Introduction to Derivatives

What are derivatives?

The term "Derivatives" originates from the term "Derive" of English language, which as per Oxford dictionary means obtains something from (a specified source).

Let us take a very simple example to understand what Derivatives are:

Let us assume that there is a farmer, who works throughout the year in his farm and produces wheat. Currently it is the month of March and the price of wheat in the spot market where the farmer sells his produce is ₹10/kg. The total cost of production of wheat for the farmer including fertilizer, seed and his effort is ₹6/kg.

However, the wheat in the farmer's land will mature in the month of June, 3 months from today. Thus, he is worried that if there is good rainfall leading to June, wheat from all the farmers will simultaneously hit the market and because of this the price of wheat might go down to ₹8/kg and this will lead to a profit of only ₹2/kg for the farmer.

He is also aware that, leading to June, the overall rainfall might not be that good, and the overall supply of wheat hitting the market could be less and this can lead to the price of wheat going up to ₹12/kg. Now, since his farm is well irrigated, he will produce the desired quantity of wheat and sell at the price of ₹12/kg to generate significant profits.

In both the scenarios, what the farmer faces is the price volatility risk even though in the latter case, the price variability is favourable to the farmer but he is more worried about the first case where his profitability will shrink due to fall in price.

On the other hand, let us assume that there is a company ITC Ltd., which uses wheat throughout the year and produces flour in the brand name 'Ashirwad', as you all know.

Currently it's the month of March and the price of the wheat in the spot market from where ITC buys is ₹10/kg. The overall cost for ITC to process the wheat into Flour (including packaging and marketing) is ₹4/kg. ITC has already tagged the packets in which it sells the flour at ₹16/kg, thus realizing a profit of ₹2/kg.

However, what ITC is aware of is that, in the month of June, if the overall rainfall is not that good, then the supply of wheat hitting the market could be less and this can lead to the price of wheat going up to ₹12/kg. This will lead to an increase in cost for ITC and shrink its profitability to zero.

ITC cannot just simply raise its price of the flour. The reason behind this is that Ashirwad flour is a branded product. There is a huge cost involved in even raising the price and it is a consumer centric product. If ITC raises the price frequently, consumers will shift to a different brand or non-branded flour.

ITC also knows that if there is good rainfall, wheat from all the farmers will simultaneously hit the market and because of this the price of wheat might go down to ₹8/kg. In this case it would lead to a profit of ₹4/kg.

In both the scenarios, ITC faces price risk, even though in the latter case, the price fluctuation is favourable to ITC but it is more worried about the first case where its profitability will shrink due to fall in price.

Now the important thing to note is: The farmer faces the risk of losing money if the price of wheat goes down; and ITC faces the risk of losing money if the price of wheat goes up. Thus, both of them (farmer and lTC), in order to avoid this risk and to reduce the price uncertainty, enter into a contract, which says that:

This contract between farmer and ITC to buy and sell fixed quantity wheat at a specific price and at a specific date is called a DERIVATIVE CONTRACT.

According to the contract, the farmer in June is entitled to sell wheat at ₹11/kg, no matter what the price of wheat is in the spot market, and ITC has to buy the wheat at ₹11/kg, whatsoever the price of wheat be in the spot market.

Thus, by the virtue of this contract both the farmer and ITC have eliminated the price risk. This is precisely what the use of derivatives is or that is what derivatives are.

Derivatives are contracts in which two parties enter into a contract in order to eliminate or hedge their risk. It could be price risk or risk of any kind of uncertainty.

In the Indian context, the Securities Contracts (Regulation) Act, 1956 (SCRA) defines "derivative" as-

1. A security derived from a debt instrument, share, loan, whether secured or unsecured, risk instrument or contract for differences or any other form of security.

2. A contract that derives its value from the prices, or index of prices, of underlying securities.

The first definition says that the derivative contract for wheat between farmer and ITC is derived from the underlying asset, which is 1000 Kgs of wheat.

The second definition says that the value of the wheat contract depends on the value or price of the wheat, which is the underlying asset in the spot market.

This means that in the spot market, say in April, even if the price of wheat goes up to ₹13/kg, the person holding this contract still has the right to buy wheat only at ₹11/kg. Thus, the value of this contract, which previously was only ₹11,000, has now increased to ₹13,000.

A derivative is a financial contract with a value that is derived from an underlying asset. Derivatives have no direct value of themselves - their value is based on the expected future price movements of their underlying asset.

The underlying instruments can be anything such as bonds, commodities, currencies, interest rates, market indexes and stocks. So, there are different types of financial derivatives available in the market. Let us discuss them in the next section.

Derivatives in Financial Markets

We can have derivative contracts on any assets. There are various types of derivatives contracts such as:

- Commodity Derivatives

- Currency Derivatives

- Equity Derivatives

- Interest Rate Derivatives, etc

Let us discuss some of the markets with respect to the above derivatives and the way they help in reduction of risk or uncertainty.

Commodity

Tata Steel produces and sells steel. It has a huge inventory of steel and is worried that two months later, if the price of steel drops in the spot market, then it will have to suffer losses when it is selling its steel.

On the other hand, there is a company like Maruti, which uses steel to produce cars. Maruti is seeing a huge increase in demand for cars in the next two months and plans to increase its production for which it needs steel. However, they are worried that two months later, if the price of steel in the spot market increases, then it will have to spend more money.

Thus, Tata Steel and Maruti enter into a contract in the derivative market to sell and buy steel respectively two months later at a pre-fixed price, thus locking the price uncertainty.

Currency

An exporter produces shirts and exports them to the United States. It is expected to receive a payment for the shirts it has supplied in a month's time. The current USD-INR exchange rate is ₹72 and he is expected to receive a payment of $1,000. Thus, as per current rate, he expects to get ₹72,000 a month later.

However, he is worried that a month later, when his dollar payment comes, the Indian rupee might strengthen, and the USD-INR exchange rate might become ₹70, and thus he would only receive a payment of ₹70,000 instead of ₹72,000, what he had thought earlier.

On other hand, an importer plans to import machinery for $1000 a month later and as per the current exchange rate plans to save ₹72,000 by month end so as to pay for the machine. However, he is worried that a month later, when he has to pay $1000 for the machinery, the USD-INR exchange rate might go up to ₹74 and he has to spend ₹74,000 instead of ₹72,000 to get the machine.

Thus, the importer and the exporter enter into a contract in the currency derivatives market to buy and sell dollar respectively one month later at a pre-defined exchange rate locking the price uncertainty.

Equity

An investor holds around 500 shares of Reliance since the last 2-3 years which he does not want to sell at the moment. However, he is worried that the next day, when the verdict of Reliance and RNRL case will be out in public domain and if Reliance loses the case, then the stock price of Reliance might go down significantly and his wealth will shrink for the time being.

On the other hand, there is a speculator who has already some insider information that Reliance will win the court case and its stock price will increase.

However, he does not want to buy Reliance shares in the spot market as he does not want to hold the same for a long period.

Thus, the investor and the speculator in the equity derivatives market enter into a contract to sell and buy Reliance respectively one month later at a pre-defined price rate locking the price uncertainty.

Types of Derivative Markets

We have learned the different types of derivative contracts but these are traded at different marketplaces. Let us discuss what they are.

