Introduction

"Real Estate is one the most crucial and important investment avenues that has a deep impact on one’s personal and investing journey".

This module intends to simplify the same.

Real estate is the land along with any permanent improvements attached to it, whether natural/man-made—including water, trees, minerals, buildings, homes, fences, & bridges. Real estate is a form of real property that is tangible.

People often use terms land, real estate, and real property interchangeably, but there is a thin distinction between them, specifically:

The term ‘land’ is used for the part of the earth's surface that is not covered by water.

Real Estate is land plus man-made additions like Buildings.

Real property includes the physical property of the real estate, but it expands its definition to include a bundle of ownership & usage rights.

There are four types of real estate:

Residential:

The most common definition of residential real estate is an area developed for people to live in. Residential real estate is often the important investment a person owns, and the value of the real property on the estate is subject to shifts in the real estate market. Many people invest in residential real estate with the dual objective of profiting from price appreciation as well as rental lease.

Commercial:

Commercial real estate includes malls, shopping centers, hospitals, educational institutions, hotels, and offices. Apartment buildings are considered commercial, even though they're used for residences because they're owned to produce income as rent.

Industrial:

Industrial real estate includes manufacturing properties as well as warehouses. These buildings can be used for all types of functions like storage, distribution of goods, etc.

Vacant Land:

Vacant Land refers to any parcel or combination of parcels of real property without industrial, commercial, & residential buildings.

