Introduction

About the book

The Thoughtful Investor by Basant Maheshwari (author) is one of the best books on investing from the perspective of the Indian stock market; if you want to start your investing journey.

It covers almost everything, from financial analysis to individual sector analysis, acquisitions, and even the behavioural aspect of investing. There are several sections in the book that teaches you to identify the tops and bottoms of a stock, P/E expansion and contraction, how to identify the next big trend, and which stocks to avoid while investing for the long term.

About the author

Basant Maheshwari is a renowned Indian investor, portfolio manager and author. He also runs Basant Maheshwari Wealth Advisers LLP; a SEBI registered PMS Company. Basant is a full-time equity investor and has had a history of identifying several multi-baggers over the last 15 years. His book The Thoughtful Investor helps several novice investors all over India to learn the art of stock investing.

Buy the book

This book will guide you in making correct decisions in the stock market while investing. We highly recommend you to read the entire book. (affiliate link)

The World Of Investing

The Business of Investing

In this section, Basant talks about what Indians think about investing and the risks associated with the game, the advantages of investing in stocks and how buying a stock of a company is in some cases a better way to wealth creation than physically doing the same business. To achieve financial freedom, one must have a corpus that is fifty times their annual expenses.

“An investor has to be lazy in taking profits and agile in cutting losses.” – Basant Maheshwari

Magic of Compounding

The author emphasizes on the magic of compounding, which is the most important aspect of investing. Investors are unaware that the magic of compounding is dependent not only on the rate of return, but also on the initial capital and the time period over which the investment is allowed to compound. The chapter also discusses how a bad year can wash away years of hard work, which many investors fail to recognize in the early stages of their investing careers. Long time can compensate for a little less return rate. Being in the game matters more.

Equities Don't Outperform All Asset Classes All The Time

This section discusses the argument that equities do not always outperform all asset classes, a painful truth that market participants refuse to discuss because they refuse to understand that returns from equities are non-linear and come in bunches that are sometimes too abrupt. As a result, it is perfectly normal for a broad investment portfolio to underperform other asset classes for up to twenty-five years. This argument is supported by examples and data from both the Indian and US markets.

The author gives an instance of the period of 1992 to 2003 where the benchmark index gave less return than the bank fixed deposit which gave a return of 12% at that time. He mentions that during the tremendous rise in the Sensex during 2003 to 2008, there were times when the Indian equity market underperformed gold.

In such a case, the concept of index investing is rendered obsolete, and the only way to generate returns is to hold a small number of stocks like TTK Prestige, Page Industries, Gruh Finance & Hawkins Cooker which rallied 10 to 35 times at that time and, more importantly, to avoid staying in sync with the broad index.

Index Investing -Indexes in India are market cap weighted rather than price weighted, as they are in the United States. Which means the Indian index gives more weight to few stocks. But same thing is happening in US market too, for eg: - FAANG (FAANG refers to five prominent American technology companies: Facebook; Amazon; Apple; Netflix; and Google (Alphabet))

Attributes Of A Full Time Investor

“When work becomes passion - wealth follows”. - Basant Maheshwari.

This section discusses the characteristics that make up a good investor, some of which include being passionate about stocks as well as being optimistic about things in general as a person.

An investor must also devote a significant amount of time reading books about people who have made a fortune. He refers to investing as a game or a bet several times in this book, not to diminish the long-term appeal of this art, but to remind the reader that the act of investing is always surrounded by uncertainty.

Some advice:

The first job of an investor should be to look for like minded people who focus on serious investing. Develop a habit of reading and create a list of books on people who made it big in the world of investing and try to understand the philosophies to sharpen his/her own skills. An investor should go through these books slowly, underline the important points and make notes, wherever he/she feels like. The easiest way to develop the skill in the investing game is by being in the market, reading experiences of people who have succeeded in converting a limited capital into a retirement fund. The other aspect is to put real money to work and not engage in mock trading that involves trading with paper capital only as one won’t learn how to handle the emotions of greed and fear.

The Pain Of Losing

“Market tops and bottoms are caught by two people: fools or liars.” – Basant Maheshwari.

The author argues why this is such a common feature of an investor's life that cannot be eliminated. The pain of loss arises from both permanent and temporary capital loss, but an investor should understand that someone who cannot bear the pain will find it difficult to participate in the gain.

Companies don't grow at 40% on an individual basis. There must be a sector tailwind for which these stocks are leaders. The author also suggests that one should not buy immediately when the market crashes and should wait on the sidelines and wait for the 'blood to dry'.

Risk vs. Return

“Most investors get rich by avoiding risk and not by taking it.”- Basant Maheshwari

Investing can be a highly effective way to grow your money and lay the groundwork for the life you want to live. It's also important to remember that investing is not a risk-free strategy, and there's always the possibility of losing money or not making as much as you expected. All investments are risky due to factors such as inflation, taxes, economic downturns, and market drops.

Different types of investments have varying levels of investment risk as well as varying returns. In general, the greater the potential investment return, the greater the investment risk. Cash offers lower returns and a lower risk of loss, whereas growth investments such as stocks offer higher returns and a higher risk of loss.

Buy What You See

In this section, the reader is introduced to the benefits and drawbacks of employing this concept. The author talks about his own experiences using this method to find winning stocks. For example:- Jockey products which are manufactured by Page Industries.

This section is chock-full of historical evidence demonstrating how much more an investor could have achieved by implementing this strategy. In the long run, shareholder return is determined solely by ROE (Return On Equity).

Macro Numbers – How Much to Analyze?

Basant focuses on the study of macro numbers and their relevance to how they are debated in the media and among investors. He discusses why macro events, with the exception of a few, have a limited shelf life and how a long-term equity investor should deal with these events.

The global liquidity tap of quantitative easing initiated by the dollar printing exercise of the U.S Federal Reserve and categorized as QE1, QE2, and now QE3 provides good information on how newly printed dollars would go on to affect the different asset classes.

He also points out that the annual budget is one such event where people waste a lot of time analyzing it, as all budget provisions are industry wide events and don’t affect one specific company over another.

Budgets have limited shelf life and good companies do well even with bad budgets whereas bad companies struggle to deliver even with good budgets. For example:- A trader in Surat would do nothing differently just because a macro number has come in a certain way but the passive owner of a much larger and efficient business like Tata Consultancy Services will be tearing their hair trying to forecast the actual impact of these numbers.

Any event that affects all the players of an industry should in most cases be ignored.

One needs to understand that Indian markets are driven predominantly by inflow from foreign investors as the local retail participation is quite low. As India is a predominantly current account deficit country these foreign inflows are needed to get over the external deficit issue.

Intrinsic Value – Theory And Practice

This section discusses the theory of intrinsic or fair value as computed using the discounted cash flow method, how it differs from the actual price, and why price and value rarely equal each other due to the dominating factor of emotion in stock price discovery.

The author says that John Burr Williams stated that the intrinsic value of a stock equals the discounted value of future dividends plus the residual value of the business. In other words, one had to predict the future dividend payoffs and then bring it to present value by discounting it with an appropriate number.

Discounting is the process of equalizing the purchase power of a rupee to be received later in the future to its current value. For example, if prices are expected to rise every 10% every year then the value of the goods and services that can be bought for ₹100 one year later would need only ₹90.90 to be purchased today.

In case a company is not paying dividends as per Williams, the intrinsic value should be the future payoffs when the company actually starts paying dividends, whereas companies that retain and invest a large part of the present cash flow for future payoffs, the intrinsic value will be the present value of the residual cash whenever the company is ultimately liquidated.

The above argument basically suggests that a company which does not pay a significant amount of dividend in the current phase should pay higher dividend in future if this is to be valued ahead of a company that is paying dividends and that companies that do not generate enough surplus for distribution to their shareholders should be valued lower.

That is primarily the reason why cash guzzling, asset heavy, and negative cash flow companies like cement, steel, oil and gas etc. are valued cheaply to the cash distributing asset light businesses like consumer pharmaceuticals, and IT Services.

The author says that ultimately the price of a stock is governed by what the buyer is willing to pay and not by what he/she actually pays or by what a seller is willing to take and not by what he/she should actually take.

Bull Market, Trends And Economic Bubbles

What Makes for an Economic Bubble?

This section explains the essential characteristics of an economic bubble and how an astute investor can detect it. A stock market bubble can occur in any asset class or sector and must be supported by liquidity, leverage, and an open-ended dream on anything new or that has been depressed for an extended period of time. In this context, it is important to recognize that there is always a bull market somewhere for an investor to profit from, and regardless of the broad indices, an astute investor will always find ways to multiply wealth if he is on the lookout for a new emerging sector theme.

Brief History of Economic Bubbles

This is followed by a chapter that discusses all of the global bubbles, including the Tulip mania of 1634, the South Sea bubble of 1720, the Railway Mania of 1860, the United States Great Depression of 1929, the Nikkei bull market of 1989, the Nasdaq bubble of 2000, and the United States Housing and Emerging Markets Crisis of 2008.

Each of these bubbles is explained in order to communicate the common theme that ran through them: liquidity and leverage acting on anything new. The purpose of introducing the reader to these previous bubbles and their characteristics is to make it easier for them to attempt to catch the next bubble when it appears.

An attempt has also been made to explain how liquidity, by itself, does not create a bull market, but rather how a bull market is created by the uniqueness of an asset class on which liquidity is made to act as a catalyst. The purpose of discussing past bubbles is to make an investor aware that, while the past does not always accurately predict the future, the patterns mostly remain the same.

Identifying Tops And Bottoms

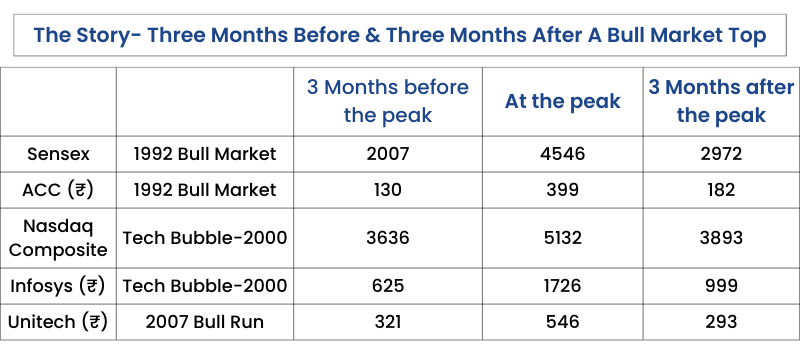

Identifying tops and bottoms is a difficult game, but we still discuss the important features of both tops and bottoms while arguing that it isn't necessary for an investor to buy at the bottom and sell at the top to make a lot of money because investors who are aware of the signals that are emitted at the tops and bottoms will do equally well.

These signals do not come from the general psychological arguments of everyone investing and no one talking about stocks, but rather from the specific price action that the underlying securities reflect a few months before and after these turning points, which are referred to as tops and bottoms in hindsight.

Signs of a bull market:

- Launch of fresh mutual fund schemes to raise money to buy stocks of the sector in demand.

- Inflow by Foreign institutional investors (FII)

- Maximum Leverage -That is when participants of the market are full in and have also taken leverage with their position by buying shares in finance, which they had no intention of holding for long.

Why market falls suddenly:

A small price drop causes leveraged people to receive margin calls, which cause a chain reaction of selling and further price drops. This creates more fear in the market, and the weak players begin to sell. One must remember that, while a bull market will raise stock prices, a company will take its own time to perform.

Signs of bear market:

- Valuations are most reasonable at the bottom with prices being justified mostly by P/E ratio, dividend yield or a price to book value ratio.

- Public participation is minimum

- Leverage is very small with minimum volatility

- Sense of uneasiness around ( as the macro environment will be throwing up bad numbers)

Sectors that recover first (In order):

- Automobile Companies: People who had been putting off their vehicle purchases have now begun to do so.

- Banking Sector: The likelihood of bad assets decreases, and businesses begin to perform. Increased economic activity also promotes business expansion, which leads to more loans thereby increasing the business of the lenders.

- Industrial companies: In order to expand, you will need to purchase machinery.

Identifying The Next Big Trend

“Most investors remain focused on trying to find the next big trend rather than participate in the ongoing one.”- Basant Maheshwari

Somewhere, there is always a bull market: in some asset class. In the 1970’s when Dow Jones was going nowhere, gold, silver and crude oil were hitting new highs.

Whatever happens globally happens in India. For example:- If in the 1980’s investors made a lot of money in the MNC’s names like Colgate, Nestle, Hindustan Unilever, that’s because the business of these consumer companies had rewarded shareholders in the U.S and Europe.

New Sector for each bull market. The bull run always happens in stocks that were not the leaders of the previously concluded bull markets and would normally come from new sectors. For example, cement led a bull run in 1992, but it was IT companies who led the bull run in 2000.

Above average growth of company and industry. One should look at the revenue growth of most of the companies in a specific sector. For example:- when software was becoming a trend, most of the IT companies including Infosys and Wipro showed high revenue growth.

Scale of opportunity: A scalable business is one where there is scope to grow the business as much through volumes as by pricing. Investors should also try to estimate the market size in relation to the leading player in the segment.

First generation entrepreneurs: Most Companies that start a new trend are incubated by first generation entrepreneurs. For example :- Google, Infosys, etc.

Stocks hitting all time high: Focus on the sector where most of the stocks have started to hit new all time highs. Wealth is also created by buying at high and selling it at a higher price.

Small Market Capitalization: Most of the bull market stocks will be sector leaders having small market capitalization. Companies like Page Industries, TTK Prestige were small companies to start with.

Relatively Expensive Valuation: The actual threat to a bull market stock is not excessive valuation but slowing growth as valuations remain expensive and then over-stretched till such a time that the company keeps delivering above average rates of growth.

Illiquid and unpopular: It suggests investors are willing to take a long term view without undergoing quick buy-sell decisions. Unpopularity suggests it is not actively followed by the analysts of the research houses of Dalal Street.

Lack of entry barriers: A spate of IPO’s towards the end of the run is important and with very high entry barriers it will become difficult for new companies to join in.

Bear market IPOs: In a bull market if there are 10 IPOs, maybe 9 out of them will be bad, but in a bear market if there are five IPOs, one of them would have the potential to become a multibagger.

Pickaxe and Shovel Theme - The development and spread of the internet increased the efficiency levels in the user sectors of the economy. So the author uses HDFC Bank as an example as it was the direct beneficiary of the computerisation and internet drive.

Company And Financial Analysis

Understanding Business Models

This section begins with an understanding of business models, including concepts such as entry barriers, pricing power, brands, patents, and production costs. The discussion then moves on to market share and how it differs from mindshare, as well as the other critical factors that determine whether an investment is good or bad.

A good business is one that purchases on credit and sells on cash. Purchasing on credit indicates that there is plenty of competition amongst the suppliers while selling on cash means that the buyers are weak and dispersed. Both these attributes shift the bargaining power of the business to the company.

Additionally, if sales are happening for cash, it reflects that the product/service is in demand and the company does not have to keep a high inventory. This coupled with an excess of creditors over debtors because of the credit purchases and cash sales would keep the working capital in check while taking it negative at times.

Business Models:

- Entry Barriers

- Brands

- Market share vs. Mindshare - Mindshare refers to the customer coming to purchase the product.

- Franchise-led growth necessitates less capital investment.

- Changing the metric of measurement - Buying commodity and selling brands

- High gross margins

- Government Lease

- Patents

- Low cost of production and economies of scale

- Large Upfront Capital Expenditure

- Network Effect and Switching costs

- Product Penetration and Distribution Network

- Low Priced Items

- Postponement Possibility - Products that cannot be delayed, such as toothbrushes and medicines.

Tools of Financial Statement Analysis & Growth, RoE with DuPont Analysis

These tools discussed in this chapter work together to assist an investor in conducting a thorough financial analysis of a stock. The chapter begins with the argument that no single analytical tool is sufficient and that an investor must rely on a combination of these. The DuPont method of analyzing the RoE is followed by case studies from the past, reasons for how and why the RoE matters, and how it equates with growth and dividends.

Acquisition

When Does an Acquisition Work Out & When It Doesn't?

This section focuses on the specific reasons why companies buy other companies. The discussion uses real-world examples to explain the criteria that allow some acquisitions to benefit some companies while harming others.

For example:- Bharti Airtel moved to Africa after its domestic business started showing signs of saturation and the acquisition of the african telecom company Zain for $10.7 billion was made to extend its faltering growth. Bharti tried to rebrand, increase penetration, expand market share but the profitability of the newly acquired company didn’t justify the acquisition amount.

The author uses another example of an acquisition, when Emami acquired Zandu Pharma with the intention to increase the reach of Zandu through Emami’s distribution network, which proved to be a successful acquisition for Emami.

Acquisitions generally indicate that a company is entering a period of slow growth. The ROCE is diluted because cash held in investments does not form part of the capital employed, whereas cash used in an acquisition does. As a result, if a company has a lower ROCE than the current one, the ratio will fall.

Is Your Company Taking Up Market Share?

This section provides a detailed argument for sticking with companies that gain market share from competitors, as well as methods for understanding and evaluating this. The discussion expands on the environment in which it is easy for a company to steal market share from a competitor.

If your company has a revenue growth more than the competitor and the rate at which the market is expanding then your company is eating up market shares of competitors.

But keep probability in mind: If growth comes at the expense of equity dilution, it's not a good sign. When a new competitor raises product awareness, the leader is always the first to gain market share. An unorganised sector suffers from a lack of operational efficiencies, financial support, and is typically composed of family businesses that do not wish to expand.

Evaluating The Management Of A Business

“Buying an expensive business managed by an honest management fetches better results than one managed by suspicious people.” – Basant Maheshwari

In this section, the author tells us how to evaluate the company's management through various aspects of study, both financial and otherwise, which is as important as the business model.

Management can be evaluated in a variety of ways.

- The management's overconfidence can be seen if they bring a large number of IPOs from the group company. For example, Kishore Biyani's Future Group.

- Mergers or acquisitions of companies related to the promoters.

- Honest management always pays their taxes and maintains a healthy dividend payout.

Promoters in their first generation.

It is difficult for an investor to evaluate first generation promoters, one good way is to go through red herring prospectus and check the financials of the previous years to create an opinion on the ability of the management for long term execution.

Transparency in Annual Report.

The quality of disclosure in the annual report indicates the scale of transparency. For example, when the author bought Page Industries, he was worried about what if the management intends to get into backward integration planning of manufacturing yarn, to which management replied that they won’t undertake venture which gives it an incremental ROCE of less than 35% further adding they had 200 vendors to buy yarn from, then why should they enter in a crowded field.

People rarely change: Avoid management that was once suspect but is now showing a clean cheat.

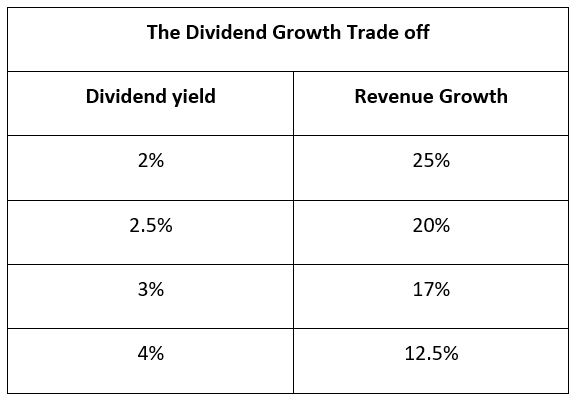

Dividend - The Only Sure Thing From A Stock

This section discusses dividend payments, which are one of the most important aspects of investing in publicly traded companies. Furthermore, in the long run, a company's share price mimics its dividend growth, and investors must be on the lookout for the dividend to growth payoff, in which either the dividend or the growth must be sacrificed for the sake of the other. The dividend growth quotient is a concept the author created to ensure that this payoff matrix can be evaluated to determine whether or not the payoff is favorable to the investor. An ideal dividend distribution ratio is around 25-30% of the net profits.

The logic of this relationship by the author is that if the yield is low it has to be compensated with higher revenue growth. Companies that want to grow fast need to retain and reinvest their earnings back in the business whereas companies who give out lots of dividends theoretically can’t grow fast.

Operating Leverage

Looking for Margin Expansion & How Companies Cook Books of Accounts:

This section discusses how a company is set up for operating leverage and the key triggers for it, while the following section discusses how companies cook their books of accounts and how an astute investor can spot them without doing too much analysis.

Operating leverage: When a company increases output, it adds less to its fixed costs, resulting in a more than proportionate increase in profits. Companies with a high gross margin but a low net margin are more likely to see their margins expand. A company that manipulates its financial statements will typically show lower revenues, higher expenses, or a larger block of fixed assets. Because of asset over invoicing, fixed assets are valued at a higher rate.

Dividends and taxes are good indicators of earnings quality because they must be paid in hard cash.

Keep an eye out for frequent equity dilutions. The rate of increase in inventory and receivables should not be faster than the rate of increase in revenue. A change in auditor or an excess of related party transactions are also red flags.