There are 2 types of Derivative Markets.

- Over the counter trades (OTC)

- Exchange traded contracts.

Over the Counter Market

The OTC is a market where financial instruments such as currencies, stocks and commodities are traded directly between two parties, through a dealer network. Agreements on what, how many, for what price and under what conditions, are all made based on mutual consent. The contracts between two parties are tailor made and customized. They meet specific requirements of dealing with counterparties. OTCs are mostly traded for smaller companies that do not meet the criteria for a listing on the stock exchanges.

In an OTC trade, there doesn’t exist any, formal rules or mechanisms for risk management to ensure market stability and integrity. Management of counter-party risk is decentralized and located within individual institutions. Hence OTC trades have high Counterparty risk, due to which the volume in these markets are quite low.

Exchange Traded Contracts

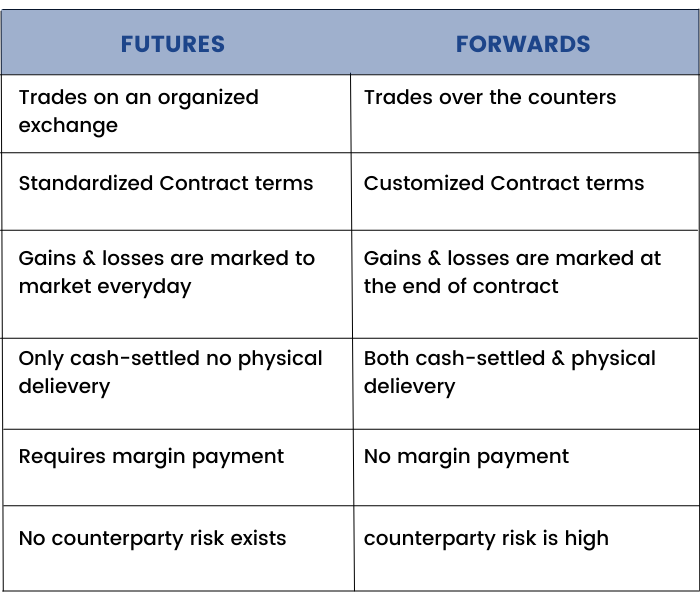

Exchange traded contracts are those derivative contracts which takes place between two parties via a recognized exchange. Simply put, these are derivatives that are traded in a regulated fashion. Exchange traded derivatives have become increasingly popular because of the advantages they have over over-the-counter derivatives, such as standardization, and elimination of default risk.

Let us understand, what is Standardization?

The exchange has standardized terms and specifications for each derivative contract, with respect to quantity, and quality- making it easy for the investor to determine how many contracts can be bought or sold.

Suppose a person wants to trade in Gold futures at MCX exchange. So, the exchange specifies that the contract of 1 unit of gold is of 1kg and the purity factor of Gold is 995. Any other quantity or quality variation is not allowed at the exchange.

Talking of Default risk, lets know how is it eliminated in exchange traded contracts.

The derivatives exchange itself acts as the counterparty for each transaction involving an exchange traded derivative, effectively becoming the seller for every buyer, and the buyer for every seller. This eliminates the risk that the counterparty to the derivative transaction may default on its obligations.

Exchange traded derivatives have a mark-to-market feature. The gains and losses on every derivative contract are calculated on a daily basis. If the client has incurred losses, he or she will have to replenish the required capital in a timely manner or else the exchange squares up the position.

Because of the standardization feature and sound risk management policies, the exchange traded contracts have high liquidity, which makes it easier for the traders to trade, hence attracting more volume. There are various types of derivatives contract Forwards, Future, Options and Swaps.

Future and Options are exchange traded contracts whereas Forward and Swaps are OTC contracts.

Take your trading skills to the next level with our Masterclass on Advanced Commodity & Currency: Forex Trading Course! Enroll now!

We will discuss more on the Forwards and Futures market in our upcoming units.

Forwards Markets

First, let us understand the concept of 'Forwards.'

What is a forward contract?

A forward contract is an agreement to buy or sell a particular asset at a pre-decided price in future.

Remember the contract between the farmer and the ITC to buy and sell a specified quantity of wheat at a specific date and at a specific price is known as a forward contract.

In this case, one of the parties entering into a forward contract assumes a long position to buy the underlying asset at a certain specified price and the other party assumes a short position to sell the asset on the same date for the same price. A forward contract is a type of customized contract, can be between any two or more parties, and is not traded on stock exchanges and thus there is no middleman in the contract. Owing to this nature of the contract, there is a high probability of default by any of the parties, which is known as the "Counterparty risk".

Features of a forward contract

- Each contract is custom designed and hence is unique in terms of contract size, expiration date and the asset type and quality.

- This is a bilateral contract and hence exposed to counterparty risk.

- On expiration date, the contract has to be settled by delivery of the asset.

- The contract price is not available in the public domain.

Futures Markets

Next, let us discuss the concept of the 'Futures' contract and how it differs from Forwards.

What is a futures contract?

A future contract is similar to the forward contract in terms of its basics; however, the key difference is that a future contract is standardized in nature and is traded on stock exchanges. To facilitate liquidity in the futures contracts, the exchange specifies certain standard features of the contract.

So, futures can be summarised as -

- A standardized contract with standard underlying instrument,

- A standard quantity and quality of the underlying instrument that can be delivered,

- A standard timing of such settlement

The futures market came into existence overcoming the shortcomings of the forward market. Futures market is more pronounced among the trader and investor community across the world because of the fact that the counterparty or the default risk is virtually zero. Every futures contract carries a guarantee from the exchange where it is traded and hence in case of any default by the counterparty, it becomes the obligation of the exchange to pay off the other party.

Features of Futures Contract

Now that we are clear with the concept and features of the Forward contract, let us discuss the features of Future contracts.

Features:

1. Contract size

The size of the contract depends upon the contract we are trading in. The futures transaction can be entered in accordance with the prescribed lot size and the participants can only trade in multiples of the lot size while dealing in the futures market

The quantity of wheat or rice in case of contract for agricultural commodity futures, or value of currency in case of currency futures, or the number of shares in case of equity futures, everything is already predefined in terms of basic size.

2. Trading Cycle

Equity Futures are traded in cycles of 3 months. At any point of time, one can take a position to buy or sell the underlying equity share or an index for the current month and the coming two months. For example, if currently it is the month of October, then an individual can choose to enter the contract to buy or sell the underlying asset in the month of October or November or December.

A trader can take either the near month, or the next month or the far month position while trading in futures contracts on the stock exchanges.

Similarly, in the currency futures segment, the contracts are traded in the cycles of 12 months. At any point in time one can take the position to buy or sell the underlying currency for the current month and the coming eleven months.

Shape your financial journey - Enroll in our Future & Options Trading Course

3. Expiry Date

Futures are traded with a specific time frame in mind such that there is an expiry or settlement date for each future contract. All the outstanding positions (long or short) are settled on this expiry date. In the equity futures segment, the expiry date is the last Thursday of the expiry month.

*Note: If that Thursday is a holiday, then the previous trading day is taken under consideration. Similarly, in the Currency futures segment, the expiry date is the last business day of the month. If 27th September 2018 is a Thursday, then the contract expiry date will be 27th September and if it is a Friday then the expiry will be on Thursday.

