Portfolio With Alternative Investments

What Are Alternative Investments?

When we talk about investments, everybody thinks about certain products – shares, bonds, fixed deposits etc. Right? However, over the years, the world of investment has gone through a sea change and now, many other products are available to bring diversity to your portfolio. These are called Alternative Investment products.

In this module, we will tell you all about alternative investment and also discuss some of the most important things that you should know about while creating a portfolio.

So, let’s begin:

To begin with, let us understand what is an alternative investment?

To put it simply, any investment product that is not a traditional investment is an alternative investment. Unlike traditional investment products, an alternative investment may or may not be regulated.

The world of alternative investment is massive and can range from hedge funds managed by professional fund managers to gourmet vintage wines grown several decades ago in a family-owned small vineyard in some corner of the world.

Alternative investment products can be tangible such as gold or intangible such as cryptocurrencies, hedge funds or private equity.

Some alternative investments can be quite complicated in nature and can be illiquid. That is why for long time, they were popular among institutional investors. However, thanks to ETFs and mutual funds – alternative investments have become easily accessible to retail investors as well.

While some people put real estate in the category of traditional investment, others consider it as an alternative investment. Since in India, traditionally people have considered buying a house or land as a form of investment, we will consider real estate as a traditional investment for this module.

Traditional Vs Alternative investments

Since in its definition, alternative investments are linked to traditional investments, a comparison between the two becomes imperative.

It is important to remember that generally alternative investments have shown little correlation to traditional investments such as stocks and bonds. By nature, they are more illiquid and more complicated than a traditional portfolio. They are a great addition to any portfolio. Many alternative portfolios provide a significantly higher return than traditional investments.

Now, let us draw a comparison between the two:

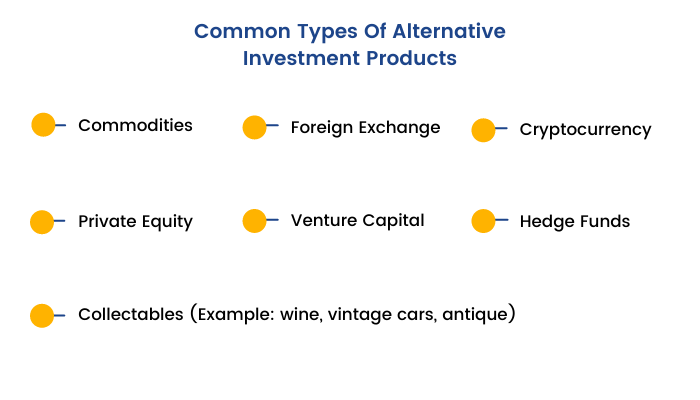

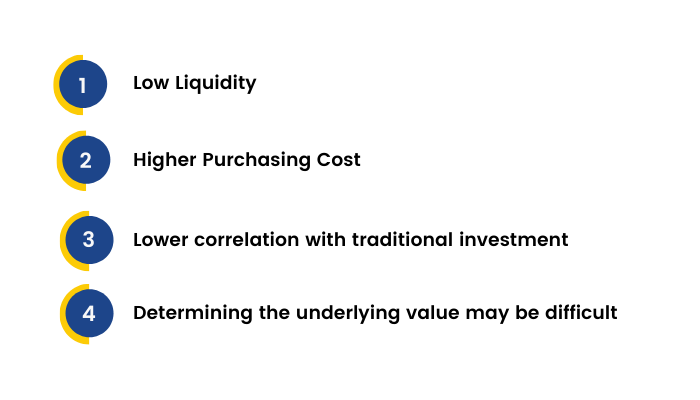

Features Of Alternative Investments

Most alternative investment products have the following features:

1. Lower liquidity

Compared to traditional investment, alternative investments have relatively lower equity. This is mainly because they don’t trade in a centralized market and have lower demand than traditional investments. Moreover, many of them may be close-ended and hence may have exit restrictions. Hence, liquidating an alternative investment and cashing out a position may be difficult at times.

