Cloning Investments

What is Cloning?

A clone is simply a portfolio of stocks created based on the stock ideas of one or more successful fund managers. Empirically, cloning the stock ideas from top money managers has proven to outperform the overall market. It is a powerful way to validate an investor’s own stock picks. It involves identifying successful strategies of investors that have consistently generated positive returns in the past and expected to do so in the future. We then copy these strategies and tweak it according to our needs.

Cloning can be simply referred to as creating a clone or copying an investor’s investment strategy. Copying a strategy can be advantageous because it is less time consuming, is efficient and involves less fees, which in turn, shall provide better returns for an investor.

Cloning can look very simple, but it requires a lot of patience and time. Cloning as a strategy can prove to be very advantageous for those who are not involved full-time in the markets or have little experience in the capital markets.

Though we got a brief introduction on cloning, a few questions are unanswered: why should we even clone others? How do we clone? In the coming units, we will discuss them all.

Why should we clone?

First let us answer the question: Why should we clone?

According to the paper, imitation is the sincerest form of flattery: Warren Buffett and Berkshire Hathaway, written by Gerald S. Martin, states, if an investor would have copied Warren Buffet’s investments even after they were publicly disclosed, i.e., after 1 month, they would have earned 14.36% annual returns per year, which is better than what the market earned in most of the years.

Mohnish Pabrai, manager of American based Hedge Fund Pabrai Investments Funds has cloned the majority of his purchases and has been quite successful in doing so. According to him,

"Cloning is a very powerful notion. No good books have been written on cloning yet. If you take what Buffett did, then you are already beating the S&P by 11.5% per year.”

Mostly what Pabrai Funds did was to copy the other investors. Mohnish Pabrai said,

“I just give a slight tweak to it. I don’t buy what others are buying. I first look at what they are buying. Then I buy what I can understand and limit myself to two-three decisions a year.”

To have a better understanding of how cloning can be advantageous, let us take the example of Walmart Inc.

Walmart is an American Corporation which operates in a chain of grocery stores and hypermarkets. Its founder, Sam Walton, has mentioned on numerous occasions,

“Most of everything I've done, I've copied from someone else.”

Mr. Walton, one by one visited the most successful grocery chains in the world, copied the best parts of each store and established his own one which came to be known as Walmart. Today Walmart is a $380 billion (As of 1st July,2021) company with more than 2.3 million employees across the length & breadth of the globe.

Not only Walton, but several other businessmen who have achieved success weren't the first in their industry with a breakthrough technology, they just copied an idea and made it more efficient. If people have achieved success in the past by simply copying and tweaking the idea a little bit, then cloning may be advantageous.

There are several other reasons to clone, for example, if you take a look at the stock market, there are more than 5,500 listed companies on the Bombay Stock Exchange (BSE) alone. Analyzing a company takes a lot of time and money, and it is simply impractical for an individual to scan each company one by one.

If you cannot analyze the economy and all the stocks and industries present in an economy, what can we do?

The answer is pretty straightforward. If we can take a look at the institutional holding pattern, we can get a decent idea about good-quality investments in every sphere.

There is a problem with this approach though; the data of a fund’s holdings for a period are released at the end of a particular period, i.e., end of that month or quarter. But why is it a problem?

Let's suppose you want to buy a stock by looking at fund manager's holdings, you either have to look at the last period's holdings or you have to wait for the latest updates to come, which are generally, at the end of a month or quarter. A fund manager by then would have already purchased that instrument at the best possible price. It is possible that you have to overpay when you're buying, or, underpay when you're selling that stock. This doesn't mean that investors will not generate profits; it simply means that this strategy will not give us maximum returns in most of the cases.

Questions may arise into your mind that why are people not cloning other’s ideas more frequently? Or if we know what works, why do we want to do something else?

