Types of Loans

Introduction

Loans can be a lifesaver, isn't it? Be it buying a new home or going for a world tour, or completing higher education from the best colleges – loans help us make our dreams come true. In this module, we will cover all the basic concepts associated with loans and talk about the types of loans available in India and things that you should keep in mind while applying for a loan.

What is a loan?

A loan is a sum of money that one individual/business/company borrows from another individual/business/company to meet any planned or unplanned financial requirement. The party that gives the money is called the lender and the party that receives the money is called the borrower. By taking a loan, the borrower incurs a debt that he has to pay back along with interest. The interest rate is pre-decided and is levied at periodic intervals (for example, monthly, yearly etc.)

In other words, when Mr Khanna lends ₹10,000 to Mr Sawant for a year at an interest rate of 14%, Mr Khanna is the lender and Mr Sawant is the borrower. Mr Sawant has to pay back ₹ 11,400 (₹ 10,000 + ₹ 1,400 interest) to Mr Khanna after a year. This whole process is a loan.

While loans can be exchanged between two individuals, in this module we will discuss only bank or NBFC loans – i.e. when the lender is a bank or Non-Bank Financial Corporation (NBFC) and the borrower is an individual/business/company.

Important concepts regarding loans

Before delving into advanced topics, let us first discuss some basic concepts regarding loans:

1. Principal: Principal is the initial amount of loan given. In the above example, ₹10,000 is the principal.

2. Interest: Interest is the additional amount paid back by the borrower – ₹1,400 in the above example.

3. Interest Rate: The rate at which interest is calculated is called the interest rate i.e. 14% in the above example. It can vary depending on the type of loan and the loan principal amount. For example, the interest rates of personal loans will be different from that of car loans. Similarly, the interest rates for larger amounts of loan such as ₹2 crores and above can be different from smaller amounts.

There are mainly two types of interest rate:

- Fixed rate: This rate does not change throughout the time period of the loan (also called the term or the tenure of the loan).

- Floating rate: This rate can change over the term of the loan. The fluctuation is dependent on various market and economic factors. Change in floating rate can affect the tenure and the monthly installment of the loan.

But which one should you choose if given an option? Well, it is highly dependable on the situation and your risk profile. Let's discuss a few differences between the two:

4. Equated Monthly Installment or EMI: When total payment amount (principal + interest) is divided into equal sections which the borrower pays to the lender, then it is known as an EMI. In the above example, the total payment of ₹ 11,400 can be divided into 12 equal EMI of ₹ 950 each.

This is a very common terminology you will often hear with regards to bank and NBFC loans. The total payment plus the interest amount always has to be repaid by the borrower in EMIs to the banks.

5. Payment Schedule: It is as the name suggests – a schedule of payment. Since a loan is paid back over a period of time, a payment schedule is drawn while giving out the loan to keep things transparent between the lender and the borrower. EMIs and payment schedules go hand in hand. The payment schedule gives a list of the EMI payments to be made by the borrower.

6. Amortization: The process of spreading out the loan repayment into a series of fixed payments is called amortization. The payment schedule is drawn in such a way that the loan is paid back at the end of the specific period.

7. Moratorium: Sometimes, the lender may decide to grant a holiday period in a loan when the borrower does not have to incur the EMI payments. This is known as a moratorium. For example, during the 2020 coronavirus pandemic, several banks decided to grant a holiday period to help the common people bide the economic crisis.

8. Security/collateral: At times, the lender may ask for a guarantee before granting a loan which is known as collateral. This remains as a security to the lender so that in case the borrower defaults the loan, the lender can sell it and recover a part or whole of the loan.

For example, in the case of home loans, the house on which the loan is given remains collateral. Hence, in case the borrower does not pay back the loan, the bank or NBFC sells off the house and recovers the loan.

9. Loan eligibility: This reflects whether the borrower is eligible to take a loan. Banks analyse the financial health of a person to determine whether he/she is capable of repaying back the loan. Things such as borrower’s income and other financial liability are taken into account while assessing the loan eligibility of a person.