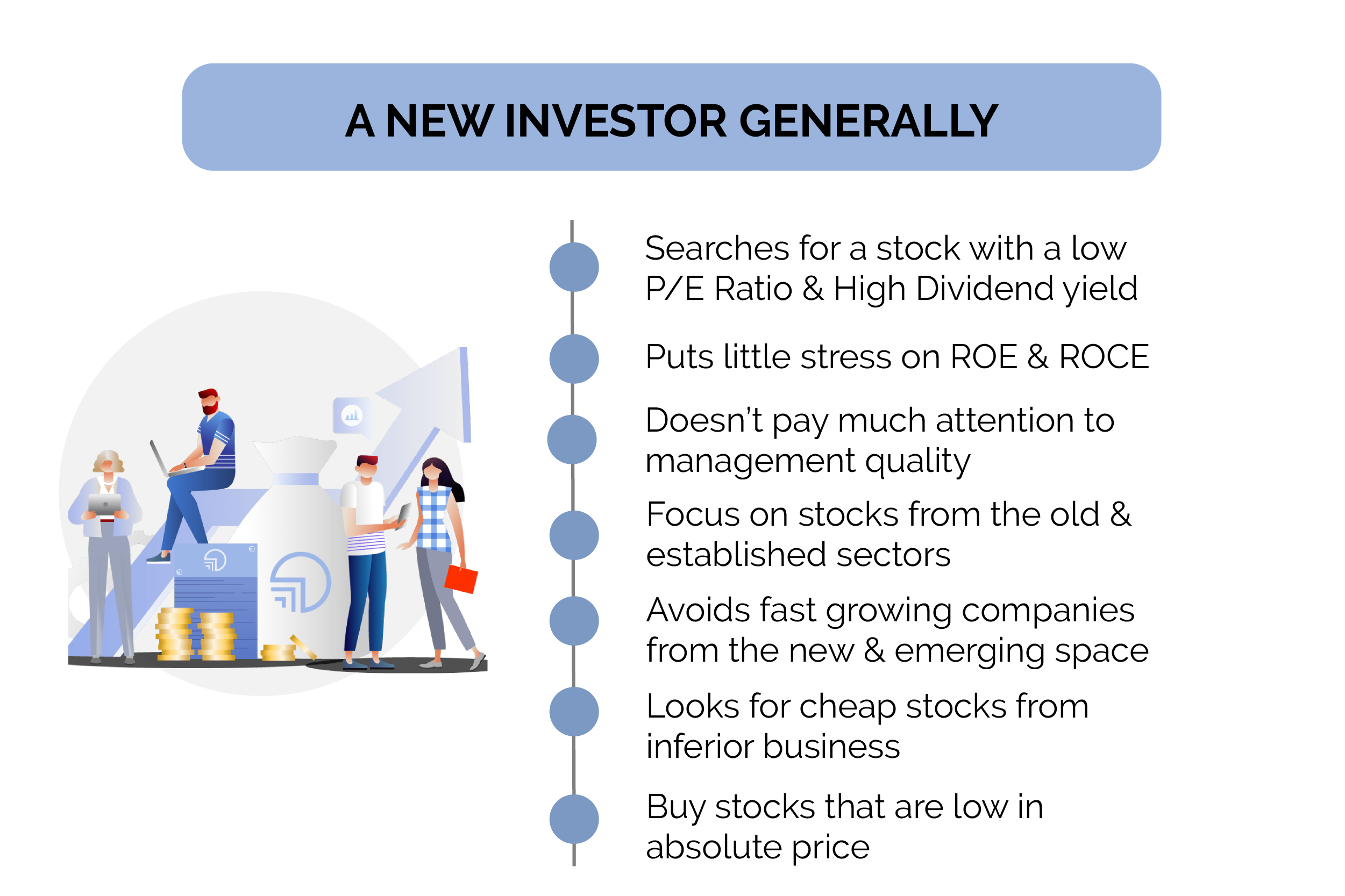

Stocks To Avoid

In this section, the author talks about stocks to avoid or companies that an investor should avoid or be cautious of even if it's soaring high in the bull market.

It is more important to avoid losers than to find winners, because a stock that has doubled in price must double again for the investor to break even.

The chances of making money are multiplied many times over with a focused company as opposed to one that runs multiple businesses under one roof.

Stocks to avoid:

- Growth achieved through repeated dilution of equity or debt. Companies which are fast growing with low ROE, low entry barriers and with negative cash flows, such companies fund growth through raising debt or through equity dilution.

- Diversification that isn't necessary. Ex: CESC’S entry into grocery retailing through Spencer’s was not welcomed by the author as it was an unrelated business. One should Avoid companies that continue to diversify into unrelated industries. It shifts management's attention away from the task at hand.

- Companies who make a lot of acquisitions as it is never cheap because it dilutes the ROCE when compared to the growth that the company generates on its own.

- Large market capitalization in comparison to the size of the sector. If the company's valuation rises much faster than the size of the total market opportunity, it's time to sell.

- Cyclicals that are performing excessively well. When the cycle is in full swing, cyclical stocks report record earnings and expansion plans and then aggressively expand, but when the cycle turns, they go into distress. The timing of the exit is critical in this case.

- Excessive showcasing. If the company's management interacts with the press too much, giving projections, it's best to avoid such companies. Companies that have no expectations generate great returns.

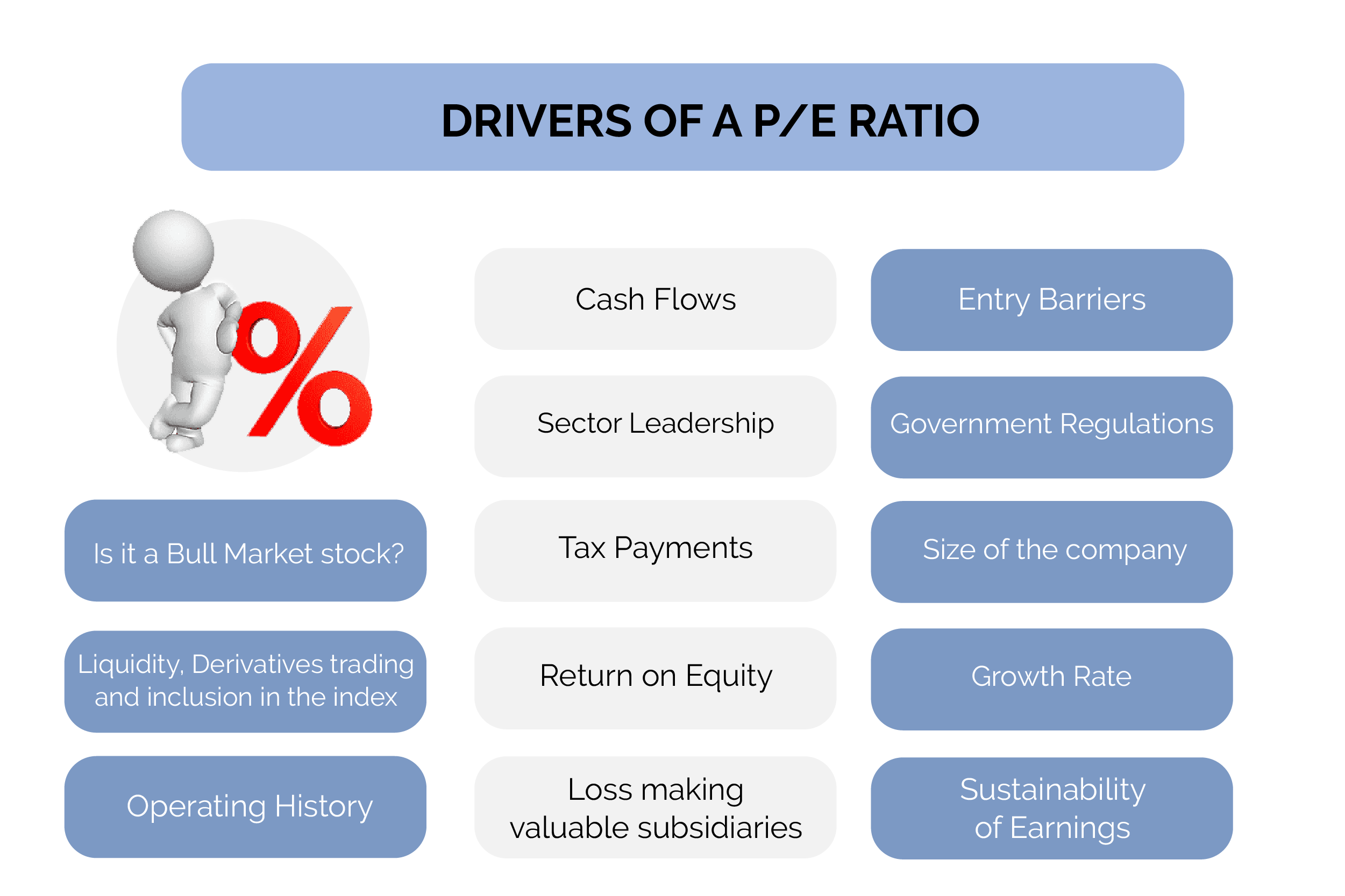

Drivers Of P/E Ratio

This chapter delves into the enigma of the price-to-earnings ratio. It begins with a discussion of the various drivers of a P/E ratio and why some of these drivers are more important than others, despite the fact that there is no single way to calculate the correct P/E of a stock. The debate extends to how some stocks are valued based on cash flow and dividends rather than just growth. There are over a dozen factors that influence a stock's P/E ratio, and all of them are discussed in detail here, with real-world examples whenever possible.