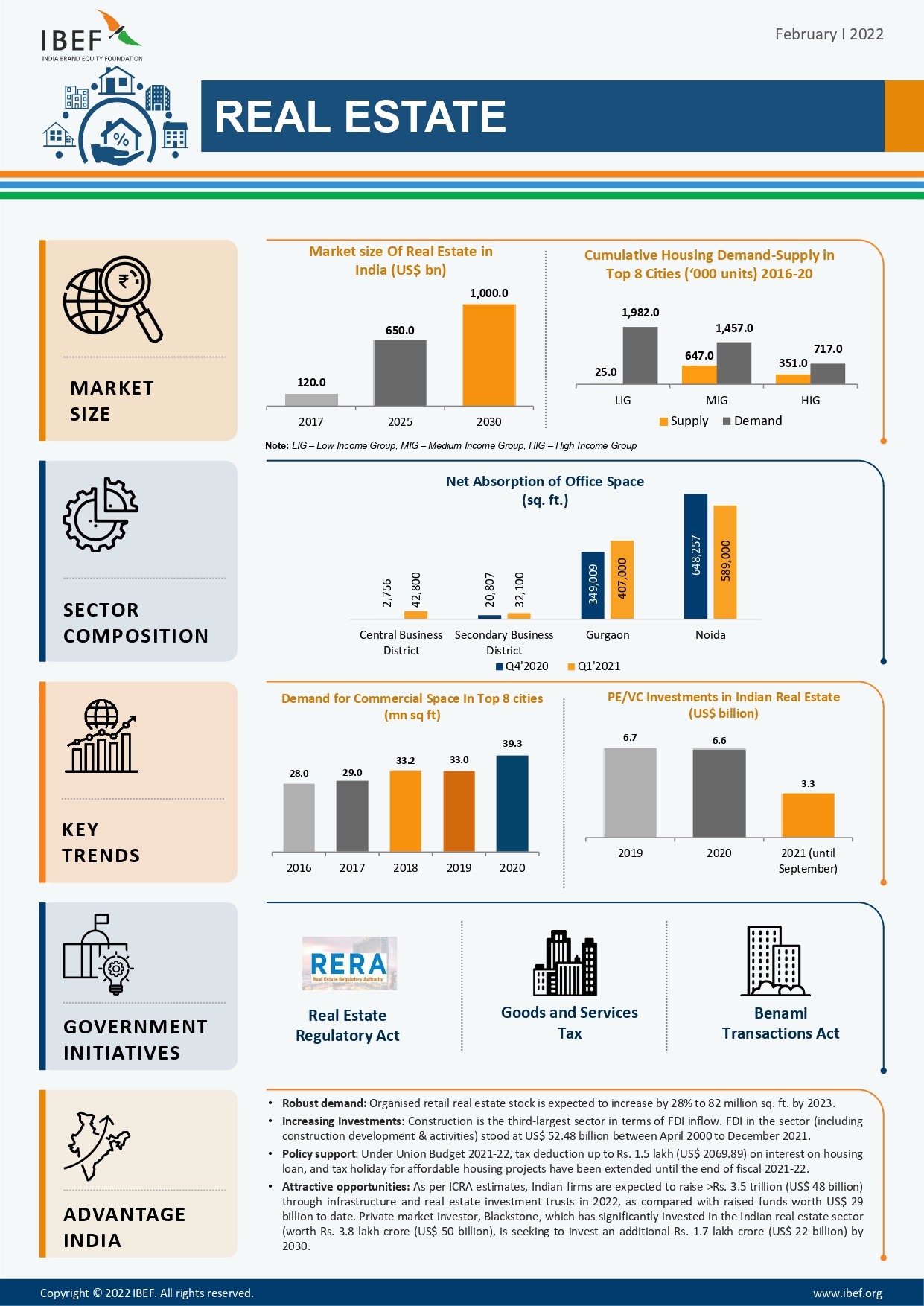

Indian Real Estate Industry

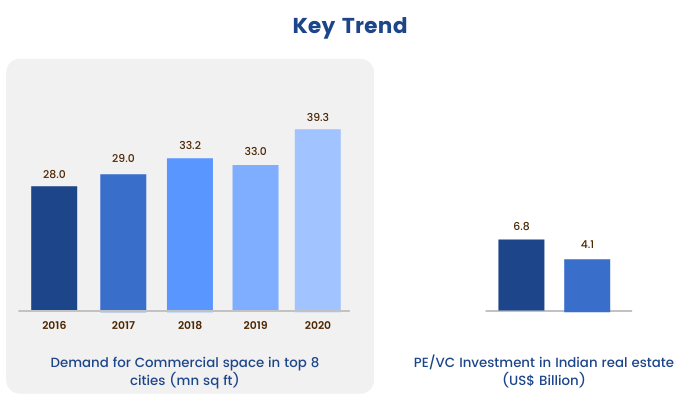

In India, Real Estate and its related ancillaries are the largest employer second only to agriculture. In the past few years, the Real Estate sector has been growing at a CAGR of 30%, making it an excellent investment. The real estate industry is divided into four sub categories, viz. Housing, Retail, Hospitality, & Commercial.

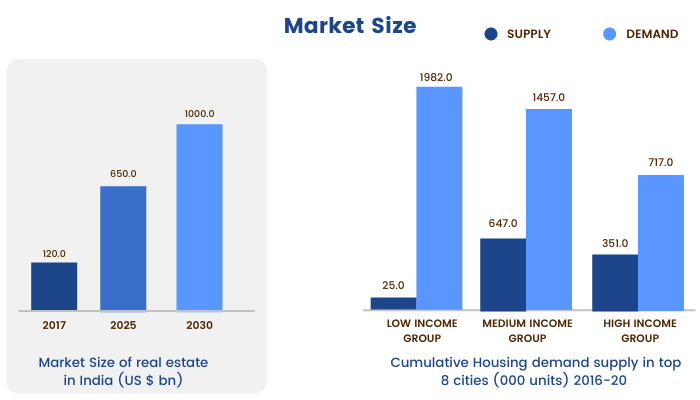

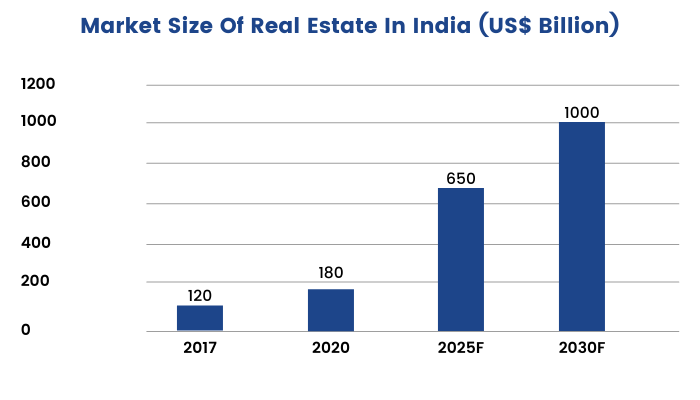

The real estate sector in India is expected to reach a market size of US$1 trillion by 2030 from US$120 billion in 2017 and contribute 13% to the country’s GDP by 2025. Retail, hospitality, and commercial real estate are also growing speedily, providing the much-needed infrastructure for India's burgeoning urban population & its growing needs.

According to the Economic Times Housing Finance Summit, about 3 houses are built per 1,000 people per year compared to the required construction rate of five houses per 1,000 population. As per some estimates, the current shortage in urban housing stands at about 10 million units. An additional 25 million units of affordable housing shall be required by 2030 to meet the country’s growing demand.

Real Estate Investor

There are different types of investors in the real estate market. The market is humungous, and participants in this market all have similar goals, i.e., to earn a handsome return by investing in the real estate market. We will discuss each one of them but before, let's understand who is a real estate investor anyway?

Who is a real estate entrepreneur or investor?

A real estate entrepreneur or a real estate investor is someone who actively/passively invests in real estate.

There are three criterions based on which we can divide real estate investor/entrepreneur:

Legal Structure:

Real estate investors can be distinguished by the type of legal structure in which they operate. It helps in determining the amount of liability they have.

- Institutional Investor: Institutional investors are big corporations who invest lump-sums in real estate investments. These institutions typically issue long-term bonds to finance themselves. Bonds have a secondary market, which makes them liquid and provides investors the ability to easily enter and exit the real estate market.

- Individual Investor: Individual Investors in the real estate market are retail investors with unlimited liability. This means that their personal assets can be attached in case of default.

Degree of Control:

Real estate investors can be distinguished based on the degree of control on the property.

