FAKE by Robert Kiyosaki

Introduction

About the book

The book 'Fake' by Robert Kiyosaki takes a look at three specific counterfeits in life: fake money, fake teachers and fake assets. If you don't want your future to be fake, then you should learn about these concepts. It simplifies the complex issues in life, such as money and investment, and it clearly helps in identifying the difference between reality and illusion or fake.

About the author

Robert Kiyosaki is an entrepreneur, investor and author of some of the best selling books on personal finance like Rich Dad Poor Dad and Fake. He teaches millions of people around the world about financial literacy and how to accomplish financial independence. He believes that each of us has the power to make changes in our lives, take control of our financial future, and live the rich life we deserve.

Buy the book

This book teaches you about the importance of financial education and explains different strategies so that you can secure your future financially. We highly recommend you to read the entire book. (affiliate link)

Fake Money: The World Is About To Change

Fake Money:

In 1971,President Richard Nixon took the U.S. dollar off the gold standard. In 1971, the U.S. dollar became “fiat money”, government money. Rich dad called government money,”fake money.”

He also said: “Fake money makes the rich richer. Unfortunately, fake money also makes the poor and middle class poorer.”

That is why:

Lesson #1: “The rich do not work for fake money.”

Lie #1: Saving money will make you rich.

Image Source: Congressional Budget Office

Image Source: Congressional Budget Office

Fake Teachers: What did school teach you about money?

For most people, the answer is “nothing.” Most teachers are great people. But, our educational system is broken, obsolete, and fails to prepare students for the real world.

In school many teachers were fake teachers. Simply said, they did not practice what they taught.

Student loan debt is over $1.2 trillion and is the number one asset of the U.S. government. In the criminal world, this is called extortion.

Fake Assets:

First we need to define and understand the difference between an asset and a liability.

1.Assets put money in your pocket. Liabilities take money out of your pocket.

2. The author’s poor dad always said, “Our house is our biggest asset."

3.The author's rich dad said, “Your house is not an asset – it’s a liability.”

4.Millions of people believe their house is an asset.

For most people, their “assets” are taking money from their pockets.

Warren Buffett calls derivatives “financial weapons of mass destruction.”

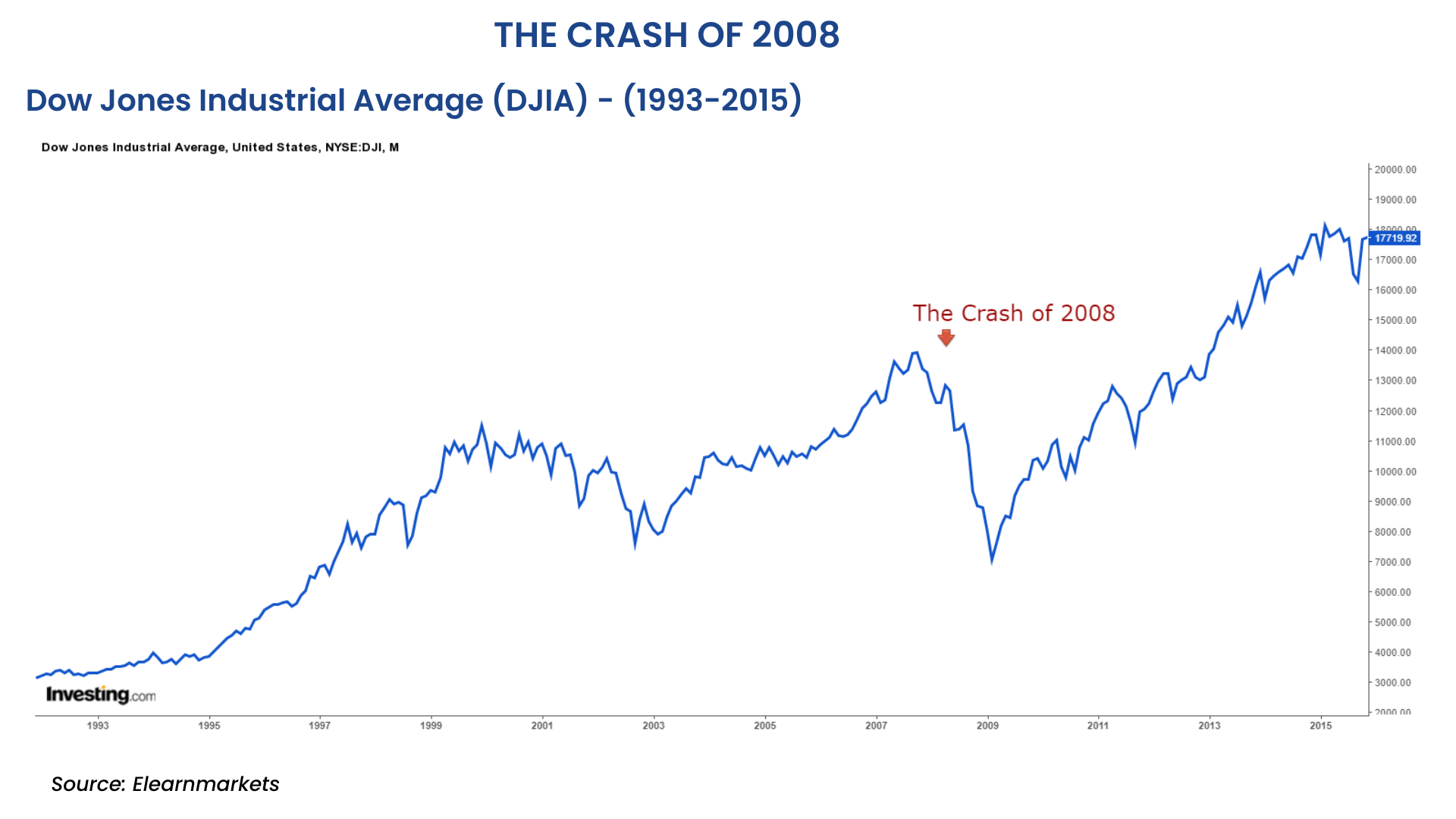

In 2008, almost $700 trillion in derivatives exploded, nearly bringing down the world economy. Many people blamed the “subprime real estate” buyer for the real estate crash. The reality was the elites were manufacturing fake assets called derivatives. That was the real problem.

Today, there are three types of modern money. They are:

1.God’s money: Gold and silver

2.Government’s money: Dollars, Euros, pesos, etc.

3.People’s money: Bitcoin, Ethereum, ZipCoin, etc.

In God We Trust: Who Has Earned Your Trust?

Robert find it interesting that on all fake paper U.S. dollars we see the words: In God We Trust

Why are we asked to trust in God? What happened to God’s money, gold, and silver? Gold is atomic number 79. Silver is atomic number 47. Gold and silver were here during the formation of planet Earth. Gold and silver will be here when the last cockroach is finally extinct.