10. Default: When the borrower fails to repay the loan, then it is known as a default. This is not a favourable position for a buyer since a person faces various kinds of repercussions once identified as a defaulter.

Advantages and disadvantages of taking a loan

Loans come with several advantages such as:

- They help fulfill our goals and objectives faster.

- Loans from banks or NBFCs offer low interest rates and are highly regulated as well.

- Bank or NBFC loans are flexible. You can choose from a variety of tenure and loan types.

- Bank or NBFC loans can offer tax benefits. For example, the interest in home loans and educational loans are tax-deductible.

However, bank or NBFC loans have a few disadvantages too:

- They are granted to people with sound financial stature. It is difficult to obtain a bank or NBFC loan for someone who is recently starting off their financial journey or someone with poor financial records.

- You end up paying more than you borrow since you have to pay interest on the loan.

- Some bank or NBFC loans may also have high-interest rates.

Classification of loans

From the last unit, we got the basic ideas of loans as well as their advantages and disadvantages. Let us now learn how loans are broadly classified. They are broadly classified into three categories:

- Secured loans

- Unsecured loans

- Others

Secured loans

We discussed collateral in the previous chapter. A secured loan is a loan which is backed by collateral. The borrower needs to submit collateral of some kind which he/she owns. The same is kept with the bank or NBFC till the loan is repaid in full. Once the repayment is complete, the papers are released by the bank or NBFC.

The collateral can be in any form. In the case of a home loan, the house is the collateral, in the case of a car loan, the car remains as collateral. Recently, Gold loans have become very popular. In gold loans, gold jewellery or coins are taken as collateral. People can also keep their stocks, bonds, insurance policies and other investments as collateral.

From the bank’s perspective, secured loans are safer since they can sell off the collateral in case of a default in the loan. Hence, typically secured loans have lower interest rates since they are less risky to the banks or NBFC.

Unsecured Loans

These are loans which are not backed by collateral. The loans are given based solely on the basis of the financial capability of the borrower. These are riskier to banks since they have to simply trust that the borrower will repay the loan. Hence, banks conduct a thorough financial analysis of the borrower to estimate their repayment capacity.

Since they entail more risks, unsecured loans have higher interest rates too. Personal loans and credit cards are the two most popular examples of unsecured loans.

Other types of loans

Sometimes banks or NBFCs take collateral on a case to case basis. Hence, they can neither be classified as a secured loan nor as an unsecured loan. Education loans, agricultural loans and business loans fall under these categories.

In the case of education loans, the loan is given to a student, who is yet to have a financial history. Hence, the financial eligibility of the parents is taken into account. Banks may or may not ask for collateral for giving out the loan. This is solely the discretion of the bank or NBFC. Hence, an education loan can sometimes be a secured loan and sometimes an unsecured loan.

Type of Loan- Home Loans

As we have learned earlier Loans are available to both individuals and businesses. For simplicity of this unit we will discuss the most popular types of loans for individual borrowers available in India. So, without any further ado, let start with the most common type of loan in India i.e, Home Loans. We will also discuss other types of loans such as car loans, personal loans etc. in the upcoming section of this module.

Home Loans

Everybody needs a home to live. However, buying a home entails an investment of a significant amount. Most people spend a lifetime trying to gather that kind of fund.

Thanks to home loans, anyone can now buy a home now. Home loans are loans given out by banks and NBFCs where the loan amount can be used to purchase a house or land or to construct a house.

