Hybrid Mutual Fund

Previously we have learned what Equity and Debt mutual funds are, right? Let us now discuss what Hybrid mutual funds are? As the name suggests, it is nothing but the combination of both Equity and Debt mutual funds.

Hybrid mutual funds aim to seek a balance between risk and return and hence invest in both equity and debt investments.These mutual funds are also called Balanced funds. The ratio of debt and equity depends on the investment objective of the fund. Based on an investor’s preferences and risk profile, a variety of hybrid funds are available in the market.

How Does a Hybrid Fund work?

The main objective of a hybrid fund is to have a balanced portfolio. The fund manager invests in a variety of financial instruments in varying proportions and carries out rebalancing at regular intervals to achieve the investment objective.

Who is it Ideal For?

Hybrid funds are less risky than equity funds, yet they generate more returns than debt funds. Hence, they are quite popular among conservative investors who seek to achieve a balance between risk and return. Moreover, they are known for producing stable returns over some time.

Types of Hybrid Funds

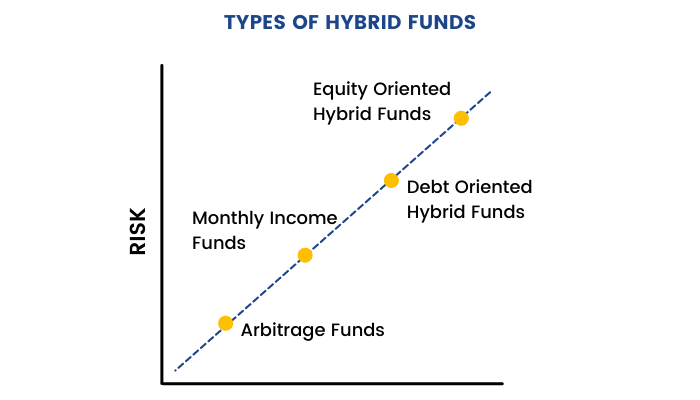

Based on whether more funds are allocated to equity or debt, Hybrid funds can be of various types:

Equity-oriented Hybrid Funds

Equity-oriented hybrid funds invest more than 65% of their assets in equities and the rest in debt and money market instruments. The equity portion can be invested in companies of any sector and any market capitalization.

Debt-oriented Hybrid Funds

These hybrid funds invest more than 65% of their assets in different kinds of fixed-income instruments such as government bonds, corporate bonds, treasury bills, debentures, etc. In addition, somepart is also invested in cash and money-market instruments to maintain the liquidity of the fund.

Monthly Income Funds

Monthly income funds aim to generate regular income by investing 15-20% of their funds in equity instruments and the rest in debt instruments. The regular income is generated through dividends from the equity instruments.

Please note: Although they are called monthly income funds, they may not necessarily generate monthly income. Moreover, they also have a growth option where an investor can choose to grow their money rather than withdraw regular income from the investment.

Arbitrage Funds

Arbitrage funds try to benefit from arbitraging – buying in one market at a lower price and selling in another at a higher price. However, arbitraging opportunities are not easy to find. In the case they are not available, these funds invest in debt instruments or cash. Arbitrage funds have been discussed in detail in the upcoming chapter of this module.

Explore the essence of benchmarks and their crucial role. Dive into our Masterclass on Advanced Commodity & Currency: Forex Trading Course now

Things to Consider with Regards to Hybrid Funds

If you want to seek a balance between risk and return, hybrid funds may be a good idea for you. Here are a few things to consider while investing in hybrid funds:

Risk factor: Hybrid funds have varying risk profiles. Equity-oriented hybrid funds are riskier than debt-oriented funds.

Return: Different hybrid funds generate different kinds of returns. So this is an essential factor to check before investing.

Investment Horizon: Typically, hybrid funds have a medium-term investment horizon of 3 to 5 years.

Tax on Gains: It is essential to know the tax implications while investing in hybrid funds. The equity component is taxed as per equity taxation rules, while the debt component is taxed as per debt taxation rules.