The answer is related to human psychology. If humans were so prone to cloning, we wouldn't have different companies with different strategies, or, we wouldn't have different investors with different approaches. Everything would have been the same. It is seen that everyone wants to be different; we want to establish our own identity by following the path that we prefer.

It is seen that people generally do not want to clone. It is not easy to digest for us humans to just simply copy someone’s idea/philosophy and live with it.

To overcome this factor, we should not just simply copy an investor's strategy, instead, one must carefully analyze the investment & do our own due-diligence before risking our capital.

In the words of Mohnish Pabrai, who is a very successful clone investor himself,

“There's something in the human psyche and something in our evolution that makes we human beings averse to doing things the easy way or taking some simple ideas and just running with it. The few of us, who can transcend like Sam Walton and Bill Gates, etc, get a massive advantage. In fact, in the investing business, you see this all the time – no one is willing to clone."

Another factor attributing against cloning can be the DIY generation. Many young blooded individuals view the 20% CAGR returns generated by Mr. Buffet since inception as a slow & boring method of creating wealth. For them, the stock market is more like a game of roulette and the stakes are double or nothing.

How to clone?

Now that we have understood why we should clone, let us understand how to clone?

Cloning can vary from person to person, there are a number of financial instruments like stocks, bonds, commodities, etc. from which one can decide to clone and moreover there are multiple markets to choose from. There are Developed economies like The United States, The United Kingdom coupled with Emerging Market economies like India, Philippines, South Korea, amongst others.

Investors must be mindful of adequately diversifying their holdings even if they are cloning. For instance, instead of exactly cloning a value investor’s portfolio, you can add some of the top holdings of a growth investor’s as well. The key to successful cloning is to bid a reasonable risk-return profile.

Suppose, you decide to invest in an equity strategy, you may consider adding alternative investments like gold or fixed income instruments into your portfolio. Traditionally, gold and equity have demonstrated a negative correlation. This implies that Gold shall outperform in a period of poor market performance thereby lending stability to your portfolio.

The first step towards cloning is to create a process. This can be rigorous and requires a lot of effort. Here are some of the ways using which you can get started:

1.Selecting an investor or a group of investors and creating a replica of their portfolio –

We all revere someone or the other’s thought process & ideologies in the market. Over the years, I’ve been humbled by the learnings of these market wizards who possess an infinite stream of knowledge. And what better than cloning the entire portfolio!

2.Selecting a group of investors and replicating a portfolio of their top picks-

This investment style is much-more prone to selection bias given the contradictory philosophies.

Personally speaking, I find small caps to be a much more lucrative investment than their larger peers. And who can ace this game better than the likes of Porinju Veliyath, Ashish Kacholia and Mukul Agarwal?

And there it is! A tailor-made portfolio that is equally allocated amongst the twelve stocks (top four holdings in each of the portfolio)

3.Selecting a group of investors, studying their stock picks and investing in the ones which fall in your circle of competence –

This is a more suitable approach for people who understand a little about the markets, and do not want to bet on something completely unknown to them. Investing blindly can be dangerous and it is best to stick to your circle of competence.

Circle of competence is a broad term and for me it signifies those companies I understand in and out; the fundamentally strong stocks which I would add further in market dips.

4.Following only the largest holding of investors whom you want to follow –

An example would be to only purchase the largest holding of all your favourite market veterans.

The hardest part of cloning an investment is not to create one, but instead, knowing when to buy & sell. Allocating a huge chunk right at the peak of the market cycle is seldom a great idea. Yes, cloning does involve timing the market since these are ready made portfolios which we work with. Of course, the new purchases can be added as and when the data is made public but the already existing ones are sizable and must be paid attention to.

In this regard, it is crucial to note that cloning is not a fool proof strategy with guaranteed profits. A legendary investor with an impressive track record, has the right to be wrong. Mistakes are imperative while making investments and those who quickly correct usually survive the longest in the financial jungle.

How to pick an investor or group of investors?

After learning the basics of cloning investments, let us all agree cloning can be a big-time saver and save us from rigorously time-consuming financial analysis. But the question is: Whose investments should we consider cloning? How can we choose an expert investor or fund manager?

Everyone has their tastes and preferences when choosing fund managers or individual investors. When choosing an investment, an investor's philosophy, their knowledge about the markets, their age and public image all will matter. We have listed out 5 key factors which we should look for when selecting an investor:

- Good track record – Investors must always examine the past performance of a fund manager through multiple market cycles Thereafter, the returns must be compared with an appropriate benchmark to check whether the investor has outperformed/underperformed the markets historically.

- Background – Investors must check the background of the fund manager as well as the organization/group to which he belongs. Signs of corporate governance issues as well as a troubled history must be taken seriously and must be avoided for investment purposes.

- Investment philosophies – Look for strategies that suit your tastes & preferences. Avoid ones that you don’t feel comfortable investing in. For instance, it is better to stick to debt funds if you are a highly risk-averse investor.

- Current Holdings – Current holdings are important to check for a couple of reasons. One is to ensure that if that investor is following his mandate or not. For example, if the mandate says that a fund manager is supposed to be following the value strategy for that fund but their holdings show that he/she is following the growth strategy, then this is a point to ponder over. Secondly, the investor can assess the quality of companies as well and check if he/she resonates with the investment style of the manager.

Where can I find such crucial information?

Even though picking an investor or a group of investors seems relatively straightforward, it can be extremely difficult to find such essential information on the market. This is where our StockEdge app can be useful. Let’s get started:

The prowess of StockEdge in aiding investment decisions is second to none. No doubt it is a must have tool for traders and investors alike!

You can gain access to portfolios of Market Czars such as the likes of Rakesh Jhunjhunwala, R.K. Damani, Vijay Kedia, Madhusudan Kela, Dolly Khanna and many others at the touch of a button.

And if this is not enough, let me help you get familiar with another powerful feature that allows you to track key changes in investor portfolios.

Let us now check out Dolly Khanna’s portfolio:

Here’s what she bought and sold recently:

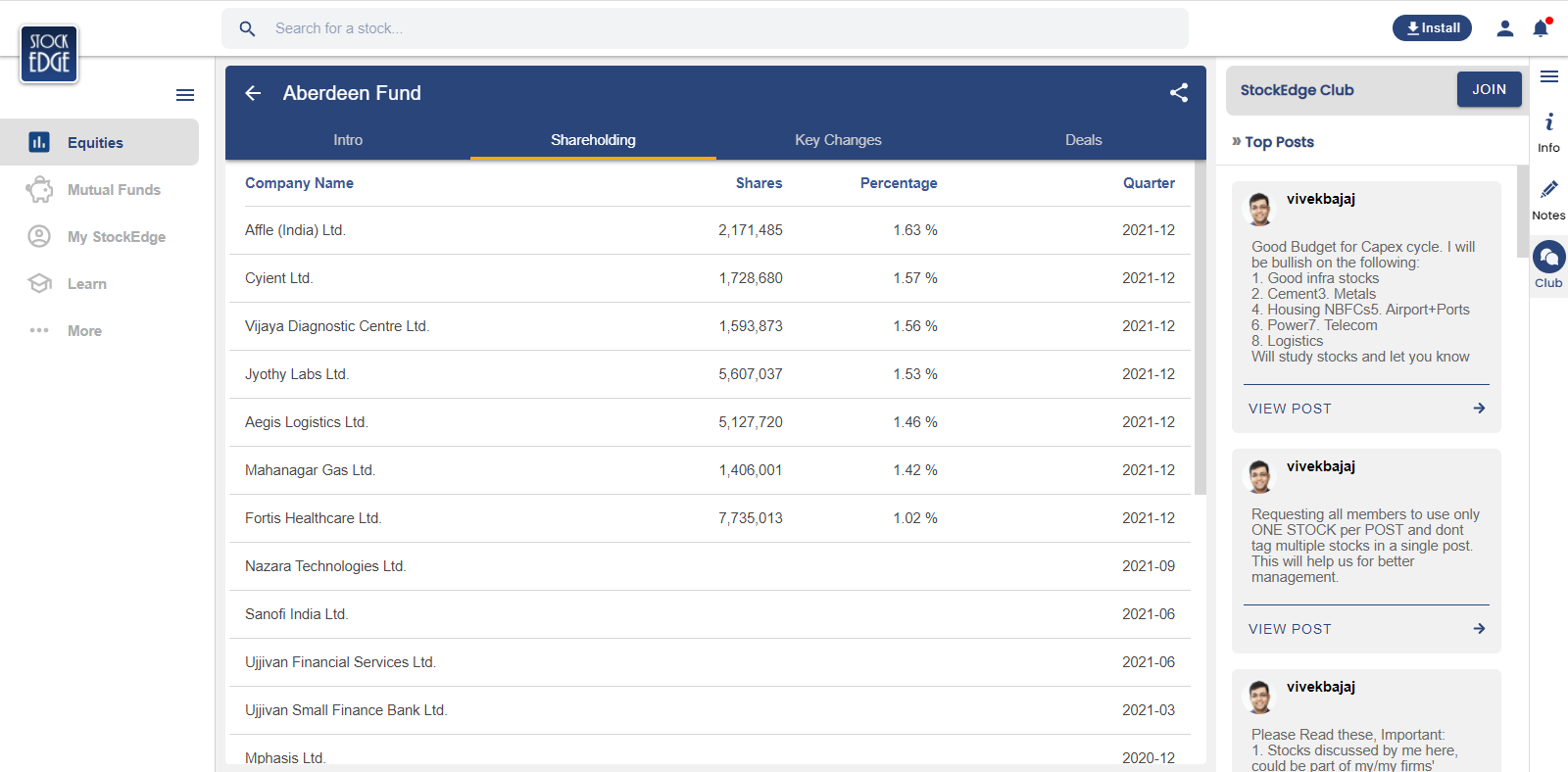

Similarly, the actions of Marquee Institutional Investors can also be tabbed in a jiffy:

Let us look at the Stock Holdings of Aberdeen Fund:

Investing is simplified!

What are clone funds?

Now, if you are one of those who doesn’t have the requisite time to scan investor portfolios and conduct basic checks on the company’s fundamentals here is something that might interest you- Clone Funds.

A clone fund is similar to a mutual fund, that tries to replicate the performance of another successful fund. The clone fund can in turn invest in multiple funds/strategies.

There are numerous advantages of investing in a clone fund:

1.Access to due diligence and expertise - Clone funds have experienced fund managers who conduct proper due diligence & risk management before investing in that company. Hence, investors are assured about the safekeep of their investments.

2.Diversification - Instead of investing in a particular fund, several clone funds invest in multiple strategies, which make them less prone to failure.

3.Less time-consuming – As discussed earlier, this instrument is suitable for those who are short on time to keep track of their investments. Well, this doesn’t imply that cloning funds are a buy and forget strategy either.

4.Lower management fees – This typically depends on the fund you have chosen but as a norm passive funds charge low management fees.

There are some disadvantages also:

1.Double layer of fees – An investor, who invests in clone funds, has to pay a double layer of fees. This is because the clone fund will charge management fees of let's say 1% and the fund in which the clone fund shall invest will charge a similar amount that takes the total fees paid to around 2%.

2.Time lag – Most of the funds do not release their holdings data before the end of a month or quarter, which means the price at which the clone fund shall buy or sell, will not exactly match the fund that they will replicate.

We have completed our journey of learning everything about cloning investment. To give you an idea of how to apply cloning by yourself. Coming units, we will discuss some case studies.

Case Study 1 – Monish Pabrai

Mohnish Pabrai started investing in 1995 with $1 million in savings. By 1999, he had amassed $5.1 million, growing initial capital at a rate of 43.4% per annum, thereafter which he started Pabrai Investment Funds.

He left his Masters degree in Engineering at Illinois Institute of Technology, he left midway to start his company TransTech.

From 1999–2007, his returns averaged a whopping 37.2% per annum and from 2007-2009 when the world was hit by a financial crisis, his rate of return was at a negative 47.1% compounded per year. His overall track record since 1995-2013 has been impressive at 25.8% per annum even after the Dotcom crisis of 2000 and the housing bubble of 2008.

Let's look at what Mr. Pabraihas has to say about cloning investments:

"I think the reason you will get an advantage (in cloning your investments) is that most people don't have the temperament or the patience. They may buy IBM because [Warren] Buffett bought it and it may get a bump in price, but they will not hold it until Buffett holds it. They will buy it in November 2011 and by February 2012 they will have already sold it making 10%. He also said: "I am such a genius". And that's the problem. This gene of cloning is very quirky – most people are willing to clone but only partially. They will buy what Buffett buys, a lot of people do that, but they don't do the rest of it. That is stupid cloning. Half-baked stupid cloning. We don't want to do stupid cloning. You do it all the way."

Stock holdings of Mohnish Pabrai:

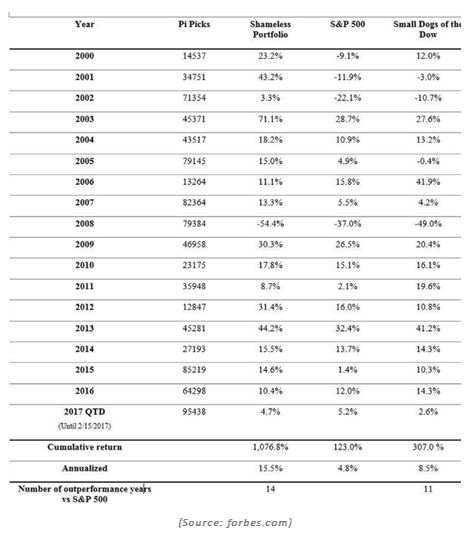

The Shamelessly Cloned Portfolio:

The shamelessly cloned portfolio is a portfolio created by MohnishPabrai. This portfolio comprises of the five most convicting ideas of the cloned managers which are selected for the portfolio. The shameless portfolio is inspired by the "Small Dogs of the Dow" and at the beginning of each year, the portfolio is invested and left untouched for that particular year.

Mr. Mohnish picked eight value managers for this portfolio himself. After setting up an algorithm using the "R" programming language, the mathematical constant "Pi'' picked up all the stocks. "Pi '' is used to avoid all the possible human biases when picking up the stocks.

Case Study 2 – Meb Faber

Meb Faber is the founder and the CIO of Cambria Investment Management. He completed his education from the University of Virginia, with a double major in Biology and Engineering Science.

AlphaClone is a cloning investment tool that lets an investor find and track the stock ideas of top money managers, which is developed by Faber himself.

Smart Pilot Strategy:

Smart Pilot Strategy is a cloning strategy which uses its methodology and selects ten managers with the highest performance potential.

There are two smart pilot strategies, known as Smart Pilot (Hedge) and Smart Pilot (long). Here are the returns of the two strategies, in comparison to the S&P 500 index, net of a management fee of 1%, over the last decade:

Conclusion:

Cloning is not an end but the start of a process to find suitable investment ideas. Blindly cloning generally doesn't help. An investor must develop a strong reasoning before lapping up any stock.

Once again, it must be noted that cloning is not foolproof. There is no guarantee of success. Even after following the process, it is possible that an investor can generate negative returns.

Empirical market data has proved cloning to be a sound & successful strategy.Nonetheless, it remains quite unpopular in the present investor realm.