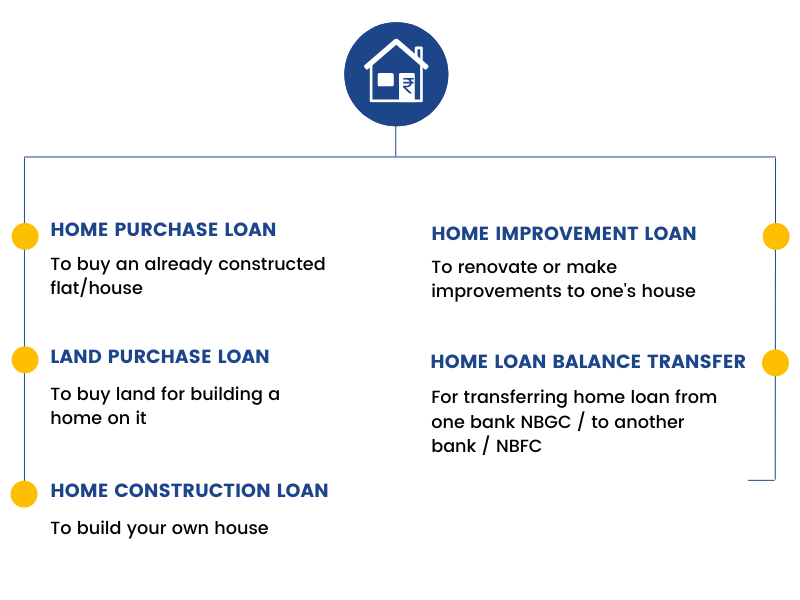

Home loans can be of various kinds depending on the purpose of usage of the fund:

1. Home purchase loans: The vanilla form of loan used to buy an apartment or a house. Most people refer to this loan when they mention home loans. This is the most common type of home loan.

2. Land purchase loans: The loan amount is used to purchase land to build a home.

3. Home construction loans: The loan amount is used to build a new home over an already owned land.

4. Home improvement loans: These loans can be availed to meet home renovation needs such as repairs or improvement to existing residential properties. Once disbursed, these loans can be used to meet a number of renovations needs such as paying the contractor, purchasing materials, and paying the interior decorator. One can also use it to buy furnishings, furniture, household appliances or for services such as painting, carpentry and other such needs.

5. Home loan balance transfer: Sometimes, people having already an existing home loan may find the offering by another bank or NBFC attractive and want to shift to the new financing authority. This can be due to a variety of factors such as interest rate benefit, prepayment benefit, better policies and others. In this scenario, the home loan from one bank can be transferred to another bank – which is known as a home loan balance transfer.

Important things to know about home purchase loans

- The bank does not finance the entire value of the home. Typically, 80-85% is financed by the bank or NBFC and the rest has to be financed by the purchaser of the house.

- Home loans are generally provided for a longer period of time – 20 to 30 years. Since home loans principal are generally large in amount, this helps in spreading the repayment into smaller EMIs, thus making it more affordable for the home purchaser.

- Home loans have some of the lowest interest rates among loans. Generally, the interest rate varies between 7-8% per annum as of 2021.

- Home loans can be taken at fixed or floating rates of interest. Many banks or NBFCs offer consumers to shift between fixed and floating rates as well.

- Since the house remains as the collateral for a home loan, ensuring the house is typically a part of the home loan. This is beneficial for both the home purchaser and the bank since both have the peace of mind that the home is safe from all kinds of calamities and accidents.

- Home loans can be prepaid by the borrower and completed much before the expiry of the loan tenure.

- Typically, home loans involve submitting quite a lot of documents since banks want to establish a number of things such as the borrower’s purchasing power, the builder’s credibility and many other things.

Home loans have made purchasing homes affordable for those, who would otherwise stay in a rented accommodation. They can now get the ownership of a house with the amount that they pay as monthly rent.

In this respect, let us see the pros and cons of buying a house vs renting one which will help you understand which one works better for you.

If the monthly house loan EMI fits your budget, buying a home is always a better idea than renting one.

Explore the 'A2Z of Finance' course and delve into various types of loans. Kickstart your finance journey with in-depth knowledge. Enroll now!

