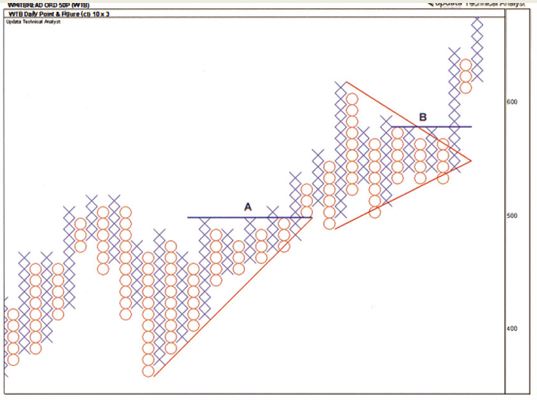

Symmetrical Triangles - Sloping Top And Sloping Bottom

In our last topic, we have briefly described how sloping tops & bottoms influenced the strength of a chart pattern. This unit, we will further elaborate & explain symmetrical triangles pattern formation on a point & figure chart.

When you see a sloping top and bottom in a pattern, this indicates uncertainty and confusion on the part of the participants and therefore the direction of the breakout cannot be predicted with any degree of certainty. There is some evidence that the breakout is more likely to be in the direction of the underlying trend, and this tends to be the case with smaller patterns. The bigger the pattern the more likely it is to be a reversal pattern and thus it leads to a warning.

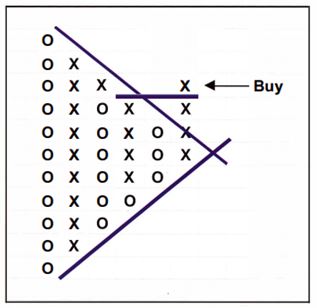

Buy signal following a symmetrical triangle

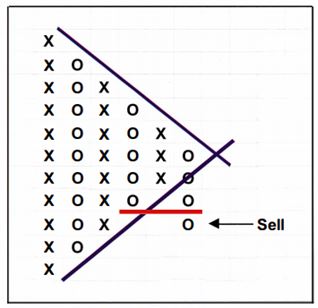

Sell signal following a symmetrical triangle

The important thing to note with these symmetrical patterns is that the signal is not given by the break of the trend line. As in all Point and Figure Analysis, the signal is generated when a breach of a previous column occurs. The buy and sell occur after a double-top and double-bottom breakout, respectively.

The chart of Whitbread Plc showing an upside and a symmetrical triangle.