Gresham’s Law states: When bad [fake] money enters the system, good [real] money goes into hiding.

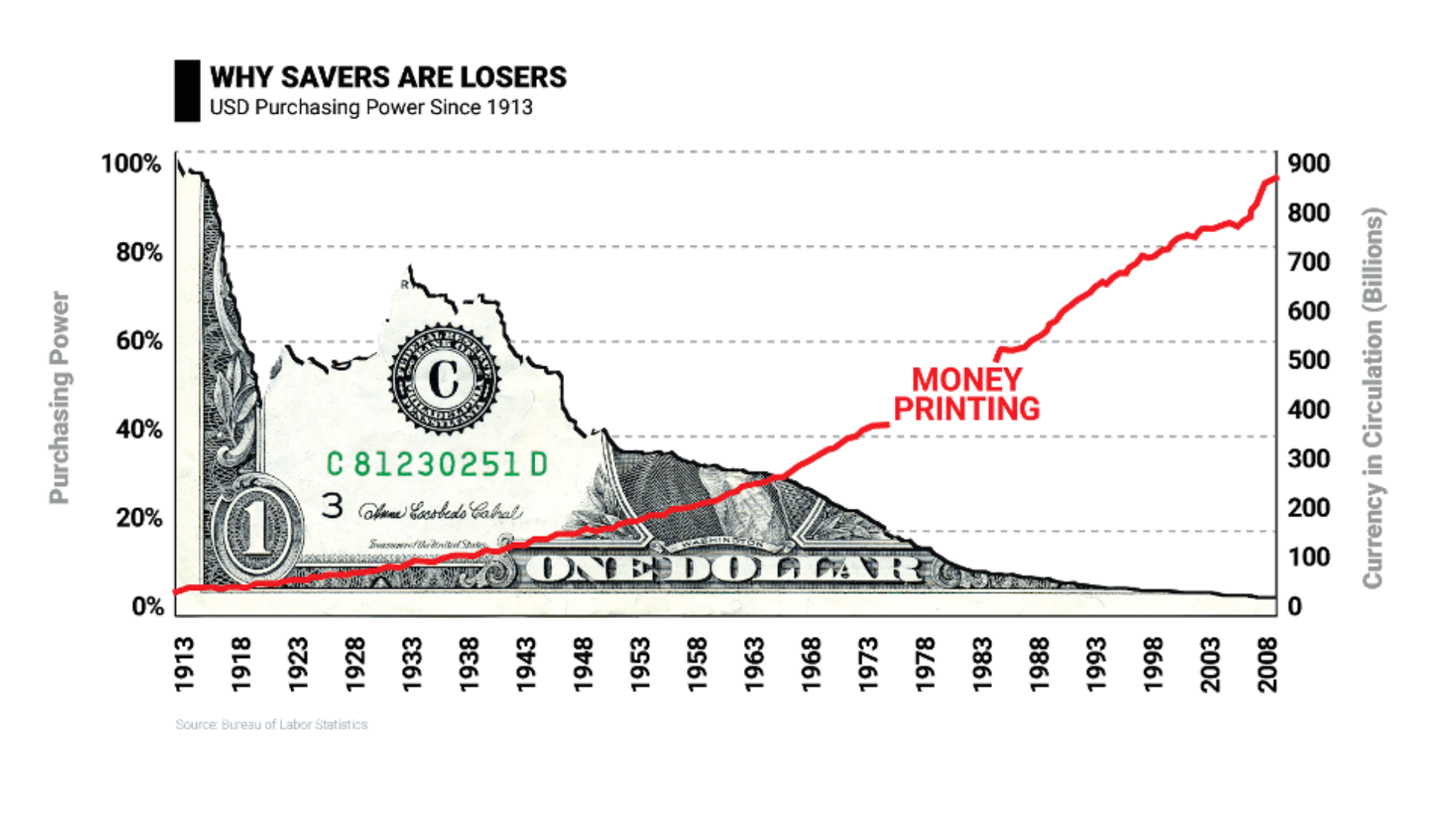

Look at this chart:

Now look at the chart of what happens to fake money, when our leaders print more fake money.

