Security Analysis For The Lay Investor: General Approach

The author talks about how the term “security analysis” is now becoming the term “financial analysis” and the latter term is more suited to this profession as it defines a wider concept.

Security Analysis begins with the interpretations of a company’s financial report.

When choosing our investments, it is best to make judgments on the basis of past performance because predictions about the future contain assumptions that enhance the chances of possibility of an error, i.e., we become more prone to selecting bad stocks than good stocks when making predictions about the future.

In the common stock analysis, the company’s valuation is compared to the current price of the stock to determine whether it is inviting a purchase and of course, an investor should also seek a margin of safety, i.e., purchasing a stock for less than its real value in the market.

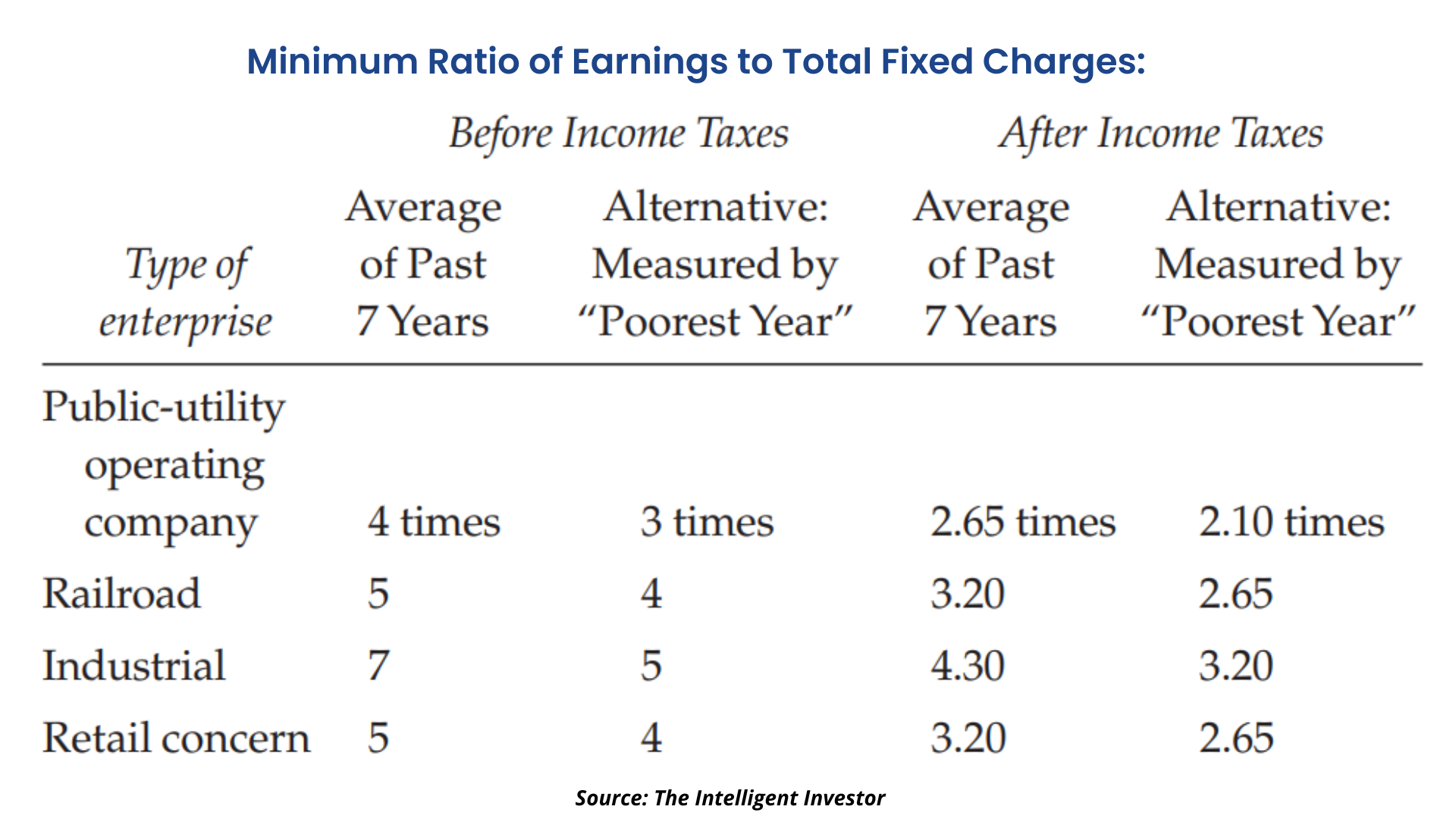

For the bond analysis, Mr. Graham provides a chart and advises us to follow that chart for better analysis:

The capitalization rate (required rate of return) may also differ, depending on the quality of the investment.

Every company has a different capitalization rate due to certain factors.

a) General long-term prospects: High price/earnings ratio and long-term vision.

b) Management: Companies with inner management issues and bad corporate governance policies shouldn’t be touched.

c) Financial strength and capital structure: The company should have an adequate amount of cash balance to make it run for a considerable future. Too much credit or "leverage" shouldn’t be in a company’s balance sheet.

d) Dividend Record: Dividend should be paid to the shareholders consistently for at least the last 20 years.

e) Current dividend rate: Dividend rate varies from company to company but most of the companies pay a significant part of their earnings (50% or more) in the form of a dividend.

f) Earnings Per Share should have grown by 6 to 7% at least for the last 10 years.

Since a company is a part of an industry, the economic position of an industry is an important factor to measure. Industry cyclicality, future industry prospects, etc. are needed to be considered when purchasing a stock.

Graham also recommends a two-part appraisal process:

A) Establish a “past-performance value”.

B) Contemplate how much of an adjustment is needed for a valuation based on future assumptions.

Also, a company having "a moat" or a competitive advantage in its market is an additional advantage.