- Active Investor: Active real estate investors purchase and manage properties for rental income, or renovate them to change the properties for gain. Active investors may invest in a land parcel and carry out construction activities to build real estate properties for sale. These investors are actively involved in the property management process and have a hands-on approach for every deal referred to as Active Investors.

- Passive investor: There are other investors which have ownership of the property. However, they do not go about managing its day-to-day affairs. As they virtually play no role in managing the property, they are known as passive investors. These investors only provide the cash flow for financing the property and take minimal decisions regarding its management.

Investment Motive:

Real estate investors can be distinguished based on their purpose or motive of Investment.

- Long Term Investors: Long-term investors also invest money in real estate to make money over a period of time. They think that real estate is a slow-moving, illiquid kind of asset that will give them a decent return after holding for a considerable period. Many corporations also invest in real estate for business purposes as well.

- Speculators: They are the kind of investors that should not be called “Investors” as they invest just for a short span of less, usually less than a year and sell as soon as its value appreciates.

- End-User: These people buy real estate for their personal use. Generally, people buy a home to live in for years. People look at their home as a factor to depict their lifestyle. Hence, Availability of Basic Amenities, distance to the workplace are important factors before buying any property.

Advantages Of Real Estate Investing

As we have discussed earlier, the different types of investors in the real estate market all have a common goal of earning a return on investments. But every investment has its pros and cons, whether it is the stock market, commodity market or real estate market. So in this unit, we are going to learn a few advantages of real estate investing and consecutively, in the following unit, we will discuss a few disadvantages. Starting off with the advantages:

A. Appreciation of Value over Time:

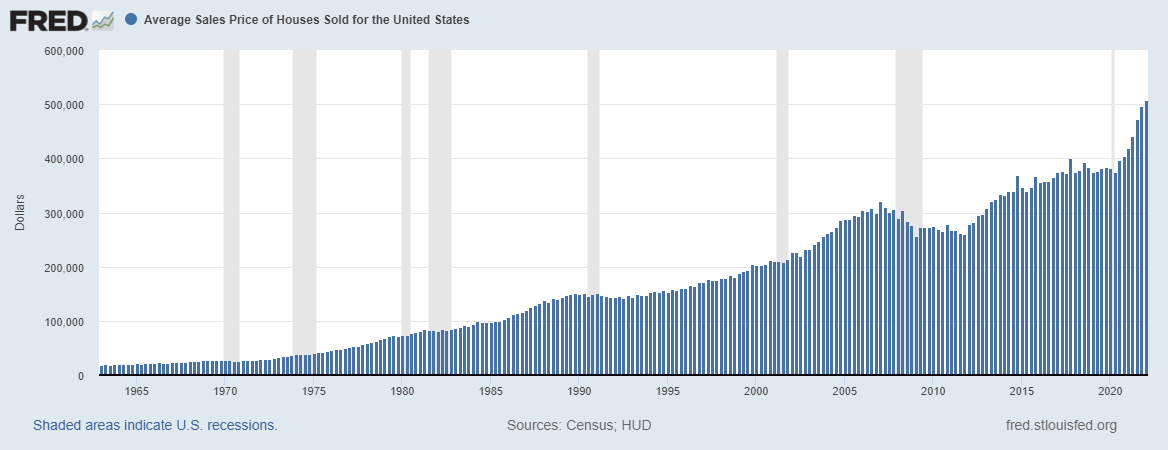

Real estate appreciates over time, generally at a slightly higher rate than inflation. Real estate is a tangible asset that derives value from Land as well as the structure created over it. It’s nowhere like stocks where prices might plunge to even zero. US Housing Prices data indicate that real estate prices could continue to rise indefinitely. As a matter of fact, with few exceptions, the average sale price of homes sold in the United States has climbed steadily year-on-year from 1963 to 2007—when the housing bubble burst and the Great Financial Crisis (GFC) of 2008 ensued. This below chart from the Federal Reserve Bank of St. Louis shows the average sales price of houses in the United States since 1963. The areas highlighted in grey indicate recessions. The key takeaway here is that even after fall of 2008, prices have inched up further and are presently near record highs.

B. Rental Income as a Steady Cash flow:

Just like stocks, real estate also provides the possibility of dual-income. In case of stocks, dividends are treated as short-term income where in case of real estate, rental income fills the void. The owner of the property can earn regular steady income from rentals. Depending upon the geographical area & location, rental income can be quite significant in terms of yield.

C. Portfolio Diversification:

Another benefit of Real estate investing is diversification of portfolio. This means the addition of real estate to a portfolio of risky assets leads to lower volatility and higher return per unit of risk. Real estate has almost no direct correlation with other popular paper-based assets like equity, debt, etc. Real estate outperforms other assets during an economic recession along with the benefit of stable yields.

D. Unique Tax Benefits:

Real estate’s unique tax benefits allow the investor to grow their wealth over time. For instance, tax benefits can be claimed for the purposes of real estate investment using home loans. The following are the tax benefits available in India for the first property investment:

- Deduction –

- Section 80C of Income Tax provides a tax deduction of a maximum of ₹1,50,000 for principal repayment.

- Section 24 of Income Tax also provides a deduction of interest paid on home loan maximum of ₹2 lakhs per year.

- Section 24 also provides a standard deduction of 30% to Net Annual Value irrespective of expenses incurred on the property.

- For the second house property, Section 80C deduction is not available, but the complete interest component is eligible for deduction under section 24.

E. Great Inflation Hedge:

The duo of rental income & value appreciation certainly beat inflation. As the prices of pieces of everyday items go up, so do rent and property value. However, the one thing that does not increase is your EMI. So whilst your annual rental income increases, the cost does not. For 12 months ending Mar 21, the inflation rate in India is 6% and annual gain from your stock portfolio is 10%, your actual profit is only 4%, as the purchasing power of the money decreases with the rate of inflation.

F. Provide Leverage:

Real estate investing also provides you benefits of leverage which might be beneficial or detrimental depending upon one’s usage. Let us understand leverage with the help of an example:

Case 1: You purchased a house worth ₹60 Lakhs. Out of this amount, you paid a mere ₹15 lakhs (25%) as down payment.

A home loan was availed for the balance ₹45 Lakhs.

The EMI was fixed at ₹45,000 per month.

Suppose in one year, the property value appreciates by 10% in a year to ₹66 lakh.

What will be your profit?

Profit will be approximately ₹6,00,000 – ₹45,000×12 (EMI) + ₹60,000 (Principal paid) = ₹1,20,000 (profit).

Case 2: Instead of buying property of ₹60 lakhs, suppose you decided to buy within your means.

Hence you bought a property of value ₹15 lakhs.

Suppose in one year the property value appreciates to ₹16.5 lakhs (10%).

What will be your profit?

Profit will be approximately ₹1,50,000 – ₹15,000×12 (EMI) + ₹22,500 (Principal paid) = – ₹7,500 (loss).

This is the benefit of using leverage.

Disadvantages Of Real Estate Investing

Some disadvantages of real estate investing are:

A. High Cost:

The biggest disadvantage with real estate investment is the high capital requirement. To get started, you need to provide for down payments, EMIs, insurance, property taxes, stamp duty and so on. Given the high transaction costs, finding buyers and sellers readily is an uphill task. This is a primary reason as to why most people resort to loans for buying property.

B. Long Term Investment:

Real estate investments are always made as a part of a long-term strategy. Real estate is a tangible asset and cannot be easily liquidated in case of an emergency. Moreover, frequent buying & selling involve high transaction costs that make liquidation an expensive affair.

C. Legal Difficulties:

Investing in real estate is tedious as it involves a lot of paperwork as well as cumbersome formalities, more so in the case of commercial real estate. Some jurisdictions also enforce land ceilings which can make the investment even riskier.

D. Liquidity Constraints:

Real estate property is very illiquid. A huge amount of money gets locked up as it is difficult to readily find buyers and sellers. Rental income also requires time to find a suitable tenant.

E. Maintenance Cost:

Maintenance costs are exorbitant in many cases. In larger cities, high property taxes make it an uphill task to sell the house at a higher price. The owner must also bear monthly expenses related to upkeep of the property, especially if the property is located in a housing complex.

F. Property Taxes:

Property taxes will vary depending on the jurisdiction in which the property is situated. An investor must also factor property taxes while valuing the property as it has the potential to wipe out a large chunk of profits.

Taxation In Real Estate

Taxation is one of the disadvantages of investing in real estate, as we have learned in the earlier unit. In this section, let us discuss the different taxes that are levied while selling any property:

A. Capital Gains Tax:

A capital gain tax is levied at the time of sale of the property. This tax is paid by the seller, irrespective of the location based on the time period for which the property is held. If the property is held for less than 3 years, the tax would be levied as per income tax slab rate of the individual and if sold after 3 years, then a flat rate of 20% shall be applicable.

B. TDS @ 1% on the sale of Property:

If the transaction value is more than ₹50 Lakhs, Then TDS @ 1% is deducted from the selling value.

C. Stamp Duty on Property:

At the time of transfer of title of property and registration with the Govt, stamp duty is required to be paid on the property. The stamp duty rate is decided by the respective states. Some also provide a concession in case the new owner of the property is a female.

D. GST on Property:

GST on real estate in case of under-construction properties is 12%. GST is to be charged at 5% without Input Tax Credit (ITC) on residential properties that are not part of the affordable housing segment, whereas GST to be charged at 1% without ITC on residential properties that are included in the affordable housing segment.

Real Estate Investing Risks

Complex tax structure is not only a drawback in real estate investments, it comes with high risk as well. Real estate as an asset class in a high risk-high return investment avenue. Let’s discuss a few risk involved in real estate investing:

A. Poor Location:

Choosing the right location is vital when it comes to investing in real estate. The location also determines supply & demand which becomes extremely crucial at the time of selling the property. Don't be tempted to buy in a specific area where prices are lower. It can turn out to be a terrible choice. There’s usually a reason behind unreasonably affordable prices. Investors must carry out a proper recce of the area before investing in a property.

B. Liquidity:

One of the biggest disadvantages of real estate is its illiquid nature. You may have to make a distress sale in case of urgent requirements of funds. It is best to invest in Real Estate only when you know that you will not be needing the money for a long time.

C. Legal Tussles:

Despite the efforts of the central government to bring transparency and limit strongmen influence, bribery and corruption continue to pose a serious risk to the Indian real estate market. In particular, theft of physical assets, bribery, fraudulent builders, delay in delivery of property, etc pose major risks.

D. Bad Tenants:

Finding quality tenants is required to make real estate investing successful. This includes verifying their employment, credit score, and criminal background or use of a third-party placement service provider, but always make sure to do your due diligence as well.

E. Market Risk:

The Real estate market is flourishing in many areas of the country. However, there is no certainty that this trend will continue. Many people who believed that real estate values always appreciated found themselves owning properties that were upside down. For instance, property owners in Lavasa & Aamby Valley City in Maharashtra are going through tough times as their land parcels find no takers.

F. Over Leverage:

Leverage works as a double-edged sword.

Real Estate Investment Through Equities

Let’s say we want to ignore most of the disadvantages of investing in real estate, such as complex legal charges, high taxes, illiquidity and more, but still want to be a part of the growing market. Is it possible? Yes, of course it is, It can be easily by investing into equity shares of real estate companies.

The average equity has outperformed one of the most renowned Mumbai properties by about 1.25 times, without even considering dividend reinvestment & maintenance outflows. However, investing in Real Estate companies can be risky due to their high gearing ratios coupled with poor corporate governance standards & cyclical nature.

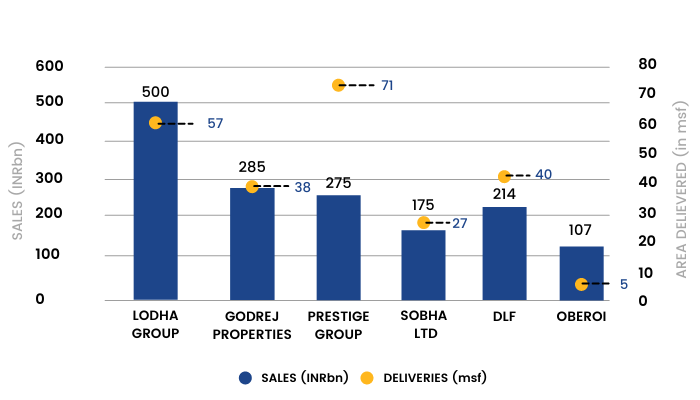

The following graph sets forth sales and deliveries by key developers across India:

Here are a few noteworthy real-estate developers in India (Other than REITs):

A. DLF Limited: Delhi Land & Finance aka DLF Ltd. was founded in 1946 by Chaudhary Raghvendra Singh. The company specializes in construction of apartments, commercial offices, hotels, shopping malls, infrastructure & golf courses, amongst others. DLF’s first residential project was in Krishna Nagar, East Delhi, which was completed in 1949, within 3 years of its establishment. DLF boasts the crown tag of being the most valued real-estate developer in the country.

B. Godrej Properties: Godrej Properties Ltd was established in 1990 by Adi Godrej as a subsidiary of Godrej Industries Ltd. The Company is headquartered in Mumbai, specializing in Residential Buildings, Commercial Complexes and Townships across the length and breadth of the country.

C. Oberoi Realty Ltd: Oberoi Realty Ltd, established in 1980, is a premium real estate developer based out of Mumbai. A few noteworthy projects include Oberoi Chambers in Andheri, Oberoi Mall in Goregaon, Sky City in Borivali, Three Sixty West in Worli amongst others in the financial capital of India.

D. Prestige Estates Projects Ltd: Founded by Razack Sattar in 1986, Prestige Estates Projects is headquartered in Silicon Valley. It operates primarily in the residential segment in South India. As of June 2020, the company has completed 247 projects covering 135 million sq. ft.

E. Phoenix Mills Ltd.: Phoenix Mills Ltd is engaged in the property development business. The company's flagship development High Street Phoenix, Kurla has emerged as the most frequented shopping destination in Mumbai. The company develops malls & has expanded its operations after its initial success to the cities of Pune, Bangalore, Chennai, Kolkata, Lucknow, amongst others.

F. Indiabulls Real Estate Ltd: Indiabulls Real Estate Ltd, founded in 2006, is a global real estate company. The Company’s operations include real estate project advisory, investment advisory, project marketing, maintenance of completed projects, engineering, industrial & technical consultancy, construction & development of real estate properties, and other related ancillary activities.

G. Macrotech Developers (Lodha): Incorporated in 1995, the company founded by Mangal Prabhat Lodha is primarily engaged in residential real estate development projects with a focus on affordable & mid-income housing. It was recently listed on the bourses.