2. Higher purchasing costs

Since you have seen the types of products, you must have realized that almost all of them are expensive. Hence, purchasing an alternative investment can entail a higher cost. Additionally, in some cases, a cost may be involved during the purchase, such as a fund management cost, which has to be paid by the investor.

3. Lower correlation with traditional investments

Alternative investments generally have little or no correlation to traditional investments. And this is what makes it a good choice for any portfolio. Consider a situation such as 2020, when global markets crashed due to the Covid-19 pandemic. Naturally, the value of all portfolios went down. However, those portfolios which had some amount of alternative investment did not suffer as much.

4. Determining the underlying value may be difficult

As mentioned earlier, the world of alternative investments is vast. Some products may be so complicated that determining the underlying value may be difficult. For example, a piece of antique furniture may be valuable due to its design, craftsmanship and age. However, different people will have different opinions about exactly how much it is worth.

Benefits Of Alternative Investment

So, now comes the obvious question – why should you invest in alternative investments? To answer this question, let us look at a few benefits of alternative investments:

1. Less correlation to traditional investment products

As we mentioned above, alternative investments have little or no correlation to traditional investment products. And this is their biggest benefit. This helps bring diversity into a portfolio, helping the portfolio bide away times when global markets crash.

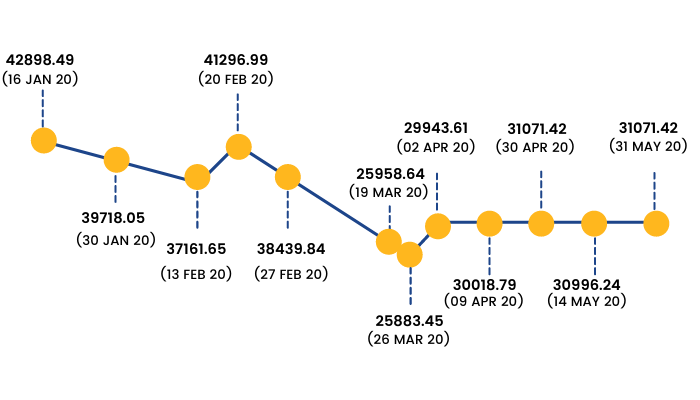

By adding an alternative investment product, your portfolio will be relatively unaffected by the ups and downs in the global markets, stock markets for example. In February 2020, when the Covid pandemic first came into light, BSE Sensex dropped sharply and then made a slow recovery over the next few months when India was battling with the pandemic. Gold prices, on the other hand, continued to rise and reached a record limit during the year.

The two graphs given below compare the Sensex levels and gold prices on the same dates. Take a look to understand how the drop in Sensex has not affected the prices of gold.

Closing level of Sensex

Above graph showing movement in BSE Sensex 30 during the outbreak of Covid-19 pandemic in India

Above graph showing the movement of gold prices during the outbreak of Covid-19 pandemic in India

2. Lesser exposure to volatility

Since alternative investments have a lower correlation to traditional markets, they have lesser volatility risk. Larger markets such as stock markets are highly volatile since they are easily affected by global events.

However, alternative investments are smaller markets which have a lower response to the global crisis and hence less volatile.

3. Potential to earn a higher return

Alternative investments have the potential to earn higher returns over the long term. Products such as private equity and hedge funds are professionally managed with an aim to provide investors with higher returns than investing in traditional products.

However, please note that many alternative investments also entail higher risk. Hence, choosing an investment option that matches your risk-to-reward potential is highly recommended.

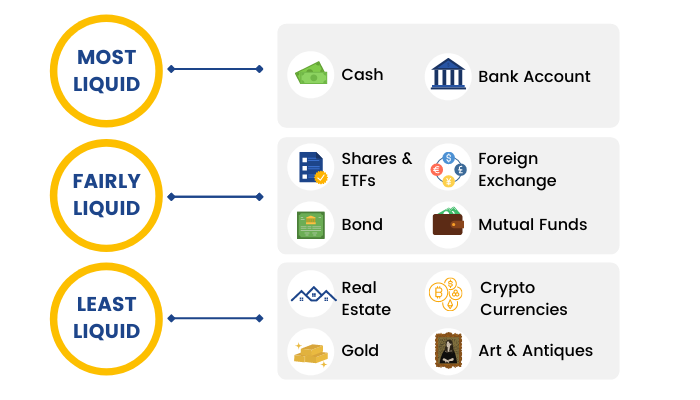

Understanding Liquidity

We spoke about liquidity while discussing the features of alternative investments. Let us now understand what it is and why is it important for a portfolio?

