Importance Of Long Term Holding

The case against churn:

Apart from the twin filters, one of the main conditions of CCP is to hold on to it for 10 years without churning it.

There are very compelling reasons on why should we not touch our investments:

1.Higher probability of profits over longer periods of time:

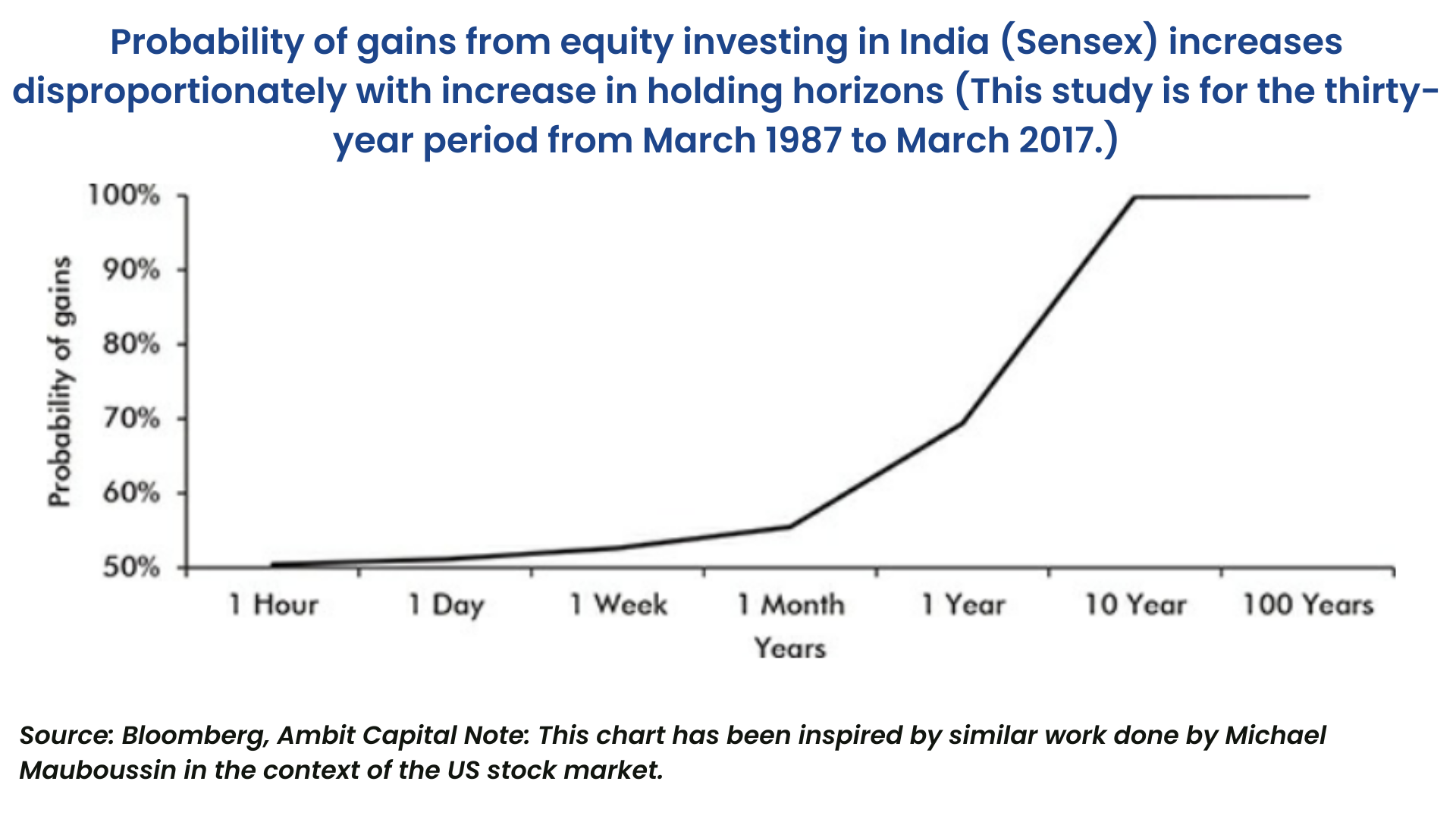

Equity is an asset class that is prone to extreme movements during short periods.

Over a longer time horizon, the odds of profits are very high.

Sensex over the last 30 years has a CAGR of 14.5%, and its standard deviation is 28.6%.

The probability of generating a positive return in one day works out to be 51.2% while in one year it comes to be around 70%.

10 years or above the probability of generating a positive return is 100%.

2.Power of compounding:

Holding a Portfolio of stock for 10 years allows the power of compounding to play out its magic. Over the longer term, the portfolio will be dominated by the winning stocks, whilst the negative return generating stocks will keep on declining, and become inconsequential.

Thus, the contribution of the winners will outweigh the negative contribution of losers. This will eventually help the portfolio to compound handsomely.

For example, if we invest 50% in Stock A and 50% in Stock B, and if the returns of both the stocks are 26% and -26%, the portfolio return would be 17.6% in a 10-year period. That is strange.

3.Neutralising the negatives of noise:

It is easy to say that we should ignore the noise in a market but, it is quite another thing to master the psychological effects of that noise.

Once you have identified a great franchise and you have the ability to hold onto it for a long period of time, there is no point trying to be too precise about timing for entry or exit. The reason behind this is, as soon as you try to time that entry/exit, you run the risk of noise rather than fundamentals driving your investment decisions.

4.Transaction cost:

By holding a Portfolio of stock for over 10 years, the fund manager resists the temptation to buy/sell in the short-term, which in turn, reduces the transaction cost. This will ultimately add to the overall portfolio performance.

Around 9% of the final Corpus is lost to churn over the 10-year period.

The shortfall in the return is obviously the returns that the broking committee earns for helping the investor churn his/her portfolio.