Basics of Stock Market for Teenagers

Introduction

This module will introduce the basic concepts of the stock market. Age is just a number, so if you are a teenager or just starting your career and interested in learning the stock market dynamics. Yes, this module can be helpful for all of you and anyone eager to learn the basics of stock market. So let us start our journey to the stock market. The stock market is a part of our financial system in India. Therefore beginning with the concept of ‘The Financial System’ will be smarter.

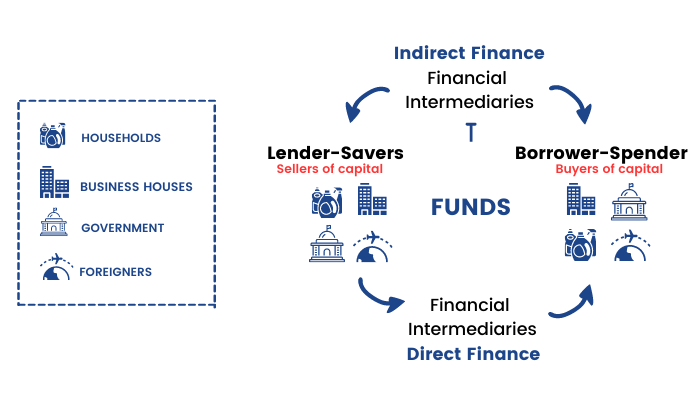

The Financial System

Financial market is a platform where buyers and sellers are involved in the sale and purchase of financial products like shares, mutual funds, bonds and so on. Alternatively, the financial market is a place where the savings from several sources are mobilized towards those who need funds. Buyers of capital and sellers of capital channelize money through various financial instruments. Understanding the basics of stock market helps in grasping how these markets function.

What Constitutes the Securities Markets in India?

There are three important elements constituting a Securities Market:

- Buyers of Capital

- Sellers of Capital

- Intermediaries

Buyers of capital: These are the people who constitute those set of people who are the net spenders in any economy. They take capital from the savers and utilize it. Example: Corporate houses, Government etc.

Sellers of capital: This class constitutes the group of people who are net savers. These are the people who are net providers of money to the people who need money. Example: Retail Investors, Big Investors like Rakesh Jhunjhunwala.

Intermediaries: These are the class of people who are the providers of finance to the spenders. They facilitate the movement of money from the savers to the spenders. The market mediators play an important role on the stock exchange market; they put together the demands of the buyers with the offers of the security sellers. A large variety and number of intermediaries provide intermediation services in the Indian securities markets. The banks play an important role as an intermediary in the securities market.

Unlock the secrets of the stock market with our 'Stock Market Made Easy' course. Enroll now and master the financial system!

We got a brief idea of the financial system from the above picture and the stock market is a part of it. So, in the next unit, let us first understand- What is a stock?

What Is a Stock and Why Is It Important?

Let us start this discussion with a few examples and analogies. Who do you think are the richest men in the world? Can you identify the two men in the image?

The 1st picture is of Mr. Bill Gates whose net worth is almost $113 billion and the second picture is of Mr. Warren Buffet whose net worth is approximately $159.7 billion as of May 2025.

This is a crazy amount of money! But the question is do they have this amount in their respective banks? Or Do they have these amounts in their houses, or lockers? The answer is Neither.

Bill Gates has billions worth of stock in Microsoft and other investments whereas Warren Buffet has put billion worth of stock in a company called Berkshire Hathaway.

We will understand the concept more clearly with an example of a company? Are you familiar with Domino’s Pizza?

We all Love Pizzas! Isn’t it? So, when we eat Domino’s pizza, we feel good. But have you ever thought, who owns Domino’s? The answer is any one of us can be an owner of Domino’s! But how do we do that.? We do that by buying or owning its company’s stock. Jubilant Foodworks is the master franchise owner in India for Domino’s Pizza. Domino's is one of the most important brands whose franchise is under the portfolio of the company Jubilant Foodworks.

When we purchase company stock we become owners in that company. So how much does it cost to become an owner of Jubilant Foodworks. Well the answer ₹694.20 ( as on date 20th May 2025)

There are 66.02 Crore shares which are held by various shareholders of this company.

Let’s understand its story in greater detail.

In 1960, Tom and James Monaghan founded ‘Dominik’s’ in Michigan. Later it was revamped to Domino’s. By the late seventies, there were over 200 franchise pizza businesses in the United States. And they were constantly expanding. The company opened the first Domino’s Pizza outlet in New Delhi, India in 1996. In the Indian subcontinent, Domino’s franchise is operated by Jubilant Foodworks Limited. Domino’s has enjoyed enormous success in India, and it has become its second largest market in the world after the US.

Quick service, offering local tastes like Peppy Paneer and Kebab, expanding menus , great offers and use of technologies have been the key variables of their success.

So What Does It Mean to Own the Stock of Jubilant Foodworks?

1.You own a percentage of the company.

2.You share a percentage of the company's profits.

Why Should You Own or Buy the Stock?

Stocks are nothing but an investment just like a home or an education is. If you buy a home for ₹10,00,000 and sell it in five years for ₹42,00,000, you have made a ₹32,00,000 profit on your investment. Similarly, if you paid ₹20,000 for college tuition and got a better job when you graduate the increase in your salary or higher education is the reward for the investment.

That's exactly why you would buy stocks as well, it's just the basics of stock market.

When you buy stocks, they can reward you by way of price appreciation and/ or Dividends.

What is Price Appreciation and Dividend?

You might buy a stock for ₹100 today and over the next five years the price of that stock would increase to ₹300 giving you a profit of ₹200 over that time period. This is price appreciation. Look at the chart below of Jubilant Foodworks as how the prices have appreciated over time. You can clearly see that price appreciates for stocks over the long run.

Alternatively, when you own stocks, as discussed earlier you are the owner of the company. So you have a share of the profits earned by the company.

So when a company decides to share a part of its profits to its existing owners or shareholders – it is known as dividends. Another term you learnt under the basics of stock market.

Dividends refer to the share of profit or retained earnings which are paid by a Company to its shareholders. The Company may decide to reinvest its profits in business as well without paying dividends. Dividends are decided by the board of directors of the company and it has to be approved by shareholders. Dividends are paid quarterly or annually.

So when you buy stocks you can earn by price appreciation as well as dividends.

Now that we have understood some basics of stock market. Next, we will discuss- What is stock market? in the following unit.

What is Stock Market?

When you hear the word market what's the first thing that comes to your mind?

Well maybe the vegetable market or the farmer's market. Yes, that's exactly what a market is. But why is it called the market? It's because it is a place where transactions take place for various products. You go there in order to be able to buy a certain product which is being sold by someone else.

The Stock Market is also like a farmer’s market where investors buy and sell shares, and other financial instruments instead of vegetables. There are buyers and sellers of various financial instruments and the stock market is the marketplace where this exchange of securities takes place at different prices. The price of each share of the company is determined by a constant bid and ask of what investors/traders value a company at. This trading is facilitated by stock exchanges.

There are two big stock exchanges in India:

- Bombay stock exchange (BSE) – Sensex is its Index

- National stock exchange (NSE) – Nifty 50 is its Index

Stock market index is another important concept under the basics of stock market and we will elaborate the concept in the next unit.

What is Stock Market Index?

There are thousands of companies listed on stock markets, making it almost impossible to monitor each company. This is why stock market indices are created which brings together a select group of company stocks and regularly measures them to show the performance of the overall market or a certain segment of the market.

Sensex is the oldest market index in terms of equities and also includes shares of 30 firms listed on the BSE. Sensex was first compiled in 1986.

There is Standard and Poor’s CNX Nifty index which includes 50 shares that are listed on the NSE. It was founded in 1996.

Overall, an index helps an investor to pick stocks faster, understand the health of the stock market, enables them to study the market sentiment, makes it easy to compare the performance of an individual stock and thereby overall aid in convenient passive investing.

An index reflects the general market trend for a period of time. It is a broad representation of the country’s state of the economy. Index is also used actively as a benchmark to judge the performance of various mutual funds, and investors.

Overall, an index helps:

- An investor to study various sectors,

- Understand the health of the market,

- Enables us to study market sentiment, and,

- Makes it easier for us to compare the performance of an individual stock with the market.

- Used as a hedging tool to hedge portfolios.

The criteria of stock selection can be based on the type of industry, market capitalization or the size of the company, price of the stock and any other feature.

Some of the notable indices in India are as follows:

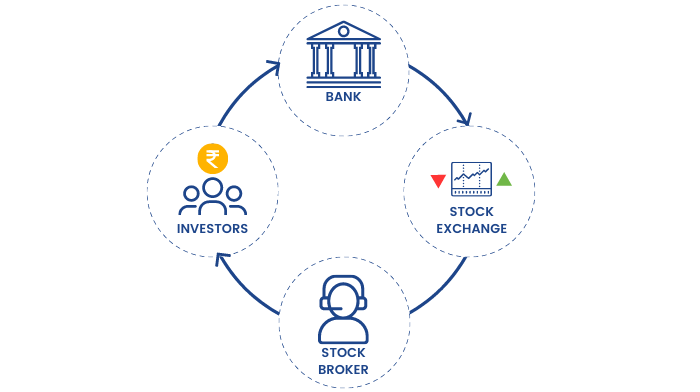

Who Are the Participants in the Stock Markets?

Earlier in the module, we have discussed broad categories of participants in the financial system. Similarly, there are different categories of market participants in the stock market that we will discuss in this section. So, let us begin:

Investors: An investor is the backbone of the capital market of any economy as he is the one lending his surplus resources for funding the setting up of or expansion of companies, in return for financial gain. Both of them are the most important participants in the stock market.

Investors in Stock Markets can broadly be classified into Retail Investors and Institutional Investors.

Retail Investors are individual investors who buy and sell securities (stocks) for their personal account, but how to select such stocks for investments? We will learn this in the next unit of our Basics of Stock Market for Teenagers module.

This category also includes High Net worth Individuals (HNI) which comprise of people with large personal financial holdings.

Institutional Investors comprise of domestic Financial Institutions, Banks, Insurance Companies, Mutual Funds and FII’s (Foreign Institutional investor is an entity established or incorporated outside India that proposes to make investments in India).

Clearing Corporation: A Clearing Corporation is a part of an exchange or a separate entity and performs three functions, namely, it clears and settles all transactions, i.e., Completes the process of receiving and delivering shares/funds to the buyers and sellers in the market, it provides financial guarantee for all transactions executed on the exchange and provides risk management functions.

National Securities Clearing Corporation Limited (NSCCL), a 100% subsidiary of NSE, performs the role of a Clearing Corporation for transactions executed on the NSE.

Stock Brokers and Sub-brokers: Stock Broker means a member of a Stock Exchange and Sub-broker means any person not being a member of Stock Exchange who acts on behalf of a Stock broker as an agent or otherwise for assisting the investors in buying, selling or dealing in securities through such stock brokers.

Depository: A bank or company which holds funds or securities deposited by others, and where exchanges of these securities take place.

Depository Participant (DP): The Depository provides its services to investors through its agents called depository participants (DP). These agents are appointed by the depository with the approval of SEBI.

According to SEBI regulations, amongst others, three categories of entities, i.e. Banks, Financial Institutions and SEBI registered trading members can become DPs.

How to Select Stocks for Investment?

After deciding to invest as a beginner in the stock market, it is time to learn how a first-time investor should start company analysis. And to choose the right stock for one self. How exactly we can track a company and its performance - what steps do we need to take, and the tools that can help us, these are the basics of stock market which need to be answered, before you enter into the field of investing in stock markets. So the first thing that is required is to choose stocks or companies, which you understand. Stocks which you can track in your day to day life. Say Domino’s which we discussed. We understand the concept and business of Domino’s and can relate to it.

However to get a proper structure, there are two ways you can select stocks for investment.

The 1st approach is known as the Top-Down approach. In this approach you select a sector and find out the best company in that sector. The 2nd approach is the Bottom – Up Approach where you select a company and then figure out which sector it belongs to and what kind of scope that sector has.

To choose the right stock, one has to understand the business of the company and understand the sector which the company belongs to. If the sector has potential to grow, the company will grow too.

Let's go back to the Domino’s and Jubilant Foodworks example.

So this company is mainly into delivering Pizzas. One can order sitting at home or workplace and can enjoy hot yummy pizzas. So now if you look at the sector and from the macro point of view, due to the pandemic, people will refrain themselves from going out to restaurants but still want to enjoy good food and pizzas, they will order food online. With the ease of technology and the service, people and especially millennials have resorted a lot to order food online. You need to look around the common things, lifestyle of people, economy and you get stock ideas from there.

"You only have to be able to evaluate companies within your circle of competence. The size of the circle is not very important; knowing its boundaries, however, is vital"- Warren Buffett.

As Warren Buffett, the world's most successful investor ever has said so often: "Know your circle of competence and stick within it." Let us understand the concept of 'Circle of Competence' in the next section of our Basics of Stock Market for Teenagers module.

Circle of Competence

Warren Buffet is considered as one of the most successful investors in the world. He is known as the father of investing. Many people around the world study his techniques, try to learn from him, and emulate his methods. One such method, and approach to select stocks which he uses and recommends is Circle of Competence. Let us learn about this concept under the basics of stock market.

What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital – Warren Buffet.

Your circle of competence with respect to investing defines your understanding about certain businesses. The businesses that you understand fall within the circle, and the ones you don’t understand fall outside it. Identify a company which is within your area of competence, whose business you understand, probably whose products you are using and you will be able to make a judgment on that company based on the product you're using.

A business will be ‘within’ your circle of competence if you fully understand the underlying economics of it:

- How does it work?

- What drives its growth?

- What makes it profitable?

- How does it stand against its competitors?

- How does it manage its raw material costs?

You need to have the answers to such questions.

As a newbie to investing you can start off with an exercise. Focus on your day to day activities. This way you can get into the habit of identifying the manufacturer of the product which you are using.

Example: When you get up early in the morning, what is the 1st thing you do? You brush your teeth. So the question is which toothpaste do you use? Say you use Colgate. So Colgate is listed on the stock exchange. So you have one stock to track for investing i.e. Colgate as it is in your circle of competence. You understand that every individual whether he/she lives in rural or urban India will brush their teeth. Know the price of Colgate toothpaste you buy. Know the prices of other company’s toothpaste too. Track the stock price of Colgate. So it becomes a natural process that once you start using a product your mind will start relating that product with the listed company associated with that product.

Join our 'Stock Market Made Easy' course and expand your investing circle of competence today!

Now that you have decided to invest in a stock, how do you analyze whether it is a good investment or not? So, in the next unit of basics of stock market we will learn how to analyze a stock.

How to Analyse a Stock?

Let us discuss this again with a few analogies and examples. Suppose you have a sister at home, and your parents want to search for an appropriate life partner for her. What are the things which you would be keeping in mind while taking up this task? When you look for a groom, you define a certain criteria for it. These criterias are based on your family, the bride to be and other priorities in life. Correct? and you evaluate the person on the basis of those criteria, to see whether the chosen man is good for your sister or not. For stock selection and investing also, we need to decide on certain criterias. If those criterias are fulfilled, then we consider it for investment.

When we look for a life partner, we look and we want to know certain things about him.

Things like his current financial condition, and what he earns and how much he can earn in the future. It's a simple thought. Now, if we apply the same things to a company, the thought process of evaluating a company becomes very simple.

To evaluate a company, we have to 1st evaluate its three financial statements.

- Balance Sheet

- Profit and Loss account

- Cash Flow Statement

What Is a Balance Sheet and What Does It Depict?

A balance sheet will tell us the current situation or the financial health of the Life Partner you want to choose.

What are his assets? Does he have a house to live in? Or the appropriate amount of money? What are his liabilities? Which assets does he own on EMI? What are the future liabilities if he starts a business? You will require a complete picture of his assets and liabilities to find out his current financial situation.

The same concept applies here. The balance sheet, another basics of stock market, helps us find out the current situation or the financial health of the company. The picture of assets and liabilities in the company will tell you about what amount of money the shareholders will get, if the company decides to liquidate.

This is also called the book value of the company.

What Is a Profit and Loss Account and What Does It Depict?

The Profit and loss statement answers some very important questions for an investor, when considered for investment. How much business is the company doing today? What is the cost of doing the business, and how much the company is earning from doing the business.

The P&L statement objectively gives us crisp information on:

- The revenue of the company for the given period (yearly or quarterly),

- The expenses incurred to generate the revenues,

- Taxes,

- The final earnings.

It helps a businessman to evaluate the performance of a company and provides a basis for forecasting future performance. The Profit & Loss account throws light on various business activities such as revenues and expenses, which is insightful in assessing the probability of a certain level of income in the near future.

When we compare it to our analogy of finding a suitable groom, you need to know what is the boy earning today, whether in salary or a business, and what does he save?

What Is the Actual Income?

Earnings are an important criteria which everyone has to evaluate. Knowing a company’s earnings is a key step in the basics of stock market investing.

What Is a Cash Flow Statement and What Does It Depict?

As part of understanding the basics of stock market, it's essential to know how a cash flow statement works. As part of our previous example, apart from the earning, or salary of the boy, the question arises as to how much cash is he bringing home? This means that the profit and loss statement shows us the earnings the company is making during a particular period but when we see the cash flow statement, we understand whether the company is earning via selling on credit or not, how much payment is outstanding? What is the net cash in hand which the company has, at its disposal. These pointers are reflected by the cash flow statement.

To evaluate the financial health and the performance of the company, these three financial statements are extremely important. They form a core part of the basics of stock market analysis.

Importance of Management

Another important aspect to be seen is knowing the future earning potential of the company. The management of the company tells us about how good the future outlook of the company is. How do they see the business outlook and performance of the company in the coming days? What may be the challenges? And what are the growth prospects of the company?

Today you can estimate that everything is going well, but periodically, you have to meet and ask the company management if everything is going well or not. This happens when the quarterly results are released, the company declares results every 3 months,the company, along with its results, tells us about its current situation, about what's going on now, and what does the future hold.

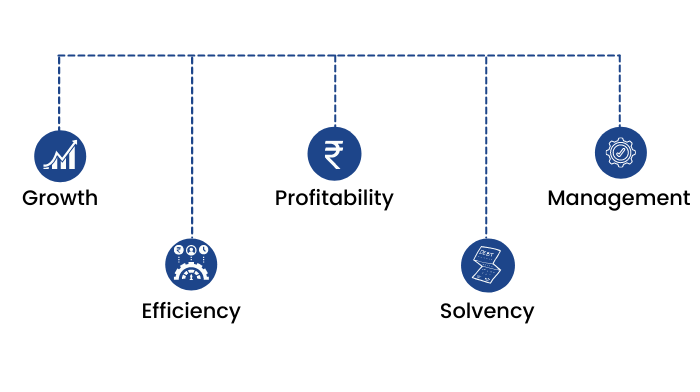

Broad Parameters to Invest in a Stock

In this section, learn other basics of stock market by understanding how to research and evaluate stocks before investing. There are five broad parameters to look at while taking up the decision to invest in a stock.

- Growth: Understanding the basics of stock market involves evaluating whether the company is growing in terms of revenue in terms of profitability in terms of scale of operation, all these factors contribute to an important decision making for investment.

- Efficiency: Growth should always be accompanied with efficiency. A healthy growth can be witnessed only if efficiency is there. Efficiency could be the efficiency to collect the money from its debtors, efficiency to use its assets and manpower. Efficiency could be applied at all fields.

- Profitability: The third important criteria to be studied would be profitability. One has to check, is the company making profits? Is the profit getting converted into cash or not? Is the profit being utilised for further growth and expansion ?

- Solvency: Solvency, a key concept in the basics of stock market can be an important measure of financial health of the company. It is a way of understanding a company’s ability to manage its business operations into the foreseeable future. Whether the company is in a position to repay all its debts during the course of time, is the company generating enough cash flow to pay off their liabilities- will tell us about the solvency status of the company.

- Quality: One of the key aspects to understand in the basics of stock market investing is evaluating the quality. By Quality I mean the quality of the management who are actually running the business. The core team , the decision makers of the company. Are they efficient enough in running the company for you to put your hard-earned money into this company?

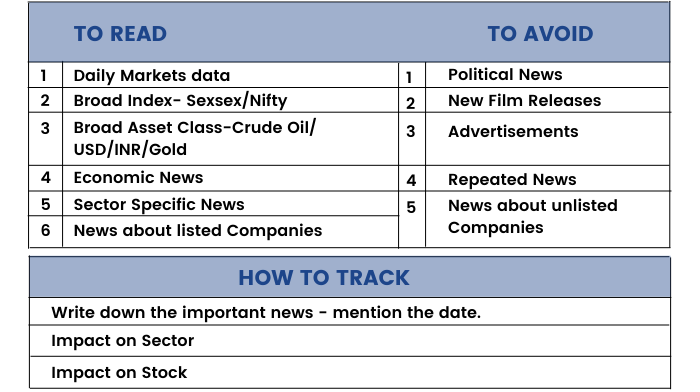

Read the Business Newspaper

When you start your career in financial markets, the first thing recommended by all mentors and market experts is to read the Pink paper. You should be reading the business newspaper. This habit forms an essential part of learning the basics of stock market. At first, It will be just numbers, loads of articles and a complete plethora of information which might be difficult to understand and relate as how this data can be used to predict the financial market.

It may seem that research by reading a newspaper is more backward looking rather than predictive. It shall give insights and news on what has happened already. What is going to happen in the future – That information may be absent while reading the newspaper.

The take away from this is that when you start to read the financial journal regularly, it helps you build a strong foundation in the basics of stock market. You would realise that you are up to date with what is happening in the corporate world and the capital markets. It will help you have an edge over your friends. Moreover you can definitely impress people in any group discussions or social gatherings. We all read newspapers in different styles. There are people who read the newspaper from start to end from word to word as “Reading is definitely easier than critical thinking”.

On the other hand there are people who read many newspapers in a very short time. The point is, it’s not only important for every financial market participant to read but also judge and filter what is important and has relevance and rest to move on . To do this skilfully we should always ask three questions.

1. Is the article based on opinion or facts?

2. Does the article talk of what has already happened in the past or does it predict the future?

3. Will the article have a long term or a short term impact on any Asset class?

To make this task more organised, we can divide the newspaper into a few broad categories, and classify which news to read and which news are the ones, we can avoid.

How to Track the Market?

Now that we have understood how important investing is for all of us, and how we take decisions to support our investment activity, we need to have proper resources or infrastructure to carry out our decision making.

Listed below are some good websites which can help you track the markets.

1. www.stockedge.com

2. www.nseindia.com

3. www.bseindia.com

4. www.moneycontrol.com

5. www.finance.yahoo.com