Things To Consider About Earning Per Share

Graham begins with two advice for his investors:

1) Do not take short-term earnings seriously.

2) Looking for traps in the per-share figures.

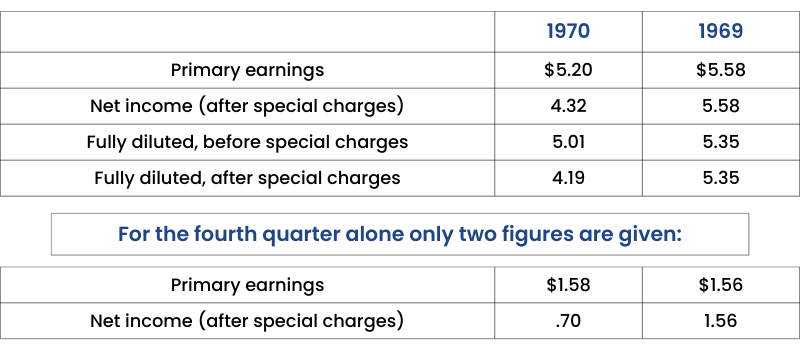

The author goes on and shares an example of the Aluminium Company of America (ALOCA). The figures shown are:

On the contrary, it looks like this company is going pretty well. The fourth quarter shows earnings of $6.32, considering the price of the share was 62, it would be 10 times its earnings. But Graham then goes on to explain that the real story of this company lies in the footnotes.

If we take a look at the footnotes, it was seen that the Net Income after Special Charges, would be only $2.80 instead of $6.32, which makes it 22 times earnings instead of 10 times its earnings. The company had an effect of “dilution”. This technique can make a stock look like it's good, but in reality, it is bad.

In the 1970s, many companies had started this misleading technique and for a common investor, it is not easy to understand these kinds of entries in a report.

Other accounting factors like the method of depreciation, FIFO, and LIFO methods of inventory measurement, matter and their choice of calculations should be thoroughly taken into consideration before making an investment decision on a stock.

The author says, "stock valuations are really dependable only in exceptional cases". The costs of trading and taxes should be taken into consideration before taking any advantage of a price discrepancy. In most cases, the market's judgment on pricing is also unreliable.