Businesses with higher PE have:

- Earnings that are predictable and sustainable.

- Entry barriers are high.

- Positive cash flow

P/E Expansion vs. P/E Contraction

This section discusses the critical topic of P/E expansion and P/E contraction, as well as how stocks continue to fall even as earnings continue to rise simply because the P/E gets ahead of itself, and why some stocks refuse to fall even after they become expensive. When a company generates above average growth for longer periods of time it reaches a stage where its own size becomes an enemy and it starts facing challenges from market saturation, competition, product obsolescence, etc. which leads to P/E contraction.Whereas investors looking for multibaggers just need to identify a compounding machine with a potential for P/E expansion. The triggers for P/E expansion are rising EPS and growth in sales.

Strong earnings growth backed with a quick P/E expansion leads to multibagger.

Buying And Selling Strategies

Should a Small Investor Always Stick to Small Cap Stocks?

“If buying small and micro caps is the way to riches it is also the path to bankruptcy” -Basant Maheshwari

This section begins by explaining why it is not a good idea for investors to focus solely on small caps. The pitfalls of small cap investing, survivorship bias issues, and when it makes sense to focus solely on small caps versus when it makes sense to stick with tried and tested large caps.

Small cap companies with no entry barriers are unsuitable because they lack the ability to grow into large cap companies.

A company must have revenues of at least ₹100 crore to demonstrate that their business model is viable. Small caps have a very slim chance of surviving a pandemic.

You must determine whether the small cap company has the ability to scale its operations or not.

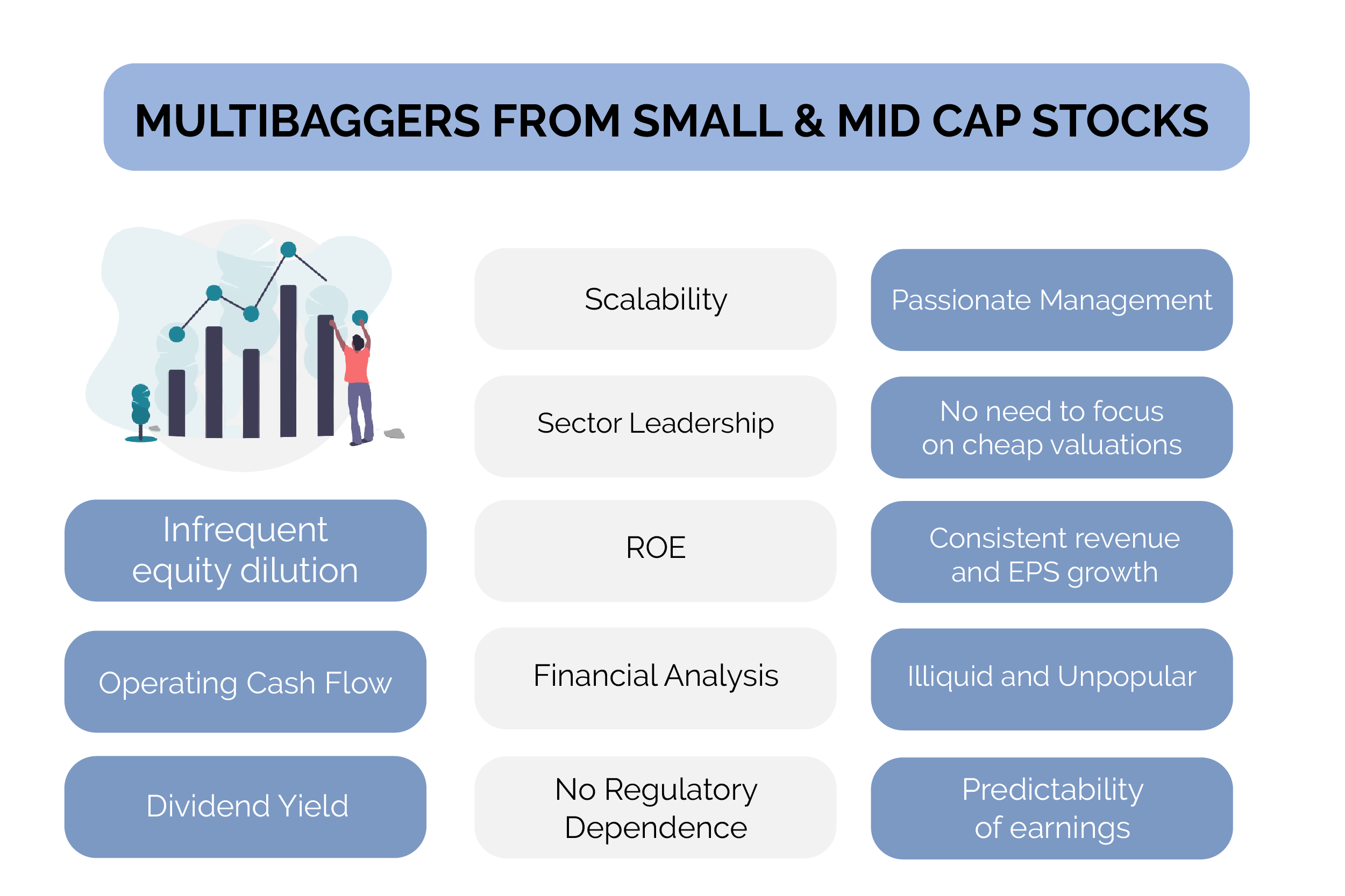

Multibaggers from Small and Midcap stocks

Small cap companies are the ones which could lead you to early retirement but such companies also have potential to put you back to work from retirement.

This section elaborates on the various filters that should be used when purchasing potential multibaggers from the small and mid cap space.

These filters include business, sector positioning, management, growth, industry tailwinds, and financial analysis of these potential winners. The trigger for multibaggers will be the company's growth and scalability, not the valuation at which it is available.

For example, when a company continues to take market share away from the organised sector. VIP Industries or Safari may fall into this category.

Small cap companies that are not leaders in their industry run the risk of slipping in terms of earnings delivery and execution. However, if the sector is very large, one may not need a leader. SUN TV vs. ZEE, for example.

The combination of no equity dilution, less/no debt, and increased revenue through operating leverage is a sure-fire multibagger.

One must determine whether the management is competent because - Small cap companies frequently lack the resources to hire professional managers. A promoter whose motivation is not management compensation but rather the performance of the company would be the best. For example - Ambika Cotton Mills.

Profitability may suffer temporarily as a result of advertising or capital expenditures should not be given much weight.