Liquidity is the ease or efficiency with which an asset or security can be converted into cash.

To put it differently, liquidity is the ease with which you can buy or sell an asset or security in the market. Cash is the most liquid asset because you can easily convert it into an asset of your choice.

Let’s take a quick look at the liquidity of the most common assets we know about:

As you can see from the above illustration, a range of products is available to any investor to build a portfolio. The most liquid assets have the least return, while the ones with lesser liquidity have the potential to pay a higher return. While holding cash gives you no return, keeping your money in a bank account gives you around 3% interest or even less (as of April 2021). On the other hand, assets that give you the most return are also the least liquid.

A portfolio needs to have a balance of all three categories mentioned in the illustration above. The percentage of allocation will vary from one person to another, depending on their liquidity needs. For example, for people who are less than 35 and are actively working, cash flow may not be a problem. They can decide to allocate most of their funds in fairly less liquid segments to earn higher returns.

On the other hand, for retired people, cash flow is a primary concern. Hence, they may decide to opt for cash, bank account and less risky investments such as bonds.

And this brings us to an essential concept related to portfolios – Risk. We will discuss all about it in the next section.

The Concept Of Volatility

While talking about investments, another concept that is important is volatility.

Volatility is the variation of a particular asset’s price over time. It is the movement of an asset’s prices from the mean.

It is measured by standard deviation or variation of the security’s prices from the market index. Some assets are less volatile while others are more. When it comes to the derivatives market, volatility plays a major role.

Volatility and risk are very closely related. Volatile assets are mostly risky, because their price movements are less predictable. We have discussed risk in detail in the next section.

Volatile assets also give you an opportunity to earn more, because prices can move higher up. However, please bear in mind that this means that prices can move down as well, and you may end up losing money.

The share market is a volatile market. Other volatile markets include commodities, forex, derivatives market, etc.

Volatility is affected by a large number of factors such as the economic and political situation of a country, inflation, global market conditions, oil prices, central bank rate decision and others.

The volatility of a portfolio is the measure of how much and how fast the prices of individual assets of a portfolio goes up and down. This is known as Portfolio Volatility.

How does volatility affect your portfolio?

Volatility has a significant impact on your investment decisions. Let us understand this through an example. Suppose you have a balanced portfolio with traditional asset classes such as stocks and bonds and alternative asset classes such as gold, forex (EUR-USD) and cryptocurrencies. Apart from a bond, all the other asset classes are volatile in nature. Now, suppose the value of the EUR-USD currency pair falls suddenly, your portfolio will suffer a setback. You might want to mitigate the risk by investing more in long term bonds, which has low volatility. On the other hand, suppose you have ₹100,000 to invest today, and you cannot understand where to invest. You come to know of significant news about the Bitcoin market. So, you invest the amount in Bitcoins. Due to the high volatility of the cryptocurrency market, the prices of Bitcoins go up significantly over the next few months, and you end up earning sizable returns.

Of course, this is a much simplistic example. The situation in reality may be more complex.

Volatility Index

You must have come across the term volatility index or VIX while reading about business news. A volatility index is an index that calculates the degree of fluctuation of an index such as Sensex or Nifty 50. Every major index in the world has a volatility index. For example, the VIX which tracks the movement of the S&P 500 index of India is known as the CBOE Volatility Index and is the most popular VIX in the world. It is more popularly known as “the VIX”. The term VIX was coined by the Chicago Board of Options Exchange in 1993.

The India Volatility Index is circulated by NSE and calculates the degree of fluctuation expected by active traders in Nifty50 over the next 30 days. This index was started in 2008 and its calculation is based on the famous Black and Scholes Model.

Interpreting India VIX

It is easy to be bogged down with terminologies, but understanding India VIX is really easy. Let us suppose that India VIX is 10.5 today. This means for the next 30 days, active investors of Nifty expect to obtain an annualized return of 10.5 from the index.

Simple right?

Effect of Vix on your portfolio

So how is Vix relevant to you?

If the majority of your portfolio consists of equity, it is a good idea to track Vix. If you see Vix be extremely high, be careful. Such optimism may be a bad sign. Moreover, the market changes rapidly, giving little time to investors to react. Hence, keeping an eye on Vix will definitely help you in the long run.

Risk – An Overview

Any discussion of portfolios is incomplete without an understanding of risk. Right?

Basically, risk is the probability that the actual outcome of an investment will vary from the outcome of expected return. It is the chance of losing some or all of the original investment.

Over the years, people around the world have tried to quantify risk and invented various parameters of doing so. One of the most common methods used is Standard deviation which measures the movement in an asset’s prices in a given timeframe compared to its historical averages.

Risks come in various forms. For example, if you are investing in shares of a company, you are exposed to the risk of the prices of the shares going up and down in the share market. You are also exposed to the risk of the company performing badly which can affect the prices of the shares.

Let’s take Yes Bank as an example. In 2020, when news concerning Yes Bank’s problems came into the limelight, its share prices fell from ₹ 36.85 on 5th March 2020 to ₹ 16.20 on 6th March 2020 (closing price of the day taken in both cases).

Risk can be of various types – industry-specific risk, competitive risk, international risk, market risk, etc.

Every investor needs to have a thorough understanding of risk to be able to manage it more efficiently. While in this module, we have touched upon various concepts related to risk, we recommend improving your knowledge about risk, which may be very useful.

Risk And Return

Return is the gain or loss made from an investment. In the financial world, risk and return are very closely related. In other words, they are two sides of the same coin. A positive correlation exists between risk and return: the greater the risk, the higher the potential for profit or loss. Return on investment is measured as a percentage.

The key to investing smartly is to strike the balance between risk and return so that you don’t take too much risk, but then don’t affect the return on your investment either by playing it too safe.

Portfolio risk

Since we are talking about the portfolio, another very important concept is portfolio risk. To put it simply, portfolio risk is the overall risk of the portfolio. It is the summation of the risk of individual investments in your portfolio. While deriving the portfolio risk, the weights of each investment are also taken into account.

Portfolio risk can be of various types, the most common ones are:

1. Market risk: Also known as systematic risk, this is the risk of investing in a particular market. The impacts of this kind of risk were felt severely when global markets crashed due to the outbreak of the Covid-19 pandemic.

2. Inflation risk: This is the risk that is attributed to the inflation rate in a particular economy where you are investing. This affects the ‘buying power’ of your portfolio. For example, if your portfolio’s return is 5% but the inflation in the economy is 6%, actually, you are not making money in your portfolio. This is inflation risk.

3. Interest rate risk: Let us suppose you invest ₹ 10,000 in a fixed deposit for 1 year @ 6% today. However, after 15 days, the interest rate for 1 year fixed deposits is increased to 7%. So, in reality, you lose out on 1% of interest. This is an interest rate risk. Portfolios which contain bonds are more susceptible to this risk, however, all portfolios are exposed to interest rate risk in some way or the other.

4. Currency rate risk: Portfolios that invest in foreign exchange or global economies are exposed to currency rate risk. For example, if the electronic vehicle company Tesla looks promising to you, you might want to invest in Tesla’s shares. However, shares of Tesla are listed in NASDAQ, which is located in the United States of America. So, when you invest in Tesla, you will have to convert your Indian Rupees into US Dollars – thus, exposing yourself to the fluctuations of the INR to USD rate and vice versa.

5. Concentration risk: This risk is imparted to a portfolio by concentrating on a specific industry, asset, sector or region. For example, if a major part of your portfolio is invested in the banking sector, and for some reason, the banking sector does not perform well, your portfolio returns will be heavily affected.