Image Source: FAKE by Robert Kiyosaki

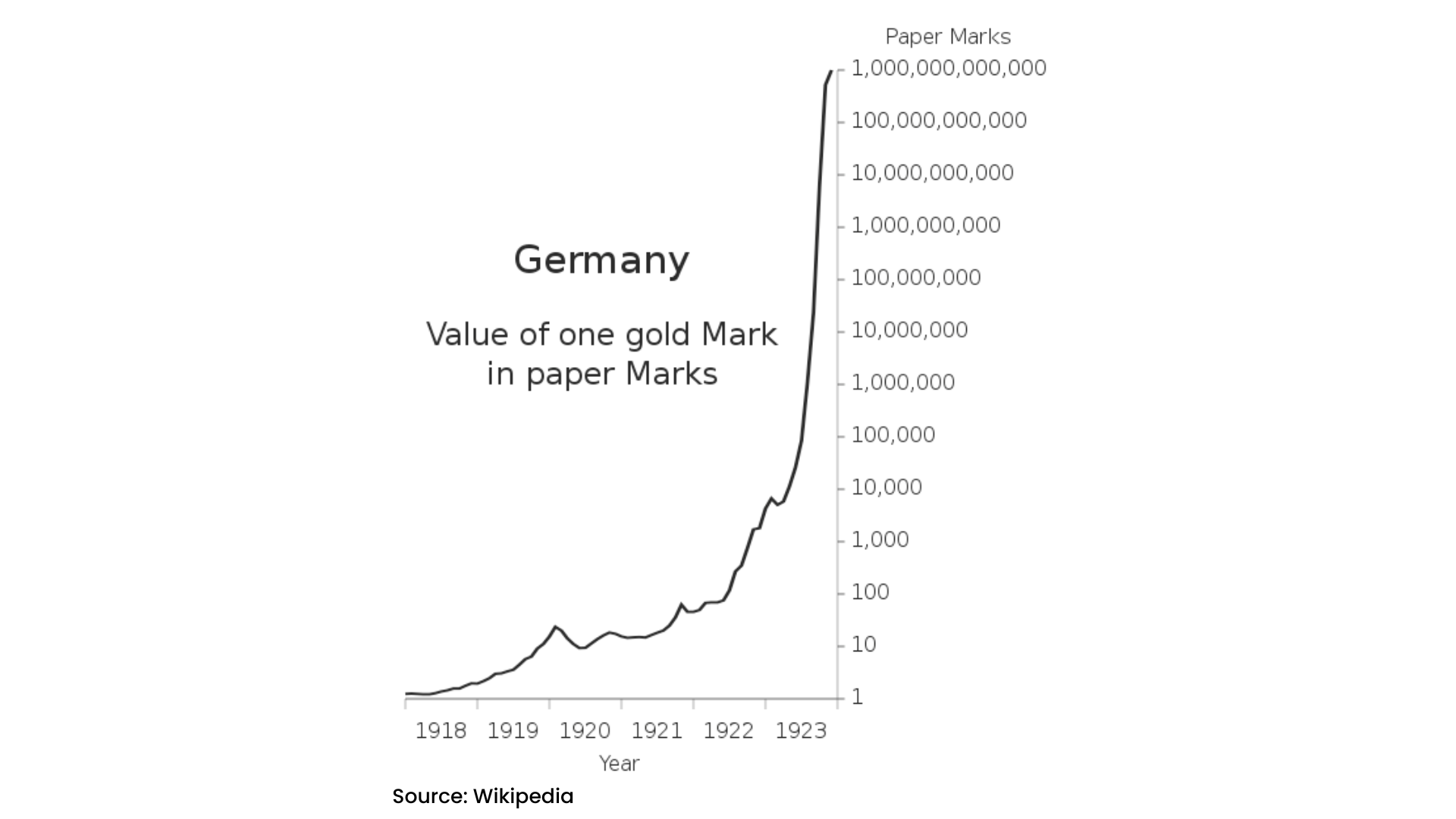

Is history repeating itself?

It had been seen that German children in 1923 played with money in the streets – billions in fake money; under the Weimar Republic after WW1, inflation was such that a U.S. $1 was worth 4.2 million D.M.

The chart below shows where the kid’s money came from:

The FRED chart above shows the United States printing trillions in fake money after the crash of 2008.

Do you notice a similarity with the 1920s German printing of fake money, the Reichsmark?

The bad news is, never in human history has fake money survived. Odds are that all of today’s paper money will return to its true value: zero.

Do you still “trust in God”?

Buckminster “Bucky” Fuller wrote about “Freeing the scholar to return to his studies” – in other words: getting students out of school and letting them get back to their studies.

Fuller was saying that the invisible people who control the world economy search our schools to find the best and the brightest so they can train them to run the world economy.

Seven Practical Reasons I Own Real Gold And Silver: A Case For God’s Money

Reason #1: Real gold and silver are not investments.

The author says that Gold and silver are his insurance, protection from the leaders and himself.

Reason #2: No risk.

Always remember, the price of gold or silver will go up or down because the value of our fake money is going up or down.

Just as Warren Buffett holds stocks forever, the author says he will own gold and silver forever.

The author advises using banks for storing short-term cash, that is the operating capital. But never hold any long-term wealth in banks because they are too risky.

This is what happened in 2008:

- Subprime borrowers, people borrowed money to buy a house they could not afford.

- Banks were happy to issue the subprime loans.

- The bank then sold the mortgage to an investment bank.

- The investment bank then packaged thousands of these subprime loans, labeling them mortgage-backed securities, or MBS, a financial derivative.

- Investment banks sold these MBS to governments, investment funds, pension plans, and other gullible people.

- To give all parties a sense of security, these elites bought insurance policies, known as credit default swaps, CDS.

- Everyone was getting rich because everyone was collecting “fees.”

- The elites created an economy built on deals that moved assets around instead of building new ones. They created exotic, and risky, financial instruments, including derivatives and credit default swaps, that produced sugar highs of immediate profits but separated those taking the risk from those who would bear the consequences.

The entire global monetary system is built on counterparty risk.

Two minds are better than one – except in school, where two minds working together is called cheating.

Reason #3: Gold and silver attract real wealth. Wealth attracts wealth just as poverty attracts poverty.

Reason #4: Why real gold and silver? Why not paper gold and silver exchange traded funds (ETFs)?

The author does not trust anything in paper. Anything in paper is a derivative, a fake, something that requires a counterparty for value.

Financial Education:

Much of the global banking system runs on what is known as fractional reserve banking.

The world’s banking system is built on fractional reserve banking, a system that has been running the world for thousands of years.

Reason #5: The system is broke and broken. The gap is growing. We are on the verge of class warfare.

A picture is worth a thousand words.

Printing Fake Money: History Repeats Itself

Printing fake money is not new. The ancient and modern banking systems are built on printing fake money. Printing fake money is the way banks make money. The reason banks make so much money is that, for thousands of years, the banking system has had the license to print money.

People, who work for money, work for people who print money.

Americans are reaching retirement age in worse financial shape than the prior generation.

History has proven that printing fake money never ends in prosperity. History is evidence that printing fake money always ends in poverty for those who work for fake money.

Historically – from the Chinese, the Romans, the German Weimar Republic, and Venezuela today – printing fake money has never produced a sustainable prosperity. Historically, printing fake money has always ended in either depression, revolution, war, or all of the above.

How Much Money Are You Printing? How To Take Control?

Printing Money #1: Printing Cows

- For thousands of years, money has taken many forms. Money has been beads, feathers, stones, animals, and pottery. One of the earliest and most important forms of money was cattle.

- When a person left his cattle as collateral, the moneylender was paid in kind with the children of the cattle. Calves, or kinder, were an early form of interest. Today, when a banker lends you money, the interest you pay your banker is today’s modern form of kinder.

- In kind means like-for-like. Calves-for-cattle, money-for-money, and an eye for an eye.

- Interest is in kind. Or, another way to look at it: Interest is money having children – or money printing money.

- Modern banks could not survive if they were not allowed to charge interest on their fake money.

Credit Cards:

When you use your credit card, you are printing money. There is no money in a credit card. The only thing behind a credit card is your good credit. Your good credit is the bank’s collateral. In America, your credit is measured via a FICO score, a measurement of how creditworthy you are. The difference is that when you use your credit card, you are printing money for the bank – money you have to pay back and, likely, pay interest (in kind) on.

Loans:

When you borrow money for a car, home, or business loan, you are printing money. You are printing money for the bank, and the bank charges you interest on their newly printed money.

Printing Money #2: The Fractional Reserve System

Printing Money #3: Derivatives

Derivatives from an Orange:

Think of an orange. When you squeeze the orange, you get orange juice. The orange juice is a derivative of the orange. When you take the water out of the orange juice, you have orange juice concentrate, a derivative of both orange juice and the orange.

Derivatives of Money:

Stocks are derivatives of a company. A mortgage is a derivative of real estate. And a bond is a derivative of money.

Printing Money #4: Inflation

1.With inflation, debt gets cheaper – because money gets cheaper – and debt can be paid back with cheaper dollars.

2.With inflation, people spend faster. They are afraid prices will go up.

3.With deflation, people do not spend. They wait for prices to get lower, which may lead to financial depression.

4.Historically, when the gap between the rich and everyone else grows too wide, revolutions occur.

When inflation fails, many countries have suffered hyperinflation, often fueled by a hyper-printing of money. The Chinese symbol for crisis is made of two words: danger plus opportunity.