Real Estate Investment Through Mutual Funds

Apart from investing in the equities of real estate companies, there are mutual funds available too. Real Estate mutual funds are thematic funds or sector funds that invest into securities of real estate companies and infrastructure companies. They invest in equities, debt securities of real estate companies as well as units of REITs / InVITs.

Returns on real estate mutual funds/equities primarily depend on real estate prices that are cyclical in nature.

What is a Real Estate Investment Trust (REIT)?

REITs are a hybrid investment class, demonstrating characteristics of both equity & debt.

The concept of REITs originated in the United States when President Eisenhower signed the REIT Act into law in 1960. The US Congress accepted the bill with a view to provide US investors with the opportunity to invest & profit from diversified, large-scale professionally managed portfolios of US Real Estate.

REITs are similar to mutual fund units that allow investors to pool funds for investment in a diversified portfolio of high-value real estate properties and mortgages. REITs own a portfolio of income-generating properties such as highways, commercial buildings, office parks, etc.

The rent thus collected is later distributed among shareholders as income and dividends. REITs are required to distribute at least 90% of their net taxable income to unitholders in the form of dividends, hence providing a steady stream of assured income. REITs are highly liquid & its units are freely traded on the exchange.

Illustrated in the below graph are capitalization rates for the Indian Markets (yield of REIT). They appear to be attractive compared to other geographies.

Dive into the world of financial mastery! Explore 'Real Estate Investment Through Mutual Funds' and join our 'Forex Trading Masterclass' today.

How Does REIT Generate a return?

A.Capital Gains: The price of listed REITs in the market fluctuates depending on the health of the Real Estate market coupled with demand-supply dynamics. A booming real estate market drives up the prices of REITs and hence provides capital gains to investors.

B.Dividend: Dividends are paid out by REITs from the rental income received by REIT. This refers to income that REIT receives by renting out and leasing properties held by REIT after deducting operating expenses such as depreciation, maintenance charges, management fees, etc.

C.Loan to subsidiaries: REITs can generate interest income from the loans given out to its subsidiaries.

Types of REITs

Previously we have learned the concept of REITs and how a REIT generates a return for investors. However, the concept of REITs in India is not well developed. There are different types of REITs that we are going to discuss over here.

A.Equity REIT: This is the most popular type of REIT and usually earns income from rents. It generates income by operating and managing commercial properties.

B.Mortgage REIT: Mortgage REITs directly/indirectly lend money to property owners by purchasing/originating mortgages or Mortgage-Backed Securities (MBS) Mortgage REITs also generate income in the form of interest accrued on the money they lend to proprietors.

C.Hybrid REIT: This option allows investors to diversify their portfolio by parking their funds in both mortgage REITs and equity REITs. The income source for hybrids include both rent and interest.

D.Publicly Traded REIT: These are Corporations that list their shares on the stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Individual investors and traders can buy shares from the exchange.

E.Private REIT: These types of corporations work as private placements, where a limited set of people invest in the properties managed by that REIT.

Listed REITs in India:

A.Embassy Office Parks: Incorporated in 2012, Bengaluru-based Embassy Office Parks Private Limited is in the business of real estate including renting, selling, buying, and operating leased or self-owned real estate properties. It is a joint venture of the Blackstone Group L.P, a New York City-based largest alternative investment firm in the world. Embassy REIT owns, operates, and invests in rent or income-generating office real estate and related assets in India in accordance with the REIT Regulations. It was the first REIT to list on the Indian exchanges in April 2019.

B.Mindspace REIT: is the second REIT to be listed in India in July 2020 after Embassy Park’s debut in the previous year. Mindspace Business Parks REIT has a quality office portfolio in Mumbai, Hyderabad, Pune, and Chennai with a total leasable area of 30.2 MSF. The business parks in Mumbai include Mindspace Business Park Airoli (E&W), Paradigm Mindspace, Malad, and The Square, Avenue 61, BKC.

C.Brookfield REIT: Brookfield India Real Estate Trust is India's only institutionally managed public commercial real estate company, sponsored by an affiliate of Brookfield Asset Management (BAM), part of Brookfield Group. The Company's portfolio consists of campus-format office parks in prominent metros such as Mumbai, Gurgaon, Noida, & Kolkata.

How To Invest In REITs?

Like Stocks, REIT Units are also listed & freely traded on stock exchanges. Individuals can invest in REIT via the following methods:

A.Stocks: Individuals who want direct exposure can directly invest in listed REITs on the stock exchange.

B.Mutual Funds: Individuals who want to diversify their investment portfolio can choose this indirect method where an investor would be required to invest in any mutual fund that invests in REITs.

C.Exchange: Traded Fund: Using this particular investment option, investors would avail indirect ownership of properties as well as diversification.

How to assess the best REIT?

An investor should check the following points before investing in any REIT:

A.The sponsor/developer of the REIT trust is the single most important factor while assessing a potential investment. A trustworthy builder has a strong track record of completing projects on time. Timely completion of constructions aids rental income while delays lead to cost overruns. Check stability of rental income & management’s plans for expanding the portfolio.

