Financial Institutions

As we have learned earlier, a financial system consists of several financial institutions such as banks, etc. Financial Institutions are intermediaries between lenders & borrowers of capital. They bridge the gap between investors (savers of capital) and companies & Governments (borrowers of capital) through several financial instruments.

The four major types of financial institutions are:

- Banks

- Investment Companies

- Insurance Companies

- Broking Firms

Let us discuss each one briefly:

Banks

Banks are a very important part of the economy because they provide vital services for both consumers and businesses. They are financial institutions licensed to receive deposits and give loans. They also provide financial services such as wealth management, exchange of currency, locker services, and many more. There are several different kinds of banks like retail banks, commercial or corporate banks, and investment banks. In India, banks are regulated by the central bank - RBI.

You can read more about them in our Banking Module.

Investment Bank

Investment banks or Merchant Banks specialize in providing services designed to facilitate business operations, such as capital expenditure, financing, and equity offerings, including initial public offerings (IPOs). They commonly offer brokerage services to investors, act as market makers for trading exchanges, and manage mergers, acquisitions, and other corporate restructurings. JP Morgan, Goldman Sachs, Morgan Stanley, Citi Bank, Nomura, Macquarie, etc are a few globally reputed Investment Banks with operations in India.

Insurance Companies

The insurance companies offer risk management in the form of insurance contracts. The basic concept of insurance is that one party, the insurer, will guarantee payment for an uncertain future event. Meanwhile, another party, the insured or the policyholder, pays a premium to the insurer in exchange for that protection on any uncertain future occurrence.

Allianz SE, AXA, Prudential Life, Nippon Life, and MetLife are some of the biggest insurance companies globally. However, the Indian market continues to be dominated by The Life Insurance Corporation (LIC).

Broking Firms

Broking firms bring buyers and sellers together at the best possible price and extract a commission for their services. Apart from Broking, Wealth Management, and Financial advisory services are the niche services of broking firms. It acts as an intermediary between the market participants & the stock exchange. Zerodha, Upstox, Kotak Securities, Motilal Oswal, and Sharekhan are some noteworthy broking houses in the country.

Let’s discuss some common terminologies related to Account opening in a brokerage firm.

Trading A/C: It provides a platform where users can electronically buy and sell different financial assets like stocks, bonds, commodities, and currencies. The stockbrokers facilitate the opening of trading accounts. One cannot trade directly on the exchange. It has to be done via SEBI registered brokers. It allows you to trade in multiple stock exchanges simultaneously.

DEMAT A/C: A Demat account is a place where shares are kept safely in electronic form. The Demat account acts as a librarian. It maintains all the records of financial securities and is stored electronically. For this service an account maintenance fee is charged known as annual maintenance charges (AMC).

POA: In general terms, POA (Power of Attorney) is a legal document that enables a person to make decisions and take actions on your behalf.

In the stock market, Power of Attorney is a document signed between the client and the brokerage firm. POA document gives limited authority to the stockbrokers to sell shares in the stock exchange from the client’s Demat account. But recently, there were several instances of stockbrokers trading through the clients' accounts without their consent. So, the market regulator SEBI issued new guidelines for POA; now, a broker's authority is only limited to the transfer of securities & funds from clients' Demat and bank accounts.

BSDA: A basic service Demat Account (BSDA) is a type of Demat account, which is intended for small investors.

The charges to maintain this account are lower than normal Demat A/C.

This was introduced in 2012, as SEBI felt the majority of the investors were using the account very little but still were paying high maintenance charges.

An investor cannot have both regular and BSDA accounts open at the same time.

The limit for investment value in this account is ₹2 lakhs for BSDA in case it exceeds the amount, the brokers can charge as high as normal Demat A/c.

E-KYC

KYC stands for ‘Know your customer.’

To open a trading account with a SEBI-registered intermediary, one has to submit personal details, which will then be verified by the intermediary. It is done to prevent frauds such as money laundering and customer fake accounts.

The KYC process necessitates the following documents:

After the details have been verified by the intermediary, an account with a broking firm can be opened.

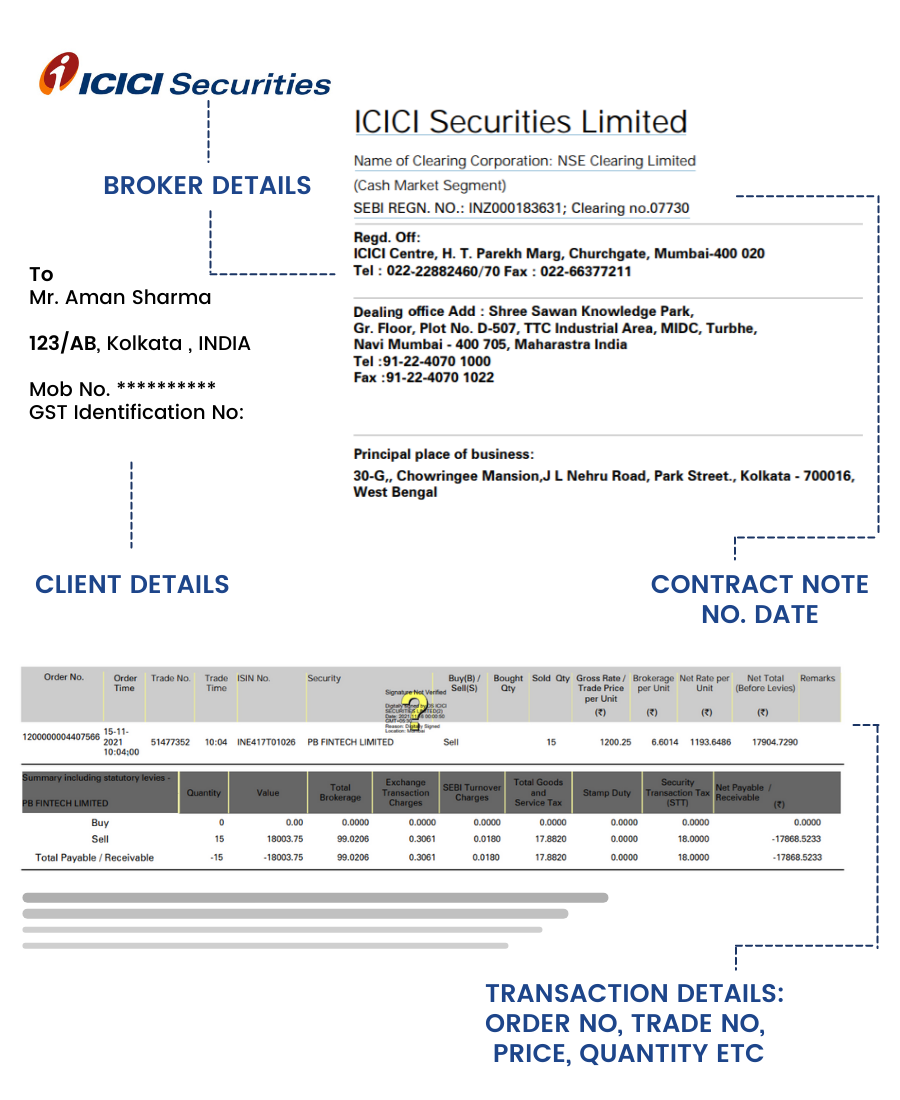

Contract Note: Contract notes are one of the most relevant legal documents available to market participants in the stock market. This is because it records all the necessary details with respect to the transaction undertaken and also all details about the profit and loss incurred. It records all the transactions or trades on a particular day, brokerage fee and taxes. It is basically a reference point for clients to see their trades and get all the information at one place like date, period, size; quantity exchanged, etc. It also mentions a reference number that can be used to cross-check transaction information with the stock exchanges. The contract note is in a standardized format which is prescribed by the stock exchange.

The following details are mandatory to be in a contract note.

- Name, address, and SEBI Registration number of the stock broker.

- Authorized Signatory for the stock broker.

- PAN of the stock broker.

- PAN of the Investor.

- The Contract note number, date of issue , the settlement number, and the period for settlement.

- The order number and time

- The trade number and time.

- The quantity and details of securities bought/sold

- The trade price and the brokerage

- Service tax rates and any other charges.

- Securities Transaction Tax as applicable.

- Authorized Signatory’s signature of the stock broker.

Note: DP Charges, margin details, and outstanding positions of the client don’t reflect in a contract note.

Margins: Margin Trading is a form of loan by the broker to the client to buy securities in excess of his account balance. For example, XYZ Broking Firm offers its clients a 3X margin on delivery trades. This means that an investor can purchase stocks worth ₹300 with an actual account balance of ₹100. Needless to say, the broker charges a nominal interest rate for this facility.

Pledging: Simply put, pledging of securities refers to mortgaging financial securities such as stocks, bonds, debentures, etc. Traders pledge their stock & ETF holdings to receive margin funding from the broker. The investors are entitled to all corporate benefits such as dividends, right issues, etc on their shares while they remain pledged.