Long Put Vs Short Call

Now we will discuss the differences between a 'Long Put' and a 'Short Call,' both being somewhat similar.

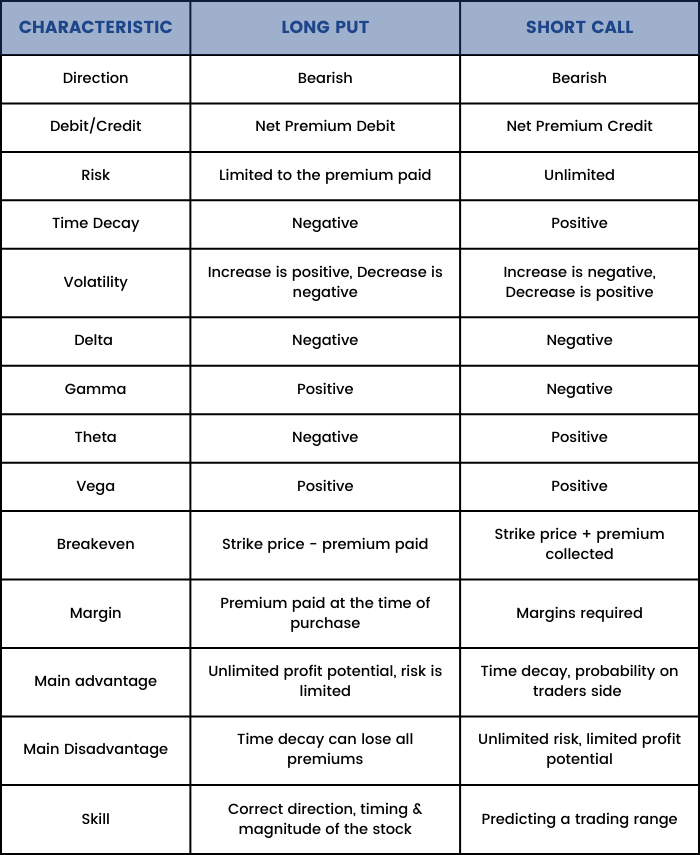

A long put and a short call both are bearish strategies. Even though they both are bearish, they have opposite risks and rewards.

Buying a put is a limited-risk strategy, whereas selling a call is an unlimited-risk strategy.

Which strategy is better in the particular circumstance depends on the risk profile of the trader, time frame, and anticipated magnitude of the move.

If the trader is bearish in the short run, then the purchase of a put may be appropriate; however, if the view is bearish but believe that the underlying stock can fluctuate and that it will take time for the bearish move to occur, then selling an Out-of-the-money (OTM) call may be appropriate.

An important aspect which needs to be kept in mind while deciding whether to buy a Put or sell a Call is the volatility factor. If an increase in the volatility is expected, then buying Put options are always better as while selling a Call, the premiums may not decay fast.

Moreover if you want to sell a Call, it is always better to initiate it towards the second half of the expiry period. Since the Expiry is near, premium decays are faster.

The table below compares the characteristics of along put to the characteristics of a short call: