Efficient Markets, Random Walks And Bubbles

The theory that financial markets are very efficient, forms the basis for arguments against the idea that markets are vulnerable to excessive exuberance or bubbles. Financial assets are always priced correctly, at all times. Price may appear to be too high or too low at times, but according to efficient market theory, this appearance must be an illusion. Price changes are unpredictable as they occur in response to new information, which by the very fact that it is new is unpredictable.

BASIC ARGUMENTS THAT MARKETS ARE EFFICIENT AND THAT PRICES ARE RANDOM WALKS

The term efficient markets first became widely known through the work of "Eugene Fama" and his colleagues. "George Gibson" had written in his book that when shares become publicly known in an open market, the value which they acquire may be regarded as the judgement of the best intelligence concerning them. The efficient market theory has been commonly used to justify elevated market valuations, for example, the 1929 stock market peak. It is difficult to make a lot of money by buying low and selling high in the stock market. The impact of smart money as claimed by the efficient markets theory, is to drive asset prices to their true values. They would be buying under-priced stocks and consequently tending to bid their prices up.

REFLECTIONS ON "SMART MONEY"

The efficient markets theory holds that differing abilities do not produce differing investment performances. It claims that the smartest people will not be able to do better than the least intelligent people in terms of investment performance. According to this theory, there can be no such profit opportunity for smart money. Effort and intelligence mean nothing in investing. The smartest money has already mostly taken over the market through its profitable trading and has set the prices correctly. Another explanation in support of the efficient markets theory is that professional investors, institutional money managers or securities analysts do not seem to have any dependability to outperform the market as a whole. The reason that stronger evidence has not been found to prove that people who are smarter tend to make more money is because there is no good way to measure how smart the investors are. Though from the available evidence, we can say that smart people will, in the long run, tend to do better at investing.

EXAMPLES OF "OBVIOUS MISPRICING"

Despite the general authority of the efficient markets theory, one often hears examples that state the opposite. Recently many of these examples have been Internet stocks: judging from their prices, the public appears to have an exaggerated view of their potential. The valuation the market places on stocks appears ridiculous to many observers and yet the influence of these observers on market prices does not seem to rectify the mispricing. The investors in these stocks do not think clearly about long-run investment potential.

QUESTIONING THE EXAMPLES OF OBVIOUS MISPRICING

Despite the apparent obviousness of some examples of mispricing there are those who question the examples. Siegel mentioned a list of fifty stocks that were apparently called the "Nifty Fifty" as early as 1970. These were glamorous stocks for which people had high expectations and that traded at very high price-earnings ratios. Analyses by Siegel and Garber impugn some of the popular examples of irrational prices in speculative markets. If one considers the top twenty-five firms in the Nifty-Fifty when ranked by the price-earnings ratio these firms are still underperforming the market. Siegel himself does not claim that his evidence suggests that all prices are right, and argues that today many internet stocks have indeed become overpriced.

STATISTICAL EVIDENCE OF MISPRICINGS

There is no shortage of evidence that firms that are "overpriced by conventional measures" have indeed tended to do badly later. There is a sort of regression to the mean for stock prices. These findings have developed an approach to the market called "value investing". Value investors buy under-priced assets and bid up their prices. They also divert demand away from overpriced assets. Their strategy is to pull out of overvalued individual stocks but not out of the overvalued market as a whole.

EARNINGS CHANGES AND PRICE CHANGES

Stock prices approximately track earnings over time - that despite great fluctuations in earnings, price-earnings ratios have stayed within a remarkably narrow range. There have been only three bull markets (periods of sustained and dramatic stock price changes) until now:

a)bull market of the 1920s terminating in 1929.

b)bull market of the 1950s and 1960s.

c)the bull market from 1982 to the present.

The first bull market was a period of rapid earnings growth. In terms of overall economic growth, the 1950s were a little above average. In the third bull market, price earnings were not viewed as a simple reaction to earnings increase.

DIVIDEND CHANGES AND PRICE CHANGES

Some economists claim that there is a good relation between real stock price movements and real dividend movements. Stock price movements cannot be considered to have been caused largely by the speculative behaviour of investors if they correspond to dividend movements. In Kenneth Froot's theory, stock prices overreact, in a certain sense, to dividends, but yet there are no profit opportunities for trading to take advantage. Co-movements between real prices and real dividends is the response of the latter to the same factors - that irrationality influences prices. They are both determined by fashions and fads.

EXCESS VOLATILITY AND THE BIG PICTURE

Anomalies discovered within the efficient markets theory include the January effect, the small-firm effect, the day-of-the-week effect and others. Miller states that we abstract from all these theories because they distract us from the pervasive market forces that should be our foremost concern.

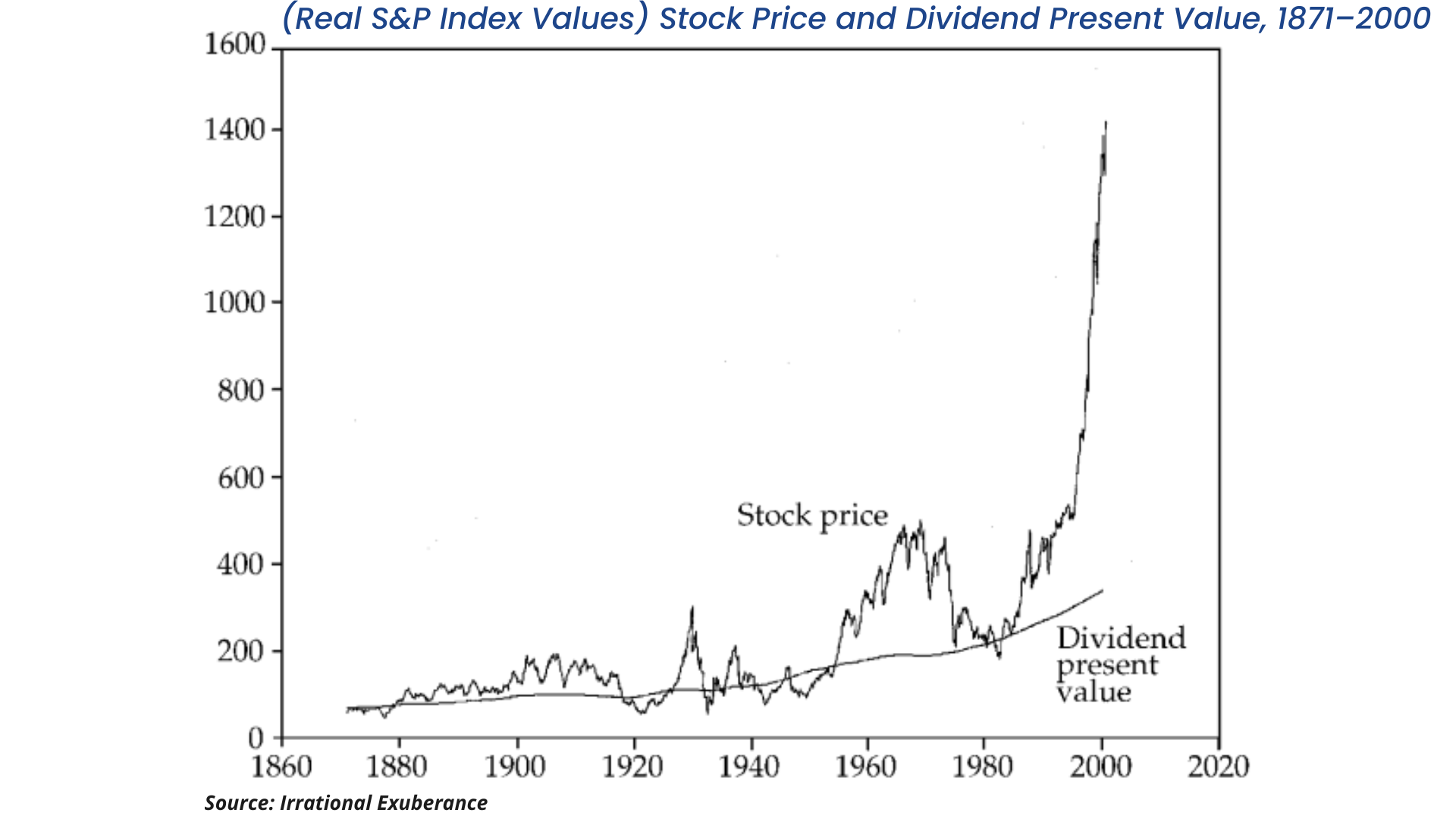

If stock price movements are justified in terms of future dividends that firms pay out, then under efficient markets we cannot have volatile prices without having subsequently volatile dividends. An updated version of the S&P Composite Stock Price Index showing both the stock prices and the dividend present value are shown above.

Stock prices seem to be too unstable to be considered in accord with efficient markets. By considering the above figures, we learn that the interpretation given in the media for stock market fluctuations in terms of the outlook for the short-run business cycle is generally misguided. A substantial fraction of the volatility in financial markets is probably justified by news about future dividends on earnings. Excess volatility due to speculative bubbles is one of the factors that drive speculative markets.

THE GRAPH UPDATED

One interpretation of the above graph is that the sudden spike represents the "big, rare event" that might finally reconcile the efficient markets theory with this data. But it would have to be a sudden sharp spike in the dividend series, not the price series to suggest such a reconciliation.