“Margin Of Safety” As The Central Concept Of Investment

Equity value strategy looks to exploit equity market inefficiencies that exist in the short to mid term due to investors over-reaction in the near-term events.

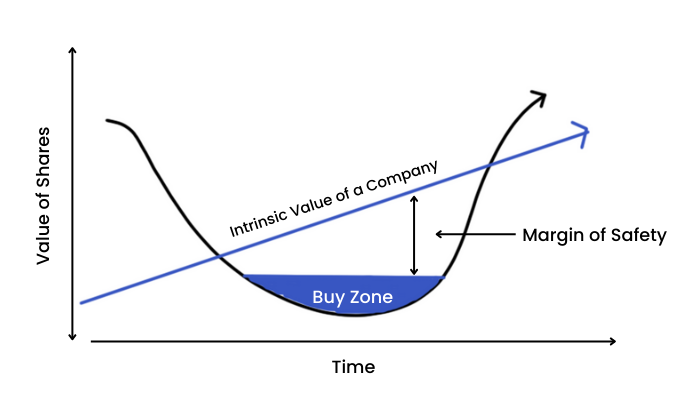

The goal of an investor is to keep as high a margin of safety as possible. The higher the margin, the more an investor has the freedom in case a negative situation takes place in a company/economy before selling has to take place.

If we overestimate our abilities and investment, we are bound to buy a mispriced stock. Ultimately, the financial risk does not depend on what kind of investments we have, but what kind of investors we are. One more factor that an investor should think about is how they are going to react when their investments don’t turn out to be exactly as they planned.

If we are buying, then that means someone else is selling. How do we know that the other person is not right?

We should calculate how the share’s price needs to go up including the costs of trading and taxes before we break-even.

Investment is now most intelligent when a shareholder thinks like a businessman. The author suggests some principles for doing so:

1) Know your business.

2) Do not let anyone else run the business.

3) Do not enter manufacturing or a trading item, unless a reliable circulation shows it has a chance to yield profits.

4) Have the courage of your experience and knowledge.

To achieve satisfactory results is easy for an investor, to achieve superior results is very difficult and harder than it looks.

Conclusion:

Successful investing is not about avoiding risk, it’s about managing it.

Investing is an adventure and the financial future is always unpredictable. The Intelligent Investor is a very old book but still in today's world its implications remain. Software’s like Bloomberg and the introduction of paperless trading have changed the market significantly to what it was 100 years ago but the basics remain the same and anyone can still apply and achieve by applying and following the guidance of this book.