Portfolio Construction Strategies

“Large wealth creation opportunities don't come too often and when they do they should have the power to make a difference on an investor's balance sheet.” – Basant Maheshwari.

This is a brief section that begins with the benefits and drawbacks of a concentrated and diversified portfolio, the various sectors and stock filters that investors must use when constructing a portfolio, how to assign weights to each stock, and how to design a diversified portfolio.

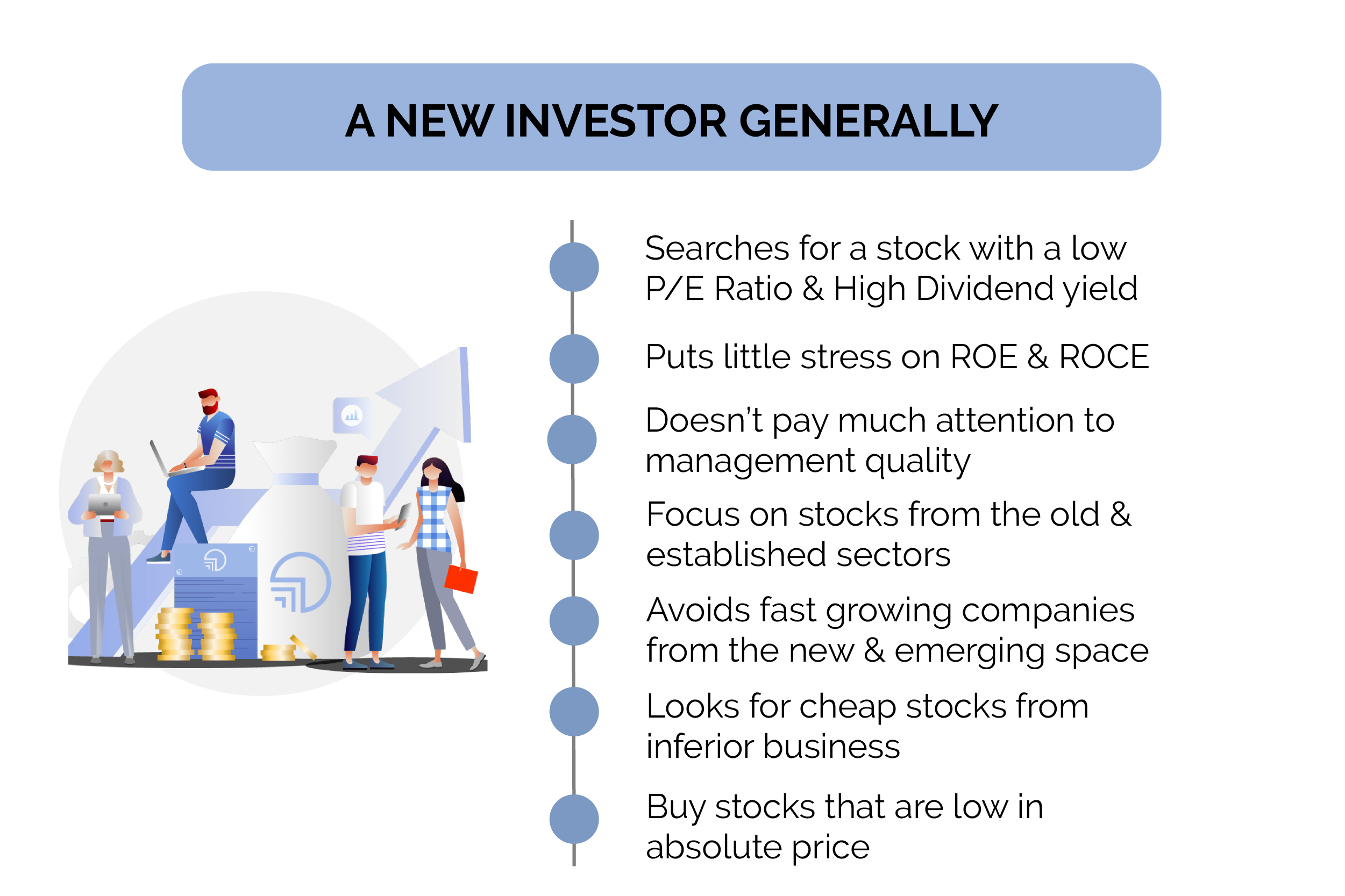

The discussion also includes a note on the thoughts that cause the majority of first-time investors to lose money in the market. This chapter concludes with an argument about when and how to buy, why there is no sin in buying a stock after it has moved up from the initial purchase price, and why selling at a higher price to buy it back lower isn't always a good idea for the overall portfolio.

Advantages of Concentration - It reduces the likelihood of making a bad decision because one can carefully select the investment. Better risk management because one can bet a lot of money on a few stocks, one is more likely to be alert and exit at the first sign of trouble.

Disadvantages - Due to illiquidity, it can be difficult to exit stocks at times. However, if one can only have a small portfolio, this should not be a problem because big money is made here. One must be confident and knowledgeable about the company, as one cannot afford to lose.

Advantages of Diversification - It increases your level of excitement because there are many companies about which you must stay informed. On the other hand, having few stocks means you have to do nothing most of the time, which is boring.

Disadvantages - Reduces the overall quality of the companies you own.