Calculating portfolio risk

So, the obvious question is, how do you calculate the risk in your portfolio?

There are various methods and ways to do so. The most common one is Beta.

Beta

Beta is the volatility of an individual portfolio to the market. It is most commonly used to measure risk in the share market. The beta of the market is 1. An asset with a beta of 1 will move up and down in the same way as the market. A stock with a beta of 0.5 will rise and fall only half as much as the market.

You can calculate your portfolio’s beta through the following steps:

- Calculate the value of each stock in your portfolio – current market price of each share X number of shares. Add them up.

- Now calculate the weightage of each stock in your portfolio .

- Find the beta of each stock.

- Multiply the individual weights by the appropriate beta.

- Add up the weighted beta figures.

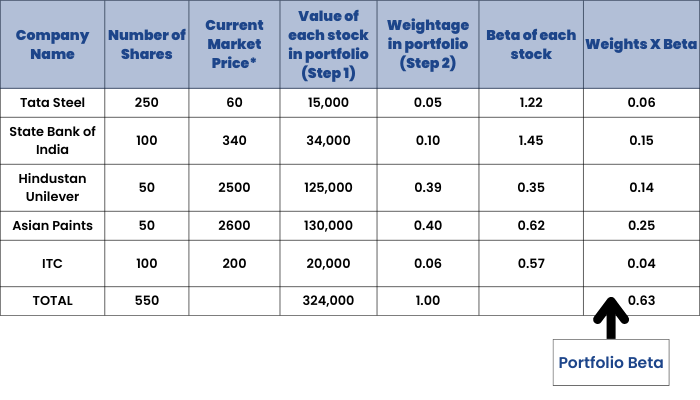

Let us take a sample portfolio and see how Beta is calculated.

Suppose a portfolio consists of 5 shares – Tata Steel, State Bank of India, Hindustan Unilever, Asian Paints and ITC. Let us follow all the steps mentioned above to arrive at the portfolio Beta:

So our portfolio beta is 0.63, which is a moderate beta. As mentioned before, since the market’s beta is 1, this portfolio is less volatile than the market.

Alpha

Talking about portfolios, another concept is very important – Alpha. The alpha of a portfolio is the excess return of a portfolio as compared to an index. This is why alpha is often referred to as ‘excess return’ or ‘abnormal rate of return’. It is important to remember that markets are efficient. Hence, earning an abnormal rate of return is not possible for a long period.

The challenge in a portfolio is to strike the balance between Alpha and Beta so that you take a calculated risk and earn a good return as well. The main job of professional portfolio managers is to create this balance.

Alpha is one of the measures used to evaluate a portfolio. Alpha is a single number (such as 2 or 4) that represents the performance of a portfolio in percentage relative to a benchmark index. An Alpha of 4 means that the portfolio’s performance has exceeded the performance of the benchmark index by 4%.

Portfolio Diversification

Now, we come to the most important aspect of a portfolio – portfolio diversification. We explained liquidity, volatility and risk in the previous sections, which will help us understand portfolio diversification better.

So, what is it?

Portfolio diversification is the process of investing in different asset classes, sectors and markets to minimize the overall risk of your portfolio.

Taking the example of Yes Bank, we discussed it earlier. Imagine you invested all your money in Yes Bank. On 6th March, when the prices fell from ₹ 36.85 to ₹ 16.20, you would have lost more than half of your money.

We follow portfolio diversification mainly to avoid such a scenario. And this is where alternative investments become very useful. They give us more choice to diversify and more markets to invest in.

The main purpose of portfolio diversification is to reduce risk – risk associated with a particular market, risk associated with a particular company, risk associated with a particular country and so on.