Type of Loans- Personal Loans

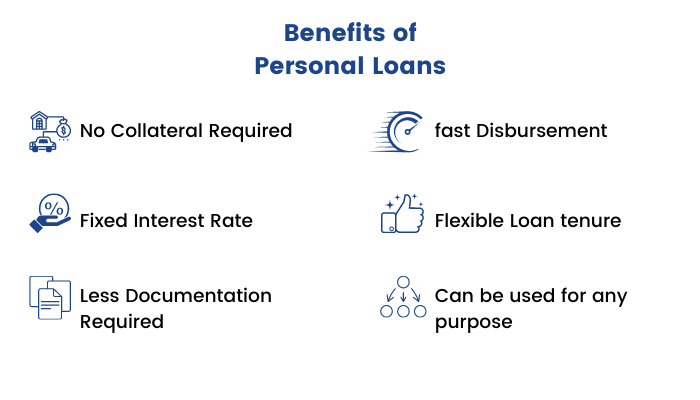

We often face various personal financial requirements that come unannounced. Also, sometimes we need funds to meet our life goals and dreams. Personal loans are the answer in such cases. These are unsecured loans provided based on the financial health of people to meet any kind of financial need.

They are the most versatile form of loans. Unlike home loans or education loans where the proceeds have to be used for specific purposes, personal loans can be used for anything – funding vacations, meeting medical emergencies, debt consolidation or even meeting day-to-day living expenses. However, since personal loans are unsecured loans given solely on the basis of the financial health of a person and the money can be used for any purpose, the terms of personal loans are less favourable than other kinds of loans:

- The tenure of personal loans is usually very short – from 1 year to a maximum of 7 years. Most people take them for 3-5 years.

- Personal loans are given at a fixed rate of interest. However, since they are not backed by any collateral, the interest rate of personal loans tends to be on the higher side.

- Banks consider a number of things while giving out a personal loan which includes a good credit score and stable income.

- Good credit score plays a very important role in the case of personal loans. People with good credit scores can get personal loans at a lower interest rate compared to those with a lower credit score.

- Personal loans typically are processed faster and need less documentation.

Types of Loans- Loan Against Property

Unlike personal loans, these are secured loans where the loan amount can be used for any purpose, like a personal loan. Instead of keeping your properties idle, you can use them for meeting your financial requirement by taking a loan against that property. Commonly known as LAP, these are loans given keeping a property as collateral. The pledged property can be residential, commercial or industrial. The disbursed loan amount is usually a percentage of the property value and can be used for any purpose by the borrower. Loan against properties is a method to use the dormant potential of your immovable assets to meet your financial goals such as higher education of children or their marriage or attending to emergency financial requirements.

- LAP has slightly higher interest rates than home loans, but it is still low compared to other unsecured loans such as personal loans and credit cards which can help you meet similar financial goals.

- LAP can be prepaid by the borrower.

- LAP has a longer tenure.

- Since the interest rate is lower, the EMI of LAP also tends to be lower.

- LAP can only be given on a property that is free from any other kind of loan. For example, if a house has a home loan running on it, it cannot be used for LAP.

- For taking a LAP, the borrower has to be the undisputed owner of a property. In case the property is disputed, it cannot be considered for LAP.

Difference between LAP & Personal Loan

Since both personal loan and LAP are modes of financing various personal requirements, we can draw a comparison of the two and understand which one is more suitable for individual needs:

Types of Loans- Car Loans

Purchasing a car is no more a luxury. It has slowly become a necessity and a way of life. Thanks to car loans, any kind of car can be bought without putting a dent in a person’s financial planning. Car loans can be taken for buying both new and used vehicles. They are secured loans where the car itself remains as the collateral.

- The tenure of car loans typically ranges from 24 months to 60 months.

- Once qualified for a car loan, you can purchase a car immediately.

- To avail a car loan is quite easy since in most cases car dealers have tie-ups with specific banks.

- Car loans are given at a fixed rate of interest.

- Banks finance up to 100% of the vehicle’s on-road price. However, this is solely at the discretion of the bank.

