Put Options

What is a Put Option?

A put option is an option contract that gives the buyer the right, but no obligation to sell the underlying asset at a specific price also known as the strike price.

Put options can be traded on many underlying assets like stocks, currencies, and also commodities.

They help us to protect our trades against the decline in the price of the above assets below a specific price.

The trader does not have to own the underlying asset for buying or selling puts.

The put buyer has the right, but not the obligation, for selling the asset at a particular price, within a specified period.

Whereas, the seller has the obligation to buy the asset at the strike price if the option owner exercises their put option.

What is meant by Buying Put Options?

It is one of the simplest ways for trading put options.

When the options trader has a bearish view on a particular stock, then he can purchase put options to profit from a decline in the asset price.

Example:

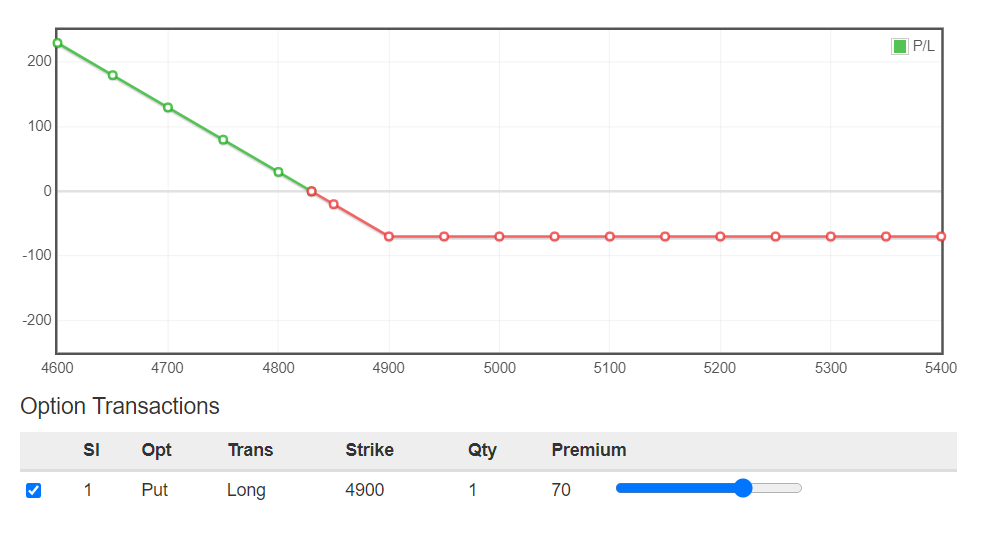

Suppose the stock is trading at ₹4900 and put option contract with 4900 strike price is trading at ₹70 expiring in a month’s time.

You are expecting that the price of the stock will drop sharply in the coming weeks.

The payoff diagram of the examples will look as below:

If the prices fall as expected then we earn profits.

But if our trade does not go according to our expectations, then our loss will be only limited to the premium price that we had paid.

What is meant by Selling Put Options?

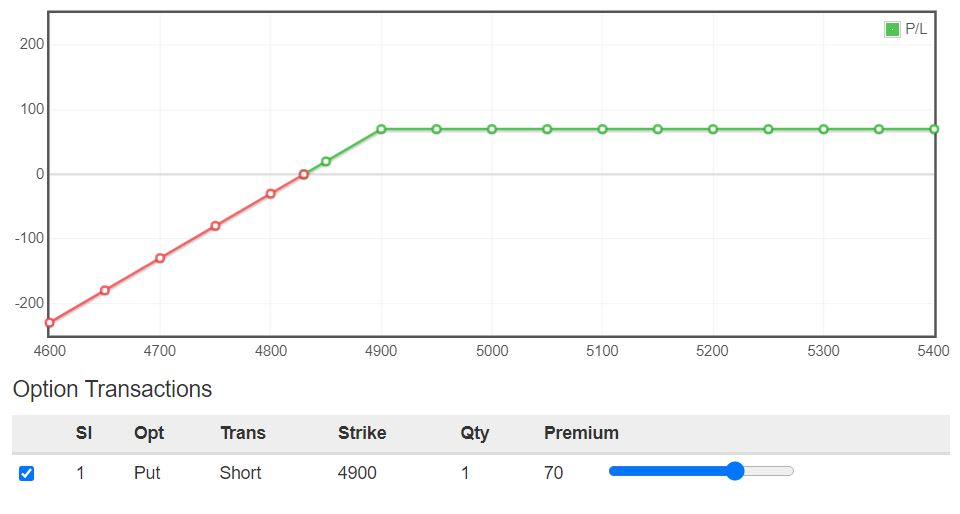

Put sellers sell options with the expectation to gain the premium amount when the underlying asset either goes up or remains in the existing range without seeing a negative bias.

Once puts have been sold to a buyer, then the seller has the obligation to buy the underlying asset at the strike price if the option is exercised.

The stock price must increase above the strike or remain in the strike price zone in order to make a profit.

If the underlying stock’s price falls below the strike price before the expiration date, then the buyer exercises his right resulting in a loss for a put option seller.

From the above diagram we can see that the profit is limited to the premium whereas if the prices move against our expectation then we may suffer unlimited losses.

Difference between Call Options and Put Options:

An investor buys a put option when he expects the price of an underlying asset to fall within a specific time period whereas an investor buys a call option when he expects the price of an underlying asset to rise within a specific time period.