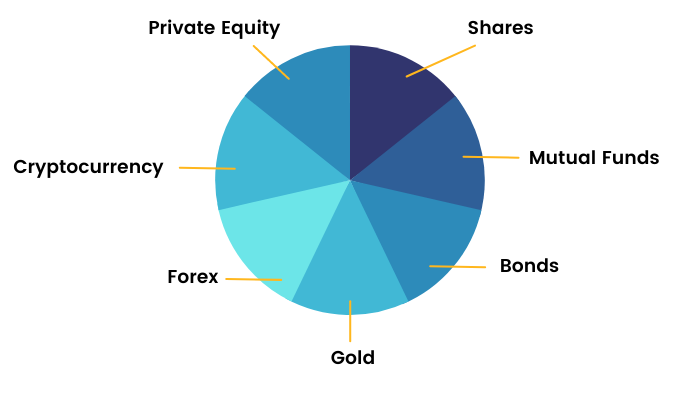

A well-diversified portfolio looks something like the picture below. There should be a range of asset classes. You can also diversify into various markets such as India, Hong Kong, the USA, Europe and so on.

How to diversify your portfolio?

Here are some common ways you can diversify your portfolio:

1. Include a variety of asset classes: As we mentioned earlier, investing in a variety of asset classes is the first tenet of diversification. Be it fixed deposits, stocks or gold – keeping only one asset class in your portfolio will either prove too risky or will earn you lesser returns than you potentially could earn.

Instead, go for a mix. Include the asset classes that you feel comfortable in. Learn about different asset classes to expand your portfolio’s horizon.

Within our ELM School, you will find detailed modules about all the popular asset classes in the world. You can start your educational journey from here.

2. Expand to different industries: Include several industries into your portfolio so that if one industry performs negatively, your entire portfolio is not severely affected by it. For example, in 2020, the prices of crude oil went down drastically. At the beginning of the year, WTI Crude Oil was trading at $61.17 per barrel. It went down to $11.26 during the year. If your portfolio was heavily inclined towards crude oil, imagine the amount of loss it would have suffered.

This is why including a variety of industries is always recommended.

3. Continue to build your portfolio: Portfolio creation is a lifelong phenomenon. Every time you invest your money, however small it might be, you are building your portfolio. Keep diversifying whenever you build your portfolio. In case you are investing in mutual funds, take the SIP route. The rupee cost averaging will help you in the long run.

4. Know when to get out: Getting out is as important as getting in. If an asset class you have invested in has not performed as per your expectation for a long time, it will be wise to get out and invest in another asset that is performing. It is human to make mistakes, moving on and exploring other avenues is very important.

Finally, it is important to remember that diversification does not mean that there will not be any losses. It is a method to minimize risk, not eliminate it completely.

Alternative Investment Products

Speaking of alternative investment products, there is a range of products that you can include in your portfolio. The world of alternative investments is huge and is ever-expanding.

Below, we have explained some of the common products:

1. Commodities

Commodities are an important investment product and a popular one. To put it simply, commodities are the basic goods we use every day – coffee, tea, orange juice, crude oil and others. These commodities are traded in the market, more specifically commodities exchanges. Some are more popular than others.

As an investor, you can participate in the price movement of certain commodities. They can be an important addition to your portfolio and a great method to diversify it.

We have a detailed module about commodities. We recommend you read it before taking the plunge into the commodities market.

Click here to read it.

Speaking of commodities, gold is one of the most popular commodities traded worldwide. Traditionally, Indians have invested in gold jewellery and bars as a method of savings. However, thanks to the developments in the commodities market, various modes are available for investing in gold such as ETFs, futures and options and others.

In our module about Gold, you can get a comprehensive understanding of the precious commodity and how you can invest in it.

Click here to read the module.

2. Foreign exchange

Different countries have different currencies and their values are determined based on their supply and demand. Usually, a currency’s value is pegged to another country’s currency such as the US Dollar or Euro. These currencies are known as foreign exchange or forex.

Forex is traded in the foreign exchange market and is usually traded in pairs known as currency pairs. EUR-USD is the most popular currency pair where the value of the Euro is determined by the value of USD and vice versa.

The foreign exchange market is a highly volatile market with extensive opportunities to earn profits. However, the downside is that since the market is very volatile, you can make losses too.

Hence, we strongly recommend having a thorough understanding of foreign exchange and the forex market before diving into the market.

Click here to read our detailed module about foreign exchange.

3. Cryptocurrency

Cryptocurrencies have become a very popular product in the last few years. These are digital or virtual currencies that are based on a technology known as the blockchain. Unlike normal currencies which are issued by a country’s government agency, cryptocurrencies are issued by solving very complicated mathematical problems and are decentralized. Since they are not issued by a government, they are not controlled by any government as well.

While cryptocurrencies are a good addition to any portfolio, they are inherently complicated. Hence, understanding them is imperative before venturing out into the area.

We have an exhaustive article about cryptocurrencies. Click here to read about it.

4. Private Equity

Private equity, as the name suggests, involves investing in private companies that are not listed in a public exchange such as the Bombay Stock Exchange or the National Stock Exchange. This investment can be done through firms or companies. The money can be used in a variety of methods such as buyouts of public companies, making acquisitions to be used as working capital and others.

This is a kind of alternative financing that companies seek from the market. As an investor, you will hand out your money to private equity firms, who in turn, will invest the money into companies that show promise. Private equity firms charge management and performance fees from the investor.

5. Venture Capital

Venture capital or more popularly VC is a kind of private equity where the money is provided to startup companies and small businesses to help them grow. Normally, venture capital is provided by high net worth investors, investment banks and other financial institutions. The investment may or may not be in the form of money. It can be in the form of technology, managerial expertise and other assistance.

Venture capital is risky in its core nature since it invests in startups with little or no track records. However, historically, the returns have also proved to be higher. Moreover, through venture capital, investors get equity in the company and may or may not be involved in company management.

6. Hedge Funds

Hedge funds have become a very popular option in the last few years. Hedge funds are a kind of investment company that invests very aggressively. At its core, it is like a mutual fund but it invests in highly risky assets. So although they may earn very high returns, the loss potential is also substantial.

Hedge funds use a variety of strategies to earn returns for their investors. They invest in derivatives and make aggressive use of leverage. Hedge funds are not easily accessible to retail investors, only accredited investors have the option of investing in them.

7. Collectables

People often decide to invest in collectables such as art, antiques, wine, vintage cars, etc. The value of these products go up as time passes and people make substantial profits by selling them at a later date. However, the key lies in choosing the right product. Not every piece of art is a classic, right?

As we have mentioned before, the world of alternative investments is huge. From buying a bottle of wine to investing in complicated cryptocurrencies – a wide range of options is open to you.

Choosing wisely is the key in this scenario. Gather sufficient knowledge before you venture out into the world of alternative investments. With the right product mix, it is possible to strike a balance between liquidity, risk and return in your portfolio and achieve the right kind of portfolio diversification.

Forex copy trading

To maximize your trading potential, consider starting with Forex copy trading. This innovative method allows you to emulate the trading strategies of successful traders, providing you with insights and techniques that could enhance your performance. By observing seasoned traders, you can learn how they make decisions and adapt those strategies to your own trading style. First, choose a reliable platform that offers copy trading services. Look for platforms that provide transparent performance metrics and allow you to track the results of traders you wish to follow. This will help you select traders who align with your risk tolerance and goals, ensuring a more personalized trading experience.

Once you identify a trader to copy, allocate a portion of your capital to their strategies. Monitor the trades they execute and stay informed about their market insights. Regular communication with your chosen trader can deepen your understanding and improve your trading skills over time.

It's important to regularly assess the performance of your forex copy trading strategy. Adjust your selections based on market changes and the success rate of the traders you follow. This proactive approach enables you to refine your investment portfolio continuously, allowing for better risk management and potential profit maximization.

How to Choose the Right Trader to Copy in Forex

Analyze the trader’s historical performance first. Look for consistent profit margins over at least six months or more. This timeline helps you gauge their ability to perform in various market conditions without relying on short-term gains.

Check Risk Levels

Review the risk-reward ratio. A trader might have high profits, but if the risk is disproportionately high, it could lead to significant losses. Aim for traders whose risk levels match your comfort zone. Use features like drawdown percentages to assess how much the trader’s portfolio fluctuates during downturns.

Examine Trading Style and Strategy

Understand how the trader operates. Whether they focus on day trading, swing trading, or long-term investing, their approach should resonate with your trading philosophy. If a trader employs complex strategies, ensure you grasp the fundamentals of what they’re doing. Look at the number of trades made. A trader who places too few trades might not optimally exploit market opportunities, while one with excessive trades may indicate overtrading or chasing losses. Balance is key.

Review their transparency. Traders who provide insights into their strategies and decision-making processes foster trust. This transparency indicates a willingness to share knowledge and keeps you informed about your investments. Finally, monitor their communication style. Regular updates, performance reviews, and responsiveness to questions reflect a trader’s dedication. Effective communication enhances your understanding and confidence in the trader’s abilities.

Key Metrics to Analyze Before Starting with Copy Trading

Examine the performance history of potential traders meticulously. Look for consistent returns over multiple months or years. A trader’s average monthly gain should be above market benchmarks. Aim for traders with at least a three-month track record for better reliability.

Risk-Reward Ratio

Assess the risk-reward ratio displayed in a trader’s profile. A ratio of 1:2 or better indicates that the trader aims for higher rewards relative to risks. This metric helps you identify how much risk they take on for the potential profits.

Drawdown Rates

Monitor the maximum drawdown. This shows the most significant loss from a peak to a trough. A lower drawdown means the trader manages risk effectively. Look for those who keep drawdowns in the single digits to ensure smoother performance during market fluctuations. Evaluate the trader's activity levels as well. Traders who make frequent trades can indicate a solid engagement with the market. While frequency can vary, consistent activity often correlates with opportunity identification. Finally, consider the trader’s strategy type. Different strategies work better in various market conditions. Ensure the strategy aligns with your risk tolerance and investment goals. Having clarity on these metrics helps in making informed decisions when selecting traders to copy.

Common Mistakes to Avoid in Forex Copy Trading

Begin by selecting traders with a consistent performance history. Many investors mistakenly chase high returns from traders with only a short track record. Look for those who demonstrate reliability over time, as this indicates a stable strategy. Avoid putting all your funds into a single trader. Diversifying your investments helps mitigate risk. Allocate funds to multiple traders with different trading styles and strategies to create a balanced portfolio. This approach can lead to more stable returns. Keep an eye on the trading strategies employed by the traders you follow. Some traders may engage in high-risk tactics that can lead to significant losses. Prioritize traders who maintain a balanced risk-reward ratio that aligns with your own risk tolerance. Do not ignore the importance of setting realistic expectations. Understand that Forex copy trading does not guarantee profits and that losses are a part of trading. Set achievable goals based on your risk appetite and investment horizon. Regularly review and assess the performance of the traders you copy. Failing to evaluate their strategies and results can lead to missed opportunities for adjustments. Be ready to replace underperforming traders if their strategies no longer meet your investment needs. Establish clear parameters for your investments, including stop-loss limits to protect your capital. Many traders overlook this crucial step, which can result in excessive losses if trades go against them. Ensure you set boundaries to safeguard your investment. Stay informed about external market factors that can impact trading performance. Market news, economic releases, and geopolitical events can affect currency movements. Staying updated allows you to anticipate potential impacts on your chosen traders. Finally, resist the temptation to manipulate trades based on emotions. Trading decisions driven by fear or greed can lead to impulsive actions. Stick to your strategy and avoid making hasty moves based on temporary market fluctuations.

Conclusion

We are now at the end of this module, but the learning does not end here. What we discuss here is not very popular as of now, but soon enough, investors will find new opportunities for investments other than normal asset classes like equity or debt. Cryptocurrency is now emerging as a major alternative investment these days; probably a few years from now, we might see portfolios of cryptocurrencies. We have already curated a module on cryptocurrency in ELM School. Click here.

Other than this, there are different types of modules to read here. Do read them to enhance your knowledge and skill in finance.