Introduction

Everybody deserves a home of their own. Thanks to home loans, the dream of buying a house and turning it into a loving home is now a reality for millions in India.

In this module, we will tell you all the essential information you need to know about home loans. You will find answers to questions that you might have.

What is a home loan?

Simply put, a home loan is an amount of money borrowed from a financial lender for purchasing a house. However, the purview of home loans extends beyond purchasing a house only. From buying land to renovating your own house – home loans can be taken for a variety of purposes.

While talking about home loans, it is important to remember that financial institutions such as banks and non-banking financial institutions (NBFCs) do not finance 100% of the market value of the property. They finance a certain amount only, which depends on the type of loan.

For example, for home purchase loans (where the loan is provided to purchase a flat/house), the bank finances up to 90% of the loan amount. The proportion of finance solely depends on the discretion of the loan approving authority.

Sometimes, they can decide to finance less than the maximum amount, if they evaluate a greater risk in the loan (such as lower credit rating of the borrower).

4 Important aspects of home loans

1. Large principal amount: Since we are talking about purchasing houses, the principal amount of home loans is usually large and range from few lakhs to a few crores.

2. Longer tenure: Home loans typically have longer tenure which extends up to 30 years.

3. Interest rate: Home loans are given on fixed and floating rates of interest. We have discussed this in detail in section 4 of this module.

4. Credit score: The borrower’s credit score matters significantly while providing a home loan. Hence, having a Cibil score of 750 and above is ideal for availing a hassle-free home loan. This has also been discussed in detail in section 6 of this module.

Advantages and disadvantages of taking a home loan:

Like everything else in this world, taking a home loan has its own advantages and disadvantages. Let’s take a quick look at some of them:

Advantages:

- Ideal for everyone: Home loans have made buying a home affordable to everyone. A person starting his/her career or a middle-class businessman can today think of owning a house, thanks to home loans.

- Cost-effective: Home loans have lower interest rates. It is more cost-effective than other credit modes such as personal loans, credit cards or gold loans.

- Saving and investment: Your house is an investment. So, don’t consider your home loan EMIs as a part of the expense. Rather, it is a mode of saving and investing in a tangible asset.

- Safety of the property: We all know that buying a house can be tedious, and sometimes risky. Incidents of dubious builders and bad constructions are not rare. When you avail of a home loan, the bank or NBFC will have a qualified legal team to look into all the papers of the property and ensure everything is in order. They will have your best interest in mind. You can be assured of the legality of the entire transaction.

- Tax benefit: Well, this is a significant benefit of availing a home loan. You can claim deduction on the principal and interest component of the home loan while filing your income tax. We suggest consulting your tax consultant to know the details of these deductions.

Disadvantages:

- Commitment: Yes, the first thing that comes to anybody’s mind while considering a home loan is the commitment to pay. A home loan repayment can take up to 30 years – a long time, isn’t it? A lot of things can happen during this time.

- Loss of opportunity to invest somewhere else: Once you have committed to a home loan, a significant chunk of your income will be blocked for paying EMIs. You could invest that money somewhere else and earn short term returns.

In the long run, the advantages of a home loan far outweigh the disadvantages. And above all, the happiness of having your own home and making it a happy place for your family is a different feeling altogether. Hence, if you can afford it, home loans are always a good idea.

Renting vs taking a home loan

A frequently asked question, with regards to home loans, is whether you should buy a house or stay on rent. Let’s do a quick comparison of both:

- Buying your own home has some inherent benefits such as the pride of owning a house. It brings in a sense of security.

Rent keeps increasing every year. With a home loan, you pay the same EMI for a long period of time. - In case of renting, you may not stay in the same house forever. Shifting is a cumbersome process.

- When you stay on rent, you don’t have to be bothered about the maintenance of the house and other paraphernalia. That remains the owner’s responsibility. However, if you are the owner, maintenance becomes your responsibility.

- Your home loan EMI is a saving. You are eventually investing the money in real estate. Your rent, on the other hand, is an expense. You don’t get anything in return.

What should you do?

So, should you rent?Or should you buy your own home?

If you are sure to stay in the same city for long, buying a home is better than renting. However, if you plan to move cities, then purchasing a home may not be a good idea.

From an investment perspective, purchasing a home does make sense.

Types Of Home Loans

Before we get into the nuances of home loans, let us first discuss the types of home loans available in India.

1. Home purchase loans

This is the vanilla form of loans where the loan amount is used to buy a residential property such as an apartment, a bungalow or a row house. Usually, banks finance up to 90% of the present market value of the property and NBFCs finance upto 80%. Almost all banks and NBFCs who are into the business of lending, offer home purchase loans.

