Interrelation amongst various asset classes

Are assets correlated?- Yes, we already answered this question in Unit 3 of this module. But what is the interrelation among different asset classes? So, let's now try to answer this question here.

Interest rates vs Bonds

Bond prices are inversely related to interest rates. A rise in the interest rates generally means a fall in the prices of bonds. This is because the price of a bond, like any other asset is the present value of the future cash flows. Hence, an increase in interest rate will reduce the present value of cash flows, taking the price of the bond lower and vice-versa.

When we say generally, it means that sometimes, corporate bonds may rise or fall irrespective of the movement of interest rates. Say, for example, Jet Airways filed for bankruptcy. The price of its bond will fall irrespective of the level of interest rates in the general economy.

Barring such instances it is imperative to find the prices of bonds rising when interest rates in the economy fall or are expected to fall. Similarly, bond prices slump when the interest rates in the economy rise or are expected to rise.

Interest Rates vs Currency

Suppose you are a global investor looking to invest your money. You are given the following two choices:

(a)Either invest your money in a US Bond yielding 5%

(b)Or invest it in Indian Government bond yielding 7%

Where will you put in your money, provided you feel both countries are equally safe? Ofcourse, the country that is providing the higher interest rate, India in this example.

Therefore higher interest rates tend to attract foreign cash flows and since investors need to buy a currency in order to invest in assets denominated in that currency, higher interest rates tend to be associated with rising exchange rates. Resultant, keeping other things constant buy the currency of the country whose interest rates are expected to rise.

The US Federal Reserve (FED) began increasing interest rates in 2015. In 2018, however, it took the most number of increases (4) and raised it from 1.5% to 2.5%. Notice how this led to an increase in the dollar index as global investors found it lucrative to invest in the US rather than other countries.

Since bonds are inversely related to interest rates, solving the equation, we find that there is an inverse relation between bond prices and exchange rates.

Currency vs Commodity

Currency of the countries exporting commodities, are highly correlated to the prices of such commodities.

To understand this better, let's consider Australian Dollar (AUD) VS US Dollar (USD). Australia has the world’s largest gold reserves, with studies estimating that 17% of the world’s total gold reserves resides in Australia. Hence it is obvious to note that as gold prices increase, investors would pay Australian Gold miners in AUD to buy gold. This leads to a higher AUD vs USD.

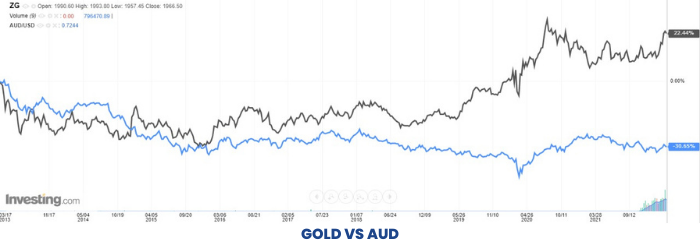

The chart below shows the high correlation between Gold prices (black line) and AUD (blue line).

As can be seen from the chart, it is practically indifferent to buying gold or AUD as both are highly correlated.

The correlation between Canadian Dollar (CAD) vs USD and Crude Oil is also high. This is due to the fact that Canada is an oil exporter and benefits when the prices of crude oil are on the rise.

Resultant, an investor tracking a commodity rise, can alternatively buy the currency of the country which is the major producer of the same.

Bonds vs Commodities

Before moving to understand the relationship between bonds and commodities, let us first understand an important concept that drives interest rates.

The Drivers of Interest Rates

Interest rates are driven by 3 factors

(a)GDP growth rate

(b)Inflation rate

(c)Central Bank monetary policy

Let's derive the theoretical interest rate of the Indian economy through the following hypothetical numbers:

Suppose the 10 year expected GDP growth rate for India stands at 6%, 10 year expected inflation is 4%. This would mean that the 10 Year government bond (risk free) should be yielding 10% (i.e. 6% + 4%).

However, the market price of the bond is trading at 9%. Here comes the plug-in figure of -1%. This means that the RBI’s monetary action is keeping interest rates lower by 1% “artificially”.

Hence the prices of interest rates can be affected by any of three factors listed above.

Coming back to understanding the relationship between Bonds vs Commodities.

A rise in commodity prices signals inflation. And remember what rising inflation does to interest rates? Interest rates rise with rising inflation and as bond prices are inversely related to interest rates, bond prices fall.

As a result, since Commodities are inversely related to Bond Prices, an investor should theoretically sell bonds when commodity prices pick up.

In the practical world, you should be aware that intermarket relationships give you a signal about the trend or warning about a reversal. Hence its advisable to look out for technical breakouts in the respective charts along with analysing intermarket relationships before taking a trade.