Risk – An Overview

Any discussion of portfolios is incomplete without an understanding of risk. Right?

Basically, risk is the probability that the actual outcome of an investment will vary from the outcome of expected return. It is the chance of losing some or all of the original investment.

Over the years, people around the world have tried to quantify risk and invented various parameters of doing so. One of the most common methods used is Standard deviation which measures the movement in an asset’s prices in a given timeframe compared to its historical averages.

Risks come in various forms. For example, if you are investing in shares of a company, you are exposed to the risk of the prices of the shares going up and down in the share market. You are also exposed to the risk of the company performing badly which can affect the prices of the shares.

Let’s take Yes Bank as an example. In 2020, when news concerning Yes Bank’s problems came into the limelight, its share prices fell from ₹ 36.85 on 5th March 2020 to ₹ 16.20 on 6th March 2020 (closing price of the day taken in both cases).

Risk can be of various types – industry-specific risk, competitive risk, international risk, market risk, etc.

Every investor needs to have a thorough understanding of risk to be able to manage it more efficiently. While in this module, we have touched upon various concepts related to risk, we recommend improving your knowledge about risk, which may be very useful.

Risk And Return

Return is the gain or loss made from an investment. In the financial world, risk and return are very closely related. In other words, they are two sides of the same coin. A positive correlation exists between risk and return: the greater the risk, the higher the potential for profit or loss. Return on investment is measured as a percentage.

The key to investing smartly is to strike the balance between risk and return so that you don’t take too much risk, but then don’t affect the return on your investment either by playing it too safe.

Portfolio risk

Since we are talking about the portfolio, another very important concept is portfolio risk. To put it simply, portfolio risk is the overall risk of the portfolio. It is the summation of the risk of individual investments in your portfolio. While deriving the portfolio risk, the weights of each investment are also taken into account.

Portfolio risk can be of various types, the most common ones are:

1. Market risk: Also known as systematic risk, this is the risk of investing in a particular market. The impacts of this kind of risk were felt severely when global markets crashed due to the outbreak of the Covid-19 pandemic.

2. Inflation risk: This is the risk that is attributed to the inflation rate in a particular economy where you are investing. This affects the ‘buying power’ of your portfolio. For example, if your portfolio’s return is 5% but the inflation in the economy is 6%, actually, you are not making money in your portfolio. This is inflation risk.

3. Interest rate risk: Let us suppose you invest ₹ 10,000 in a fixed deposit for 1 year @ 6% today. However, after 15 days, the interest rate for 1 year fixed deposits is increased to 7%. So, in reality, you lose out on 1% of interest. This is an interest rate risk. Portfolios which contain bonds are more susceptible to this risk, however, all portfolios are exposed to interest rate risk in some way or the other.

4. Currency rate risk: Portfolios that invest in foreign exchange or global economies are exposed to currency rate risk. For example, if the electronic vehicle company Tesla looks promising to you, you might want to invest in Tesla’s shares. However, shares of Tesla are listed in NASDAQ, which is located in the United States of America. So, when you invest in Tesla, you will have to convert your Indian Rupees into US Dollars – thus, exposing yourself to the fluctuations of the INR to USD rate and vice versa.

5. Concentration risk: This risk is imparted to a portfolio by concentrating on a specific industry, asset, sector or region. For example, if a major part of your portfolio is invested in the banking sector, and for some reason, the banking sector does not perform well, your portfolio returns will be heavily affected.

Calculating portfolio risk

So, the obvious question is, how do you calculate the risk in your portfolio?

There are various methods and ways to do so. The most common one is Beta.

Beta

Beta is the volatility of an individual portfolio to the market. It is most commonly used to measure risk in the share market. The beta of the market is 1. An asset with a beta of 1 will move up and down in the same way as the market. A stock with a beta of 0.5 will rise and fall only half as much as the market.

You can calculate your portfolio’s beta through the following steps:

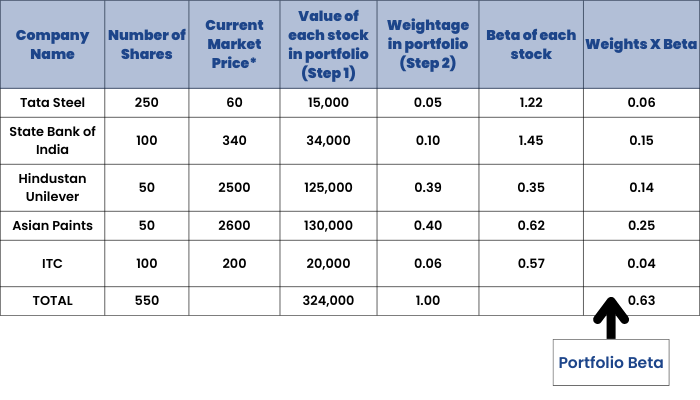

- Calculate the value of each stock in your portfolio – current market price of each share X number of shares. Add them up.

- Now calculate the weightage of each stock in your portfolio .

- Find the beta of each stock.

- Multiply the individual weights by the appropriate beta.

- Add up the weighted beta figures.

Let us take a sample portfolio and see how Beta is calculated.

Suppose a portfolio consists of 5 shares – Tata Steel, State Bank of India, Hindustan Unilever, Asian Paints and ITC. Let us follow all the steps mentioned above to arrive at the portfolio Beta:

So our portfolio beta is 0.63, which is a moderate beta. As mentioned before, since the market’s beta is 1, this portfolio is less volatile than the market.

Alpha

Talking about portfolios, another concept is very important – Alpha. The alpha of a portfolio is the excess return of a portfolio as compared to an index. This is why alpha is often referred to as ‘excess return’ or ‘abnormal rate of return’. It is important to remember that markets are efficient. Hence, earning an abnormal rate of return is not possible for a long period.

The challenge in a portfolio is to strike the balance between Alpha and Beta so that you take a calculated risk and earn a good return as well. The main job of professional portfolio managers is to create this balance.

Alpha is one of the measures used to evaluate a portfolio. Alpha is a single number (such as 2 or 4) that represents the performance of a portfolio in percentage relative to a benchmark index. An Alpha of 4 means that the portfolio’s performance has exceeded the performance of the benchmark index by 4%.