Conclusion

Responding to an increasingly well-informed consumer base & bearing in mind the aspect of globalization, Indian real estate developers have shifted gears and are ready to ride the growth wave ahead of us.

A major turning point has been the shift from family-owned businesses to that of professionally managed ones. Real estate developers, in meeting the ever-growing need for managing multiple projects across the nation, are also investing in centralized processes and systems to source raw material, organize manpower, and hire qualified professionals in niche areas like project management, architecture, & engineering.

The commercial real estate sector is rediscovering its mojo and is expected to bounce back strongly once the pandemic is taken care of and things are back to normalcy.

Nonetheless, the growth levers of the residential sector are well in place. The Central Government’s ambitious Pradhan Mantri Awas Yojana (PMAY) scheme aims to build around twenty million affordable homes in urban areas by 2022. Expected growth in the number of housing units in urban areas shall correspondingly support the demand for commercial and retail office space.

As per some estimates, the current shortage in urban housing stands at about 10 million units. An additional 25 million units of affordable housing shall be required by 2030 to meet the country’s growing demand. Increased investor interest by global majors such as BlackRock, Sotheby’s, Brookfield, amongst others is an encouraging sign.

Real Estate Developers now realize asset-light models such as BOT (Build Operate Transfer) and PPP (Public Private Partnerships) are sustainable and generate better returns on capital employed. The managements are hesitant to raise funding via debt and cite examples of fallen angels of the 2000s era such as the likes of Jaiprakash Associates, Unitech, Gammon Infra, IVRCL, ARSS Infra, Lanco Infratech and so on.

The Securities and Exchange Board of India (SEBI) has given its approval for the Real Estate Investment Trust (REIT) platform, which shall allow investors from all walks of life to own Real Estate. Although, a grand success in the United States, REITs remain an untapped opportunity for Indian real estate developers to raise funds in the years ahead.

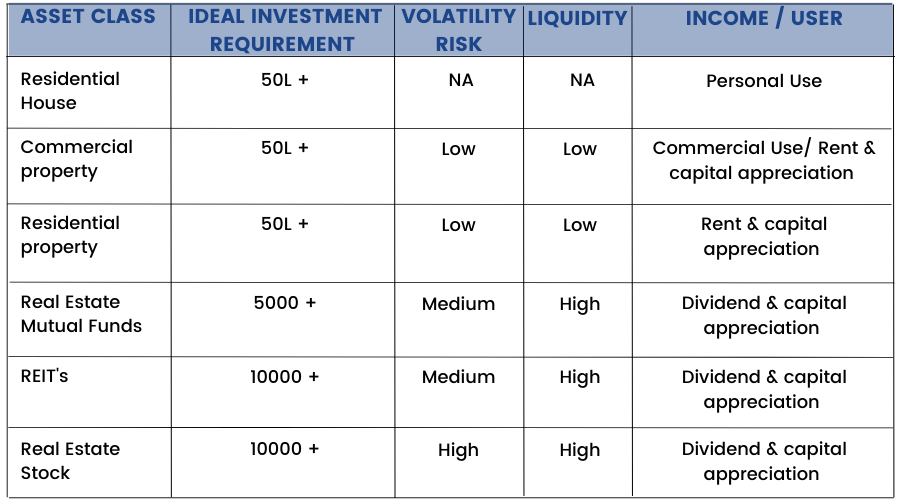

Below table summaries various real estate investing instruments discussed in this chapter: