Financial Position

Financial Planning starts with evaluating our current financial position. Let us know how:

What is your financial position today?

The very first step in financial planning is to understand where we stand from a financial point of view.

We can understand this by measuring our financial health.

Just like a human requires regular checkups to make sure their health is well, you need to constantly measure and check up on your finances to make sure that they’re doing well too.

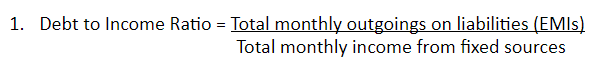

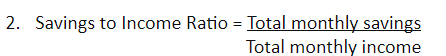

You can use the following formulas to determine your financial health -

Ideally, your debt to income ratio should not be higher than 30%, as this would mean that you are straining your income.

This means you should not be spending more than 30% of your income on paying loans / interest on loans.

Ideally, you should be saving at least 20% of your monthly income to save and invest.

Contingency Reserve = 6 to 24 months of your living expenses.

You should set aside 6 to 24 months of living expenses as a contingency fund to be used only in times of emergencies. This should include any EMIs that you may have.

After implementing these simple rules, you will find that your finances are more in your control and manageable.

How to Build a Contingency Fund

Generally, everyone experiences various demands or requirements at certain stages, like children’s education, marriage or retirement.

But, the one need that is constant at any stage is the need for liquidity.

In simple terms, it is the need for ready cash, which may arise for an emergency like medical attention and expenses.

Hence it is imperative that we take this requirement very seriously and build enough cushions to face any eventuality at any time.

These cushions include contingency funds.

The thumb rule is that one must have at least 3 to 6 months of gross income available during an emergency.

This time limit can also depending on other factors like -

- The number of dependents, especially considering whether they are older or younger dependents; and

- The number of earning members in a family; etc.

The fundamental factors that have to be considered for building this cash cushion are:

- Money should be available at call.

- There should not be any conversion cost – to convert the investments into cash.

- The income should be taxed only on withdrawals, and not on accrual basis.