The author’s checklist includes the following items:

- ROE > 30%

- No dilution of equity and less/no debt

- Debt should be less than 50% of the net worth

- Positive cash flow

- Dividend yield is 1.5 to 2%

When To Catch A Falling Knife And When Not To?

In this section the author tells when to catch falling knives and when not, along with a detailed explanation of the importance of the company's and sector's quality when catching these falling knives.

The author categorizes stocks into three groups.

- In a low-quality industry, a high-quality company (Infrastructure). Voltas saw its stock price move down hitting the bottom despite having good financials, and then recover equally fast.

- A high-quality firm in a high-quality industry (consumer). Titan Industries, is one such company where the author took position in 2008 after it fell to almost 50% from the highs, the author basically wants to convey that A high-quality company in a high-quality industry won’t fall much beyond a point.

- A low-quality company in a low-quality industry (Real Sector). Unitech started falling as the fundamentals started deteriorating with each passing quarter.

The last one should always be avoided by investors because it has the greatest potential for harm. When the fundamentals begin to deteriorate and when the retail investors begin to rationalize it, having a part-owner mindset can backfire and cause one to not sell.

The author had taken a long position in Voltas, which was now falling in value. So he used to go on long walks and count the number of Voltas AC in his neighborhood which gave him the assurance not to sell. However, he made a mistake when he realized that AC contributed only 30% of the company's revenue. After a high growth company begins to slow down on the growth curve, it rarely returns to the high growth stage.

High-quality stocks are rarely cheap, so trying to buy them at a discount is a strategy that rarely works as well as it is debated. Believers in a story typically enter early, before the bottom, and must bear the pain before the gain.

The Ones I Saw And Missed

“An investor who always regrets his mistakes is like a person who repents about every girl he saw but did not marry!” – Basant Maheshwari

This section discusses the author's regrets about stocks he saw but did not buy, and how an average investor will always have more misses than hits, but what matters is how much he makes from his hits rather than how much he does not make from his misses.

Lesson from United Spirits: Even if the stock increased 50 times, Basant would not invest in a company with questionable management.

Lesson from Nagarjuna Construction: Just because a stock has risen by 15% does not mean it cannot rise any further.

Lesson from Aban Offshore: Buying a mediocre business with a lot of tailwinds is preferable to buying a great business with a lot of headwinds.

Lesson from Bharti Airtel: If there is a problem, such as the company not being profitable, you could enter when the company becomes profitable. It is never too late to buy or sell a good stock.

Lesson from Kaveri Seeds: If the financials are good, the company is debt-free, has a high ROCE, and promises average growth, one can buy a small amount of shares without trying to understand everything about the company.

A debt-free company with a high ROCE is the first sign of a solid business model.

A person learns more about a company after purchasing stock than he does before purchasing stock. One should not be concerned about missing an opportunity because if one passes, the next one will arrive sooner than expected.

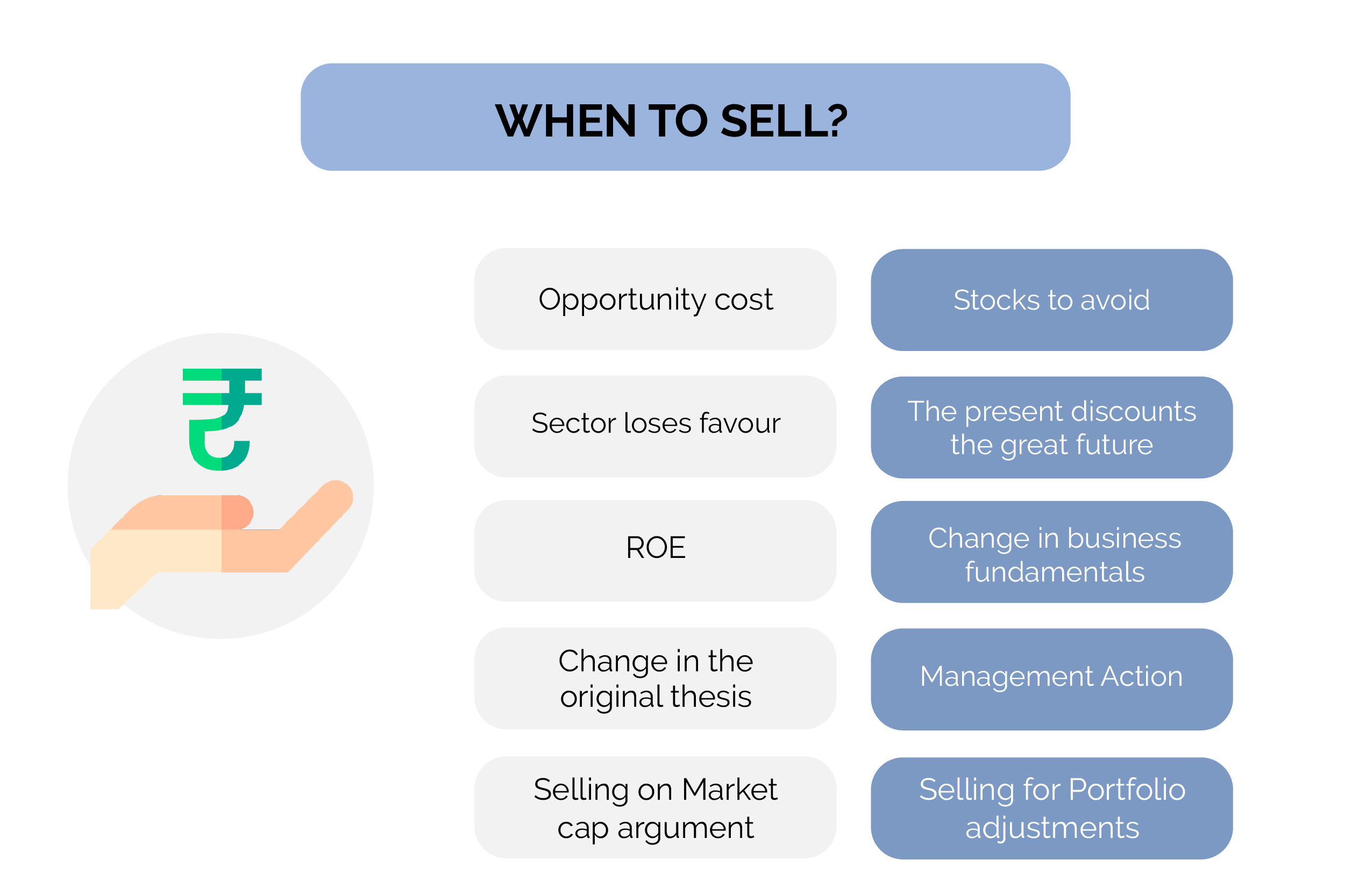

When To Sell And When Not To?

This section deals with an in-depth discussion of when to sell. There are notes on when to sell a cyclical, when to sell banks and NBFCs, and when to hold stocks indefinitely.

This section is heavily influenced by the author’s own experiences of his stocks.

- Look at Opportunity Cost as money is limited.

- Valuations that have been extended- If a company's market cap is low in comparison to the potential for growth, a high P/E ratio is irrelevant.

- The bull sector is losing favor. - It is not necessary to buy at the bottom or sell at the top in order to make money. However, if a person is stuck in the fall, it is preferable to fall with the leader rather than with a laggard.

- Changes to the original thesis - Changes in fundamentals, ineffective management, or government policy.

- Business in general is slowing.

