Long Call

As we have discussed earlier there are four types of Naked Option Strategies.

- Long Call

- Short Call

- Long Put

- Short Put

Firstly, let us start with ‘Long Call’.

A Long call is one of the most basic option strategies. It involves the purchase of a call option. It is a bullish strategy.

If the stock rises, you have unlimited profit potential with limited risk.

A premium of long call increases in value from a rise in the underlying stock and volatility expansion.

The premium of a Call declines in value from a decline in the underlying stock, time decay, and volatility contraction.

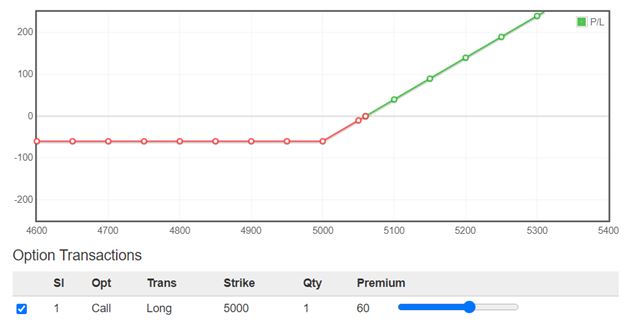

Below is the illustration of the payoff diagram of a Long Call Option

The key to becoming a successful option trader is to select the best strike price and time frame to match your risk profile and goals.

The higher the strike price of a call, the premiums are lower. And lower the delta, the greater is the leverage. At-the-money (ATM) and Out-of-the-money (OTM) options seem lucrative for option buyers.