B.Checking the quality of tenants is also quintessential. Well established blue-chip companies reduce the credit risk & are more likely to honour their long-term leases

C.The occupancy rates across properties must be strong. This leads to higher rental incomes and in turn higher dividends.

D.Moderate concentration risk in the form of properties or tenants should be preferred. It is ideally desirable to invest across multiple markets. Similarly, a single tenant making up a significant chunk of the income should be interpreted with a pinch of salt.

Advantages of REITs:

The following are key benefits of investing in REITs:

A.Diversification: REITs allow the investor to diversify investment portfolio through exposure to real estate in a hassle-free manner. This diversification provides investor benefits of real estate like any other asset class (Like Gold, Equity, and Debt).

B.Capital Gains: A better performing REIT will potentially increase in value over time and can be sold at a good amount of profits. This will provide capital gains to the investor.

C.Transparency in dealing: REITs are highly regulated by SEBI, which requires financial accounts to be audited by investors. This will continuously increase the transparency of the dealing and make the entire process transparent.

D.Small Initial Investment: The key problem of investing in real estate is the larger ticket size which is not possible for any small investor or retail investor. REIT provides the opportunity to invest in Real estate via it at a much lower cost than any stock.

E.Professionally Managed: REITs are professionally managed which ensures fair dealing and smooth operations.

F.Liquidity: Units of publicly listed REITs are easily purchased and sold anytime which provides liquidity to the investor.

G.Regular Income: REITs are mandatorily required to distribute 90% of their rental income to investors in form of dividends and interest payments. This will provide the investor with regular income.

Limitations of REITs

A.Fewer Options: There are only a few REITs that are listed on the stock exchange, so this is not like stocks that provide a large variety.

B.No Tax Benefits: REITs are not providing any benefit to the investors. For instance, the dividends earned and capital gain from REIT companies are subject to taxation.

C.Low growth prospects: Due to regulations, the company needs to spend 90% of their rental income as dividend distribution, which just leaves 10% to reinvest in their venture again.

D.Market Risk: Since REIT units are listed in the exchange, these are associated with market-related fluctuations. This is why investors with a weak risk appetite should weigh in the return generating capacity of this investment beforehand.

Tax on REIT Income:

There are two types of taxation rules applicable on REITs, one for dividend and another for capital gains:

A.Taxation on Dividend: As per existing rules, dividends from REITs are taxable in the hands of the investor. Dividend added as income in hands of investor and taxed according to slab rate.

B.Taxation of Capital Gain: If the investor sold units holding less than 1 year from the date of the unit received, Short term capital gain (STCG) is applicable @ 15%. Where if holding period exceeds more than 1 year, LTCG @ 10% applicable if the gain is more than 1 Lakh (including equity investments) with no indexation benefit.

Why Is Diversification In Real Estate Required?

Diversification is an extremely important process for investors. In order to reduce overall risk from different markets, investors spread their money into different investments. Diversification in real estate is also required as real estate investment is much steadier and tangible, which makes it difficult for your investment to disappear into the air.

There are also two types of thoughts:

- Diversification

- Specialization.

Investors who diversify do so in order to reduce unsystematic risk. They ought to balance risk & reward by allocating their investments in real estate across different markets and corners of the nation. Investors who specialize, on the other hand, focus on buying similar types of properties. They try to repeat what is successful, without spreading themselves too thin.

Interesting Facts about Real Estate:

- The real estate sector is the second-largest employer in the country after the agriculture industry. The real estate market has grown at a CAGR of 30% in the past decade making it an outstanding investment.

- There are about 29,95,84,361 households in India, second only to China. This staggering number exceeds the population of more than half of the world’s countries.

- The real estate sector in India is growing at a brisk pace & is expected to reach US$ 1 trillion by 2030. According to estimates, it will contribute around 13% of the GDP by 2025

- The retail real estate and warehousing segment attracted private equity (PE) investments of US$ 220 million and US$971 million, respectively, in 2020.

- Kankarbagh Colony in Patna, Bihar is Asia's second-largest residential colony, spread over an area of 900 acres.

Recent Government Initiative in Real Estate Sector:

Several initiatives undertaken by the Central Government in collaboration with the States are expected to give a major boost to the realty sector, scarred from the pandemic blows. The Centre’s Smart City Project, aimed at building a hundred futuristic & liveable spaces is a landmark decision in this regard. Listed below are a slew of measures that are expected to give wings to the realty sector as well as its ancillary industries:

- The Real Estate Regulation & Development Act (RERA) was passed in 2016 with a view to adjuvate speedy resolution of disputes for homebuyers as well as fresh investments. This act was further amended to include the union territory of Jammu & Kashmir. This move paved the way for any Indian citizen to own land & freehold property in the valley as opposed to only local residents earlier.

- Tax deduction on interest of housing loan up to ₹1,50,000 on principal repayments (Section 80C) & tax holiday for affordable housing projects were extended till the end of 2021-22 fiscal.

- Tax relief measures for home buyers & real estate developers for primary purchase/sale of residential units up to a value of ₹2,00,000 under the Atmanirbhar Bharat 3.0 package.

