Drivers Of P/E Ratio

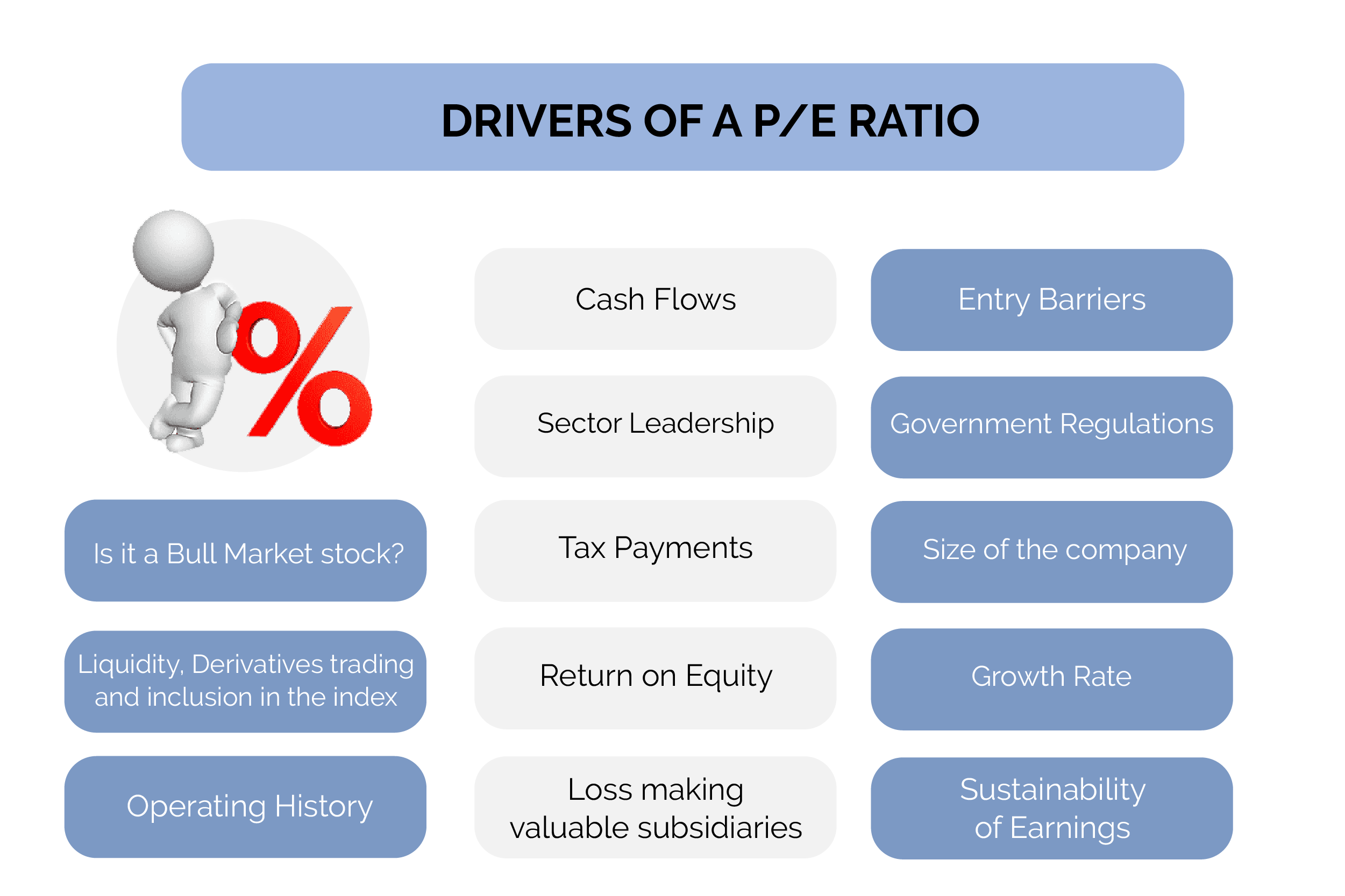

This chapter delves into the enigma of the price-to-earnings ratio. It begins with a discussion of the various drivers of a P/E ratio and why some of these drivers are more important than others, despite the fact that there is no single way to calculate the correct P/E of a stock. The debate extends to how some stocks are valued based on cash flow and dividends rather than just growth. There are over a dozen factors that influence a stock's P/E ratio, and all of them are discussed in detail here, with real-world examples whenever possible.

Businesses with higher PE have:

- Earnings that are predictable and sustainable.

- Entry barriers are high.

- Positive cash flow

P/E Expansion vs. P/E Contraction

This section discusses the critical topic of P/E expansion and P/E contraction, as well as how stocks continue to fall even as earnings continue to rise simply because the P/E gets ahead of itself, and why some stocks refuse to fall even after they become expensive. When a company generates above average growth for longer periods of time it reaches a stage where its own size becomes an enemy and it starts facing challenges from market saturation, competition, product obsolescence, etc. which leads to P/E contraction.Whereas investors looking for multibaggers just need to identify a compounding machine with a potential for P/E expansion. The triggers for P/E expansion are rising EPS and growth in sales.

Strong earnings growth backed with a quick P/E expansion leads to multibagger.