Dividend - The Only Sure Thing From A Stock

This section discusses dividend payments, which are one of the most important aspects of investing in publicly traded companies. Furthermore, in the long run, a company's share price mimics its dividend growth, and investors must be on the lookout for the dividend to growth payoff, in which either the dividend or the growth must be sacrificed for the sake of the other. The dividend growth quotient is a concept the author created to ensure that this payoff matrix can be evaluated to determine whether or not the payoff is favorable to the investor. An ideal dividend distribution ratio is around 25-30% of the net profits.

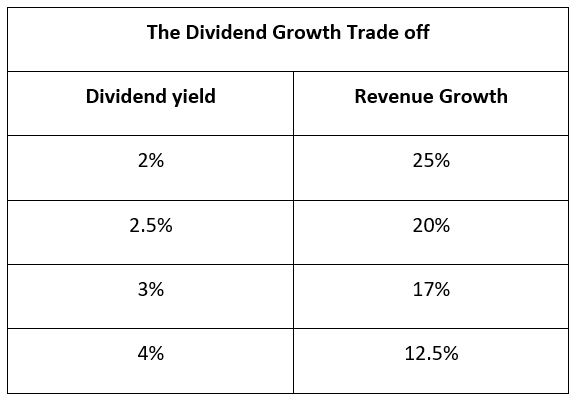

The logic of this relationship by the author is that if the yield is low it has to be compensated with higher revenue growth. Companies that want to grow fast need to retain and reinvest their earnings back in the business whereas companies who give out lots of dividends theoretically can’t grow fast.