A Tale of Two Tribes

Professor Damodaran starts the book by asking the readers which tribe they belong to, the number crunchers (using left brain in order to remain logical) or the story tellers (using right brain for creativity). He advises the readers to use both sides of the brain, i.e., combine logic with creativity in order to succeed in valuing companies in the stock markets.

A Sample Test:

The professor has taken a different approach by directly starting up by introducing valuation to us rather than the building blocks first. This is done in order to clarify different approaches to valuation.

Before understanding the approach, it will be better to know as to how the Professor values a company. He generally values a company on the basis of three estimates-

- Sales growth

- Operating margins

- Sales to capital employed ratio

You would come across these three variables or estimates in later chapters when he values a company. Let’s now look at the different approaches to valuation by the professor with the help of an example of Ferrari.

How would a Number Cruncher approach the valuation of Ferrari?

I expect Ferrari to grow revenues at a CAGR of 4% per year for 5 years, post which it will continue to grow at perpetuity at the GDP growth rate. The pretax operating margin would be 18.2% and Ferrari will generate sales of EUR 1.42 for every euro invested.

If you notice, this somehow confuses a normal reader as to how these numbers are making sense.

How does a storyteller approach valuation of Ferrari?

Ferrari is a luxury automobile company that charges really high prices for its cars in comparison to its competition. On one side, it will earn a very high margin because of pricing but on the other hand it will make itself available to just a small market, therefore slower revenue growth than the automobile market.

Now, this approach is making some sense as it's easily digestible, however, it gives little understanding as to what price should be paid for this luxury automobile company.

Using both sides of brain

Ferrari, being a luxury automobile maker should be able to garner a revenue growth of 4% per annum for the next 5 years, which is lower than the automobile market in general. The company will be able to earn higher margins than a typical car maker of 18%. And finally, the company would require higher reinvestment needs and therefore the sales to capital employed ratio would be at 1.42.

This looks the best amongst the three as the stories are backed by numbers and similarly numbers are backed by a story.

The allure of storytelling

Stories not only help us connect with others but are far more likely to be remembered than numbers. But it is very easy for a storyteller to wander into a fantasy land where he or she forgets to integrate the story with reality. Like saying, HDFC bank can grow its revenues at a CAGR of 25% forever is a good story however, makes it very unrealistic in real world as attaining 25% CAGR consistently over long term is very difficult to attain.

The power of numbers

With the storage and processing capabilities the investors today have a lot of numerical data with them, typically more than required and hence leads to “analysis paralysis”. So why do we need numbers then? Well, in an uncertain world, numbers offer a sense of objectivity and precision. The precision is however often illusionary as there are many behavioral and cognitive biases that can influence the numbers for businesses. For example, just because you like HUL, you are biased towards the company and hence your revenue and operating margin estimates are bound to be higher than other analysts tracking the company.

Professor Damodaran explains the three aspects for effective data management, such as:

- Use judgment on the amount of data and the time period over which the data analysis is to be run. Try to minimize biases in data collection.

- Use basic statistics (average, CAGR, etc) to make sense of large data

- Finally come up with interesting ways to present the data that makes sense even to a novice.

We relate to and remember stories better than we do numbers, but storytelling can lead us into fantasyland quickly, a problem when investing. Numbers allow us to be disciplined in our assessments, but without stories behind them, they become weapons of intimidation and bias rather than discipline.

Valuation as a bridge

The solution is simple. You need to bring both stories and numbers into play in investing and business, and valuation is the bridge between the two.

How to discipline story telling?

Professor Damodaran has suggested a 3P framework.

- Whether the story is possible. Going 100% electric car is a possible event. This although makes sense, however, we do not know how and when this will happen. Hence, it’s a possible story but unlikely to happen if we factor in reasonability.

- Whether the story is plausible. Replacement of old combustion engines with electric vehicles is a plausible event. This seems reasonable, however, I can not still be very sure about it since there are production constraints to meet the replacement demand. Hence, it’s a plausible story.

- Whether the story is probable. 25% of the new cars purchased globally will be electric. Now, this seems like a probable event or story.

Not all possible stories are plausible. Similarly, not every plausible story will be probable.

The valuation process:

Given below are the steps to follow in order to transform the story-to-numbers:

Step 1: Develop a narrative for the business you are valuing.

In the narrative, you tell your story about how you see the business evolving over time.

Step 2: Test the narrative to see if it is possible, plausible, and probable.

There are lots of possible narratives, not all of them are plausible, and only a few of them are probable.

Step 3: Convert the narrative into drivers of value.

Take the narrative apart and look at how you will translate it into valuation inputs, starting with potential market size and moving on to cash flows and risk. By the time you are done, each part of the narrative should have a place in your numbers, and each number should be backed up with a portion of your story.

Step 4: Connect the drivers of value to a valuation.

Create an intrinsic valuation model that connects the inputs to an end value in the business.

Step 5: Keep the feedback loop open.

Listen to people who know the business better than you do and use their suggestions to fine-tune your narrative and perhaps even alter it. Work out the effects on the value of alternative narratives for the company.

Change is constant

Finally, the professor advises us to not have the illusion that the story can not change. It is bound to change as the business environment as in the GDP growth rate, inflation, interest rates change around you. Hence be cognizant to this fact and update the story as and when change is material.

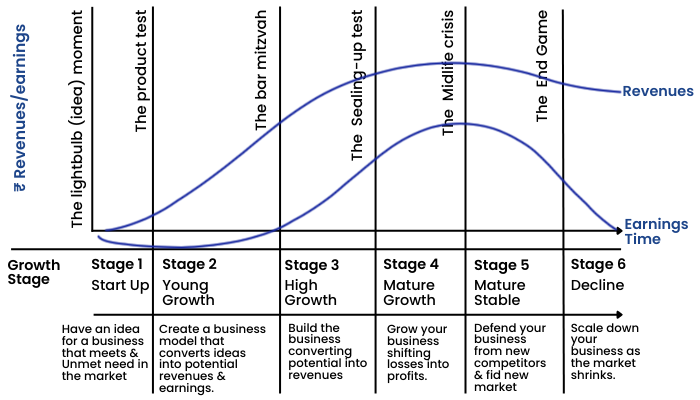

Another determinant for changing the story for a company is when the corporate life cycle of the company changes. Look at the chart.

The Corporate Life Cycle

Early in the life cycle, when a business is young, unformed, and has little history, its value is driven primarily by narrative, with wide differences across investors and over time. As a company ages and develops a history, the numbers start to play a bigger role in value, and the differences across investors and over time start to narrow.

Professor advises to use the story to process numbers at each of the stages in the corporate life cycle in order to generate views about the company.

The following chapter onwards, each of the steps of valuation are discussed in depth.