Duration And Its Types

Now that we have an understanding of a bond's duration. It is also important to learn the different types of bond's duration. So, basically there are 2 kinds of Duration which are widely used by today’s investors. They are:

- Macaulay Duration

- Modified Duration

1.Macaulay Duration:

A bond’s Macaulay duration can be calculated as the weighted average of the number of years until each of the bond’s promised cash flows are repaid, where the weights are the Present Values (PV) of the bond’s each cash flow as a percentage of the bond’s value. This concept was introduced by Frederick Macaulay and hence the name Macaulay Duration.

Let’s try and understand this concept with the help of an example:

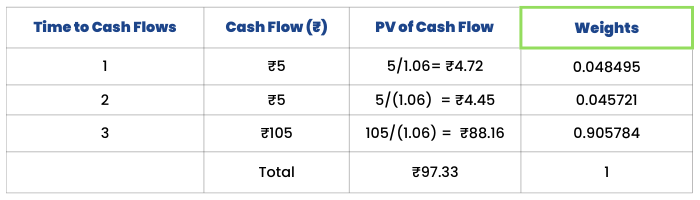

Imagine a 3-year bond with a face value of ₹100 and a coupon rate of 5%. The bond pays its coupon on an annual basis. It also has a YTM of 6%.

To calculate the Macaulay Duration, we need to first find the Present Value (PV) of the future cash flows of this bond:

The Macaulay duration of this bond will be calculated as:

= 0.048495*1+0.45721*2+0.905784*3

= 2.587 years. This means that the bond will take 2.587 years to pay all its promised cash flows.

Macaulay Duration is one of the most important concepts in Duration.

2. Modified Duration:

Modified Duration is the modified version of Macaulay Duration, which is calculated by dividing Macaulay Duration with the bond’s YTM.

If we continue with our previous example, we will get a Modified Duration of 2.587/1.06 = 2.44.

The modified duration figure indicates the percentage change in the bond’s value given an X% change in its interest rate. Unlike the Macaulay duration, modified duration is measured in percentages.