Eight Philosophical Reasons To Own Real Gold And Silver

Reason #1: Trust

Reason #2: Gold and silver are not investments

Reason #3: Real gold and silver have no risk

Reason #4: Affordability

Reason #5: Complexity vs. Simplicity

Reason #6: What is real money?

The following are the definitions of real money.

1.Medium of exchange – readily acceptable for financial transactions.

2.Unit of account – value is measurable

3.Store of value

Reason #7: Buying gold and silver coins is easier and less expensive than buying gold and silver mines.

Reason #8: Gold, the tears of God.

Invisible Money:

On August 15, 1971, President Richard Nixon did more than take the dollar off the gold standard. He made money invisible.

Ever since 1971, our education system has been a case of the blind leading the blind.

Today, people without real financial education are blind. They cannot see the cash heist, they cannot see how their labor and their lives are being stolen via the very money they work for.

The American education system –the most expensive educational system in the world is corrupt. Perhaps that is why even massive amounts of money spent cannot change the fact that the educational system produces the worst results in the Western World.

When the author was nine years old he asked his poor dad, the head of Education for the island of Hawaii, when he would learn about money. The Poor Dad's response:“We don’t teach about money in school.” That’s when the author went in search of a real teacher.

The main reason money is not taught in school is because teachers can only teach what the government allows us to teach.

Entrepreneurs do not have a job. An entrepreneur’s job is to create jobs.

Employees and entrepreneurs are very different people.

Our school system trains people to be employees. Employees do not need to know about money. That is why there is no financial education in our schools.

Entrepreneurs must know about money. If the entrepreneur does not know about money, employees lose their jobs and the entrepreneur is often out of business.

In 2018, the number one asset of the U.S. government was student loan debt, currently at over $1.5 trillion. This means that, for millions of young people, student loan debt is their biggest liability.

Income for the top 1 percent rose 31.4 percent from 2009 to 2012: but crept up a barely noticeable 0.4 percent for the bottom 99 percent.

Subprime Education:

In 2012, student loan debt surpassed the $1 trillion mark, as well as credit card debt. As of 2018, federal student loan debt is the number one asset of the U.S. government.

The United States went from subprime mortgages for poor people to subprime education for poor students. Subprime education loans are the worst-of-the-worst loans. At least a subprime mortgage can be forgiven via bankruptcy. Most subprime education loans can never be forgiven.

Inflation:

Without inflation, the banking system, Mandrake’s Magical money Show, and Grunch’s cash heist will not work.

A few reminders:

- Without inflation, Mandrake cannot pay back the money that was printed.

- When there is inflation, people spend faster, afraid prices will keep rising.

- If there is deflation, people stop spending, waiting for lower prices.

- The banking system must produce inflation, or the economy collapses.

- Inflation steals from the poor and middle class.

- The people who can least afford inflation pay the highest price: they pay with their lives.

- Why is America, the richest country in world history, so deeply in debt?

- Why is there no financial education in our schools?

- It is easier to give a man a fish…than to teach a man to fish.

What Made The Three Wise Men Wise? The Value Of Lifelong Learning

What made them wise was their lifelong search for great teachers.

They were wise men, rich men because they never stopped learning. They kept seeking new knowledge, knowledge from great teachers.

America is now a debtor nation, printing more and more money to pay off the debt printing money creates. America is much like a person who uses his credit card to pay off his other credit cards.

Financial stupidity is very profitable for people who know how to print fake money.

Apprenticeship: Real Teachers

At the age of nine, the author became an apprentice to his rich dad. Apprenticeship is one of the oldest methods of real education. Apprenticeship works because most apprentices learn from real teachers, not fake teachers.

Going Back To School: Fighting What’s Fake

- Learn to invest in real estate.

- You need to learn to use debt as money.

- Money is debt. It means money can only be created by creating debt. It means, the U.S. Federal Reserve Bank and the U.S. Treasury will encourage everyone to get into debt. If people do not get into debt, our economy will not grow.

- There is no money in your card. You don’t need money in the bank. Money is created out of thin air, the moment you charge something on your credit card.

- Using credit cards. Millions will buy houses and cars, using debt. Millions will work harder and grow poorer because they never learned to use debt.

- Real estate will always be the basis of wealth. Real estate is like gold and silver. The word real is derived from Spanish. Real in Spanish means ‘royal.’ Royalty throughout history has always valued land, gold, and silver.

- If you learn to use debt as money, and buy royal estates with debt, as I have, you will become a very rich and smart man.

- If you use debt to buy liabilities, you will join the millions upon millions upon millions of poor and middle-class people who will spend their lives working for the ‘royals’ who own the banks, working for fake money to pay off their debt.

- If you do not want to learn to use debt as money, stay out of debt. Debt is very dangerous. Debt is like a loaded gun. Debt can both kill you and protect you.

- This class begins when you enter the real world.

- Getting rich takes work and discipline.

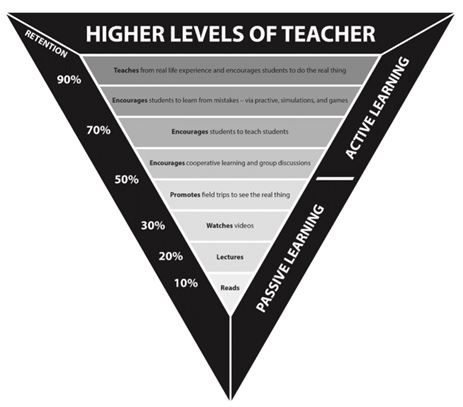

How to tell the difference between real teachers and fake teachers?

1.Fake teachers teach via lecture and books. Real life is a classroom.

2.Real teachers teach from real-life experience, from their mistakes, and encourage you to do the same.

3.You do not have personal freedom until you have financial freedom.

How To Catch A Lot Of Fish: Seeing The Invisible

Rich dad often said, “You cannot catch fish in clean water, You can only catch fish in muddy water.”

It is easier to give people fish than to teach people to catch fish. Why?

Because learning to catch fish is hard. All real learning is hard.

Prosperity has made many people soft, weak, and lazy.

Many actually believe they are entitled to be rich.

Money is a drug. Without financial education, people become addicted to money. Money makes them happy. Money solves their problems. Money heals their pain. Today, billions are addicted to the “quick fix,” the “temporary high” of money. The problem is, the “highs” become “lows,” and the addicts go back to work to feed their addiction. Addicts will do anything to feed their addiction.

Corrupt money creates corrupt people. Don’t change the world, change yourself.

The reason the gap between the rich and everyone else is growing is because, without real financial education, the fish – the people – are swimming in muddy water. This is why and how the academic elites who run our legal system, banks, and Wall Street are catching a lot of fish.

What is Financial IQ?

IQ is a measure of a person’s ability to solve problems. Financial IQ is a person’s ability to solve money problems. Financial IQ is measured in money. Financial IQ can go up if the person practices.

