Portfolio Risk

Some of the primary aspects to take care of while creating a portfolio are risk and return. Not only do risk and return of individual assets make a significant impact on a portfolio, but the correlation between all of them is also equally important. A portfolio that can maximize return by undertaking minimum risk is known as an ‘Efficient Portfolio’.

Let us understand each of them and see how it is relevant to portfolio management:

Portfolio Risk

Portfolio risk is the probability that the assets within a portfolio will not produce the desired returns or fail to meet an investor’s financial objective. Each asset within a portfolio, irrespective of what they are – shares or bonds – carry a certain amount of risk.

We know you must be thinking how can bonds be risky, aren’t they safe? The key is to remember that they have less risk, but still, they are not risk-free. To understand more about the debt market and risk, you can read our module on the Debt Market.

Risk is a very important aspect associated with portfolios.

Portfolio risk can be reduced through diversification, which has been discussed in detail in section 7 of this module.

Concept of Portfolio Beta

A portfolio beta calculates the volatility of a portfolio against the benchmark index. In other words, Beta is the sensitivity of an asset’s returns to the return on the market index. Beta is measured on a scale against a benchmark.

The beta of the market index i.e., the benchmark is 1.

A beta of more than 1 means that the security is more volatile compared to the index. Put another way, A beta of 1.5 indicates that if the index rises/falls by 1%, the stock is expected to rise/fall by 1.5%.

Similarly, a beta of less than 1 means the security is less volatile compared to the index.

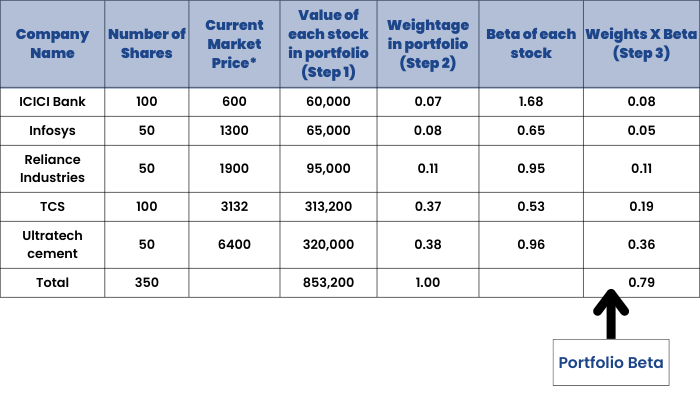

Portfolio beta calculation

The beta of a portfolio is measured by measuring the volatility of each asset in a portfolio. It can be simply calculated by adding up the beta of each asset and adjusting it to the weights of each asset in the portfolio.

Steps to calculate portfolio beta

Beta can be calculated by following these four steps:

Find the value of each stock in your portfolio – Number of shares X share price

- This value will give you the weight of each asset in your portfolio – The value of individual shares/total value in the portfolio

- Multiply the weight of each asset (arrived at step 2) with the individual asset’s beta. You will arrive at the weighted beta of each asset.

- Add the individually weighted beta to arrive at the portfolio beta.

So, our portfolio’s beta is 0.79 which goes to show that it is less volatile than the market.