Benefits Of Alternative Investment

So, now comes the obvious question – why should you invest in alternative investments? To answer this question, let us look at a few benefits of alternative investments:

1. Less correlation to traditional investment products

As we mentioned above, alternative investments have little or no correlation to traditional investment products. And this is their biggest benefit. This helps bring diversity into a portfolio, helping the portfolio bide away times when global markets crash.

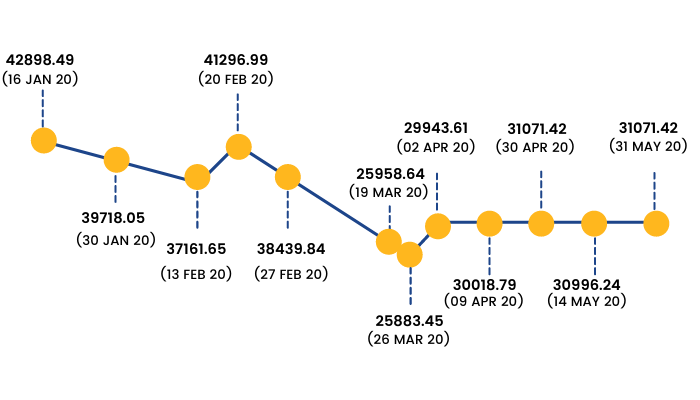

By adding an alternative investment product, your portfolio will be relatively unaffected by the ups and downs in the global markets, stock markets for example. In February 2020, when the Covid pandemic first came into light, BSE Sensex dropped sharply and then made a slow recovery over the next few months when India was battling with the pandemic. Gold prices, on the other hand, continued to rise and reached a record limit during the year.

The two graphs given below compare the Sensex levels and gold prices on the same dates. Take a look to understand how the drop in Sensex has not affected the prices of gold.

Closing level of Sensex

Above graph showing movement in BSE Sensex 30 during the outbreak of Covid-19 pandemic in India

Above graph showing the movement of gold prices during the outbreak of Covid-19 pandemic in India

2. Lesser exposure to volatility

Since alternative investments have a lower correlation to traditional markets, they have lesser volatility risk. Larger markets such as stock markets are highly volatile since they are easily affected by global events.

However, alternative investments are smaller markets which have a lower response to the global crisis and hence less volatile.

3. Potential to earn a higher return

Alternative investments have the potential to earn higher returns over the long term. Products such as private equity and hedge funds are professionally managed with an aim to provide investors with higher returns than investing in traditional products.

However, please note that many alternative investments also entail higher risk. Hence, choosing an investment option that matches your risk-to-reward potential is highly recommended.