Stamp Duty And Registration Fee

Buying a house requires you to register the property in your name with the necessary government authorities. This is where stamp duty and registration charges come into play. Stamp duty and registration charges are essential payments to be made to complete the home purchase procedure.

Stamp duty

Stamp duty is the tax levied on all monetary transactions that take place while completing the home purchase such as conveyance deed, sale deed and power of attorney. For the calculation of stamp duty of each document, the value and nature of the property is considered and then the circle rate is taken into account and the higher of the two is charged.

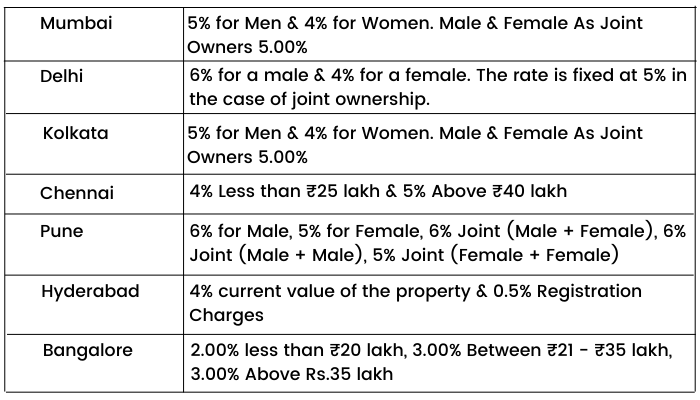

Let us see the stamp duty rates of a few major cities in India as of November 2021.

Registration fee

The registration fee is paid over and above the stamp duty to get the property registered in your name. This fee is usually 1% of the total cost of the property or the market value. Different cities follow a different system in this regard. For example, in Kolkata, it is 1% of the total cost of the property while in Mumbai it is 1% of the market value or ₹ 30,000, whichever is lesser.

Does the home loan disbursement amount include stamp duty and registration?

Usually, these are not included in the home loan disbursement amount and hence has to be paid by you separately.