There are six foundational words to real financial education. They are:

1.Income

2.Expense

3.Asset

4.Liability

5.Cash

6.Flow

The author says that banks never asked for your report card. They never ask what school you went to. The banker will never ask for your GPA. The only thing the banker wants is to see the financial statement. The financial statement is the report card for the real world.

If a house is cash flowing positively, with money going into your pocket, then the house is an asset.

If a house causes cash to flow out of your pocket, the house is a liability.

In 2008, millions of people found out their homes were liabilities.

Follow the Money:

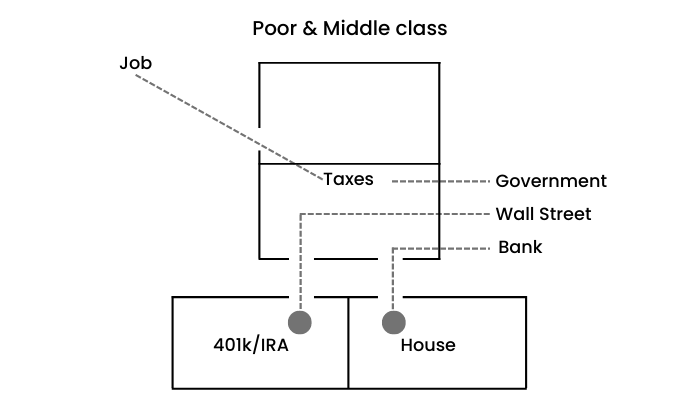

The middle class is the asset for the government, Wall Street, and the banks. Compare the cash flow of the middle class to the cash flow of the rich.

Lessons:

- Real financial education teaches the rich to keep the cash flowing into the asset column.

- Fake financial education keeps the cash flowing out of the pockets of the poor and middle class and into the pockets of those who print fake money, the pockets of the academic elite.

- Fake financial education keeps the water muddy.

Infinite Return:

Using 100 percent debt to produce $25 is an example of an infinite return. It is money for nothing, money created from financial intelligence.

Stocks:

Let’s say you purchase 100 shares of a stock for $1 per share. You have invested $100. The price of the stock rises to $10 per share. The 100 shares are now worth $1,000. You sell 10 shares at $10 and receive the original $100. The 90 remaining shares are free once you have recouped your initial investment.

The primary reason why most people are not rich is because they went to school.

Why are people not rich?

In school, students are taught that mistakes make you stupid. In real life, making mistakes makes you richer. God designed humans to learn from their mistakes.

Cheating means asking for help. In school, students take tests on their own. Asking for help is cheating. In real life, business and investing are team sports. The rich have teams. The average person does not have a team.

Good grades mean you are smart. As the author discusses earlier, your banker does not care about your GPA, he is more interested in your real report card which is your financial statement.

Get out of debt. In real life, debt makes the rich richer.

In 1971, money became debt. Bankers love debtors because debtors make bankers richer. The richest people in the world know how to use debt to make money.

Taxes are patriotic. The American Revolution had its origins in a tax revolt, the Boston Tea Party, in 1773. In real life, the rich don’t pay taxes.

Simple does not mean easy.

Without real financial education in our schools, millions become the fish that the elites trap in their nets and webs of lies. Without real financial education, millions go to school, get a job, pay taxes, save money, buy a house, and invest in the stock market. Entrepreneurs know they must make mistakes and learn from their mistakes and that business is a team sport.

The purpose of financial literacy is to empower the mind to see what our eyes cannot see, via words. The purpose of financial education is to empower our ability to see in dirty water, aka transparency. And one reason why the latest crashes have been so big and severe is due to a lack of transparency.

Why Mistakes Are Your Best Real Teachers: Using Mistakes To Get Smarter

A baby learns to walk by falling down. Next, the child learns to ride a bicycle by falling off the bicycle. Then they go to school and are taught. “Making mistakes makes you stupid.” That is insanity.

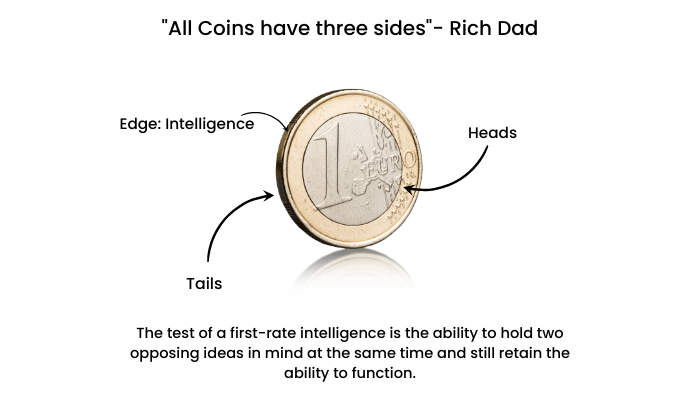

The moment you operate from the concept of “right and wrong,” your intelligence is cut in half. This is why standing on the edge of the coin – seeing both sides rather than taking sides – increases your intelligence.

Think for yourself.

Parents, out of love and a desire to prepare their children for life when they are gone, teach students not to make mistakes so they can be accepted socially.

You cannot know what you do not know. In other words, be very aware of the mistakes you will be making.

Mistakes are great – the more you make the smarter you get.

The author quotes: “My mistakes are my mistakes. Your mistakes are your mistakes. In other words, my mistakes are customized to me. Your mistakes are customized just for you”.

The most important thing that can be done is to make mistakes and learn from them.

Learning from mistakes starts with first admitting you made a mistake and then using love and compassion to learn God’s customized lesson, just for you. Then mistakes will make you smarter.

The authors discussed a few important lesson that he learned:

- From Sunday School, I learned “lead us not into temptation.”

- In today’s dysfunctional society, the temptation is to:

- Pretend to never make mistakes. People like to pretend they are perfect.

- Lie.

- Make excuses.

- Blame is really two words: “be” and “lame.”

- Go to court.

- Go big or go home.

- Bernie Madoff should be running the U.S. government, the biggest Ponzi scheme in world history.

Mistakes are the key to success:

- Thomas Edison changed the world by making mistakes. He reported failing 3,000 times before inventing the electric light bulb. Henry Ford went bankrupt before Ford Motor Company became a success. And Jeff Bezos’ Amazon-offshoot zShops failed.

- Colonel Sanders had to reinvent himself many times and found himself broke at age 65 before KFC succeeded.

The Power of Practice

Tiger Woods did not become the greatest golfer in the world without practicing, making millions of mistakes, and hitting millions of practice golf balls. Also in the book Outliers, author Malcolm Gladwell states no band in history practiced more than the Beatles. Gladwell also wrote that talent alone is not sufficient to guarantee success. The difference is hours of practice. The Beatles played up to eight hours a night for years before becoming successful. Doctors, lawyers, and dentists do not call their business a business. Professionals call their business a practice. Practice on you.

Translation: Real teachers practice what they teach. Fake teachers do not.

As Fuller said, “Mistakes are sins only when not admitted.”

Give and you shall receive. A better saying is, teach and you will learn.

Mistakes are the key to real success.

The fear of losing creates more losers.

Money is a crazy subject. People do crazy things for money, even kill a loved one, deal in drugs, sell their body, marry for money, or work at a job they hate.

The more a person avoids financial risk the greater financial risks they take.

Risk-averse people fall into four distinct categories:

1. The Worker: A risk-averse person will play the lottery, bet on the ponies or sporting events, or go to Las Vegas and pretend to be a high-roller.

2.The Student: The reason student loan debt is the U.S. government’s number one asset is because there is a quasi-religious belief in education, that a good education can be salvation from the harsh cruel world.

3.The Criminal: Many honest, risk-averse people become petty criminals. They work for cash; they do not have to pay taxes.

The fear of failure is a powerful human emotion. For most people, the fear of financial failure paralyzes them, keeps them small, poor, and obedient. For a few people, the fear of failing financially inspires them to learn, to become real students, and to seek real teachers. Mistakes are not failures. For this person, mistakes are real learning experiences. Each failure – although painful – is a lesson in humility, for only through genuine humility, does a person learn.

How Going To School Keep People Poor Bucking An Obsolete System?

Real education empowers people. It empowers them to do things others can’t. And, in many cases, things they thought might never be possible for them.

Fake education keeps people poor, small, limited, and tethered to tiny filaments of life, limited by limiting thoughts.

“I Can’t”: The most destructive words a person can use are the words “I can’t.” Especially when those words are tied to money: “I can’t afford it.”

What Causes Poverty?

When it comes to the cause of financial poverty, it is those few, short words – “I can’t afford it” – that keep people poor…and keep people small. If a person cannot those words into the question “How can I afford it?” they will always live in financial poverty, no matter how much money they may make.

Without real financial education, most people spend their lives saying things like: “I can’t afford it.” “You can’t do that.” “I wish I could do that.”

Invisible Poverty:

Schools teach people to be poor with a term known as invisible poverty.

Schools reinforce invisible poverty by:

- Punishing students for making mistakes

- Teaching that mistakes make you stupid

- Memorizing answers rather than learning by making mistakes

- Decreeing that there is only one right answer that the teachers have

- Delineating right versus wrong, rather than the concept of three sides to every coin

- Lacking real financial education

- Viewing cooperation as cheating

- Taking tests on your own

- Making it unacceptable to ask for help

- Never saying, “I don’t know”

- Not helping others

- Grading on the bell curve, where there are smart people and stupid people

In 1989, with the invention of the World Wide Web by Sir Tim Berners-Lee, the world transitioned from the Industrial Age into the Information Age, and accelerating acceleration began. Education, however, has not changed. Education remains frozen in time.

Your greatest assets are people. So people are your greatest liabilities.

For humanity to survive, each of us needs to start telling the truth. When people start talking about the human liabilities in their lives, they start telling the truth about the inadequacy of their children’s and their own education.Simply put, education is failing to prepare people for a changing world of accelerating acceleration, a world of invisible change and invisible money. Without real spiritual education, people are paralyzed because fake teachers teach them not to make mistakes and not to ask for help, because asking for help is cheating. Without real financial education, people are blind because it is easier for the academic elite to steal the wealth of blind people via the money they work for.

Entrepreneurs In Education: Can You See The Future?

Our education is the problem. It is what we teach, how we teach, and who teaches that is the problem.

Humanity is moving ever deeper into crisis – a crisis without precedent.

A Student Of God: Choose Your Teachers Well

The number one skill of an entrepreneur is the ability to sell. Sales equal income. The reason most people struggle financially is because they can’t sell.

Our mind is our problem.

Humans realize it is the development of our minds that separates us from the animals.

Split-Screen Mind:

The problem is the human mind is a dualistic, often ego-driven mind. Our mind is like a split-screen TV. It sees the world through the prism of right and wrong, good and bad, up and down, in and out, pretty and ugly. That is why all humans have a good side and dark side.

The problem is that technology is evolving – but humans are not. Humans have not changed much in the last 500-1,000 years.

For humans to evolve, the next education level will require us to turn our minds off, shut up, and tune into God.

Be silent, be still, and become a student of god, the general overall director.

Today, most people are cautious about the food they put in their body. How many people are as cautious about the information they put in their brain? Just as there are people and businesses selling junk food, there are people and businesses selling junk information.

Why are the poor and middle class getting poorer?

Because they invest in fake assets that they think are real assets.

The rich do not work for money. Savers are losers. Your house is not an asset. These are statements from Rich Dad Poor Dad, first published in 1997.

Most people are investing in real liabilities, not real assets.

Why Retire Young? The Next Big Crisis

Pensions going bust.

Pension plans are almost universally toast. Most of the time, politicians just ignore the problem and try to kick the can down the road to the next administration.

Moody’s Investors Service estimates state and local pensions have unfunded liabilities of about $4 trillion, roughly equal to the economy of Germany, the world’s fourth-largest economy.

A 2018 study by the Schwartz Center for Economic Policy Analysis at the New School has concluded that 40 percent of the American middle class will slide into poverty as they enter their retirement. Tomorrow’s poor have jobs today, but no retirement for tomorrow.

Retire Rich

In 1974, the author's goal was $120,000 a year in passive income. Then he could “retire young.” In 1994, Kim (spouse of the author) and Robert (the author) reached that goal. Kim was 37 and he was 47. Again, it took him 20 years. It took Kim only 10. Once we achieved $120,000 a year, their next goal was $1.2 million a year. Once $1.2 million was achieved, their next goal was $12 million per year. It was their personal challenge. First is to retire young, then to retire rich. The math is not difficult. First it was $10,000 a month, then $100,000 a month, then $1 million a month. Making money on the Business and Investor side of the quadrant is only a game.

The important question is this: Are you passionate about your game? Do what God wants done. What does God want done?

Transitioning into the Business and Investor quadrant is a tough journey. There are many doors to financial heaven. There are even more doors to financial hell. As you know, most entrepreneurs go through hell before achieving success in the Business and Investor quadrants. Many people take the door to financial hell and never come back. Our education system is a system without a soul. Everyone uses money every day.

Why not teach money in school?

All financial planners are selling basically the same products: stocks, bonds, mutual funds, ETFs, savings, and insurance.

The Name of the Game:

Magic does not happen because the name of the game financial planning company’s play is not “Make our clients rich.” The game financial planning companies play is “assets under management,” or AUM.

Rich Dad’s Plan:

Rich dad taught his son and the author that there are four basic asset classes.

They are:

1. Business

2. Real Estate

3. Paper Assets (stocks, bonds, mutual funds, ETFs, and savings)

4. Commodities (gold, silver, oil, food, water.) Most financial planners and CFPs sold only paper assets and insurance for commissions.

Invest in what you love.

Paper assets are best for the average investor, a person without much financial education.

All paper assets are a form of derivatives. They are not real assets. They are fake assets.

Business and Real Estate

The problem with a business and real estate is they are illiquid. If you make a mistake, you become the skipper of the Titanic. I recommend taking real estate courses before investing in real estate, then start small, follow the Higher Levels of Teacher, and practice, practice, practice. Follow the McDonald’s formula for great wealth. What business is McDonalds in? Not Hamburgers, McDonald’s business is real estate.

The McDonald’s formula looks like this:

The Power of Words

If a person wants to become rich, they must learn to control the words they think and speak. Most people think and speak words that make them poor and keep them poor.

1. Poor people say, “I can’t afford it.”

Rich people ask, “How can I afford it?”

2. Poor people say, “I’m not interested in money.”

Rich people say, “If you are not interested in money, money is not interested in you.”

3. Poor people say, “I’ll never be rich.”

Rich people say, “I must be rich.”

Assets vs. Liabilities:

Rich dad’s definition of assets: “Assets put money in your pocket.” Rich dad’s definition of liabilities: “Liabilities take money from your pocket.” A house could be either an asset or liability, depending upon which direction the cash flows.

Fake Assets Are Real Liabilities

Billions of people invest in fake assets. A 401(k) is a fake asset because cash keeps flowing out of your pocket for years. An Individual Retirement Account, or IRA, is a fake asset because it takes money out of your pocket for years. A government pension is a fake asset because it is taking money out of your pocket for years. A mutual fund is a fake asset. So are stocks, bonds, ETFs, and savings. They are all derivatives. Mutual funds are loaded with fees, fees that make the rich richer, and you poorer. Insiders know, mutual fund investors put up 100 percent of the money, take 100 percent of the risk, and yet gain less than 20 percent of the profits.

Who Took Your Money: How Retirement, Pensions, And Fake Assets Are Causing The Poor And The Middle Class To Grow Poorer?

Since 2008, the four biggest Central Banks have printed over $9 trillion to save the world economy. Where did all that money go? Who got the money? Did you? And why are so many pensions going broke?

Threats to the World Economy:

1. Rising interest rates

2. China

3. A Strong U.S. dollar

4. Pensions

Five reasons why the poor and middle class lose:

Reason #1: Gamblers Run the Casino

During the 1950s and 1960s, only gamblers invested in the stock market. It was considered unethical for a financial advisor to recommend stocks to their clients.

In the 1950s to 1960s, my poor dad and my rich dad were savers. Saving money was safer than the stock market because after the 1944 Bretton Woods Agreement, the U.S. dollar was backed by gold. The U.S. dollar became the reserve currency of the world, or “good as gold.”

In 1971, Nixon put the final nail in the coffin of the gold standard. The dollar and all government money became debt. Gamblers took over the government casino. Debtors became winners and savers became losers.

Learn to use debt and acquire assets.

Printing money made the working poor and middle class poorer because fake money creates inflation and inflation makes life more expensive.

The House of Cards Collapses:

- In 1998, the foundations of global central banks and the U.S. government printed an estimated $9 trillion, to save themselves and their friends.

- In 2018, the world is in another giant bubble economy. Stock, bond, and real estate prices have made millions of gamblers very rich.

- Between 1971 to 2018, gamblers were the winners.

- Between 1971 and 2018, the poor and middle-class workers who worked hard to earn fake money, saved fake money, and invested it in fake assets run by fake fund managers educated in our finest business schools became today’s biggest losers.

Three Giants Bubbles:

1. GIANT BUBBLE #1: 1998: Thailand bust 1999: Long-Term Capital Management bust 2000: Dot.com bust

2. GIANT BUBBLE #2: 2008: Real estate derivatives bust

3. GIANT BUBBLE #3: Bubble Top year?

The author suspects that, between 2019 and 2025, many amateur gamblers who are rich today may become tomorrow’s biggest losers.

Is the Golden Age of gamblers coming to an end?

As the saying goes: “Gambling: the sure way to get nothing for something.”

Here are the four additional reasons how retirement, pensions, and fake assets cause the poor and middle class to become poorer.

Reasons #2: Inflation

“Blessed are the young for they shall inherit the national debt.” Herbert Hoover

“If there were no government-guaranteed student loans, college tuition would be much lower.” Gary Johnson

Concerns for the Coming Generations

Baby Boomers in the United States had an easy life. We grew up during the biggest economic boom in world history.

Their children and grandchildren – Gen X, the millennial generation born after 1982, and the Gen Z internet-generation born after 1995 – have a very hard road ahead. Not only are many Millennials unemployed or underemployed, but many start their adult lives burdened by onerous student loan debt. They also inherit a massive national debt, a financial disaster left behind by their parents, grandparents, and great-grandparents.

“By a continuing process of inflation, the government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” John Maynard Keynes

“The way to crush the bourgeoisie (middle class) is to grind them between the millstones of taxation and inflation.” - Vladimir Lenin

“Inflation destroys savings, impedes planning, and discourages investment. That means less productivity and a lower standard of living”- Kevin Brady.

Remember: The banking system is based on printing money. It is known as the fractional reserve system. That means, for every dollar a saver saves, the bank is allowed to lend out a “fraction” of that money. If the fractional reserve is 10 percent a bank may lend out $9 to debtors for every $10 of savers’ money. When the $9 goes to the debtor’s bank, the debtor’s bank may lend out $8.10. The sad truth is, there is only $1 of real money in savings. That is why if savers panic, banks may not be able to give the savers back their money.

Reason #3: Real Assets Make the Rich Richer

Amazon founder Jeff Bezos is a billionaire. Do you think he became a billionaire because he received a billion-dollar paycheck?

Although Bezos’ salary of $1.7 million a year may (technically) be low, there’s a reason he’s called the richest man in the world. His net worth is skyrocketing, mostly due to the fact that he owns about 80 million shares of Amazon stock. Every month, a portion of the billions of dollars from millions of workers’ 401(k)s and retirement plans flow from their paychecks into shares of Amazon stock. Jeff gets richer although his salary may stay the same.

Lesson: “Cash” and “flow” are the two most important words in the world of money. Every month, retirement cash flows from the Moms and Pops of the world into the pockets of the Jeff Bezoses of the world.

Reason #4: Crashes Make the Rich Richer

When the market crashes, and it always does, the poor and middle class are wiped out. When markets crash, the rich simply borrow money and buy back workers’ shares at bargain basement prices.

Reason #5: Rubber Chicken Dinners

How do the rich get richer if pension funds are going broke?

The name of the game is “assets under management.” Everyone talks about the benefits of compounding interest, but few mention the danger of compounding fees. Treat agents as partners, not as real estate brokers. If a house is a rental property and putting money in your pocket, the house is an asset. If the house is your home and taking money from your pocket, then it is a liability. And that is what rich dad’s son and I learned.

