The Good And Clean Framework

There are two filters that are run on the whole universe of stocks:

‘Good’: helps in identifying stocks that have done a great job in creating shareholder value—right from judicious capital expenditure to profitability to return of surplus cash to shareholders.

‘Clean’: helps in identifying how good the company’s corporate governance is and what the quality of their published accounts is. It is a measure of the long-term sustainability of a company and its performance.

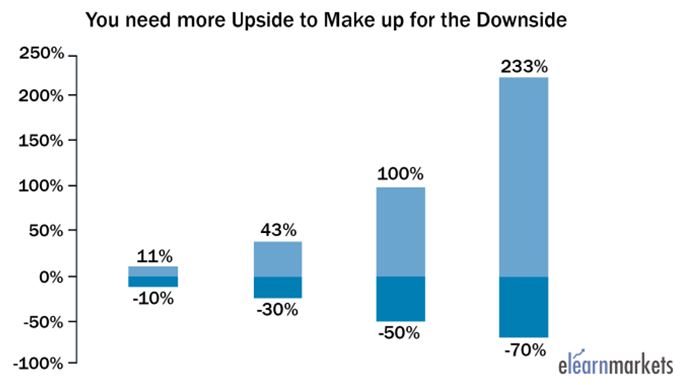

The focus on ‘good’ helps generate the upside while not compromising on ‘clean’ reduces the downside risk.

The amount of upside needed to make up for the down side.

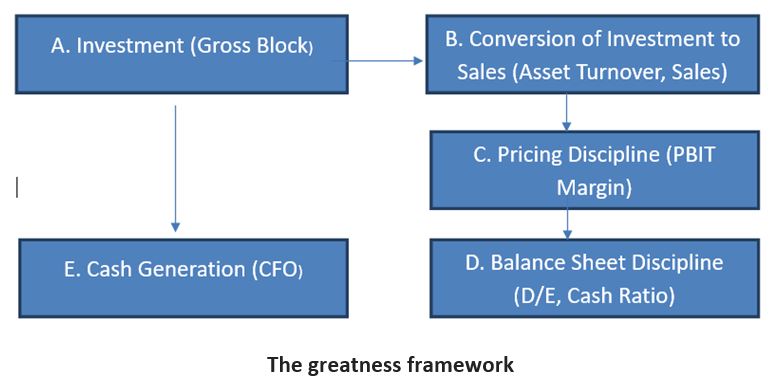

The ‘good’ framework essentially hinges on using publicly available historical data to assess which firms have, over a sustained period of time, been able to relentlessly and consistently:

- Invest capital.

- Turn investment into sales.

- Turn sales into profit.

- Turn profit into balance sheet strength.

- Turn all of that into free cash flow.

- Invest free cash flows again.

The Greatness Factor.

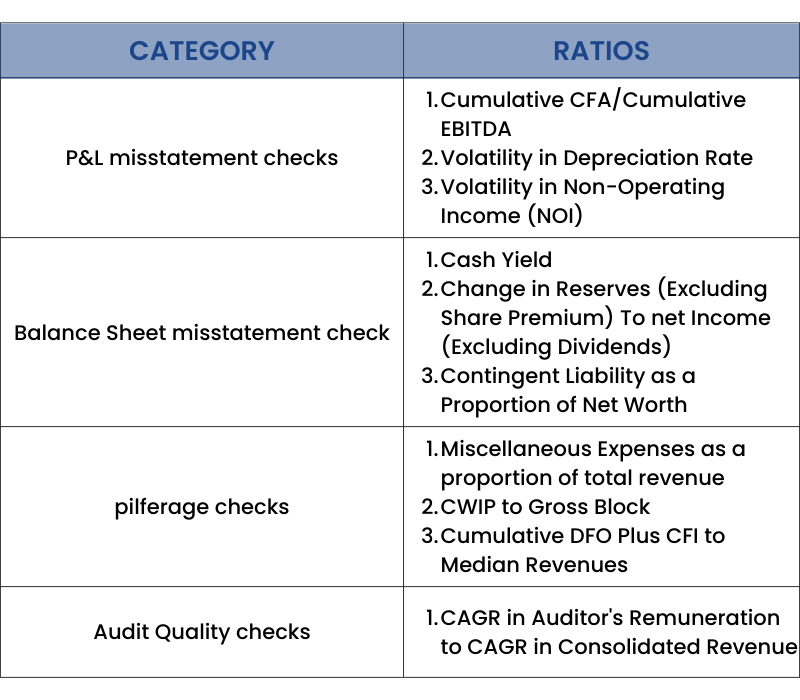

Clean: The accounting Framework checks for the quality of companies' accounts using 11 ratios

Importance of the cleanliness check - If we rate the BSE 500 companies on the basis of cleanliness and divide them into 10 groups, data shows that the company with the worst scores i.e. the least clean companies, gave the worst return to shareholders.

Therefore, ideal equity allocation should be:

1.20% Nifty tracker

2.20% Coffee Can Portfolio

3.20% small cap mutual funds

4.And 20% good and clean investing