4. Settlement Date

In India, Equity and Equity index futures contract are cash settled and physically settled. So, on settlement date, the net payoff is determined and settlement is made accordingly through cash or physical delivery of assets takes place.

Also, in the commodity futures segment on MCX, the settlement nature of various commodities varies.

For example, the gold mini contracts on MCX are deliverables, so in case any of the counter party does not square off his/her position 5 days before the settlement day, then he/she may be entitled to give or take the delivery of the underlying asset. Copper Futures contracts are cash settled.

Payoff from Futures

In this section, we will discuss 'Payoff,' i.e., the likely profit or loss that would occur with a change in the underlying asset's price. We will specifically learn the payoffs structure for futures contracts for both long and short positions.

Long Position

A trader/ investor is said to be in a long position when he has entered into the contract to buy the underlying asset on the specified date at a specified price. Thus, the trader or investor will only benefit if the price of the underlying in the spot market will increase.

For example, a trader goes long on the Nifty futures. He has a bullish view of the market and decides to buy 10 lots of Nifty futures contracts at 17200. However, if on expiry, the Nifty turns out to be 17800, then the trader would gain (17800-17200)*50* 10, i.e. ₹3,00,000

Payoff diagram for Long positions

Short Position

A trader is said to be in a short position when he has entered into a contract to sell the underlying asset on a specified date at a specified price. The trader or investor will only benefit if the price of the underlying asset in the spot market will decrease.

For example, if a trader holds a bearish view on the market and decides to sell 10 lots of Nifty at 17200. Suppose the value of Nifty happens to turn out at 17100 on the expiry. The trader will make a profit of (17100 -17200)*50*10 = ₹50,000.

If on expiry, Nifty turns out to be 17300, then instead of the profit, the trader would incur a loss of (17200 -17300)*50*10 = - ₹50,000.

Payoff diagram for Short positions

Leverage

Dealing in futures contracts requires a large capital; here comes the usefulness of 'Leverage' which is basically the use of borrowed capital to undertake an investment. In this section, we will understand the use of Leverage in futures trading.

The fact that one can take full exposure to the price movement of the underlying asset by just providing a certain percentage of money as margin, if the price movement is in one's favour the return on investment is very high compared to return on investment in case the investor takes the direct exposure in the underlying asset.

Thus, taking exposure to a higher value of asset by just providing margin or a smaller amount of sum is known as Leveraging. "Financial Leverage is a two-sided sword." Let’s understand it with an example.

Example

Let us assume that individual A buys 250 shares of Reliance Industries in cash/spot market @ ₹1000/share. For, this transaction, he has to pay a total ₹250,000 as initial outlay/investment.

On the other hand, an individual B buys 1 lot of Reliance Industries shares in futures market, which is equivalent to 250 shares at the price of ₹1000/share.

However, for this he has to pay only an initial margin of say 30% of the total contract value of ₹250,000, i.e. ₹75,000.

Now, from here, if Reliance goes up by ₹100, then both individual A and individual B makes a profit of ₹(250 x 100) i.e. ₹25,000.

However, the Return on Investment (ROI) for individual A and B are different:

ROI (A) = 25,000/2,50,000 = 10%

ROI (B) = 25,000/75,000 = 33.33%

Thus, we see that since futures allows one to invest a lesser amount of capital for taking an exposure for an asset, the return on investment is comparatively higher.

However, if the price movement is against expectations and Reliance instead of going up by ₹100 falls by the same amount then in that case loss for both the individuals is ₹25000 only but the loss in percentage terms for B (-33%) is much higher compared to A (-10%).

Thus, the way in which futures trading provides higher return if the movement is in favour, similarly, it leads to higher losses when the price movement is unfavourable.

Moreover, if one buys in the spot/cash market, one becomes the shareholder of the company and remains the same even at the fallen price then they do not need to pay any additional amount of money. Thus, if the price recovers in the future, he can still benefit from the transaction.

However, if one buys in the futures market, one does not becomes the shareholder and if the price falls, he/she has to provide additional margin money for the adverse price movement or else the broker cancels his trade and he has to suffer the losses and after this, even if the prices increases in future, one may not realize any gains or benefits. This is the inherent risk of trading in futures.

Pricing of Futures Contracts

In this unit, we will learn to determine the future price of an asset.

We know the futures instrument derives its value from its respective underlying. We also know that the futures instrument moves in sync with its underlying. If the underlying price falls, so would the futures price and vice versa. However, the underlying price and the futures price differ and they are not really the same. Say for example, Nifty Spot is at 17586 whereas the corresponding current month contract is trading at 17597. This difference in price between the futures price and the spot price is called the “basis” or spread. The basis is 9 points in our example.

Pricing of a futures contract depends on the characteristics of the underlying asset. There is no single way to price futures contracts because different assets have different demand and supply patterns, different characteristics and cash flow patterns. Market participants use different models for pricing futures. The two popular models of futures pricing:

- Cash and Carry model

- Expectancy model

Cash and Carry Model

Let us understand this concept with an example.

There are two people - Ram & Arjun. Ram decides to buy a particular stock TCS in the spot market paying total amount and takes delivery of the share. On the other hand, Arjun decides to buy TCS in futures paying just the margin.

What happens with Ram’s Position?

TCS shares are credited in his demat account. Now if TCS announces a dividend, Ram is entitled to that dividend, but simultaneously he loses out on the opportunity cost of the funds involved in buying those TCS shares in the spot market. He is basically forgoing the interest on those funds.

On the other hand, Arjun deploying just a small margin is holding a similar position in TCS. When dividend is announced Arjun is not entitled to this dividend as his demat account doesn’t have TCS shares.

We see that both Ram and Arjun are long on TCS but still their situation has few differences on account of opportunity cost of funds involved as well as dividends received. This is known as cost of carry!

The Cash & Carry Model assumes that markets are perfectly efficient. This means there are no differences in the cash and futures price. No opportunity for arbitrage exists and investors are indifferent to the spot and futures market prices while they trade in the underlying asset.

The model also assumes, that the contract is held till maturity, the price of a futures contract will be equal to the spot price plus the net cost incurred in carrying the asset till the maturity date of the futures contract.

Futures Price = Spot Price + (Carry Cost – Carry Return)

Here, Carry Cost refers to the cost of holding the asset till the futures contract matures. This could include storage cost, in case of commodities, interest paid to acquire and hold the asset, financing costs etc.

Carry Return refers to any income derived from the asset while holding it like dividends, bonuses etc. A net of these two is called the net cost of carry.

The cost of carry model used for pricing futures is given by:

Where,

S- Spot price

r- cost of financing (using continuously compounded interest rate)

T- Time to expiry

e- 2.71828

Expectancy Model

According to the expectancy model, it is not the relationship between spot and futures prices but that of expected spot and futures prices, which moves the market. This is why market participants would enter futures contract and price the futures based upon their estimates of the future spot prices of the underlying assets.

According to this model,

- Futures can trade at a premium or discount to the spot price of the underlying asset.

- Futures price give market participants an indication of the expected direction of movement of the spot price in the future.

For instance, if the futures price is higher than the spot price of an underlying asset, market participants may expect the spot price to go up in the near future. This expectedly rising market is called “Contango market”.