Two-wheeler loans:

As the name suggests, 2-wheeler loans can be used to purchase 2-wheelers such as a bike or a scooter. While 2-wheelers itself does not cost much and can be financed by one directly, these loans help people manage their finances in a better way and therefore are becoming very popular. The interest rate is not very high and the loan amount can be used to purchase a new or used 2-wheeler.

The disbursement of the loan is solely dependent on the borrower’s loan repayment capability. The 2-wheeler itself remains the collateral with the bank and in case of a default, it is confiscated by the bank or NBFCs.

- The interest rates for 2-wheeler loans can be higher than auto loans.

- Most banks and NBFCs finance 95% - 100% of the 2-wheeler price.

- The tenure of 2-wheeler loans is usually up to 4 years. However, some banks and NBFCs may offer up to 5-years.

- Like auto loans, most 2-wheeler showrooms have tie-ups with banks or NBFCs. Hence obtaining a loan is quite easy.

Types of Loans- Gold Loans

Gold has been a valued asset in Indian households for ages. This loan helps families realize the latent potential of their gold assets and use them for financing their personal needs. A gold loan is a loan where gold jewellery or coins or bars are given as collateral. The bank or the NBFC sanctions a certain percentage of the pledged gold value as the loan which is usually determined by the current price of gold in the market.

These loans are ideal for meeting short term needs of the family and hence have a shorter tenure starting from 3-months only. This is the fastest and easiest loan to obtain in India since it is backed by time-tested collateral whose value increases exponentially with every passing year. Since it involves gold, these loans have a low-interest rate as well.

While gold loans originated among the money lenders in South India, today, many leading banks and NBFCs in India offer gold loans.

Begin your finance journey with 'A2Z Of Finance: Finance Beginner Course' and master gold loans today!

Other Types of Loan

Education loans

Higher education from reputable institutes can be quite expensive – be it in India or abroad. Education loans have been designed to give students the opportunity to pursue their dreams. In an education loan, the student is the main borrower while their parents, spouse or siblings remain the co-applicants. Banks may or may not ask for collateral while extending education loans.

Education loans have a typical moratorium period in the sense that students don’t have to pay the EMI while taking the loan. The repayment starts only after 12 months of completing the course or 6 months after the student starts working, whichever is earlier.

- Education loans can be taken for undergraduate, postgraduate and even vocational courses.

- Education loans can be availed for studying in India or abroad.

- Various aspects are taken into account while disbursing education loans such as family income, the type of programme pursued and the reputation of the institute where the course is pursued.

Loan against fixed deposits:

These loans are provided keeping fixed deposits as collateral. A certain percentage of the total fixed deposit amount, typically 80%, is given out as a loan. The interest rate of the loans is dependent on the interest rates of the fixed deposits. In India, almost all banks extend loans against fixed deposits. These are secured loans where fixed deposits remain as collateral. In case the borrower defaults on the payment, the fixed deposits are liquidated and the amount is recovered.

Credit Cards

Credit cards are a form of loan where banks or NBFCs grant a credit facility to the borrower. The limit can be used by the borrower to make purchases. At the end of the billing cycle (which lasts for 1 month), a bill is generated with an outstanding amount. The borrower then has to pay back the billed amount to the credit card issuing authority. The payment for the credit card has to be made monthly. However, the borrower does not have to necessarily pay the entire billed amount in a month, provided he/she pays the minimum amount which is 5% of the total amount billed for the month.

- Credit cards entail some of the highest interest rates because they are completely unsecured. The limit is solely granted on a person’s financial health and history.

- Credit cards are the most popular and convenient form of credit available today. They can be used in India and abroad and is especially useful while travelling abroad because it eliminates the need to carry large amounts of foreign exchange. They also come with reward points and various other benefits, which add to their popularity.

- The credit limit can be used interest free if all the bills are paid in full. However, if the bills are not paid on time or in full, then the interest starts getting applied.

- A word of caution: since credit cards entail very high-interest rates, it is advisable to pay the monthly bills on time. Piling up a credit card debt can be a huge menace to one’s financial planning and can lead him to a debt trap easily.

- Apart from the credit limit, every credit card usually has a cash advance facility. The user can withdraw cash from the credit card through an ATM. However, this is highly risky and should be used only as a last resort.

Being an electronic card, credit cards are often compared to debit cards. Debit cards are electronic cards too, but they are tied to your bank account. Hence, when you use credit cards, you effectively use the balance in your bank account. It is not a line of credit and hence does not incur any interest charges.

Let us compare the two and understand which one is better to use:

1. Debit Cards

What is it?

It is equivalent to spending cash. You can use the money in your bank account.

How much money can you spend?

Only the money in your bank account

Pros

- Convenient

- Efficient usage of cash

- Keeps track of your spending

Cons

- Not possible to spend more than your bank balance

- Risk of losing money if the debit card is lost.

- It does not improve your credit score.

- If the spending and the repayments are managed efficiently, credit cards can be much more advantageous than debit cards.

2. Credit Cards

What is it?

A credit line extended by the banks/NBFCs. You have to pay interest on usage.

How much money can you spend?

Equivalent to your total credit limit.

Pros

- It helps build a credit score.

- It helps you manage your finances.

- Take benefits of reward points.

- Useful for financing spending when you are short in cash

Cons

- It can lead to a debt trap

- It may lead to a high amount of interest payments if bills are not paid on time.

- It can ruin your credit history if credit card debt is not handled efficiently.

Loan against securities

These loans are provided keeping financial securities as collateral – such as insurance policies, mutual funds, shares, national savings certificate, Kisan Vikas Patra, gold deposit certificates, bonds, non-convertible debentures and others. A percentage of the value of the securities is given out as a loan. The interest rate and tenure vary depending on the type of financial security.

Loan against insurance policies is provided keeping certain kinds of insurance policies as collateral. These loans are provided only against those policies which have a maturity value. For example, endowment policies and money-back policies. Insurance policies have to be at least 3-years old to be eligible for these loans. While certain banks offer such loans, the insurer themselves offer loans on these insurance policies.

Certain lenders offer loans against mutual funds and shares. The present value of the mutual funds or shares is taken into account while determining the loan amount.

Consumer durables loan

Certain consumer durable products have become more of a necessity than a luxury. Isn’t it? From mobile phones to air conditioners, consumer durables are a part and parcel of every household’s life. Consumer durable loans help families purchase these electronic products and in turn, manage their finances. Instead of dishing out a chunk of cash for such purchases, consumer durable loans can be used. It is possible to take a loan for as low as Rs 5,000. Usually, no collateral is required for these loans. Many lenders offer these loans at 0% interest rates and with minimal documentation and instant approvals.

Agricultural loans

These kinds of loans have been specifically designed for farmers to meet their general and day-to-day agricultural requirements. They can be taken for shorter time periods to meet working capital needs or longer time periods to buy agricultural equipment.

Agricultural loans usually have very low-interest rates and help farmers obtain better yields. The loans can be repaid after selling the crops.

Business Loans

Moving on to commercial lending and borrowings, let us discuss 'Business Loans.'

Operating a business is not easy and may often require funds that the business owners may not have. Business loans have been designed to help businesses run smoothly and give them the opportunity to grow.

Businesses can have varied needs – from financing day-to-day operations to purchasing machinery and land. Fortunately, a variety of business loans are available in India to finance specific business needs.

Let us take a look at each of them:

Types of business loans

Term loans

This is the most common and basic kind of business loan. They are highly flexible and depend on the specific requirement of the business.

- Term loans can be secured and unsecured.

- They are given based on the business’ credit history.

- Term loans can be short term or long term.

- The funds are disbursed as a lump sum amount.

Most businesses use term loans to finance capital expenditure such as purchasing a piece of heavy machinery or buying a factory or land.

Working capital loan

These are small business loans extended to businesses to meet their working capital requirements. Every business needs cash flow for meeting its day-to-day expenses. This loan helps businesses cope up with the shortfall during the offseason and meet demand during the peak season. Almost all businesses need working capital loans.

The loan amount varies depending on the size of the business and requirement. Since they finance short-term requirements, working capital loans are usually short-term loans.

Invoice financing

Also known as invoice discounting or invoice factoring, this type of funding helps to fund the time between raising an invoice and receiving payments from clients. They are ideal for small businesses who get an instant cash flow in the meantime. Lenders finance up to 80% of the invoice amount. Once the business receives the payment of the invoice, they can repay this loan.

Overdraft facility/Line of credit

Banks can provide overdraft facilities to businesses to use as per their business requirement. They may be backed by a collateral like a fixed deposit or can be solely granted on the basis of the financial track record of the company. Almost all businesses, big or small, benefit from these overdraft facilities. A limit is set in the business’s bank account and the business can withdraw the amount as and when required. The good thing is that businesses only have to pay the interest on the amount withdrawn and the time period for which it has been withdrawn. The fund can be utilized for any purpose.

Equipment financing

This loan is specifically made to help businesses acquire machines to carry out their operations. Machines can be very costly and can cause a significant dent in a company’s finances. Instead, taking a loan from a bank/NBFC and paying it back through EMIs is a more feasible option. The interest rate for these loans can be quite low, making it a viable option for businesses.

Start-up loans

This is the generation of start-ups, isn’t it? Thanks to start-up loans, anyone can start a business. Since such businesses are new and do not have a credit history, the owner’s credit history is taken into account by the lender while evaluating the loan application. However, the businesses current or projected turnover figures or other financials are considered while deciding the interest rate, the loan amount and the tenure.

Instead of taking the entire loan as a lump sum amount, borrowers can also get a pre-approved amount and withdraw the funds as and when they require it. That way, they end up paying the interest only on the withdrawn amount and not on the entire approved loan amount.

Loan against property for businesses

Some banks and NBFCs offer loans against property for businesses which require a high amount of loans. The owner of the business can mortgage his/her property to avail funds. The property can be residential or commercial. The mortgaged property has to be free from litigation and any other legal issue. This kind of loan can be short term or long term depending on the need of the borrower.

Business loans for women

These are special finance schemes to encourage women entrepreneurs and give them a strong foothold in the industry. These loans are flexible and are ideal for small to medium enterprises. The interest rates are also quite low and processing is done fast. These business loans can help women to take their first steps in the business world.

Advantages of taking a business loan

- Business loans provide funds to businesses whenever they need them. Be it in the form of term loan or working capital loans, business loans help businesses stay afloat, continue everyday operations, think of expansion and help them grow.

- If used smartly, business loans can be very profitable. By using the fund as and when you need, you can reduce the amount of interest paid on the loan, thus making the loans work for you.

- As we have seen earlier, there are a variety of business loans available with flexible repayment options. There is something for every business – a reason why business loans have become so popular.

- Business loans help business owners stay in control of their businesses. Having funds in your hand will help you make better business decisions and think about the future of the company, without worrying about funds.

Ready to master finance fundamentals? Enroll now in 'A2Z Of Finance: Finance Beginner Course' and start your learning journey today!

How To Apply For A Loan?

Now that we have a complete understanding of the different types of loans and their purposes let us know how to apply for a loan.

It is commonly believed that applying for a loan is a complicated process, but in reality, it is not. Banks and NBFCs are putting their best efforts to make the process as hassle-free as possible. With the right sets of documents, availing a loan will not be difficult.

Here are the most common steps involved in a loan application:

Step 1: Filling up the application form

Every bank or NBFC will have its own application form. Ensure that all fields are filled in with correct and genuine information. Never sign a blank form and leave it to the loan executive to fill up later.

