Some More (Mis)Use Cases

Although we have discussed a few misuse cases of blockchain, here are some more misuses cases surrounding travel, supply, shipping industries and more.

Travel on the Blockchain

The Amadeus IT Group, owners of Amadeus, the largest global distribution system (GDS) for airlines tickets worldwide, recently announced their foray into the blockchain space, stating that it would make travelling easier and streamline the process of making payments, verification of traveller IDs, luggage tracking etc. by reducing the intermediaries and settlement timing while increasing the overall flow transparency. Fast, secure and a simplified ID verification of travellers at every stage seems to be the primary use case for a blockchain.

The fallacy, once again, is that the blockchain is serving no real purpose, because this problem of ID verification at different stages can be solved simply by sharing pre-approved tokens access among the different entities constituting the value chain. It is very similar to the way when you login to many different websites using your Google login which involves no blockchain, because there is no decentralisation or consensus involved. If anything, it is the exact opposite.

Supply Chain on the Blockchain

Project Provenance Ltd. has built a blockchain platform Provenance—“a platform that empowers brands to take steps toward greater transparency by tracing the origins and histories of products. With our technology, you can easily gather and verify stories, keep them connected to physical things and embed them anywhere online.” IBM and Walmart have teamed up to launch the Blockchain Food Safety Alliance in China in conjunction with JD.com to improve food tracking and safety, making it easier to verify that food is safe to consume. Proper implementation of the ledger could also prove valuable for pharmaceutical giants, which are required by law to maintain the chain of custody over every pill. Skuchain and NTT Data announced their partnership in a blockchain supply chain venture.

These use cases would all suffer identical problems as those of tracking diamonds on the blockchain, especially the oracle problem, which occurs in linking a blockchain to real-word physical products. In any case, tracking of food or any other products in a supply chain, manufacturing process, or even couriers, amazon deliveries and Uber car arrivals are all done on simple online platforms using MIS, or any other basic data technologies at the back end. There is no need for any consensus and decentralisation here, and hence, this does not need a blockchain solution at all. The Walmart announcement, in fact, follows their previously failed attempt in 2006 to launch a system to track its bananas and mangoes from field to store, abandoned in 2009 due to logistical problems getting everyone to enter the data in the system. So what failed on account of data entry is highly unlikely to succeed just because you replace the previous database with a blockchain one.

Blockchain or not, any supply chain solution needs to meet two vital prerequisites — everyone’s participation in the chain, and honest participation at that. The garbage-in-garbage-out (GIGO) principle does not exempt the blockchain. GIGO states that if the quality of data fed to a computer is low, so will be the output. So, if the data being entered is not clean, blockchain in fact compounds the problem since the records are non-editable. Bottomline, it is the human element and compliance that is the bigger challenge in supply chains, not the technology.

Documents on the Blockchain

Bank guarantees are essential in sectors such as real estate, where they represent security for tenants’ leases, or where companies need to demonstrate that they can pay for expensive goods. However, bank guarantees can get mislaid, and clients may find the process of handling them to be too laborious and slow. This is why technology companies are now promising a solution in the blockchain—the Israeli lender Bank Hapoalim and Microsoft announced a collaboration on creating digital bank guarantees based on the blockchain technology. The new process will enable Bank Hapoalim customers to receive security documents in a digital, automated and secure manner, without physically coming to the branch and in a very short process.

This is a classic case of finding a complex solution to a simple problem — that of digitizing documents and signing them online. Several authentication apps for scanning and digital signing exist already. There is absolutely no decentralised consensus needed. A blockchain solution is just an overkill.

Shipping and Insurance on the Blockchain

Another announcement in the supply-chain space, EY has teamed up with Maersk and Microsoft on blockchain-based Marine insurance. When shipping goods from port A to port B, any number of things can go wrong: cargo gets damaged, a congested port delays docking, a storm throws a vessel off course, pirates raid a ship. So shippers buy insurance through a complex jumble of brokers and underwriters to manage the risk to their freight. Ideally, a Blockchain should be an absolute fit for this platform to function, as it will be able to guarantee that all parties - from shipping companies to brokers, insurers and other suppliers - had access to the same database, which could be integrated into insurance contracts.

However, in practice, the information flow and approvals are between a few entities (say the buyer, the seller and two or three banks in the above example). They can already achieve the same by digital signatures while sharing the documents through a digital platform (including a simple email server). No independent mining is needed, or can help in this case, hence a blockchain is certainly not the best solution.

The biggest challenge of a supplier faking an invoice, or taking multiple financings from different banks over single invoice, cannot be solved by blockchain either, unless all potential financiers become part of this network and mine/validate every single transaction; which is a big ask and is unlikely to work in the foreseeable future.

Also, shared databases like SQL and Oracle have existed for decades, and collaboration among different entities in the value chain for validation of such documents has also existed for a long time. If the validation of any documents and information is to be done by a few entities, access control-based data solutions can do the job just fine. Insurers would want to control this workflow and final approvals anyways. Hence, this does not need blockchain at all.

Governance on the Blockchain

Samsung’s win of a contract for a public sector blockchain for South Korea’s government to be put to use in public safety and transport applications, is unlikely to achieve its desired goal due to the two perennial bug-bears of all government processes—a centralised workflow and decision-making. In most scenarios, the functioning of a blockchain is the very antithesis of the working of a government, and a mating of these polar opposites remains a distant dream.

Media on the Blockchain

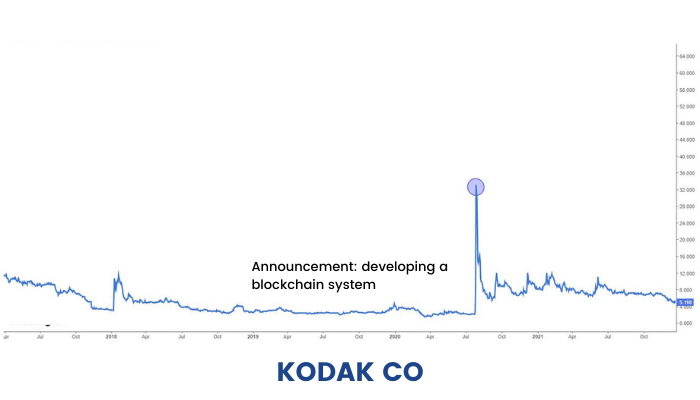

Kodak recently sent its stock soaring after announcing that it is developing a blockchain system for tracking intellectual property rights and payments to photographers. As one of the oldest names in the imaging business, it is leveraging the blockchain technology to fix problems that have been plaguing the photography industry. Kodak and WENN Digital joined hands to launch a blockchain-powered image rights management platform, dubbed as KODAKOne along with a photo-centric cryptocurrency, known as KODAKCoin. Kodak’s platform takes the whole photography and imaging industry to a new level with the features of distributed ledger technology like encryption, decentralization, immutability, transparency, and security being utilized to create a digital ledger of ‘ownership rights’ for photographers. The digital ledger will secure the work of photographers by registering work and then allowing them to license the same for use (buy/sell) within the platform.

However, the Kodakcoin concept can work only if the coin and the platform are driven by the community. But that will not help Kodak much, as it will not just decentralise itself away as a node. Given that Kodak is not likely to decentralise itself, this use case is only self-serving and the community shall not believe in it. Hence, the blockchain will be infructuous.