Similarly, if the futures price is lower than the spot price of an asset, market participants may expect the spot price to come down in future. This expectedly falling market is called “Backwardation market”

The difference between the spot and the futures price is known as Basis.

So, now that we have understood how futures contracts are priced. Next, let us discuss the different market participants in this futures market.

Hedger

What are the different participants in derivatives market?

There are three main types of participants in the derivatives market whose individual actions leads to market formation and rise or fall in the price of individual securities or the overall market.

- Hedger

- Speculator

- Arbitrageur

First, let us start with ‘Hedger’. We will discuss the other two 'Speculator' and 'Arbitrageur' in the subsequent sections.

Hedging means making an investment or taking a position to reduce the risk of adverse price movements in an asset. It enables an individual to reduce the risk arising out of future price uncertainty.

In our introductory section, the example of ITC and the farmer which we discussed, both the counterparties, by the virtue of entering into the futures contract, were acting as hedgers.

Hedging Through Futures

Hedging in equity market or any other market could be possible by using various types of derivatives products. Hedging via use of futures contract is one of the simplest forms of hedging possible and it could be executed under two scenarios:

- Long Security or underlying asset, Sell Futures

- Short Security or underlying asset, Long Futures

Long Security or underlying asset, Sell Futures

A trader buys a security at ₹800, and he might be worried about the share price going down, so in order to hedge the position, he or she can short the futures of that particular security.

Assume that the spot price of the security he holds is ₹800 and the 2 months' future contract he was holding cost him ₹804. For this he pays an initial margin. Now if the price of the security falls any further, he will suffer losses on the security he holds. However, the losses he suffers on the security will be offset by the profits he makes on his short futures position.

Take for instance that the price of his security falls to ₹720. The fall in the price of the security will result in a fall in the price of futures and the same will now trade at a price lower than the price at which he entered into a short futures position.

Hence his short futures position will start making profits. The loss of ₹80 incurred on the security he holds, will be made up by the profits made on his short futures position. However, in case the security price goes up instead of falling, then the profit he makes from his position in the underlying security is also wiped off from the loss he makes from his futures position.

Thus, it is not necessary that hedging always benefits an individual. The best that can be achieved using hedging is the removal of unwanted exposure, i.e. unnecessary risk and all that can come out of hedging is reduced risk.

Hedging lock in the price of the security at which the hedge is entered and even if price rises or falls, the investor will realize the same value from the underlying asset.

Short Security or underlying asset, Long Futures

An investor sells a security say Reliance industries at ₹1000 and he might always be worried about the share price going up, so in order to hedge himself he can go long in futures.

Assume that the spot price of the security he holds is ₹1000 and the 2 months' future contract he was holding cost him ₹1004. For this he pays an initial margin. Now if the price of the security goes up further, he will suffer losses on the security he holds. However, the losses he suffers on the security will be offset by the profits he makes on his long futures position.

Take for instance that the price of his security rose to ₹1050. The rise in the price of the security will result in a rise in the price of futures also. Futures will now trade at a price higher than the price at which he entered into a long futures position. Hence his long futures position will start making profits. The loss of ₹50 per share incurred on the security he holds will be made up by the profits made on his long futures position.

Thus, what he has done is lock in the price of the shares in his portfolio at ₹1000 and even if the price goes up or comes down, he would still realize the same ₹1000 from selling the shares and coming out of the futures position.

Speculator

We will discuss the next type of market participant, known as the ‘Speculator.’

Speculators are individuals who take large risks, especially with respect to anticipating future price movements, in the hope of making quick, large gains. Speculators can achieve these profits by buying low and selling high and vice-versa.

Their investment horizon is very short term in nature and hence they use futures markets where they also have to spend less (only margin money required) as against full amount in the spot market.

Speculating Through Futures

Speculating in the equity market or any other market could be possible by using various types of derivatives products. Speculating via uses of futures contracts is one of the simplest and yet highly rewarding forms if one's expectation of future price movement is correct.

- Bullish on security, Buy futures

- Bearish on security, Sell futures

Bullish on security, Buy futures

An investor holds a view that a particular security that trades at ₹1000 is undervalued and expects its price to go up in the next two-three days. So, he buys 100 shares which cost him one lakh rupees. His hunch proves correct and three days later the security closes at ₹1010 and he make a profit of ₹1000 on an investment of ₹1,00,000 for a period of three days. This works out to return of one percent.

Today a speculator can take exactly the same position on the security by using futures contracts.

The security trades at ₹1000 and the one-month futures trades at ₹1002. Just for the sake of comparison, assume that the minimum contract value is ₹1,00,000 and he buys 100 security futures for which he pays a margin of ₹20,000.

Two days later the security closes at ₹1012. He makes the same profit of ₹1000 on an investment of ₹20,000. This works out to a return of five percent.

Thus, using futures the speculator has made a ROI of around 5% in a short period as against 1% if he would have used the cash market.

Explore the Masterclass: Gain Key Insights on Navigating as a Speculator. Elevate your skills in Advanced Commodity & Forex Trading!

Bearish on security, Sell futures

Stock futures can also be used by a speculator who believes that a particular security is over- valued and is likely to see a fall in price. To trade based on his opinion all he needs to do is to sell stock futures. Futures on an individual security move correspondingly with the underlying security, as long as there is sufficient liquidity in the market for the security.

If the security price rises, so will the futures price. If the security price falls, so will the futures price.

Now take the case of the trader who expects to see a fall in the price of ABC Ltd. He sells one two-month contract of futures of ABC Ltd. at ₹240 (each contact for 100 underlying shares). He pays a small margin on the same.

Two months later, when the futures contract expires, ABC closes at ₹220. On the day of expiration, the spot and the futures price converge. He has made a clean profit of ₹20 per share.

Arbitrageur

Lastly comes the ‘Arbitrageur.’

An arbitrageur is a type of individual who attempts to profit from price inefficiencies in the market by making simultaneous trades that offset each other and capturing risk-free profits.

An arbitrageur would, for example, look for price differences between stocks listed on more than one exchange, and then buy the undervalued shares on one exchange while short selling the same number of overvalued shares on another exchange, thus capturing risk-free profits as the prices on the two exchanges converge.

Arbitrageurs also play a very pivotal role in the operation of capital markets. They are also known as market makers as their efforts in exploiting price inefficiencies keep prices more accurate than they otherwise would be.

Arbitraging Through Futures

Arbitraging in the equity market or any other market could be possible by using various types of derivatives products. Arbitraging via use of futures contracts is one of the most widely used methodologies of arbitrage in the Indian markets.

Even though over the last couple of years the systems have taken over a lot of roles from human individuals in the job market for arbitrageurs, still individuals with good quantitative skills and bent for adoption to technology have fared quite well and their requirement would always exist.

- If Future is overpriced: Buy spot, sell futures

- If Futures is under-priced: Sell Spot, Buy futures

Future is overpriced: Buy spot, Sell futures

Say, a stock, ABC Ltd. trades at ₹1000 in the cash market or spot market and one-month ABC futures contract's theoretical price should be ₹1010 based on futures pricing mechanism discussed earlier.

However, it trades at ₹1020 and seems overpriced. As an arbitrageur, you can make risk less profit by entering into the following set of transactions.

