Investing In Investment Funds

A defensive investor can also invest in investment funds. These are vehicles that provide a way for saving and investment, and possibly preventing individuals from making costly mistakes. These are commonly known as mutual funds or open-end funds and can be sold in the market for their NAV. At the end of 1970, there were 383 registered funds with the SEC, having a total of $54.6 billion dollars in assets.

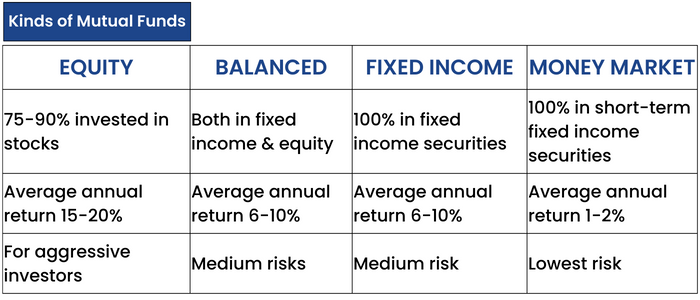

This is a large industry. There are different ways of classifying these funds:

a) Balanced funds

b) Stock-bonds

c) Bond funds

d) Hedge funds

e) Letter-stock funds, etc.

Investment funds have promoted good habits of saving and investment, they are highly regulated, and individual costly mistakes can be avoided here.

Mutual funds have historically proven to be no better than the stock market, because mutual funds have substantial management costs and the after costs returns are not higher than the stock market returns for that year.

However, an investor should expect average earnings from mutual funds. We can check the performance for the last five years to get an idea about the fund performance.

An investor should be skeptical of any significant performances in the stock market. Outperformance in rising markets may indicate speculative behavior from portfolio managers. Usually, these funds end up with high losses.

The benefit of an investment fund is that it is a cost-effective method to diversify your portfolio with little to no effort.

Closed-end funds selling at a discount can be much more profitable than open-end funds (even with sale charges included). Buying at a cheap price changes the return-on-investment (ROI) calculations.