Step 2: Submitting documents

The loan executive will give you the list of documents required for a loan application. Usually, the most common documents are:

- Photo

- Pan card

- Address proof

- Income documents

- Other documents as required by the bank or NBFC (can be property documents in the case of a home loan or LAP, vehicle purchase documents for auto loans, details of the course pursued in the case of an education loan and so on)

- Tax documents

Step 3: Loan approval

Once you have submitted the necessary document, the loan approving department will assess the eligibility for approving the loans. Various things are taken into account during this process. The loans department may ask for additional documents if they deem fit. It is advisable to comply with their requirements for smooth and fast processing of the loan.

CIBIL Score

Now, we come to a very important aspect with regards to loans – CIBIL Score.

What is CIBIL score?

A CIBIL score is a person’s credit score which is prepared by summarizing his/her credit history and credit profile. It shows a person’s past credit behaviour – his borrowing and repayment habits with different banks, NBFCs and other lenders. It is a 3-digit number ranging between 300-900. The closer it is to 900, the stronger is the credit profile.

CIBIL score is shared information which is accessed by all banks while evaluating a loan application.

Why is it important?

The CIBIL credit score plays an important part in any loan approval process. This is the first screening criteria applied by any financial institution while reviewing a loan application.

People with a high credit score are always given preference because they have a good history of repayment of loans.

But that does not mean that people with a low credit score will not get a loan. However, enhanced checking is done by the bank or NBFC and the chances of the loan not getting approved go up.

How can you ensure a good CIBIL score?

The CIBIL score is solely based on your credit history and past payments. Building a healthy credit profile is always helpful.

Here are a few things you can do to build a good CIBIL score:

- Always pay your dues on time.

- Try to use as little credit as possible in your credit card, so that the total outstanding remains in your control.

- Take loans according to your repayment power. Consider your monthly income and expenses and then understand how much you are able to pay as EMIs. This is the best way to avoid going into a debt trap.

Things to Keep in Mind while Taking a Loan

By the end of this module, we have learned the different types of loans available in India. Not only that, what are their characteristics and the purpose of taking each type of loan. Sooner or later, we might take up a loan for ourselves too. In contrast, the real-world scenarios might be a little different from what we have learned. So, to be ready for every situation of our lives in the last unit, we will learn a few things that we should keep in mind while applying for any type of loan.

There are innumerable banks and NBFCs and almost all of them offer all types of loans mentioned in this module. For someone looking to avail of a loan, it is easy to get flustered with so many offerings.

Here are a few things that you should consider while choosing a financial lender and its offering:

Trustworthy and Credible

First and foremost, ensure that your lender is trustworthy and credible. You need someone who will not impose fees and extra hidden costs during your repayment term. Your lender should be able to give you full facts of your borrowing even before you apply for the loan. A general rule of the thumb is going for a reputable bank or NBFC who have been in operations for a long time. New institutions or lesser known ones may offer a lower interest rate at the beginning, but they almost always add hidden costs later on.

Interest Rates

Of course, this is the single most important factor while choosing a lender over another. Interest rates determine how much you end up repaying for the loan and hence, the lesser the interest rate the better. Interest rates become more important if you are taking a loan at a fixed rate of interest such as a personal loan or an auto loan.

Payment Flexibility

Consider the flexibility the lender is going to offer in the payment schedule. For example, what are their late payment fees? Are there any prepayment fees? If you want to close the loan early, are there any penalties? Opt for the lender who provides maximum flexibility.

Customer Service

When you take a loan from a financial institution, you will have to interact with them for a long time. It can be as long as 20-30 years in case of a home loan. So you want a bank or NBFC who offers good and timely customer service. They should be responsive and be able to help you when you need it.

Ease of Documentation

One of the reasons why people rethink taking loans is lengthy documentation. Choose a lender who does not ask for unnecessary documentation. Some financial institutions ask for more documents than others. Speak to your friends and family and try to understand how cumbersome the documentation process is.