Five Common Misconceptions of Value Investing

Till now, in this module, we have explained the concept of value investing in complete detail. In this unit, let us discuss some common misconceptions of value investing.

1. Investing in Blue-Chips.

First, let us define stocks which are labeled as Blue-Chips.

Huge companies, essentially those with a >$5 billion market capitalisation and excellent reputation are commonly called blue-chip stocks.

In simpler words, they are safe equity investments having been termed as “safe” due to their long history of generating dependableearnings (profits for the business) and having established trust due to their sheer scale.

It is a common misconception that investing in blue-chip stocks is a means of practicing value investing. While blue-chip companies are usually more resilient to both internal and external disturbances due to their sheer size and governance practices, they might often turn out to be companies that are highly overvalued.

The basic tenet of value investing is that the current price of the investment represents a good value from the perspective of current and future earnings and potential growth. Blue-chip stocks represent a safer investment as compared to other companies of smaller sizes but a company belonging to the latter category and backed by a strong business might represent better value.

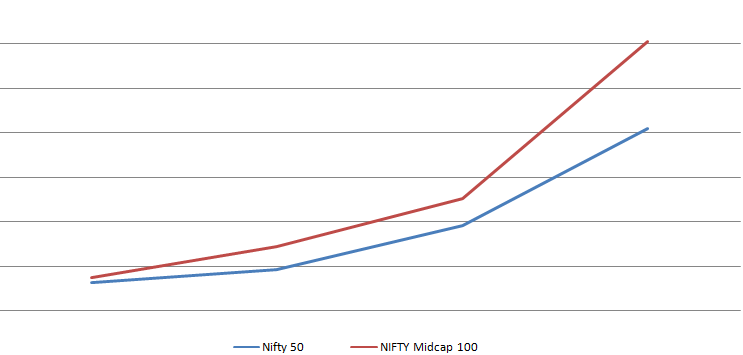

The history of the financial markets is replete with instances when mid-caps and small caps have outperformed large cap companies. One such instance is shown in the below graph where the Nifty mid-cap 100 index generated a return of 50.4% whereas Nifty 50 gave returns of 30.95%. as on Nov 2021

At the end of the day, the motive of most investors is not just to minimize risk but get highest possible returns for the quantum of risk being taken. It is also a rarity for large cap companies to turn into multi-baggers. Blue-chip companies are closely tracked by a large segment of market participants and hence every development, whether positive or negative, is reflected in the price within a very short period. Smaller companies are not tracked as exhaustively by analysts and other market participants which gives opportunity for an investor who recognizes a strong company with a sound business model early to realize higher returns.

2. Keeping up with the trend. You often hear people chasing stocks giving monumental returns for some short period of time. These may very well be the same stocks that give you monumental losses in another time period. In technical terms, these stocks could either be cyclical stocks or they could just be those stocks which are riding the bull market at the time when the entire market is up and investor sentiment in general is very high.

If they belong to the latter category and are incapable of generating returns based on the worth of their business, you need to steer clear of them for long term investing. Moreover, most often than not by the time these trending stocks become visible to the minority shareholder, it is already too late to make hay while the sun shines even for short term gains.

On the other hand, if they belong to the cyclical industry, you can very well invest in them provided you fully understand the industry and can identify the correct entry and exit points. This not only requires you to invest a lot of time in keeping up with day-to-day news but also requires a fair deal of technical knowledge of not only the industry but its external environment as well.

Hence, keeping up with the trend wherein you just invest in stocks “currently” delivering high returns is not always the best approach from a value investing perspective.

3. Diversification. Time and again, we have been taught “diversify your portfolio” and “hedge your business risk”.

What does this really mean? Are you supposed to hold 100-200 stocks of different industries?

Well, I am of the opinion that ‘Too many cooks spoil the broth’ because it is nearly impossible to hold 100 stocks which are all of substantial quality. So invariably, you will have a lot of junk stocks which aren’t reliable to generate good returns in tough times. Hence, it is better to limit your portfolio to a maximum of 15 stocks because:

a. It is easier to keep track of a smaller number of stocks – whether it is business performance or corporate governance and hence avoid keeping any junk stocks in your portfolio.

b. 15 is a good enough number to achieve optimum diversification whether it is across industries, geographies, value chain, et cetera.

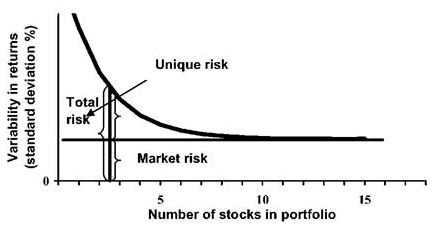

Source: www.ebrary.net

Total portfolio risk as a function of the number of stocks held (%)

As we can see from the figure above, the incremental diversification after holding 15 or more stocks is minimal. This is where you have to take into account other factors such as transaction costs which increase significantly with the increase in the number of stocks. Moreover, as we know, diversification can only be achieved for “unsystematic or business risk” and adding more stocks will not be able to mitigate “systematic or market risk”. Hence, it is never really possible to hold a portfolio of equity investments without bearing some significant risk.

4. Never losing money if you follow the ideal steps of Value Investing. An interesting article that I came across recently tried to draw parallels between a game of poker and the game of investing.

Having played Poker for more than 6-7 odd years, I consider myself to be decent enough when it comes to understanding the intricacies of the game. However, there have been several times when I have lost a lot of money even after having a great hand. Now, there are two reasons that my loss can be attributed to:

I. Luck OR,

II. Being unable to gauge competition

Now for both the above reasons, the article gave me some invaluable advice that I’d like to share it with you.

I. “On any given day, a good investor or a good poker player can lose money” – David Einhorn

We must always remember that investing is a probabilistic exercise and even following the ideal steps of value investing DOES NOT guarantee you profits or promise you zero losses.

II. “Life is like a poker game where you must learn to quit sometimes when holding a much loved hand.” – Charlie Munger

It is imperative that you gauge the odds of the competitor winning in poker and not let your biasness of a good hand prevent you from folding. Similarly, in investing, it doesn’t matter how flawlessly the business is being run if it’s the wrong business (say likely to be disrupted by technology) or if it’s in too small a market (showing no scope for major growth). Looking at the bigger picture is absolutely essential in order to prevent encountering losses in the long term.

5. Know every detail about the business and company. Understanding the industry, business and company well is not the same as knowing every last detail about the three.

“A company should be viewed as an unfolding movie, not as a still photograph” – Warren Buffett

Continuing with our comparison with a poker game, we must understand that with every card, we get to know more but we never really fully know everything until the last card. However, we cannot wait until the last card to raise our bets. We have to play the game based on the probability of a hunch we had in the beginning of the game and by continuously taking into account the forthcoming developments.

Similarly, spending a lot of time to discover the last unanswered detail may cost us the chance to buy a stock at a favourable price. As we know, greater the uncertainty, greater the potential returns from a well-timed investment. Hence, acting quick is a necessity in the game of investing where things change with the blink of an eye. That being said, it is about taking smart calculative chances and not just gambling our money away. Having a reasonable knowledge about the company and business should be a good enough reason to go ahead and invest in the same.

Note: Now that we have completed our module and discussed all the concepts of value investing, let us indulge with some case studies in the subsequent units.