Putting It All Together

Essentially, what this book has highlighted is: Investing for long periods of time in high-quality portfolios . . . . . . with a higher weightage to high-quality small-cap companies . . . . . . while ensuring that you don’t pay too much by way of fees . . . . . . and avoiding investment traps like real estate and gold . . . . . . should lead to significant and sustainable wealth creation.

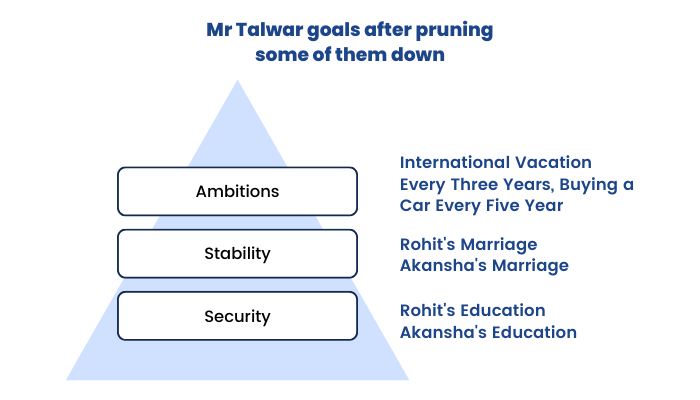

Our goals can be bucketed into three categories:

Security - These goals are extremely important to us and provide protection from anxiety.

Stability - These goals are not as important as the security-related goals, however, they ensure that we maintain a desired standard of living.

Ambitions - These goals will not be necessities but they help us achieve upward wealth mobility and give us a certain status in our social circle.

Mr. Talwar's required rate of return keeping all his goals in mind is a staggering 21% (keeping in mind the time value of money and inflation).

The ‘asking run rate’ of 21 per cent for Mr. Talwar seems steep, especially compared to the kind of returns he has generated in the past. There was no way he could hope to achieve a 21 per cent per annum return every year. This meant Mr. Talwar would have to amend his ‘ambitious’ goals. Ultimately, he lets go of his objective to buy a holiday home and reduces the frequency of overseas vacations and purchase of a new car to three and five years respectively. With these changes, Mr. Talwar’s required rate of return drops to a more achievable number of 16% per annum.

To achieve 16% annual returns the following allocation is suggested.

Equity - 80% - 18.8 % per annum, pre-tax returns

Debt - 20% - 8% per annum

Then, return is equal to 80%*18.8 + 20%*8 = 16.6%

Equity allocation

We divide the equity portfolio to 3 buckets: large cap, midcap and smallcap.

Large cap portfolios

Any company with a market cap of ₹20,000 crores is a large cap company.

Large-cap stocks are the anchor for any investment portfolio as these are time-tested companies with a long and consistent track record of generating returns for shareholders.

Robustness of these companies ensure that share prices are less vulnerable in case of sharp market pullback. This in turn, helps reduce the volatility in the overall value of the portfolio.

For investment in large cap stocks , it's advisable to use an Exchange traded fund (ETF). Outperformance of large cap Mutual Funds has more or less vanished over the last decade. ETFs have therefore become the best way to invest in large cap stocks. These ETFs typically have an annual expense ratio of 0.2 % compared to 2- 2.5% that the actively managed funds charge.

Small midcap portfolios

Any company with a market cap between 3,000 to 20,000 Cr. comes under the small mid cap portfolio category.

There will be some stocks which will be multibaggers and some will fail. As is the nature of portfolio returns, the winners will end up with more than compensating for the losers. This will happen only if the investor buys and leaves the portfolio untouched for a long period of time.

More than 20% returns can be expected from these stocks.

There are two avenues of investments in this category.

1. Mutual Funds (direct scheme route).

2.Good and clean investing approach.

Out of 5,000 stocks 4,500 are small caps. There are a number of hidden gems waiting to be discovered.