Shareholders And Management: Dividend Policy

Shareholders should always ask questions to the management when:

a) When the results are unsatisfactory.

b) When results are poorer than other companies of similar stature.

c) When a company's market price has been unsatisfactory in the long run.

In the last 20 years, the "profitable reinvestment" theory has gained popularity, i.e., instead of paying all of the dividends to the shareholders today, a company can reinvest the money in its business to generate more profits.

Investor sentiment is very unpredictable in this matter and more than 1 view can be generated for dividend policy.

Graham believes a shareholder should demand:

A) A normal pay-out of earnings (say 2/3rd) of the total earnings in the form of a dividend.

B) A clear-cut demonstration, that the reinvested earnings will lead to better per-share earnings in the near future.

C) Most of the time the companies which do not want to pay dividends are because they would like to clear out their outstanding debts first. This shows a weak mentality of the firm and its inability to generate enough cash to keep its shareholders happy.

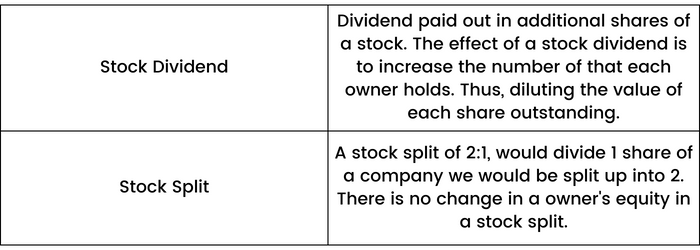

A stock split shouldn't really have an impact on how dividends a shareholder receives ultimately. A stock dividend, however, is subject to different views because the share values do get diluted which might be less than what a shareholder would have received if a cash dividend was given.

Graham also suggests that the independent directors of a company should also be responsible and should put up a comment on the dividend policy to the shareholders.