2. Home construction loans

For generations, building your house has been the main mode of having a home for families in India. Many prefer to do so now as well. A home construction loan is meant for this purpose where the borrower can use the fund to build his/her own house. This loan can also be taken to finish the construction of an unfinished house.

3. Home improvement loans

This type of home loan is provided to renovate, repair or refurbish an existing house. This kind is quite popular since it can finance up to 100% of the repair estimate and have lower interest rates too.

Home improvement loans are provided by many major lenders such as SBI, HDFC Bank, ICICI Bank, Punjab National Bank and others.

4. Land purchase loans

This kind of loan finances the purchase of plots of land for construction of a house or as an investment option. Financial institutions finance up to 90% of the purchase value. This loan can be used to purchase plots within housing societies, real estate projects or even resale of plots. The only criterion is that the plots have to be used for residential purposes only and hence, should be non-agricultural. You will need to provide requisite documents from authorities proving this. With a good Cibil Score and a commendable track record, plot purchase loans can be obtained at quite a low-interest rate, although it will still be higher than normal home loan rates. They are usually provided for a maximum tenure of 20 years. The major land purchase lenders are HDFC Ltd, HDFC Bank, PNB Housing Finance Ltd., etc. EMI repayment of these loans does not attract any tax benefit.

5. NRI home loans

These home loans are taken by non-resident Indians for purchasing a house, construction of a house or buying land in India. These help NRIs invest in properties in India. Many banks and financial institutions provide NRI home loans, the most notable of which include SBI, ICICI Bank, HDFC Bank, LIC Housing Finance and others.

6. Home Loans Balance Transfer

Sometimes, people who already have a home loan from one lender want to switch to another home loan provider because of various reasons such as lower interest rates or better customer service. In that case, they avail of a home loans balance transfer where-in the loan with the existing lender is closed and transferred to the new lender. While doing so, in many cases the new lender can offer a top-up facility, where-in some extra cash is provided to the borrower.

This again is quite popular since it helps people avail of lower interest facilities and better services.

Key features:

- Usually there is a fee associated with home loans balance transfer (usually 1% of the loan amount transferred) which the borrower has to pay to the new bank/NBFC.

- In most cases, the new bank/NBFC considers balance transfer as a new home loan application.

- This can be done only after a pre-determined period as per the original loan agreement. It cannot be done immediately after taking the original loan.

Is it a good idea?

Many people consider switching home loans as soon as they get a lower interest rate somewhere else. However, it may not always be a good idea. Here are a few things that you should consider before availing of a home loans balance transfer:

Interest rates: As mentioned above, lower interest rates are definitely a reason to consider switching. However, remember that most home loans are taken on flexible interest rates which will fluctuate from time to time. So, what seems low today, may not be so low tomorrow. However, if the interest rate provided by the new lender brings down your monthly EMI burden substantially, then it will make sense to switch.

Loan tenure: If the existing home loan has a long tenure, then switching makes sense. However, if you are left with only a few years of payment, then the costs involved with the switching will not justify the transfer. For example, in case of a 20-years loan, consider switching up to the 15th year. Avoid transferring after that.

Terms of balance transfer: What is the cost of transfer? What are the terms being offered by the new lender? – Consider all these very carefully before deciding to transfer.

Here is a concise list of all the features for the different types of home loans that we have studied in this unit:

Home Purchase Loans

To buy a new house/flat:

- Long tenure- up to 30 years

- Low interest rates

- 80-90% of the property value financed

Home Construction Loans

To construct a new house:

- Long tenure- up to 30 years

- Low interest rates

- Low processing fee

Home Improvement Loans

To repair/refurbish/renovate an existing house:

- Long tenure- up to 30 years

- Low interest rates

- Up to 100% of repair value or 90% of the property value, whichever is lower is financed.

Land Purchase Loans

To buy a plot of land:

- Long tenure

- Lower interest rates

- Up to 90% of the land value financed

NRI Home Loans

To help NRIs invest in Indian properties:

- Long tenure up to 30 years

- Quick and transparent online processing

- No prepayment charges

Home Loans Balance Transfer

To transfer an existing home loan to a new lender:

- Opportunity to avail better interest rates

- May reduce the EMI burden

- Should be decided after considering several aspects

Things To Know Regarding Home Loans

It is easy to be overwhelmed with complex terminologies and concepts while researching home loans. We have dealt with some of the important concepts here that will help you understand the purview of home loans better:

Home loan eligibility

The first question that you must be thinking is how much home loan are you eligible for? Home loan eligibility is primarily dependent on two factors – your income and your repayment capability. Of course, other things such as credit history, credit score, age, other financial obligations etc. are taken into consideration as well.

Here are a few most common eligibility criterion used by most banks and NBFCs:

Maximum loan term: 30 years

Age: An applicant’s age is important to determine the remaining years that he/she will be working. The tenure of the home loan depends on this and hence may vary from one person to another.

For example, let us assume that a bank considers 65-years as the retirement age. Hence, if a 25-year old applicant applied for a home loan, he/she will be able to get a repayment period of 30 years since at the time of repayment, the applicant will be 55-years of age, and still be working. However, if a 45-year-old applicant applies for a home loan, he/she will get the home loan for 20 years only.

Financial position

The present and future income of the applicant are taken into account to determine how much EMI will he/she be capable of paying.

Financial obligation

The loan approving authority also assesses a person’s financial obligation such as other loan obligations, credit card debt, dependants etc. while assessing the loan eligibility of a person.

Credit history and credit score

This is a very important aspect. Good credit history and credit score are important, not only for availing home loans but for availing any kind of loans.

Down payment

We mentioned earlier that banks/NBFCs do not finance 100% of the market value of the property. The borrower has to finance 10-20% of the amount – which is termed as a down payment or own contribution. In most cases, the loan approving authority reviews whether the down payment has been made and may reject the application if payment has not been made.

In case you plan to avail of a home loan, keeping aside 20% of the total purchase amount for making a down payment will be a good idea.

Co-Applicant

Having a co-applicant is mandatory to apply for a home loan. In this case, the loan is known as a joint home loan. If someone is a co-owner of the property, then he/she has to be the co-applicant of the home loan as well. However, if you are the single owner of the property, then you can choose any of your immediate family members as the co-applicant.

Some lenders allow changing the co-applicant during the term of the loan. This process is known as novation. In case you want to avail of it, contact your lender regarding the process to do so.

Difference between co-signing and co-application

Sometimes, the bank may ask you to add a co-signer to your loan. A co-signer is liable to pay the loan only when the main applicant defaults. He/she does not have an obligation to pay the EMI of the loan. However, a co-applicant is a co-borrower of the loan and is liable to pay the EMI.

Sanction and disbursement of loan

Once the bank decides to provide you with the loan, the bank will issue you a sanction letter which will have all the details of the loan sanctioned such as loan amount, tenure, interest rates and various terms and conditions of the loan.

When the loan is actually released by the bank, it is known as loan disbursement. In the case of a fully constructed property, the payment is made in full to the builder. However, in the case of purchasing an under-construction property, this amount is given directly to the builder and not to you. The bank/NBFC will release the payment in tranches as and when different stages are completed by the builder.

Ensure that the terms of payment of your agreement with the builder match the bank’s disbursement terms and schedule.

Processing fee

Almost all banks and NBFCs take a processing fee for the loan application, which typically ranges from 0.5-1% of the loan amount. This is to cover the various charges borne by the bank such as legal fees, technical evaluation of the building etc. In most cases, this amount is included in the loan amount. However, some banks may choose to charge the borrower separately. Many banks may also choose to waive this fee.

Home loan EMI

EMI or Equated Monthly Instalments is the monthly payment you make to repay your home loan. The EMI consists of interest amount and principal amount. When the home loan is sanctioned, you will be issued a repayment schedule, where the breakup of the principal and interest amount for each EMI will be provided.

Do note that as per the repayment model, in the first few years, most of the EMI consists of interest amount. As the years go by, the interest amount comes down and the principal amount goes up.

Let us understand this through an example.

The monthly EMI for a home loan of ₹ 50 lakhs taken for 20 years at an interest rate of 8.25% (we are considering fixed interest rate for the ease of calculation) will be ₹ 42,603 per month. Now, let’s see the breakup of principal and interest component of this EMI for Year 1:

So, at the end of Year 1, the borrower will be paying more than ₹ 4 lakhs as interest and repaid only ₹ 1 lakh of the interest amount.

Now, let us see, how the above table would look like in Year 10:

So, in Year 10, the borrower will be paying ₹ 2.96 lakhs as the interest, while the contribution towards principal will increase to ₹ 2.14 lakhs.

By the time the loan reaches year 15, the principal component in the EMI will get significantly higher, while the interest component will come down, as can be seen from the table below:

Now, this is a crucial aspect to consider while thinking of a home loan balance transfer. Consider how much interest you have actually paid, how much needs to be paid after balance transfer and if it is lesser than the total interest you need to pay to your original lender. Sometimes by availing a home loan balance transfer, people end up paying more interest than even the original loan.

Amortization schedule

Along with the documents that you receive from the bank for your home loan, you would receive something titled amortization schedule. This is a detailed breakup of your entire repayment schedule. It will consist of the following things:

- Opening principal – The total amount of the loan, which you have to repay

- Payment number – Each EMI will have a serial number

- Instalment amount – The amount of EMI

- The principal component in the EMI – Indicates the amount of principal being repaid in each EMI

- Interest component in the EMI – Indicates the interest component in the EMI

- Due date – The date on which the EMI is payable

- Interest rate per annum – The applicable annual interest rate. This will also indicate whether the loan has been taken on a fixed rate of interest or floating rate of interest.

- Closing principal – Indicates the principal amount that remains to be paid at the end of each EMI payment.

Let us see how the loan amortization schedule will look for the above mentioned example (₹ 50 lakhs home loan for 20 years taken @ 8.2% per annum)

When does the EMI payment start?

Once the home loan is disbursed in full, the EMI payment starts immediately. In the case of a home loan on an under-construction building, the bank releases the payment in tranches. During this phase, you will have to pay only the interest amount on the amount disbursed. This phase is known as the Pre-EMI phase. Once the entire loan is disbursed by your bank, then the actual EMI will start.

Moratorium Period

Usually, the home loan EMI starts from the day the home loan is disbursed in full. However, some lenders may offer an EMI holiday before the loan repayment stars which means you can opt for an EMI-free period. A moratorium period enables you to plan your finances better.

Although you do not have to pay the EMI during this duration, the interest is calculated from the day of full disbursement of the loan.

Home loan account statement

Once you start repaying your home loan, you will receive the home loan account statement which will contain the entire details of your repayment. In most cases, you can access it online or it will be emailed to your email id. However, physical statements will also be available, if you choose to receive it.

The home loan account statement will show all the important things that you need to know – loan amount, start and end dates of loan tenure, interest rate, type of interest (fixed or floating), EMI amount, total principal repaid till date, total interest paid and other things. It will also contain the details of pre-payment, in case you have made it as well as missed

EMI details

This is a very important document to keep track of your home loan. We suggest saving the soft copy or storing the hard copy safely. These copies will prove that you have completed the repayments on time.

Home Loan Interest Rate

The interest rate of a home loan is a very important aspect and directly influences whether one can afford a loan or not. As mentioned earlier, each EMI of home loan consists of principal and interest components. Hence, getting a competitive home loan interest rate benefits you lifelong.

Simply put, a home loan interest rate is the cost of borrowing the home loan. It is levied on an annual basis and divided into monthly installments.

Home loans are given on two kinds of interest rates in India – fixed rate and floating rate. Fixed rate is one which does not change throughout the time period of the loan.

Floating rate, on the other hand, depends on a variety of factors and hence changes from time to time. This means that sometimes, the interest rate will go up and sometimes down. In most cases, you will get the option to choose which rate you want to avail.

Some banks/NBFCs also allow switching between the two, but they may charge for such switches and there will be a limit on the number of switches that can be done in a year.

Factors that affect home loan interest rates

Home loan interest rates are affected by several factors, the primary being:

- RBI repo rate: This is the rate at which the Reserve Bank of India (RBI) lends money to the banks. If the repo rate drops, the interest rate drops as well and vice versa.

- Cash reserve ratio: This is the amount of money that banks have to keep with RBI as a deposit. If the cash reserve ratio (CRR) falls, banks have more money at their disposal to give out as loans, and hence, the interest rates fall too and vice versa.

- Demand for loans: Interest rates are also affected by demand and supply of loans in the economy. When demand for loans is high, banks have lesser funds with them to give out, and thus the interest rate goes up.

Apart from these, interest rates also depend on the borrower’s credentials. For example, if the borrower has a low credit score, the bank may offer the loan at a higher interest rate.

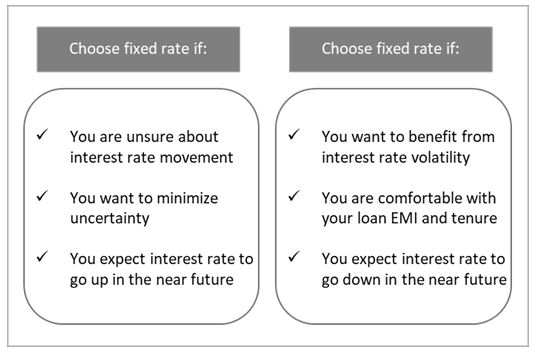

Should you go for fixed rate or floating rate?

We know, you must be thinking whether the fixed rate is a good idea or the floating rate?

Well, both have their advantages and it is entirely dependent upon you, what you feel comfortable with.

With a fixed rate of interest, you know the total interest amount you will be paying from the very beginning of the loan tenure. This will help you plan your budget more efficiently.

However, the fixed rate of interest is usually fixed a few basis points higher than the floating rate. Moreover, if you expect interest rates to go up in the near future, the fixed rate will make more sense.

Floating rate of interest, on the other hand, gives you a chance to pay lower interest (and higher too!). If you expect interest rate volatility, then the floating rate will be a better option for you.

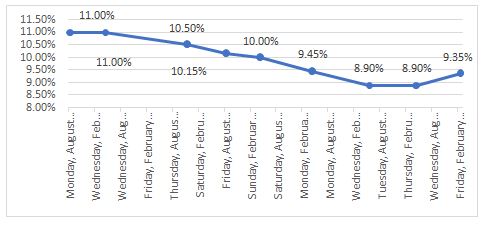

To understand how interest rates can move in the floating rate regime, let us see a quick comparison of the home loan interest rates of SBI from 2011 till 2019:

A graphical representation of SBI home loan rates

Source: https://sbi.co.in/web/interest-rates/interest-rates/old-interest-rates-last-10-years

*Highest rate in the calendar year has been chosen for illustration purpose

*Rate taken for loans above 30 lakhs and below 75 lakhs

It is difficult to predict whether the interest rate will go up or down, since it is dependent on a number of factors.

Please note that most banks/NBFCs will let you switch between fixed and floating rates. But switching may include additional costs. Moreover, many banks may not have the option of a fixed rate of interest at all.

Base Rate

While talking about the interest rate, another concept that is important to know is the base rate. Base rate is the minimum rate below which banks are not allowed to lend funds. This is set by the RBI. This has been fixed to increase transparency in the lending market and also ensure that customers get the benefit of the lower cost of funds available to banks. However, the concept of base rate is history now, since the introduction of Marginal Cost of Funds Base Lending Rate. Let’s understand what it is.

MCLR

If you have been researching about home loans, you must have come across the word MCLR. This is a new method of bank lending introduced from April 1, 2016. Earlier, loans were linked to the base rate. Now, they are linked to the marginal cost of funds based lending rate (MCLR).

Today, only MCLR-based home loans are available in India. Borrowers who had taken their loans previously and have their loans linked to the base rate have the option to switch to MCLR if they want.

Under this new regime, banks review and declare a range of MCLR rates every month - overnight, one month, three months, six months, one-year, two-years and three-years. The interest rate is decided by adding a spread (an incremental amount) to this MCLR rate.

For home loans, most banks use the six-month MCLR or 1-year MCLR to fix the interest rates. The bank may or may not add a spread as per its discretion.

For example, as on November 1, 2020, the 6-month MCLR declared by SBI is 6.95% and the home loan interest rate of SBI is also 6.95%. This means, that SBI is providing home loans at MCLR without adding any spread. On the other hand, as on November 1, 2020, the MCLR of HDFC Bank is 6.95% and their home loan interest rates (for 30.01 lakhs and above) is 7.05 – 7.55%, which means they are adding a spread to the MCLR while deciding on the home loan interest rate.

Should you switch from base rate to MCLR?

If you have taken a home loan before 1st April 2016, your loan will be linked to the base rate. In such a scenario, the most common query in your mind will be should you switch?

Now, there is no standard answer to this question and depends on a case to case basis. The spread that the banks charge on the MCLR is based on the credit rating of the borrower and the spread does not change unless the credit rating of the person changes.

Understand the spread the bank is offering you on the MCLR and also if there are any changes in the terms of the loan. Then take a prudent decision whether it makes any sense for you.

Keep in mind that once you change from base rate to MCLR, you cannot change back to the base rate.

How To Get A Home Loan

Obtaining a home loan is easier than you think. It is a simple six-step process. If your documents are in place, there’s no reason why you should find the process cumbersome.

STEP BY STEP PROCESS OF OBTAINING A HOME LOAN:

Step 1: Fill up the application form

To start the home loan process, meet a bank executive and fill up the application form. Please ensure that all the details are correctly mentioned. We strongly recommend you to fill the form yourself and not leave it up to the bank executive to fill it for you.

Step 2: Submit the documents

Along with the application form, you will need to submit the documents that the bank/NBFC asks for. The most common documents include:

- Your photo, pan card, identity and address proof (Aadhar card, voter ID, passport, driving license etc.)

- Property documents

- Your income documents

- Bank account statements

- Other documents as per the requirement of the financial institution

Step 3: Document processing and verification

Next, the bank/NBFC will process your documents and conduct necessary verifications. They will evaluate your income documents, your credentials such as your Cibil Score and property papers to understand whether they will provide the loan. They might conduct you during this stage if they need additional documents. They might also visit the property site to conduct on-the-spot verifications

Step 4: Issuing the sanction letter

Once the loan approving authority decides to give you the loan, you will receive the good news. You will then receive the sanction letter where the terms of the loan will be mentioned.

Step 5: Loan agreement signing

Once you receive the sanction letter, you will have to sign the loan agreement which will have all the terms and conditions of the loan.

Step 6: Loan disbursal

Finally, the loan amount will be disbursed. You will receive a copy of all the documents you have signed and the loan agreement. Keep them safe and secure.

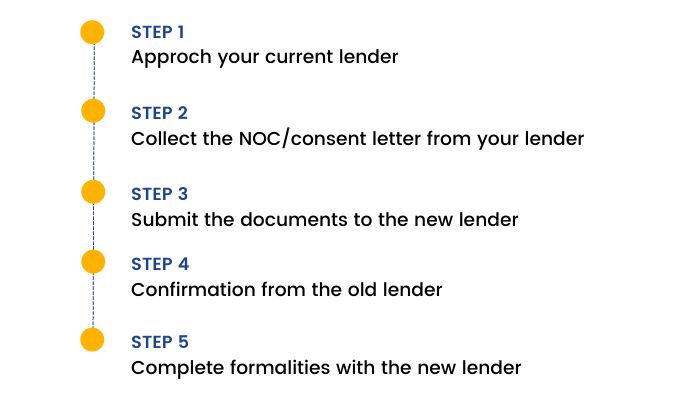

How To Transfer A Home Loan

Earlier we have learned the steps to get a home loan but you can even transfer the loan to a new lender. The process is called ‘Balance Transfer.' Home loan balance transfer is a five-step process:

Home loan top-up

The need for funds can appear anytime and for any purpose. Top-up loans come in really handy during this time. As the name suggests, you can apply for more loan on your home, after the loan has started to meet your fund requirements. This amount is given over and above the original home loan and to customers whose loan has already been running for some time.

Here are a few things you need to know about top-up loans:

- It is not necessary to use this fund for home-related needs only. You can use it for anything – children’s education, emergencies or planning a vacation.

- The top-up amount gets added to your original loan amount and runs till the end of the original home loan tenure.

- Each bank/NBFC has its own policies regarding granting top-up loans. Hence, it will be wise to check with the bank to know their terms and conditions.

- Top up loans may be granted at the same rate as the home loan, or maybe a few percentage points higher. It entirely depends on the bank’s policies.

CIBIL Score

When you go to take any loan, the single most important thing that the loan approver checks is your Cibil score. Cibil score is a consumer’s credit score which reflects his/her credit profile.

It is a 3-digit numeric code which is given based on your credit history such as your borrowing and repayment habits with all lenders in India. The score is updated regularly and is accessed by all lenders – be it a bank or an NBFC. The score ranges from 300 to 900 and the closer you are to 900, the better is your Cibil score. In general, a Cibil score of 750 and above is considered to be good.

In the case of home loans, Cibil score plays a very important role. It can impact your home loan eligibility, the interest rate, the approved loan amount and the repayment time period. While evaluating a home loan application, Cibil score is the first report checked by the authorities. A bad Cibil score may attract a higher interest rate, or worse, the loan can be rejected altogether.

How can you know your Cibil score?

Obtaining your Cibil report is quite easy. All you need to do is go to https://www.cibil.com/ and click on ‘Get Your Cibil Score Now’. You can pay a nominal fee and obtain your report.

Many banks also provide the Cibil report to their customers for free. Check with your banker to know if they provide the service.

How can you maintain a good Cibil score?

Here are a few things you can do:

- Pay credit card debts on time and in full: On-time payment and full payment reflects good repayment habits. Avoid missing out on payments.

- Avoid withdrawing cash from your credit card: People withdraw cash from a credit card mostly when they are in dire need. No one withdraws cash from a credit card when they have sufficient bank balance. Right? Lenders do not like this habit.

- Keep records of old credit card closure: In case you have cancelled and closed a credit card, keep the closure document safe. You never know when you might need it.

- Don’t approach multiple lenders for the same loan: As we mentioned earlier, Cibil score is the first thing a lender checks when you make a loan enquiry. And every time a lender checks your Cibil score, it is reflected in your Cibil history. So, when finally, you apply for a loan and they see several Cibil enquiries against you for the same loan, they will get sceptical. Also never ever apply with two lenders for the same loan.

- Check your Cibil report from time to time for anomalies: This is very important. Cibil is a system after all and it depends on the data sent by various lenders. It is possible that you might have had a loan many years ago and already repaid it. But the lender did not send the repayment information to Cibil, due to which the loan still shows as outstanding against your name. This will affect your home loan application adversely. Hence, retrieving your report from time to time, especially after a few months of repaying a large debt, is a good idea. This can easily be done by visiting the Cibil site. In case you see an anomaly, you can contact Cibil with the details. They will guide you on the next steps.

A person can take multiple loans such as multiple home loans or home loan, car loan, personal loan, credit card and others. However, it is important to know that all the loans will be reflected in Cibil history. Moreover, an increased number of loans will also bring the Cibil score down.

Home Loan Prepayment

While repaying the home loan, you have the option to prepay it before the end of the loan term. Most home loans have the option for full or partial prepayment. In the case that you want to fully prepay the home loan and close the loan, it is known as home loan foreclosure.

Sometimes, if you have a lump sum fund with you, prepayment can be a good idea. However, the most important thing to know in this regard is prepayment charges.

The prepayment charges vary from one lender to another and usually range from 2-4%. Some lenders may not take it at all. Every bank/NBFC will have its own prepayment procedure. Once prepaid, you will get an acknowledgement, which will include the prepaid amount, the outstanding loan amount (in case of partial prepayment), remaining tenure (if any) and the new monthly EMI.

In the case that you prepay your loan in full, you will get back your home documents which were with the bank.

Home loan prepayment tips

- It is a good idea to check the prepayment charges at the time of applying for the loan, to avoid any surprises later on.

- Prepaying as early as possible makes more sense. As we mentioned, in the initial few years, the interest component makes up most of the EMI amount. Hence, if you pay in the earlier years, then you end up saving on the interest payment to the bank/NBFC. However, in the later years, you would have already paid most of the interest back. Prepaying then would not help you save on the interest to be paid to the bank.

- Don’t forget to get the prepayment acknowledgement letter from the bank.

- Follow up on retrieving the original house documents and try to receive it as soon as possible.

- Do keep the tax benefits angle in mind when you decide to prepay.

NRI Home Loans

Many banks such as SBI, HDFC Bank, ICICI Bank offer special home loan schemes for Non-resident Indians (NRIs), Persons of Indian Origin (PIO) and Overseas Citizens of India (OCI). These loans can be short term or long term. These loans help NRI, OCIs and PIOs to purchase a house, build a house and renovate old properties in India. They are very popular since they enable customers to invest in India and participate in the growth story of the real estate sector of India.

Eligibility: The eligibility of the loan depends on the individual’s repayment capacity. A number of things are taken into account while calculating repayment capacities such as the source of income, monthly and annual income, credit history, age, work experience, qualifications and others. Spouse’s income and assets history is also taken into consideration.

Loan tenure: Usually NRI loan tenures are shorter than resident home loan tenures and are given for a maximum of 10 years.

Repayment: The EMI is dedicated to the person’s NRO/NRE accounts. The borrower can also choose to submit post-dated cheques for EMI payment.

Key features of NRI home loans:

An application can be made online, from any part of the world. Usually, banks have special departments and personnel who provide service exclusively for NRI customers.

- The application process is simple and hassle-free.

- The interest rates are quite attractive.

- Like resident loans, these loans are available at fixed or floating rates of interest.

- Some banks offer prepayment or part-prepayment facilities at zero fees.

- Applications are processed quickly and in a transparent manner.

Documents required for NRI home loans

Below is a list of documents usually required for processing NRI home loans. Of course, this is a general list and may differ from one bank to another:

- Duly filled loan application form

- Passport and Work Visa copy

- Proof of valid work permit

- Copy of Employment contract

- Salary slips of the past three months

- Passport size photographs

- Current overseas residential proof

- Statement for the last six months of salary account and NRE/NRO account

- A general Power of Attorney (POA)

- Property papers

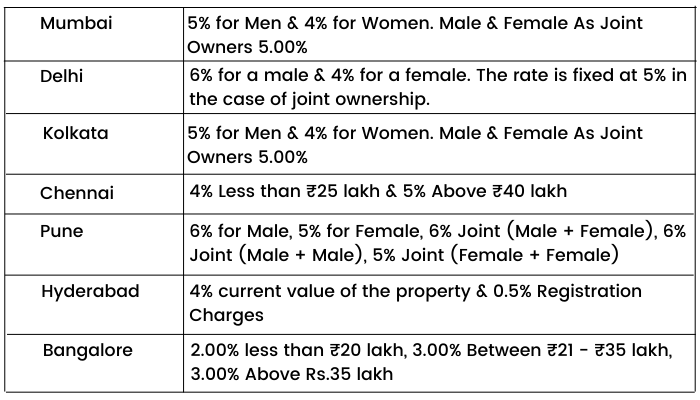

Stamp Duty And Registration Fee

Buying a house requires you to register the property in your name with the necessary government authorities. This is where stamp duty and registration charges come into play. Stamp duty and registration charges are essential payments to be made to complete the home purchase procedure.