On day 1, buy the security in the cash/spot market at ₹1000. and simultaneously, sell the futures of the security in the futures market at ₹1020.Through a series of similar actions by many arbitrageurs, the price in the spot market will start to increase as a lot of buying is taking place in the same and the price in the futures market will start falling since a lot of selling is taking place in the futures market.

This process of buying in the spot market and selling in the futures market will continue till the spot price and the futures price come to a level at which the spot futures price difference comes back to the theoretically justified levels.

Let’s assume the spot price rises to a level of ₹1005 and the futures price falls to a level of ₹1015 and now the basis is only ₹10 which is justified.

Thus, the arbitrageur now will sell its holding in the cash market at ₹1005, which he had bought at ₹1000 and cover its short position in futures market at ₹1015 where he had initiated a short contract at ₹1020, making an overall profit of Rs.10 (₹5 in cash and ₹5 in futures)

This profit of ₹10 is actually the amount by which the futures price was overpriced compared to its theoretical price when the arbitrageur initiated the trade. This overpricing was because of inefficiency of markets which the arbitrageur capitalized on.

Future is under-priced: Sell spot, Buy futures

A stock, say, ABC Ltd. trades at ₹1000 in the cash market or spot market and one-month ABC futures contract's theoretical price should be ₹1010 based on futures pricing mechanism we discussed earlier. However, it trades at ₹990 and seems under-priced. As an arbitrageur, you can make risk less profit by entering into the following set of transactions.

On day 1, sell the security in the cash/spot market at ₹1000 (if you already own, or else borrow and sell) and simultaneously, buy the futures of the security in the futures market at ₹990.

Through a series of similar actions by many arbitrageurs, the price in the spot market will start to fall as a lot of selling is taking place in the same and the price in the futures market will start rising as a lot of buying is taking place in the futures market.

This process of selling in the spot market and buying in the futures market will continue till the spot price and the futures price come to a level at which the spot futures price difference comes back to the theoretically justified levels.

Let’s assume the spot price falls to a level of ₹990 and the futures prices rise to a level of ₹1000 and now the basis is only ₹10 which is justified.

Thus, the arbitrageur now will buy or cover the number of shares it had sold in the cash market at ₹990, which he had sold at ₹1000 and sell in futures market at ₹1000 where he had initiated a buy at ₹990, making an overall profit of Rs.20 (₹10 in cash and ₹10 in futures).

This profit of ₹20 is actually the amount by which the futures price was under-priced compared to its theoretical price when the arbitrageur initiated the trade. This under-pricing was because of inefficiency of markets which the arbitrageur capitalized on.

Options

Till now, we have completed our discussion on ‘Futures.’ Starting from this section we will learn about a new derivative instrument called ‘Options’.

Options are very interesting and versatile derivative instruments. So far, we have learned about forwards and futures. We learned that futures overcome limitations of forwards. However, in futures, theoretically there is a possibility of unlimited profit as well as loss. In Future contract the trader has an obligation to bear that loss or enjoy profits as the case may be on expiry.

Now, what happens if the trader has a choice? If a derivative contract can give the trader a choice to enter into the contract or simply back out at a later stage. Suppose the trader doesn't want to enter into an obligation to fulfil the contract. If so, then the trader can exercise choice as per the situation. If the situation is in his/her favour, he can exercise the right and go ahead with the contract and take the risk as per his/her risk appetite. Else can back out and let the contract be!

Do you think this kind of choice is available? yes

This choice is called OPTION, a type of derivative contract that gives you a CHOICE.

Choice of right to buy or sell the asset, at a pre-determined price and time.

Now think about it - if in a contract, 1 party has a choice or right to enter or not enter the contract as per the situation, the other party has to take an obligation.

There are few important features of an option contract.

- When you choose to take up the right – you are the buyer of that choice or option.

- When you choose to take obligation – you are the seller of that choice or option. So, this choice can be bought or sold.

- Now choose what to do?

- When your choice is to buy the asset – it’s called a 'Call' option.

- When your choice is to sell the asset – it is called a 'Put' option.

We will learn more about Call and Put options in the subsequent sections of this module.

Call options

What is a Call Option?

A call option is an options contract in which the buyer has the right to buy a specified quantity of the underlying stock at a predetermined price without any obligation.

Now let us understand this with an example:

Let us assume that a stock is trading at ₹100 today.

And today, you are getting the option that gives the right to buy the same stock one month later, at the same ₹100, even if the shares trade more than or less than ₹100.

So, should you buy it?

The answer is yes, as this means that even after one month if the share is trading at ₹120, and you can still buy it at ₹100.

To get this right you need to pay a small amount today, say ₹5, which is called the premium amount.

Now, if the share price goes above ₹100, then you can exercise your right and buy the shares at ₹100. If the share price stays at or below ₹100 then you do not need to buy the shares. You just lose ₹5 which you had paid for the right to buy in this example.

This type of options contract is known as the 'Call Option.'

What are Long Call Options?

When the traders expect that the price can move up, or when they are bullish- then they can take a long position in the call option.

Traders need to pay a premium in order to buy a call option. They buy these options due to the expectation that the underlying price will increase.

But if the price drops below the strike price, then the option holders lose the amount paid for the premium. This happens because the contract will not be exercised by the buyer, and hence it will lapse.

For example, let us assume that you are bullish on a stock. You buy a call option with the strike price of the stock is ₹5000 and the premium which you pay is ₹70.

Premium is the maximum amount that a buyer will agree to suffer as a loss. If the price of share increases, the buyer exercises his option.

If the share’s price does not increase beyond the strike price of ₹5000, then the option expires on the maturity date. The buyer thus incurs a loss of ₹70 on the premium.

From the above diagram, you can see that your profits will be unlimited if the price moves up and losses will be limited to the premium.

What are Short Call Options?

The short call options involve selling an option of a given underlying asset at a predetermined price.

This strategy leads to limited profit if shares are traded below the strike price, and it attracts substantial risk if it is traded at a value more than its strike price.

From the above diagram you can see that when shorting a call option, the profit is limited to its premium amount that is ₹70 and the loss is unlimited.

Put Options

What is a Put Option?

A put option is an option contract that gives the buyer the right, but no obligation to sell the underlying asset at a specific price also known as the strike price.

Put options can be traded on many underlying assets like stocks, currencies, and also commodities.

They help us to protect our trades against the decline in the price of the above assets below a specific price.

The trader does not have to own the underlying asset for buying or selling puts.

The put buyer has the right, but not the obligation, for selling the asset at a particular price, within a specified period.

Whereas, the seller has the obligation to buy the asset at the strike price if the option owner exercises their put option.

