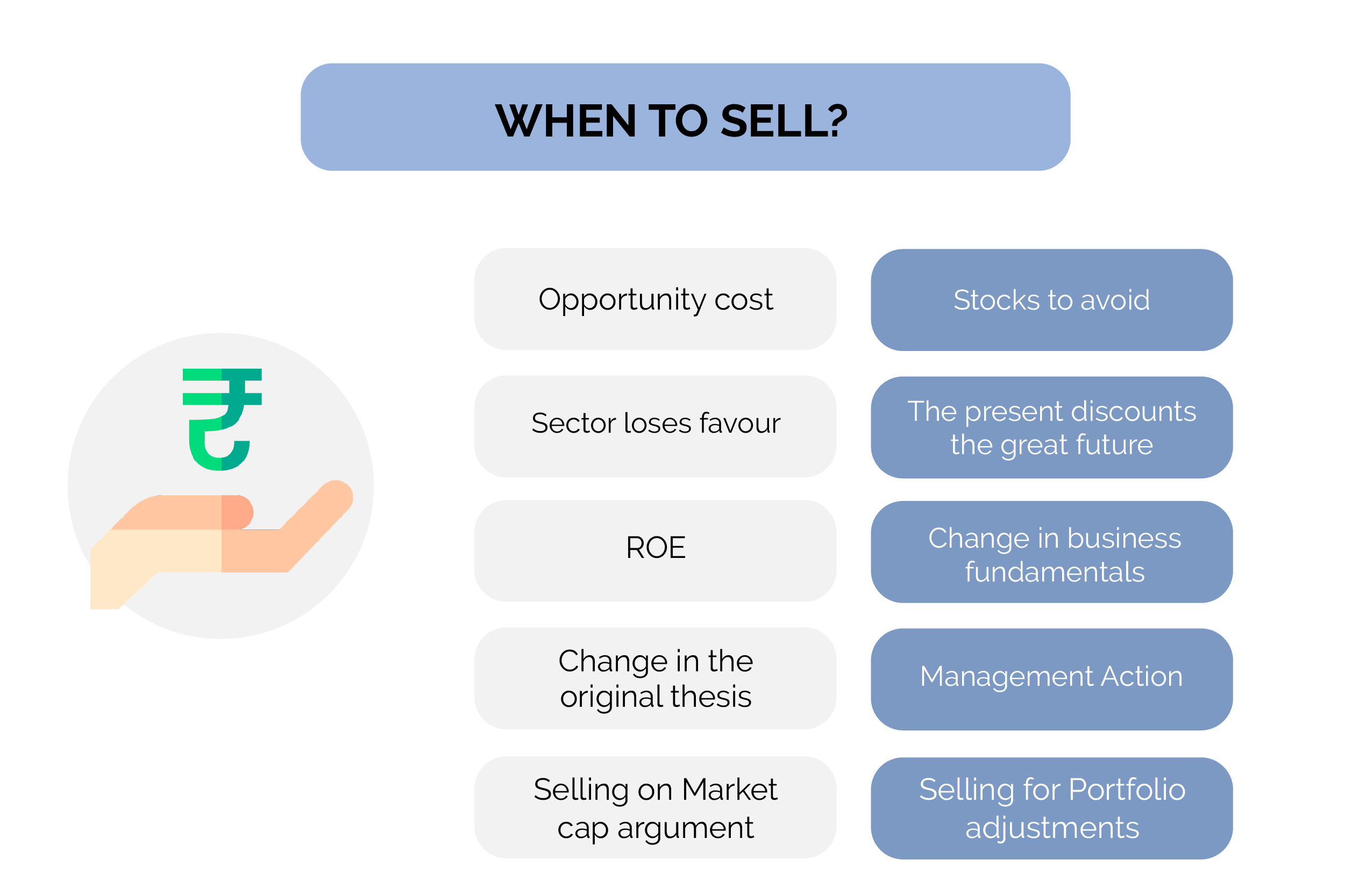

When To Sell And When Not To?

This section deals with an in-depth discussion of when to sell. There are notes on when to sell a cyclical, when to sell banks and NBFCs, and when to hold stocks indefinitely.

This section is heavily influenced by the author’s own experiences of his stocks.

- Look at Opportunity Cost as money is limited.

- Valuations that have been extended- If a company's market cap is low in comparison to the potential for growth, a high P/E ratio is irrelevant.

- The bull sector is losing favor. - It is not necessary to buy at the bottom or sell at the top in order to make money. However, if a person is stuck in the fall, it is preferable to fall with the leader rather than with a laggard.

- Changes to the original thesis - Changes in fundamentals, ineffective management, or government policy.

- Business in general is slowing.

- It is not advisable to look at the price of a stock after it has been sold because it may have an emotional impact on you.