- Assets put money (cash flow) into your pocket.

- Liabilities take money (cash flow) out of your pocket.

When your banker tells you your house is an asset, he is not lying. He’s just not telling you the truth. What he does not tell you is that your house is the bank’s asset, not yours.

The same could be said for your savings, stocks, bonds, mutual funds, ETFs, and retirement plan. They are all fake assets because the cash flows to the ultra-rich via compounding fees and expenses.

All you have to do is follow the money, and you will see where the cash is flowing to. As legendary investor John Bogle, founder of Vanguard Funds, said, “[Investors] put up 100 percent of the cash, took 100 percent of the risk, and got 33 percent of the return.”

And if the mutual fund crashes, the investor loses 100 percent. If the mutual fund makes money, investors receive 20 percent of the reward, the owners of the mutual fund receive 80 percent.

Fishing In Clean Water: Fake News…And Transparency

In a capitalist government, a democracy wants citizens to be partners, investing in projects the government needs done.

A communist government is centralized, and most capital projects are run by government bureaucrats. In China, for instance, most of the rich are friends of bureaucrats, or “princelings,” children of bureaucrats.

In the United States, “a free-market economy” means that ordinary people and citizen entrepreneurs are encouraged to participate in projects the government wants and needs done via tax incentives.

Tax Incentives for Housing. For example, the government needs entrepreneurs to provide housing. This is why “depreciation” is a tax incentive for real estate investors.

Tax Incentives for Jobs. The government also wants people to provide jobs. That is why entrepreneurs in the Business quadrant with over 500 employees pay less in taxes.

Big business attracts small business, which means more jobs, and more jobs mean more housing, more schools, more government service employees, and more taxes to city and state governments.

Tax and tax incentives are the engine of capitalism.

Failure is the other side of success. You need to go to school to be a doctor or lawyer, a tradesman, or a highly paid employee. But you do not need to go to school to become a rich entrepreneur or investor.

What the rich teach their kids about money that the poor and middle class do not.

Infinite ROI: Return on Information

There are many doors to financial heaven. And even more doors to financial hell. It is information that makes the rich richer, not money. Information that is not taught in schools.

Pictured below is what is taught in schools:

This is what students are taught in schools. Notice where the cash flows from and to.

Debt is a loaded gun. A loaded gun can protect you and a loaded gun can kill you.

The End Of The U.S. Dollar? Booms, Busts, Crashes… Collapse?

The difference between communism and capitalism:

- Communism: Communism is based on centralized government.

- Capitalism: Capitalism is based upon centralized banks.

Central banks do not like gold because banks cannot print gold. Central banks do not like Bitcoin and blockchain because people’s money does not need central banks. Central banks print government money. Government money has no integrity. God’s money and people’s money have more integrity than central bank money.

The Real Issue:

The real issue of government money is the word: confidence. As long as people have confidence in our governments and central banks, fake government money such as the dollar, yen, yuan, pesos, and Euro are safe. The last snowflake is confidence. The moment confidence is gone, government money is toast, the dollar collapses, and the avalanche comes tumbling down the mountain, decimating everything in its path.

Rich dad’s favorite definition of money was: “Money is an idea, backed by confidence, representing work truly done, and is exchangeable.”

In the hands of an idiot, debt turns into disaster.

The game the Big Banks and Wall Street plays is, “Heads I win. Tails you lose.”

From its creation in 1913, the most important Fed mandate has been to maintain the purchasing power of the dollar; however, since 1913 the dollar has lost over 95 percent of its value. Put differently, it takes twenty dollars today to buy what one dollar would buy in 1913.

Paper money eventually returns to its intrinsic value – zero. (Voltaire 1694 – 1778)

Central Banks have become more powerful than governments by virtue of their ability to create massive amounts of money without any legal restrictions or limitations on the amount.

Doctors and medicine are fake health… and that inner spirituality is real health.

Millions of people were seeking financial relief, not a cure. Most people want the easy road to wealth, which is why most people never achieve great wealth or relief from real money worries.

- Your spiritual health is found in your illness.

- Your spiritual wealth is found in your poverty.

- Your spiritual happiness is found in your sadness.

LESSON: Being present with your pain, your weakness, your darkness, and the Judas in you, is where your real spirituality is found.

How To Soar With Eagles In A World Run By Chickens Take Control Of Your Life?

In the last chapter, the author gave an analogy: How Eagles Learn to Fly?

1.STEP 1: “Wake up.”

When it comes to money, we have all been brainwashed. Brainwashed means taking on ideas that are not your own. Brain washed people are willing to die or fight for an idea.

Brainwashed people become upset when they hear things like:

- Savers are losers

- Your house is not an asset.

- The rich don’t work for money.

- The rich use debt as money.

- The rich do not pay taxes legally.

They become upset. A few become angry. They become emotional because they have been brainwashed. They become upset – “triggered” – by ideas that contradict their fragile beliefs.

2.STEP 2: Eagles teach their kids about money. Chickens do not.

Most family fortunes are gone in three generations. The first generation earns it, the second enjoys it, and the third generation loses it.

Dynasty wealth, wealth that is passed on from generation to generation. Rich dad also said, “Most poor and middle-class parents only want their children to get good jobs.”

3.STEP 3: Eagles make mistakes and learn from their mistakes. Chickens do not.

4.STEP 4: Eagles cheat - they ask for help.

5.STEP 5: Eagles invest in what they love. Chickens do as they are told.

6.STEP 6: Eagles invest for infinite returns.

Eagles invest with OPM, other people’s money. Chickens are other people.

LESSON: Tax breaks for the Bs' and Is' are similar, yet slightly different in different parts of the world. The lesson is that having a smart tax accountant and tax attorney can be the smartest thing an eagle can do.

Chickens do not have bookkeepers, tax accountants, and tax attorneys.

LESSON: Eagles spend money to increase income – on education (courses and seminars) and for professional advice from bookkeepers, accountants, and attorneys.

LESSON: Chickens who work hard and who work hard to keep expenses low so they can save money pay the highest taxes and receive the fewest tax breaks from the government.

LESSON: Chickens spend money and the money never comes back.

Why Do Chickens Lose?

Chickens do as they are told and turn their money over to “financial experts,” such as financial planners and fund managers to invest for them. The problem is that chickens learn nothing when the expert wins and learn nothing when the expert loses their money.

Education is what remains after one has forgotten what one has learned in school.

Fuller often said, “Free the scholar so he can return to his studies”. Fuller’s words – “Integrity is the essence of everything successful”

Fuller also said, “If the success or failure of this planet of human beings depended on how I am and what I do… How would I be? What would I do?”

Conclusion: The author tries to convey the message that we all should try not to follow what our governments want us to do. Rather take things into our own hands and invest in real money which are gold and silver not paper money. Financial Freedom can only be achieved when we stop working for money and money starts working for us. That is the ultimate truth.