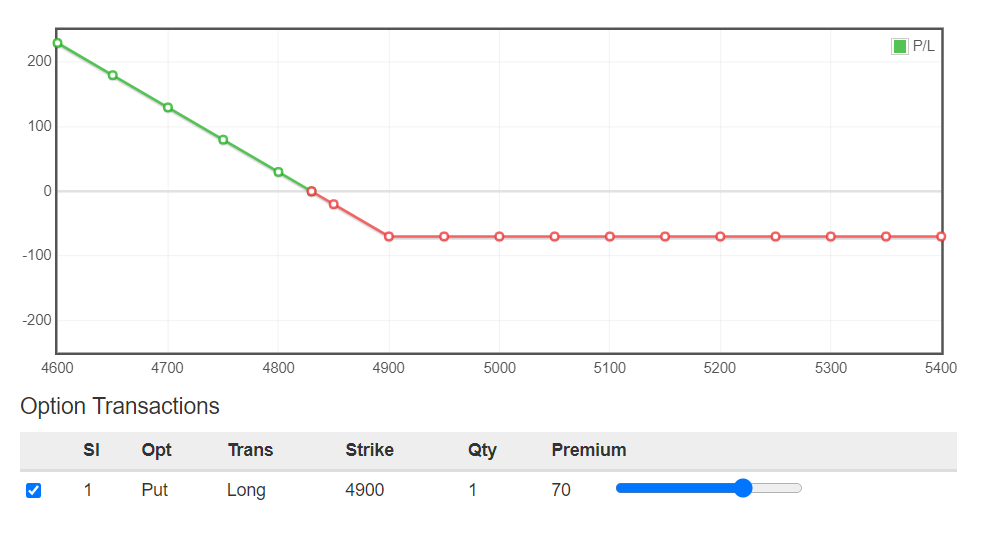

What is meant by Buying Put Options?

It is one of the simplest ways for trading put options.

When the options trader has a bearish view on a particular stock, then he can purchase put options to profit from a decline in the asset price.

Example:

Suppose the stock is trading at ₹4900 and put option contract with 4900 strike price is trading at ₹70 expiring in a month’s time.

You are expecting that the price of the stock will drop sharply in the coming weeks.

The payoff diagram of the examples will look as below:

If the prices fall as expected then we earn profits.

But if our trade does not go according to our expectations, then our loss will be only limited to the premium price that we had paid.

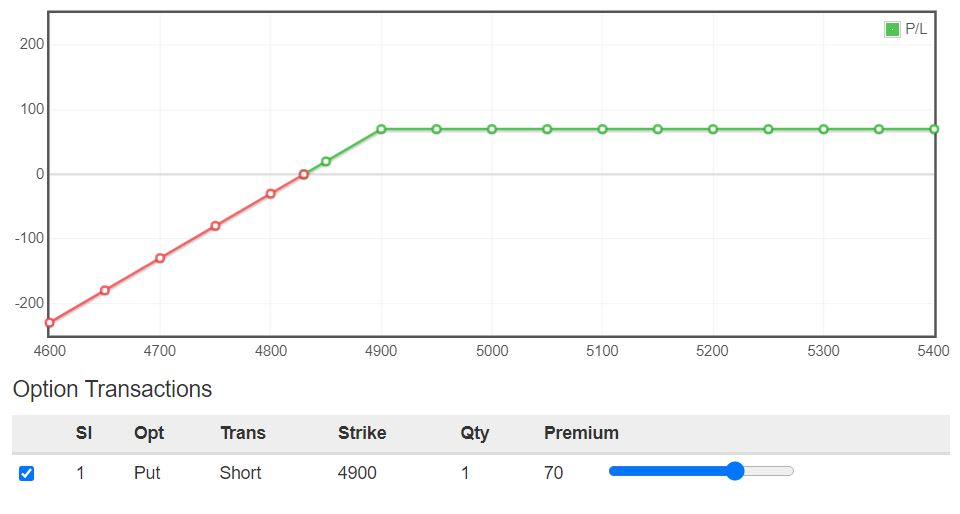

What is meant by Selling Put Options?

Put sellers sell options with the expectation to gain the premium amount when the underlying asset either goes up or remains in the existing range without seeing a negative bias.

Once puts have been sold to a buyer, then the seller has the obligation to buy the underlying asset at the strike price if the option is exercised.

The stock price must increase above the strike or remain in the strike price zone in order to make a profit.

If the underlying stock’s price falls below the strike price before the expiration date, then the buyer exercises his right resulting in a loss for a put option seller.

From the above diagram we can see that the profit is limited to the premium whereas if the prices move against our expectation then we may suffer unlimited losses.

Difference between Call Options and Put Options:

An investor buys a put option when he expects the price of an underlying asset to fall within a specific time period whereas an investor buys a call option when he expects the price of an underlying asset to rise within a specific time period.

Option Terminologies

Previously, we have learned buying and selling Call or Put options. But before we start options trading, it is essential to get used to specific terminologies related to Options.

What are the various terms used in Options?

There are different terms that need to be understood with clarity regarding options. Let us understand this with the help of an example.

Let us assume that we are bullish on a stock, which is trading at ₹670/-. We buy a call option at a strike price of ₹750. By paying a premium of ₹50 per share. The contract would mature after one month.

It looks simple but there are a lot of terms associated with it that needs to be understood.

The right to buy a stock at a specified price on a certain specific predetermined date is known as a call option contract and the person who has this right is known as a call option buyer or holder.

The person who is having the obligation to sell the stock at the specified price on the predetermined date is known as a call option seller or writer.

The predefined specified price is known as the strike price or the exercise price, whereas the price at which the stock price is trading in the market at different points of time is known as the Spot price.

In our example, ₹670 is the spot price and ₹750 is the exercise price.

To enjoy the right to buy the stock, the option buyer pays a small amount to the option seller at the time of entering into the contract. This is known as the premium.

The time (i.e. one month in our example) when the contract would lapse is known as time to maturity.

Similarly a Put option, is the right to sell the asset at a predefined price at a predefined date.

A seller of a put option has the obligation to buy the asset at the strike price, and he also receives premium to do so.

We must remember that all option buyers pay a premium and option sellers receive premium.

One more concept with respect to options is its moneyness and intrinsic value. It basically tells us about the relationship of an options contract with respect to its spot price and exercise price.

It is a classification criterion which classifies each option strike based on how much money a trader will earn would exercise his option contract at this particular moment.

It basically tells us about the intrinsic value of an option. The intrinsic value of an option is the money the option buyer will make from the contract assuming he has the right to exercise that option now. Intrinsic Value is always a positive value and can never go below zero. There are three broad classifications on the basis of moneyness. They are:

- In the Money (ITM)

- At the Money (ATM)

- Out of the Money (OTM)

All In the money options are those options which have a positive intrinsic value. For call options, a contract is ITM when spot price is greater than the exercise price and for a put option a contract is ITM when spot price is lower than the exercise price.

OTM options are those whose intrinsic value is always 0. For call options, a contract is OTM when spot price is lower than the exercise price. and for a put option a contract is OTM when spot price is higher than the exercise price.

ATM options are those where the spot price equals the exercise price and intrinsic value is also zero.

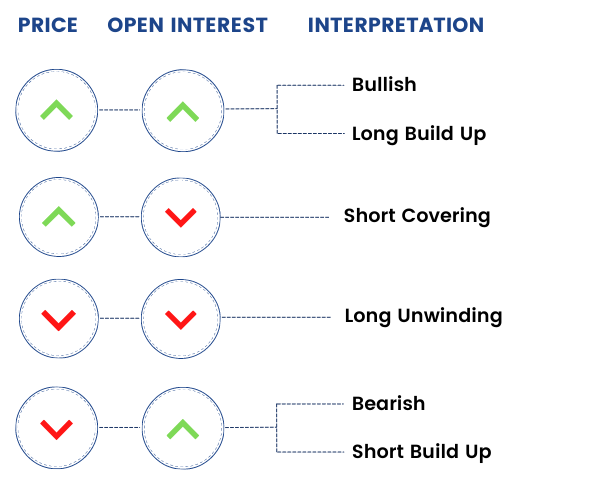

Open Interest

Now that we are familiar with different option terminologies, we will learn about an important term called the 'Open Interest' that is useful to both futures and options trading.

What is open interest and why is it important?

Open Interest defines the total number of open or outstanding contracts presently held by the market participants at a given time. It helps in identification of stock market trends.

In simple language, open interest analysis helps a trader to understand the market scenario by only showing a number of futures contracts that have changed hands during the market hours. This concept is applicable for Future and options contract traders. Open Interest or OI data changes day by day depending on the outstanding contracts.

Let’s take an example to understand the whole picture.

There are four participants in the market A, B, C, D, and E.

On 1st July, A buys 10 contracts from B => OI 10

2nd July C buys 20 contracts from D => OI 30

3rd July A sells his 10 contracts to D => OI 20

4th July E buys 20 contracts from C => OI 20

So, we can understand how OI changes depending on the change in hand of contracts.

When a new entrant trades with a new entrant in the F&O market, then the Open Interest goes up.

When an existing position holder squares off with entry of a new entrant, open interest remains unchanged.

When two existing position holders square off their positions, we see open interest go down.

How to analyse open interest data for identifying trends?

A trend can be defined by price upward and downward direction but the sustainability of that trend is questionable. There are some important factors which backs up the price to take a certain direction. OI is one of the factors and a reason for a sustainable trend as well as trend reversal.

When the price is going up or down and the future open interest increases alongside the price at a certain level then we can expect that the price movement is going to sustain.

On the other hand when a trend is present in the market and a sudden fall in futures open interest is visible then we should be doubtful about the trend. There might be a chance of trend reversal.

Open interest increasing means fresh money is flowing into the market and decrease in open interest suggest money outflow from the market.

Buyers move the market up by investing fresh cash into the market, while sellers do the opposite.

A trend depends on how many fresh contracts are exchanging hands with the new price move. If the fresh cash does not flow into the market and the fresh contract does not exchange hands, then we should be doubtful about the trend.

Click here to know which stocks have seen a sudden increase in Open Interest.

Rollover

Here in this section, let us learn another common term called ‘Rollover,’ which is popularly used in the case of F&O trading.

What is rollover?

Rollover is carrying forward a particular month’s futures positions to the next month. This is done by closing the existing futures position of the current month and simultaneously taking a similar position in the subsequent series.

Ideally, traders roll their positions in the last week of the expiry series, typically on the expiry day.

On the expiry day, traders have an option: they can either let their position lapse or enter into a similar contract expiring at a future date.

For example, if you are bullish on Nifty, you can rollover or carry forward the Nifty future position by closing your original position which is due to expire and simultaneously initiating a buying position for the subsequent month’s contract. This involves a cost i.e. difference between current series and next series prices.

Why do traders Rollover in the futures market?

Rollover is an important action for most of the derivative market participants.

- When they expect the current trend to continue in the near future

- They are not willing to book losses and are expecting the trend to reverse from the current situation.

- Cash and carry and reverse cash and carry Arbitrageurs tend to rollover their positions to take advantage of the price differentials.

What is the cost associated with a Rollover?

A rollover can give both positive and negative yield.

Positive Rollover yield: A short seller in a contango market where the future price is quoting above the spot price will have a positive rollover cost as the next series contract will trade with a premium. The contract will be available to get rolled at a higher price vis-a-vis current series contract, yielding an incremental positive spread.

A trader with long positions in a backwardation market where the future price is quoting below the spot price will also have a positive rollover cost as the next series contract will trade with a discount. The contract will be available to get rolled at a lower price vis-a-vis current series contract, yielding an incremental positive spread.

Negative Rollover yield: A trader with a long position in contango market where the future price is quoting above the spot price will have a negative rollover cost as the next series contract will trade with a premium. The contract will be available to get rolled at a higher price vis-a-vis the current series contract, yielding a negative spread.

A short seller in a backwardation market where the future price is quoting below the spot price will also have a negative rollover cost as the next series contract will trade with a discount. The contract will be available to get rolled at a lower price vis-a-vis current series contract, yielding a negative spread.

How do we calculate the Rollover?

Rollover is often expressed in percentage terms.

Nifty future June rollover statistics can be calculated as:

How to interpret Rollover?

Rollover is an indicator of traders' willingness to carry forward their existing bets on the market. But the standalone figures will not tell us in which direction traders have placed their bets.

On most occasions, lower¬ than average Rollovers signal uncertainty as well as unwinding of current trend, while the higher rollovers signal conviction of the current view which can lead to a continuation of current trend.

Hypothetically, if Rollover in Nifty futures from March series to April is at 70% and its past three-month average Rollover is 64%, it means that traders are more convinced with the current market trend by building more positions.

However, at times, tracking Rollover trends based on just percentage terms can be misleading; it is always better to see it in terms of total contracts/shares getting rolled too.

For instance, 70% Rollover may have taken place at a lower base of open interest—number of outstanding positions —while an average of 64% rolls would have happened at a relatively higher open interest base.

Therefore, analysing Rollovers purely on the basis of percentage terms can lead to faulty analysis, and hence trades should also track Rollovers in terms of total contracts rolled and also analyse Rollover trends on the basis of Rollover cost. Usually, high Rollover cost signals that the mood is upbeat in the market.

Margins

Lastly, let us talk about ‘Margins,’ which simply means taking leverage on trading positions.

Why are margins important?

Margins play a very important role in derivative trading as it enables us to leverage our positions. In fact, margins are the one that gives a Derivative Contract the required financial twist. For this reason, understanding the margins in detail is extremely important.

Margin is a kind of collateral that the parties having the long and the short side of the futures contract need to deposit with his/her broker or exchange before taking any position. The reason, the broker or the exchange takes this collateral, is in order to protect itself from any kind of credit default by any of the parties involved.

For example, if one goes long in the Nifty futures contract and if the Nifty falls, then the long party has to pay for the losses, but if he defaults, the loss has to be borne by the exchange/broker. Thus, in order to protect itself from this potential default, the exchange/broker requires an initial collateral from the trader investor before he can take any (long or short) position.

Margins allow us to deposit a small amount of money and take exposure to a large value transaction, thereby leveraging on the transaction.

Let us discuss this with an example to understand it better.

Kalyan Jewellers agrees to buy 15Kgs of Gold at ₹3000/- per gram from Prabhudas Gold Dealers Gold Dealers, three months from now.

Any variation in the price of gold will either affect Kalyan Jewellers or Prabhudas Gold Dealers negatively. If the price of gold increases then Prabhudas Gold Dealers suffers a loss and Kalyan Jewellers makes a profit.

Likewise, if the price of gold decreases Kalyan Jewellers suffers a loss and Prabhudas Gold Dealers makes a profit.

We know that this kind of agreement which is a typical example of a forward contract, works on a gentleman’s word. Consider a situation where the price of gold has drastically gone up placing Prabhudas Gold Dealers in a difficult spot.

Clearly Prabhudas Gold Dealers can say they cannot make the necessary delivery and thereby default on the deal. Obviously, what follows will be a long and legal chase, but that is outside our focus area. The point to be noted here is that, in a forward agreement the scope to default is very high.

Since futures and options market are an improvisation of the over the market trades, the issue of default is carefully and intelligently dealt with. This is where the margins play a role.

What are the different types of margins?

Now how does the exchange make sure that trade works seamlessly and no default takes place? Well, they make this happen by means of –

1. Collecting the margins

2. Marking the daily profits or losses to the market which is known as the mark to mark market (MTM).

Now, we know that at the time of initiating the futures position, margins are blocked in your trading account. The margins that get blocked is also called the “Initial Margin”

Initial Margin will be blocked in our trading account for how many ever days we choose to hold the futures trade. The value of initial margin varies daily as it depends on the futures price.

Initial Margin = % of Contract Value.

Contract value = Futures Price * Lot Size

Lot size is fixed, but the futures price varies every day.

Initial Margin

This is the first initiated amount that must be deposited in the margin account at the time a future contract is entered into.

Amount of initial margin is calculated by National Securities Clearing Corporation Ltd (NSCCL) based on the Standard Portfolio Analysis of Risk (SPAN) methodology (commonly known as NSE SPAN). The objective of this methodology is to estimate the risk element in the portfolio of all the derivative contracts of each member.

NSE SPAN determines the largest amount of loss that an open position can incur in 99% of days. It is also known as the 99% Value at risk (VaR) approach. For liquid stocks, the margin covers one day losses whereas for illiquid stocks, it covers three-day losses to allow the exchange to liquidate the position over three days. This amount is collected by NSCCL from clearing members who in turn collect the same from their trading members and clients.

Mark to Mark Margin

As we know the futures price fluctuates on a daily basis, because of which we either stand to make a profit or a loss. Marking to market, or mark to market (MTM) is a simple accounting procedure which involves adjusting the profit or loss we have made for the day and entitling us the same.

As long as we hold the futures contract, MTM is applicable.

Let us take up a simple example to understand this.

Assume on 1st April at around 9:30 AM, you decide to buy ABC Ltd Futures at ₹165/-. The Lot size is 3000. 4 days later on 4th April, you decide to square off the position at 2:15 PM at ₹170.10/-. So is a profitable trade –

Buy Price = ₹165

Sell Price = ₹170.1

Profit per share = (170.1 – 165) = ₹5.1/-

Total Profit = 3000 * 5.1 = ₹15300/-

However, the trade was held for 4 working days.Each day the futures contract is held, the profits or loss is marked to market. While marking to market, the previous day closing price is taken as the reference rate to calculate the profit or losses.

The table shows the futures price movement over the 4 days the contract was held.

Let us look at what happens on a day to day basis to understand how MTM works –

On Day 1 at 11:30AM the futures contract was purchased at ₹165/-, clearly after the contract was purchased the price has gone up further to close at ₹168.3/-. Hence profit for the day is 168.3 minus 165 = ₹3.3/- per share. Since the lot size is 3000, the net profit for the day is 3.3*3000 = ₹9900/-.

Hence the exchange ensures (via the broker) that ₹9900/- is credited to your trading account at the end of the day.

But the question is where is this money coming from?

Obviously, it is coming from the counterparty. Which means the exchange is also ensuring that the counterparty is paying up ₹9900/- towards his loss.

But how does the exchange ensure they get this money from the party who is supposed to pay up? – They do it through the margins that are deposited at the time of initiating the trade.

Now here is another important aspect we need to note – from an accounting perspective, the futures buy price is no longer treated as ₹165 but instead it will be considered as ₹168.3/- (closing price of the day 1).

Why is this happening?

Well, the profit that was earned for the day has been given to you already by means of crediting the trading account. so next day is considered a fresh start. Hence the buy price is now considered at ₹168.3, which is the closing price of the day 1.

On day 2, the futures closed at ₹172.4/-, clearly another day of profit. The profit earned for the day would be ₹172.4/ – minus ₹168.3/- i.e. ₹4.1/- per share or ₹12300/- net profit.

The profits that you are entitled to receive are credited to your trading account and the buy price is reset to the day’s closing price i.e. ₹172.4/-. Likewise, its done for Day 3.

Now On day 4, the trader did not continue to hold the position through the day, but rather decided to square off the position mid-day 2:15 PM at ₹170.10/-. Hence with respect to the previous day’s close he again made a loss. That would be a loss of ₹171.6/- minus ₹170.1/- = ₹1.5/- per share and ₹4500/- (1.5 * 3000) net loss.

Needless to say, after the square off, it does not matter where the futures price goes as the trader has squared off his position. And ₹4500/- is debited from the trading account by end of the day.

Well, if we add up all the MTM cash flow we will end up the same amount that we originally calculated, which is –

Buy Price = ₹165/-

Sell Price = ₹170.1/-

Profit per share = (170.1 – 165) = ₹5.1/-

Total Profit = 3000 * 5.1

= ₹15300/-

So, the mark to market is just a daily accounting adjustment where –

1. Money is either credited or debited (also called daily obligation) based on how the futures price behaves

2. The previous day close price is taken into consideration to calculate the present day MTM.

Why do you think MTM is required?

MTM is a daily cash adjustment by means of which the exchange drastically reduces the counterparty default risk. As long as a trader holds the contract, the exchange by virtue of the MTM ensures both the parties are fair and square on a daily basis.

Let us now relook at margins keeping MTM in perspective. As mentioned earlier, the margins required at the time of initiating a futures trade is called “Initial Margin”.

Each and every time a trader initiates a futures trade (for that matter any trade) there are few financial intermediaries who work in the background making sure that the trade carries out smoothly. The two prominent financial intermediaries are the broker and the exchange.

Clinet<------->Broker<------->Stock Exchnage

Now if the client defaults on an obligation, obviously it has a financial repercussion on both the broker and the exchange. Hence if both the financial intermediaries have to be insulated against a possible client default, then both of them need to be covered adequately by means of a margin deposit.

In fact, this is exactly how it works – Initial margin is the minimum requisite margins blocked as per the exchange’s mandate which cushions for any MTM losses. This is specified by the exchange and this initial margin is blocked by the exchange.

Maintenance Margin

Maintenance margin is the minimum amount of equity that must be maintained in a margin account. If due to MTM, the margin account falls below the stipulated level, maintenance margin call is there. It protects both investors and the broking house. The broker does not have to absorb excessive investor losses while the investor is in a situation to avoid being totally wiped out.

Conclusion

So, now that we are at the end of this module. We have learned the basic concepts of derivatives instruments. More importantly, we have discussed several types of derivatives instruments available for trading, especially in the equity markets. Trading in the derivatives segment is considered risky for novice traders. However, we have learnt quite a few concepts related to the derivatives market. But there are a lot of other elements to learn before you dive into trading futures and options contracts. Therefore we have prepared many other modules similar to this at ELM School that will unfold all the complexities related to derivatives and the financial markets as a whole. Be sure to check them out so that you gather knowledge and develop the necessary skills required to become successful in the markets.