Yield Curve

The yield Curve going up, Interest Rates are going up, therefore the debt market is going down.

Almost all of us have heard these terms recently. The problem is that many of us partially understand the Yield Curve or not understand it at all.

The first question is what exactly is the Yield Curve?

The Yield Curve is a curve which shows all the possible Interest rates of a particular debt security maturing on several dates. This curve shows a relationship between Interest Rates and Time to Maturity.

In simple terms, Yield Curve tells us what return an investor can expect from a bond if she/she invests on a particular date.

Just like we have Sensex and Nifty for stock markets in India, the Central Government Bonds, which are known as G-Sec and are 10-year bonds, also have yield curves. Those yield curves are the representation for bond markets in India.

For example, if the Government bonds have a yield of 5.8% today, it means that you will get a return of 5.8% if you invest in a 10-year Government bond today.

Generally, when the bond markets fall, yields go up and vice-versa.

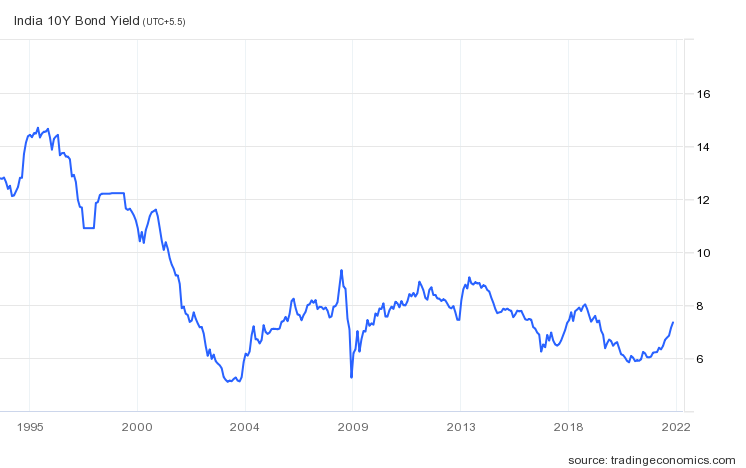

Overall, if you check the 25-year yield curve, you will see that the yields are consistently falling over a period.

Once upon a time, the yields were close to 14.69%. Today, the yields are close to 7.3%.

An important note is that when an economy goes from a Developing Economy to a Developed Economy, the yields that country offers on its Bonds start to decrease. For example, if you see the US’s bond yields, they are just at 1.5% today. Whereas previously they were very high.

Now, let’s look at the 10-year chart:

After looking at the 10-year chart, we can understand that in 2014, the yields topped out a range of 9%.

The range for the 10-year yield curve is 9%-6.5%. Near 2020, the yields bottomed out at 6-6.5%.

The latter part of 2020, and 2021 are times of the Covid pandemic, because of which the yield curve hasn’t moved naturally.

Let’s look at the 5-year data now:

In the 5-year data, the yields have topped out at 8% and bottomed out at close to 6%.

Yields move in a range over a period of time. Each time a topping out and bottoming out process of the Yield Curve takes place, the yields keep on declining.

Now if we try to predict the yields of the next 5 years, we can never be sure.

Investing in a low duration fund when yields have bottomed out, and investing in a high duration fund when yields have topped out makes total sense because when yields go up, the bond value goes down.

This is why where yields have bottomed out, investing in a low duration fund or bond should be the best option.