Stamp duty

Stamp duty is the tax levied on all monetary transactions that take place while completing the home purchase such as conveyance deed, sale deed and power of attorney. For the calculation of stamp duty of each document, the value and nature of the property is considered and then the circle rate is taken into account and the higher of the two is charged.

Let us see the stamp duty rates of a few major cities in India as of November 2021.

Registration fee

The registration fee is paid over and above the stamp duty to get the property registered in your name. This fee is usually 1% of the total cost of the property or the market value. Different cities follow a different system in this regard. For example, in Kolkata, it is 1% of the total cost of the property while in Mumbai it is 1% of the market value or ₹ 30,000, whichever is lesser.

Does the home loan disbursement amount include stamp duty and registration?

Usually, these are not included in the home loan disbursement amount and hence has to be paid by you separately.

Some Useful Tips

Now that you have learned much about home loans, let us share some tips, which may come handy:

Tips to get your loan approved faster

- Having a co-applicant significantly increases the chances of getting the loan application approved faster. Having a co-applicant helps the bank understand that you are eligible to pay the loan back in time.

- One of the main issues for the delay and even rejection of home loans is inaccurately filled forms and insufficient documents. Take your time to fill up the form carefully, with minimal mistakes. Make a checklist of the documents to be submitted to ensure you don’t forget anything.

- While processing the application, the bank may contact you from time to time for additional documents or information. Respond promptly so that the application can be processed faster. Don’t let the processing be on hold due to a delay from your side.

Tips to reduce home loan EMIs

- Pay a higher down payment amount, if you can, to lower the home loan principal. This will bring down the EMI.

- Choosing a longer tenure will reduce the home loan EMI.

- In case you have a good credit rating, or you are a long-standing customer of the bank, negotiate with the bank to reduce the interest rate. Even a 0.10% decrease will matter in the long run.

- Consider doing a home loan balance transfer to another lender who is offering a lower interest rate. This can reduce your EMI. However, while evaluating a home loan balance transfer, evaluate other factors we mentioned while discussing home loan balance transfer.

Tips to reduce home loan tenure

- Prepayment is a good way to reduce tenure. If you get some lumpsum amount during the tenure of the loan, such as an annual bonus from your employer, consider making a prepayment.

How To Compare Banks/NBFCs While Taking A Home Loan

Innumerable financial institutions are offering home loans today. Frankly speaking, it can be quite overwhelming for a person to understand which lender to go for. Add the pressure of choosing the right property and going through the purchase formalities to this – we can understand how stressful it can be.

So, here are a few points which you should consider while comparing different banks/NBFCs home loan offerings.

1. Interest rate: A quick comparison of interest rates is essential to understand who is giving the best one. Also, conduct a quick study of the historic rates to compare the movement in floating rates of different lenders.

2. Loan tenure: Are they allowing you to take the loan for a long tenure? What is the maximum age for getting a home loan?

3. Processing fee: This directly impacts your principal amount, hence, very important.

4. Prepayment or foreclosure charges: Do they have any?

5. Hidden costs: Are there any hidden costs?

6. Eligibility: What is the eligibility criteria of the lender? Check this thoroughly before applying for a loan to avoid rejection.

7. Customer service: A home loan is a long-term relationship with a lender. Therefore, you need a financial institution you can depend on. Does it have a loan servicing department? Are customer executives friendly? Are they responsive? Delve beyond the loan executive who comes to you when you are taking the loan.

8. Special offers, if any: Do any of the lenders offer any special scheme such as the Pradhan Mantri Awas Yojana.

We recommend you to make a checklist and spend some time understanding different banks’ offerings. This will help you make an informed decision.

Conclusion

So, now that you know all the nitty-gritty of home loans, it will definitely make you street smart while you are buying your home by taking a home loan. It is always better to know things before you jump in. Hope you have enjoyed the learning journey of the module. There are many such interesting modules we have curated for you in our ELM School. Do read them as well.

Happy learning!!