Conclusion

“History never repeats itself, however, it often rhymes” ~ Mark Twain

There may be certain instances, where you’ll find some of the relationships not existing. In that case, delve deeper to understand the factors better.

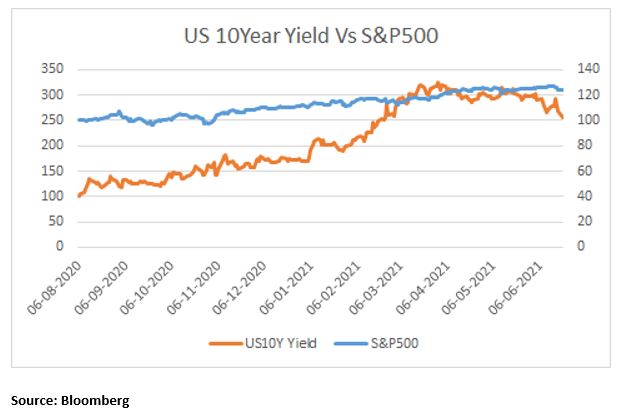

A recent example may be the increase in the yield of US10 Year Government Bonds from a low of 0.53% in August 2020 to 1.35% in June 2021. Normally, such a rapid increase should have led to a drastic fall in S&P 500. However, the opposite happened. S&P 500 instead climbed ~25% in the same period.

The reason for this anomaly was growth expectations driving interest rates rather than inflation fears.

Hence, in Macroeconomics nothing is conclusive, and cause and effect relationship has to be seen in order to find evidence of a movement in asset class.

A person studying intermarket analysis must not regard this as a mathematical formula. What is important is the knowledge of why the relationships exist in the first place.

Another important factor to keep in mind is that intermarket analysis should be considered as a signalling mechanism and not a decision mechanism. It has the capacity to give you signals or warnings, based upon which you may take your investment or trading decisions.

It might look complicated to start with, but hey, as Charlie Munger puts it, “Investing is simple, but not easy"!