Type of Loan- Home Loans

As we have learned earlier Loans are available to both individuals and businesses. For simplicity of this unit we will discuss the most popular types of loans for individual borrowers available in India. So, without any further ado, let start with the most common type of loan in India i.e, Home Loans. We will also discuss other types of loans such as car loans, personal loans etc. in the upcoming section of this module.

Home Loans

Everybody needs a home to live. However, buying a home entails an investment of a significant amount. Most people spend a lifetime trying to gather that kind of fund.

Thanks to home loans, anyone can now buy a home now. Home loans are loans given out by banks and NBFCs where the loan amount can be used to purchase a house or land or to construct a house.

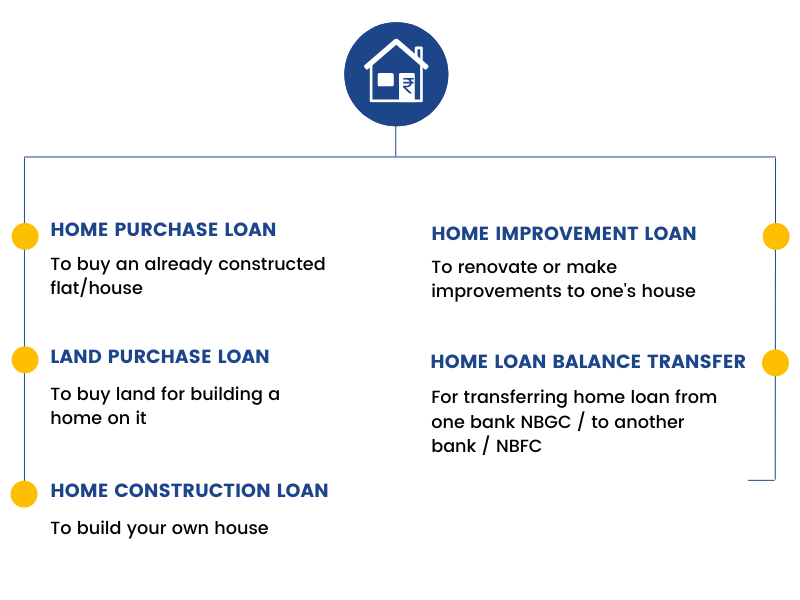

Home loans can be of various kinds depending on the purpose of usage of the fund:

1. Home purchase loans: The vanilla form of loan used to buy an apartment or a house. Most people refer to this loan when they mention home loans. This is the most common type of home loan.

2. Land purchase loans: The loan amount is used to purchase land to build a home.

3. Home construction loans: The loan amount is used to build a new home over an already owned land.

4. Home improvement loans: These loans can be availed to meet home renovation needs such as repairs or improvement to existing residential properties. Once disbursed, these loans can be used to meet a number of renovations needs such as paying the contractor, purchasing materials, and paying the interior decorator. One can also use it to buy furnishings, furniture, household appliances or for services such as painting, carpentry and other such needs.

5. Home loan balance transfer: Sometimes, people having already an existing home loan may find the offering by another bank or NBFC attractive and want to shift to the new financing authority. This can be due to a variety of factors such as interest rate benefit, prepayment benefit, better policies and others. In this scenario, the home loan from one bank can be transferred to another bank – which is known as a home loan balance transfer.

Important things to know about home purchase loans

- The bank does not finance the entire value of the home. Typically, 80-85% is financed by the bank or NBFC and the rest has to be financed by the purchaser of the house.

- Home loans are generally provided for a longer period of time – 20 to 30 years. Since home loans principal are generally large in amount, this helps in spreading the repayment into smaller EMIs, thus making it more affordable for the home purchaser.

- Home loans have some of the lowest interest rates among loans. Generally, the interest rate varies between 7-8% per annum as of 2021.

- Home loans can be taken at fixed or floating rates of interest. Many banks or NBFCs offer consumers to shift between fixed and floating rates as well.

- Since the house remains as the collateral for a home loan, ensuring the house is typically a part of the home loan. This is beneficial for both the home purchaser and the bank since both have the peace of mind that the home is safe from all kinds of calamities and accidents.

- Home loans can be prepaid by the borrower and completed much before the expiry of the loan tenure.

- Typically, home loans involve submitting quite a lot of documents since banks want to establish a number of things such as the borrower’s purchasing power, the builder’s credibility and many other things.

Home loans have made purchasing homes affordable for those, who would otherwise stay in a rented accommodation. They can now get the ownership of a house with the amount that they pay as monthly rent.

In this respect, let us see the pros and cons of buying a house vs renting one which will help you understand which one works better for you.

If the monthly house loan EMI fits your budget, buying a home is always a better idea than renting one.

Explore the 'A2Z of Finance' course and delve into various types of loans. Kickstart your finance journey with in-depth knowledge. Enroll now!