- It is not advisable to look at the price of a stock after it has been sold because it may have an emotional impact on you.

Analyzing Sectors And Industries

Basic Economy Stocks, Diversified Businesses and Spinoffs

This section begins with a discussion on evaluating low P/E stocks that are closely related to the basic economy, as well as a note on the specific characteristics of stocks from industries such as agriculture, auto, auto ancillary, fertilizers, seeds, cement, power, hotels, infrastructure, capital goods, and real estate. It concludes with advice on how to evaluate diverse businesses and comprehend spin-offs.

Coffee, according to the author, is a pure commodity play, with one exception. If the company begins to brand its products and create value products. For eg:- CCL Products India ltd.

They are expanding into the branded business. They are making freeze-dried, spray-dried, and pre-mixed products, among others. Similarly to the textile industry, obtaining a high valuation is difficult unless the company enters the branded business.

The author advises against investing in companies whose sales are reliant on others. Munjal Showa, for example (a leader in the manufacture of shock absorbers). The power sector is highly regulated, it is difficult for the company to generate high returns. As a result, if you want to play the power sector theme, you should bet on equipment manufacturers.

Analyzing Companies with Cash on Balance Sheet:

The following section examines companies with cash on balance sheets and the key features of their analysis. The author discusses why the market discounts cash - Because of doubts about the existence of cash. The suspicion has increased after the Satyam Computers debacle where the company went bust after showing cash of more than ₹5361 Cr out of which ₹5040 Cr was fictitious. It saves one during a bear market but drags one down during a bull market.

Analyzing Banks and Non Banking Finance Companies (NBFCs)

This section goes into detail about analyzing banks and NBFCs and what to look for when evaluating these businesses.

- Investors of financial stocks should focus on companies who are good with their risk management than the ones who are only focused on growing their business through loan book and network expansion.

- Investors should focus on asset quality, the NPA ratio remains the lead indicator of the asset book. The gross NPA tells investors about the overall level of negligence, the net NPA tells the amount of bad loans waiting to be written off from the books of accounts.

- Investors should also look at CASA ratio as it indicates the extent of low cost deposits.

- One should buy banks that dilute equity at a higher price to book value.

- While analyzing NBFCs one should evaluate Net interest margin, Return on Asset, Return on Equity, Price to book value, and the P/E ratio giving more stress on ROE as it is the truth.

Commodity Cyclicals Are Not Long Term Bets

The following section discusses why commodity cyclical is never a good long-term investment. It discusses when it is appropriate to hold them and when it is appropriate to fold them.

- Cyclical businesses are generally available cheap. The low P/E originates from the unpredictability of its earning stream. Such stocks should be bought when they are doing badly and sold when they are performing extraordinarily well.

- Cyclicals are valued on the basis of their underlying commodity prices, so when the prices of the commodity is the turning point, the investors should buy or sell them near the turning points.

- Another important way to look at cyclical stocks is to see their operating margin and ROE which are highest near to the top and lowest at the bottom. An expanded ROE of a cyclical stock is a sign of threat, whereas lower margin and depressed ROE remains a signal of opportunity.

- Investors should look at the lowest cost producer of the cyclical stock as it will be the last company to go bankrupt during a downturn.

Analyzing Holding Companies

In this section, there is a write-up on valuing holding companies, the pitfalls of doing so, and why a holding company's discount always remains. To explain this, let's assume a holding company valued at a market cap of 1000 crores with a listed value of investments at 1500 crores but if the company had to suddenly sell the shares and distribute the income to its shareholders by way of dividend, it will be subjected to capital gain and dividend distribution tax which would collectively extend between 20% to 40% of the value depending on acquisition costs making the discount a theoretical necessity.

If one wants to make money in a holding company, you must be optimistic about the subsidiaries. Because holding companies are always undervalued. The key to buy holding companies is to look for those entities that consolidate earnings from their subsidiaries.

PSU Stocks

Good companies grow in free markets and not in regulated environments, so that's why the author avoids businesses which are under direct control of the government. A serious investor should ignore most of the PSU stocks and all such private companies which are under the influence and regulation of policies framed by the government.

The reason is the objective of the investor and the government are not in sync.

The government will come up with policies which will help them become popular thereby compromising shareholders return, whereas the shareholders look for wealth creation which is rarely visible in PSU stocks unless the stock is quite cheap and there is tailwind.

Analyzing Secular Growth Stocks

The section concludes with this Chapter, which lists the points made while analyzing companies with long-term growth such as consumers, IT, and pharmaceuticals.

Pricing power - If a company can raise its prices by 6-8% per year or maintain its prices while the input costs are low. However, business expansion is more important because prices can only be raised only till a certain point.

Breaking the product down into smaller sizes is an excellent way to keep customers. As the price of the products falls.

Some characteristics of a long-term growth company include:

- Expensive as compared with stocks from other sectors.

- Long-term business viability, for example it’s not easy for a company like Nestle or a Colgate to go out of business.

- Generating free cash flow and low in capital expenditure as these companies throw back lots of cash dividends to its shareholders.

Portfolio Construction Strategies

“Large wealth creation opportunities don't come too often and when they do they should have the power to make a difference on an investor's balance sheet.” – Basant Maheshwari.

This is a brief section that begins with the benefits and drawbacks of a concentrated and diversified portfolio, the various sectors and stock filters that investors must use when constructing a portfolio, how to assign weights to each stock, and how to design a diversified portfolio.

The discussion also includes a note on the thoughts that cause the majority of first-time investors to lose money in the market. This chapter concludes with an argument about when and how to buy, why there is no sin in buying a stock after it has moved up from the initial purchase price, and why selling at a higher price to buy it back lower isn't always a good idea for the overall portfolio.

Advantages of Concentration - It reduces the likelihood of making a bad decision because one can carefully select the investment. Better risk management because one can bet a lot of money on a few stocks, one is more likely to be alert and exit at the first sign of trouble.

Disadvantages - Due to illiquidity, it can be difficult to exit stocks at times. However, if one can only have a small portfolio, this should not be a problem because big money is made here. One must be confident and knowledgeable about the company, as one cannot afford to lose.

Advantages of Diversification - It increases your level of excitement because there are many companies about which you must stay informed. On the other hand, having few stocks means you have to do nothing most of the time, which is boring.

Disadvantages - Reduces the overall quality of the companies you own.

When And How To Leverage And When Not To?

A leveraged portfolio in a falling market is like a hand grenade with its pin pulled out.

The chapter discusses leveraging and why it may be an important part of investing. The types of filters to use when leveraging a portfolio, as well as the precautions to take in the event of a market decline.

The author advises to leverage only if there are alternate avenues of income. Alternative source is essential so that the investor does not have to sell his shares off to repay back the loan.

The quantum of leverage should be limited to:-

- 20% of the post leveraged portfolio value.

- the amount of surplus which the investor can generate from his alternate sources of income over a period of eighteen months from the date of loan.

The author says that leveraging is not suited for investors who desire to invest on cyclical turnarounds, illiquid small caps which are not sector leaders or stocks which have no yield protection.

The Final Word- Checklist

The Final Checklist: Contacting Company Management, Dealers And Distributors

The book concludes with Chapter, which includes a detailed point-by-point questionnaire that investors can use when speaking with management, dealers, distributors, or conducting their own research. These questions are divided into different categories and are aimed at analyzing the business model, industry scenario, government regulations, management, strategy, income statement (revenue, raw material, labor, administrative costs, margins, taxes net profit), and balance sheet (liabilities, assets, working capital and capital employed).

The Checklist:-

BUSINESS MODEL:

- Nature of the business; source of competitive strength whether through brands, patents, costs, distribution, network effect etc.

- Whether the business is capex light or needs a lot of investment to grow?

- Does the company outsource its production? If so, does it plan to stay just as a design and marketing company? If not, what are the plans for further expansion in production?

- Are the vendors capable of scaling up and supporting the company by growing at a rate equal to the targeted rates of growth?

INDUSTRY:

- Whether the company is a sector leader of this industry? If not then the difference in revenues between this company and the sector leader.

- Major competitors, organised vs. unorganised; break up, if any, market share of the top five companies in the sector?

- Trend in the market share over the last few years. Whether this company has gained or lost market share from Its competitors.? Reason For the loss in market share, if any.

GOVERNMENT:

- Impact of government regulations in terms of duties and restrictions on imports and exports. Does the company have the ability to shift the burden of taxes on its customers? Here, it is important to mention that a company like La Opala started to do well from the time the government imposed anti-dumping duty on the cheap Chinese imports. An astute investor should be aware of such catalysts and risks to stock price performance.

- Does the company enjoy excise duty, sales tax, income tax or any other exemption which can go away with time, either because of imposition of these taxes or completion of the tax holiday period?

- Do the excise payments conform with the amount of reported revenues? if a company is under the 896 excise duty rate and the excise paid in the accounts does not conform to this rate it would need clarification.

- Whether The Size of The Industry is Large or small? Generally, the government does not actively regulate very small industries for raising taxes because the overall impact on its finances is minimal. For example,tobacco is more likely to see a tax change than a low calorie sweetener.

- The extent of government control on pricing as is the case in fertilizers, oil marketing companies, sugar and other sectors.

- Environment and other bottlenecks if any? This is relevant mostly for mining, industrial and other government regulated companies.

MANAGEMENT:

- Does the management bandwidth extend beyond the top level? Is there a divorce in ownership and management? If not, are the promoters managing the company as a professional enterprise?

- In the case of secular growth companies, Is the management satisfied with a 15% to 20% growth or will they strive for more if the opportunity presents itself. No company answers this question clearly but stÏIl an investor will have to use his question to get this answer. Pointers to this are the ROE and the past operating history and the presence of an economic tailwind.

- Management’s take home competition either in cash or stock options as percentage of net profit.

- If there is a promoter issue of shares or warrants at discount then why not a rights issue for all shareholders?

- Management's intention to handle free cash, either through dividend payouts, business diversification or expansion of existing facilities.

STRATEGY:

- Any new products or services that the management intends to add? Minimum threshold RoCE that the company has in mind while thinking of new ventures.

- Are the existing products as good as those of the competitors, if not is the company innovating fast enough?

- If the management is keen on acquiring a new business then the RoCE of the new venture in comparison to the RoCE of the existing one.

- In case of a PSU Bank or any other company owned by the government an investor should find out when the chairman is going to retire. This is because the new chairman of a PSU company is always eager to start from a low base and hence resorts to large scale provisioning so as to suppress the profitability number.

- Whether the management intends to generate growth by:

- Selling more of existing products to new customers- Volume growth through new geographies or new distribution.

- Selling more new products to existing customers- Innovation.

- Selling more new products to new customers - Diversification.

REVENUE:

- The past one, three, five and ten year sales growth and if they can be maintained, increased or decreased with reasons for change if any. Check for the inflection point from this past data if any, and reasons or catalysts for this Inflection point whether it was changing regulations, changing demographics or an overall change in economic set up.

- Differentiating the revenue growth above into volume and price. Can the company raise prices without losing sales and market share? How sticky are consumers to rising prices?

- Whether customers are up-trading or down-trading on their purchases?

- Change in sales mix because of some fast growing segments and repercussions of the same on overall growth. In case of a change in sales mix, the change in revenues could show a non-linear movement to a change in volume.

RAW MATERIAL COSTS:

- If the primary raw material is a commodity cyclical then the management itself will be incapable of estimating future input prices but a point to clarify will be on the ability of the company to shift the burden of rising input costs or retain the gain from falling input prices.

- Percentage of raw material to overall sales and the trend of this ratio over the last few years.

LABOUR:

- The extent of labour costs which is variable and directly linked to production.

- Are there any hiring plans on the anvil? Significant hiring plans as evident from newspapers and magazines will indicate that the company is on an expansion drive.

ADMINISTRATIVE COSTS:

- What is the percentage of fixed administrative costs? A higher proportion of fixed costs gives rise to operating leverage which generates a more than proportionate increase in profits when compared to increase in revenues.

- The revenue level that the company would reach without incurring Additional fixed or administrative costs in terms of new office, new staff etc.

EBITDA MARGIN:

- Whether there exists a scope for margin expansion and if so is it an outcome of :

- gross margin expansion

- operating leverage

- A very high EBITDA margin Is a cause of concern for a business that does not have strong entry barriers in which case the measures to protect margins.

TAX:

- Is the company enjoying concessional tax treatment because of:

A) past accumulated losses

B) from having its operations in a tax free zone?

- The remaining tenure of these concessional treatments or accumulated past losses against which the company can seek a tax shield in the future.

PROFIT AFTER TAX:

- It's the EPS that matters and not the profit after tax. For computing the EPS, the number of shares to be computed should be the diluted equity which is the number of equity shares resulting from an increase in Conversion of outstanding warrants, ESOPs etc.

- The compounded annual growth rate In EPS for the past one, three, five and ten years and whether that trend can be maintained, Increased or decreased with reasons for change if any. Check for inflection points from this past data, if any?

LIABILITIES:

- What is the nature of equity dilution over the last few years? Whether there is a trend in dilution is the company a serial dilution? Whether the dilution is done through a rights issue or at a discount through preferential allotment to promoters or institutional investors?

- In case of a bank or a NBFC, the percentage of loan book which has been created by dilution of equity and the portion that has been created out of internal accruals. Book values that are created predominantly by issuing new shares are not considered too favourable by the market unless that money is put to use.

- Secured and unsecured loans; trends in the absolute debt structure and also in the debt equity ratio; is the company growing revenues by taking debt on a regular basis? The increase in debt over the past one, three and five years should be significantly lesser than the increase in revenues of the company unless an investor is playing for a turnaround.

FIXED ASSETS

- The trend of increase in gross block for one, three, five and ten years. Whether the increase in gross block is higher, equal to or lower than the growth in revenues?

- The amount of money tied up in investments and if the amount is significant then the reason for the company to retain this amount and not distribute it amongst the shareholders.

NET CURRENT ASSETS OR WORKING CAPITAL:

- Whether the company employs positive or negative working capitals If the working capital cycle is negative then the company‘s expansion can be undertaken with minimum incremental capital employed as increase in scale will throw back lots of cash.

- The rate of growth in working capital and whether the growth in Working capital is greater than equal to or less than the growth in revenues?

- The number of debtor days, inventory holding period and creditor day -trends thereof.

CAPITAL EMPLOYED:

- Whether the capital employed is showing an increasing trend? If so, is it in line with, less than or greater than the revenue growth?

- Return on equity and triggers for increase in RoE thereof through the DuPont Analysis.

The points listed above has to be corroborated with a comprehensive financial analysis of the stock in question which includes the standard items like the P/E ratio, RoE, dividend yield etc and it is only then that an investor can formulate an opinion on the stock.The process of equity research is an ongoing process rather than an one time event and continues as long as an investor holds the stock.