- The Ministry of Housing and Urban Affairs (MoHUA) launched a housing rental portal for affordable homes.

- An Alternative Investment fund of ₹25,000 crore is being set up to revive around 1,600 stalled housing projects across the length & breadth of the country.

- Creation of an Affordable Housing Fund (AHF) with the National Housing Bank (NHB) worth ₹10,000 crores for microfinancing of HFCs (Housing Finance Corporations)

- Formal approval of 425 SEZs out of which around 265 are in operation with a view to attract domestic as well as foreign investor interest

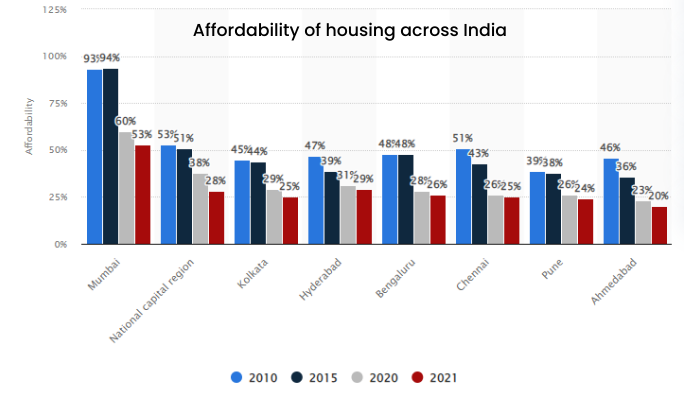

Various government measures have resulted in an increase in the affordability ratio but have taken a hit since the pandemic, as you can see in the graph below.

Source: Statista

Source: IBEF

Conclusion

Responding to an increasingly well-informed consumer base & bearing in mind the aspect of globalization, Indian real estate developers have shifted gears and are ready to ride the growth wave ahead of us.

A major turning point has been the shift from family-owned businesses to that of professionally managed ones. Real estate developers, in meeting the ever-growing need for managing multiple projects across the nation, are also investing in centralized processes and systems to source raw material, organize manpower, and hire qualified professionals in niche areas like project management, architecture, & engineering.

The commercial real estate sector is rediscovering its mojo and is expected to bounce back strongly once the pandemic is taken care of and things are back to normalcy.

Nonetheless, the growth levers of the residential sector are well in place. The Central Government’s ambitious Pradhan Mantri Awas Yojana (PMAY) scheme aims to build around twenty million affordable homes in urban areas by 2022. Expected growth in the number of housing units in urban areas shall correspondingly support the demand for commercial and retail office space.

As per some estimates, the current shortage in urban housing stands at about 10 million units. An additional 25 million units of affordable housing shall be required by 2030 to meet the country’s growing demand. Increased investor interest by global majors such as BlackRock, Sotheby’s, Brookfield, amongst others is an encouraging sign.

Real Estate Developers now realize asset-light models such as BOT (Build Operate Transfer) and PPP (Public Private Partnerships) are sustainable and generate better returns on capital employed. The managements are hesitant to raise funding via debt and cite examples of fallen angels of the 2000s era such as the likes of Jaiprakash Associates, Unitech, Gammon Infra, IVRCL, ARSS Infra, Lanco Infratech and so on.

The Securities and Exchange Board of India (SEBI) has given its approval for the Real Estate Investment Trust (REIT) platform, which shall allow investors from all walks of life to own Real Estate. Although, a grand success in the United States, REITs remain an untapped opportunity for Indian real estate developers to raise funds in the years ahead.

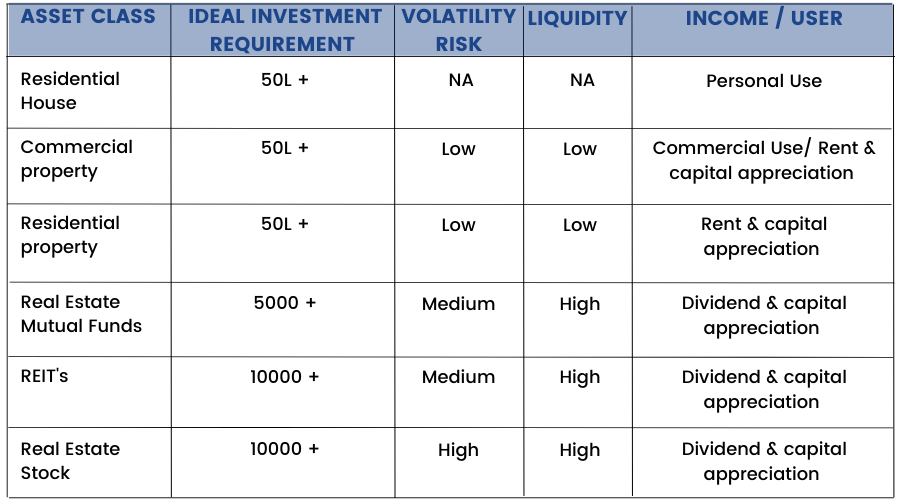

Below table summaries various real estate investing instruments discussed in this chapter: