Trading with Moving Averages

Now that we have an understanding of the concept of moving averages from the last unit let us discuss how moving averages are used in technical analysis.

What are the uses of Moving Averages?

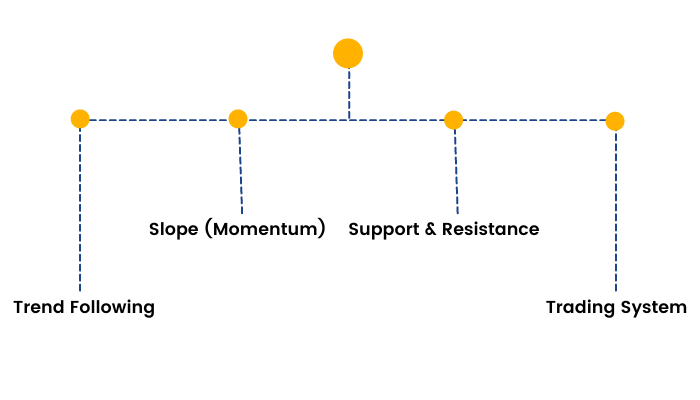

The following are some of the major uses of Moving Averages:

1. To identify support and resistance levels.

2. To quickly identify whether a security is moving in an uptrend or a downtrend depending on the direction of the moving average. When a Moving Average is heading upward and the price is above it, the security is in an uptrend. Conversely, a downward sloping moving average with the price below can be used to signal a downtrend.

3. Moving Averages also tells us the trend order. When a short-term average is above a longer-term average, the trend is up. On the other hand, a long-term average above a shorter-term average signals a downward movement in the trend.

4. Moving Average also helps in confirming the trend reversals. When the price moves through a Moving average or there is a Moving Average Crossover- It indicates a trend reversal.

For example, when the price of a security that was in an uptrend falls below a 50-period Moving average, it is a sign that the uptrend may be reversing.

5. Moving Averages help technical traders to smooth out some of the noise that is found in day-to-day price movements, giving traders a clearer view of the price trend.

Which time period Moving Average should we use?

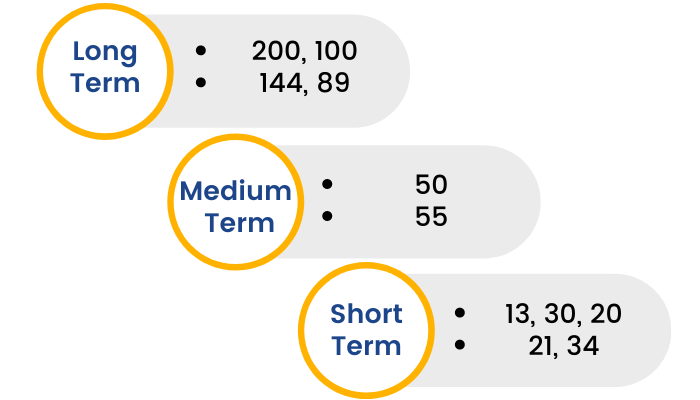

A moving average is a powerful tool for analyzing the trends in a security. We know that trends should always be specified with a timeframe.

Trend can be classified into:

- Long Term Trend: To depict the long-term trend traders use 200 period or 100 period Moving average. However, many traders also use 144 or 89 period moving average to identify long term trends.

- Medium Term Trend: To depict the Medium-term trend traders normally use 50 or 55 period Moving average.

- Short Term Trend: To depict the short-term trend traders use 13, 20 and 30 period Moving average. However, many traders also use the 21 and 34 period moving average to identify short term trends. Normally a 13 and 30 Moving average crossover for trend signals is used by many traders. To determine the trend order: 13, 21 and 34 is most commonly used.

BUY and SELL signals are given

- When the price crosses the moving average

- When the moving average itself changes direction and

- When the moving averages cross each other

Moving averages are popular technical indicators. However, it is a vast concept. It is briefly discussed in this section. But that's not enough! We have created a separate module only on Moving Averages. Follow this link to find out more.