Case Study: Page Industries

Page Industries is the parent company of some famous franchises like Jockey and Speedo.

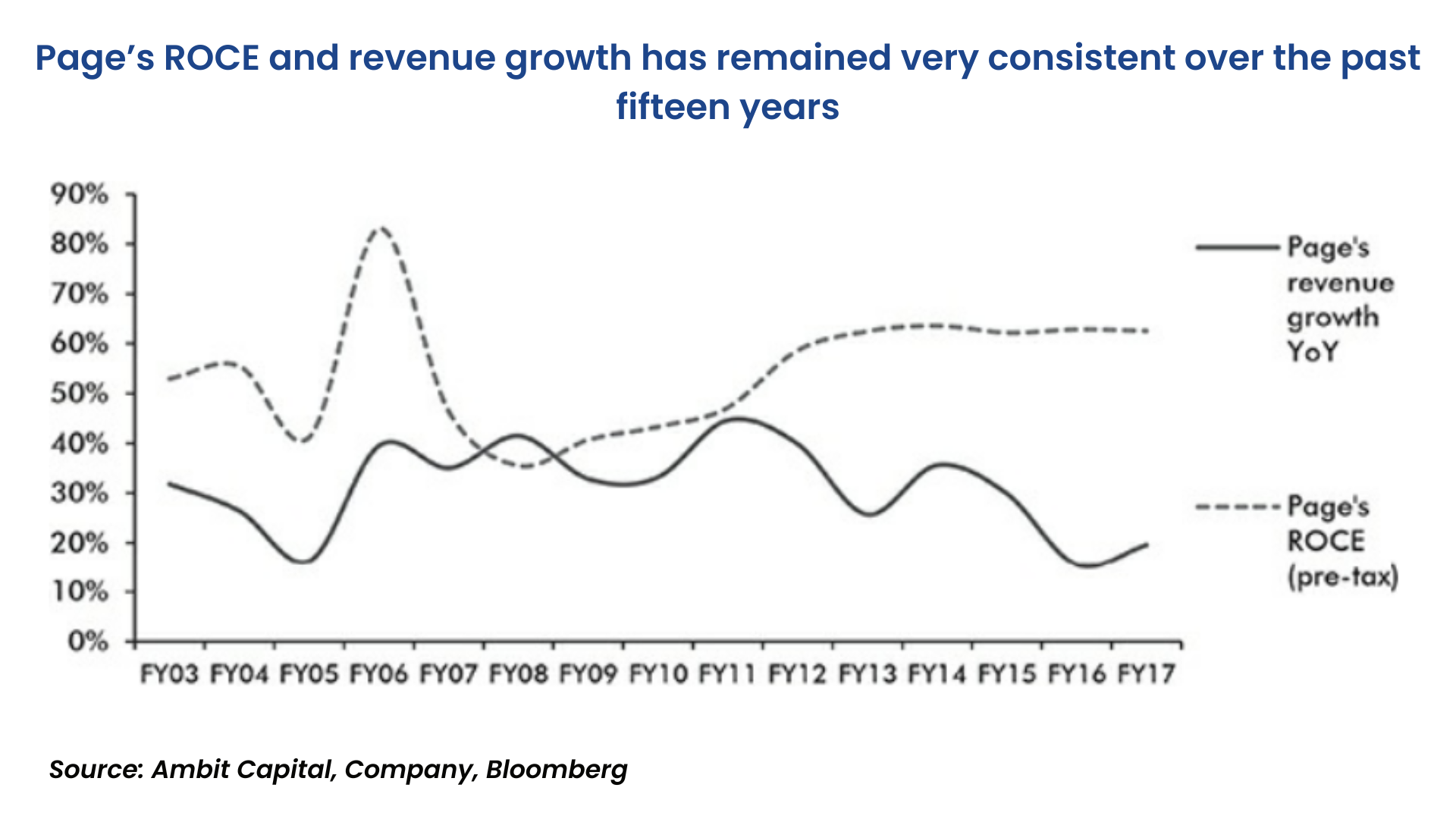

For the past 15 years, this firm has consistently achieved revenue growth in excess of 10% per annum.

This company is a perfect example according to the Warren Buffett categorisation of business. It requires capital to grow and generates decent ROCE. The company reinvested 50% of its operating cash flows into its core business activities via fixed asset investments to expand its manufacturing capacity.

The company has either maintained or improved its ROCE over time, implying that it is successful and consistent in generating healthy ROCE on the reinvested capital too.

Page’s share price has grown at 45% per annum over the past decade. The trailing P/E ratio has gone up from 27 times in 2007 to 70 times in 2017, implying a CAGR of 10% in the P/E multiple.

The firm has delivered a 32% earnings CAGR over this decade.

Conclusion:

80% of Page’s share price can be attributed to its earnings growth and only the remaining balance of 20% to P/E multiple. Its price performance is largely attributed to its healthy earnings trajectory rather than the rating of its P/E multiple.

Reasons of success for Page Industries:

1.Focus on keeping its notes by maintaining strict capital allocation discipline:

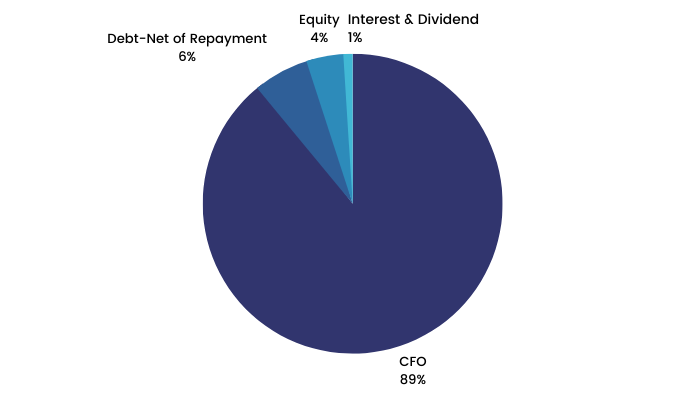

89% CFO, 6% debt, 4% equity, 1% interest and dividend.

Source of Funds for Page Industries from FY 07-17 (Large Internal Accruals)

2.The manufacturing process of Page is its biggest competitive advantage.

3.Page is in a labor-intensive industry where there is a limited scope for automation. While other company's attrition rate is 100%. Page’s attrition rate is only 12-13%.

It has achieved this through capacity expansion, i.e., not more than 1500 labourers in a single factory, while they also focus on hiring women.

Lifestyle support has been provided to their workforce and they ensure that their workforce is regularly trained. This ensures high-efficiency, productivity across the company. The operational efficiency helps them to produce high-quality products.

4.Innovative marketing, retail and distribution. Advertising has been unique by this company, with high impact campaigns. Consistent use of Caucasian models in its advertisements, projecting it to be an international brand.

5.The biggest franchise is Jockey USA.

6.Increase in size and depth.