Options For Investing In Gold

When we think of gold, mostly we think of buying the yellow metal in its physical form. But that’s not all. Today, an investor has a world of options for investing in gold. Here are the most common ones:

Physical Gold

Commonly known as gold bullion, one can purchase physical gold in a variety of forms – jewellery, coins, bars and others. Gold can be bought from a jeweller, a bank or any other authorized dealer. This is the most popular form of investing in gold across the world.

However, buying physical gold is quite inconvenient since the initial investment amount can be quite high (because one has to buy at least 1 gm of gold) and the investor has to arrange for its storage and safety.

Pros: Direct ownership of gold

Cons: May incur extra cost for storage and insurance

Gold Exchange Traded Funds

Gold exchange-traded funds (ETFs) are popular and cost-effective methods of investing in gold. ETFs are funds which represent the prices of an underlying asset – in this case, gold.

They are bought and sold in a stock exchange (BSE or NSE) and can be purchased with a relatively low investment. Over the last few years, Gold ETFs have become a very popular form of investment, mainly due to the ease of buying and selling.

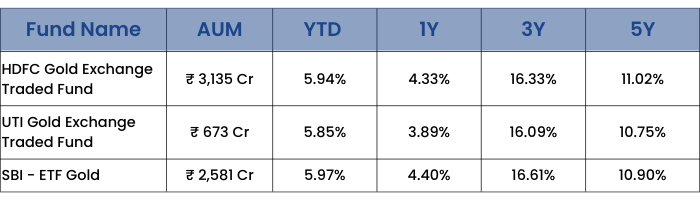

In India, there are many gold ETFs which have given significant returns to investors. Here are a few popular ones:

Data as on June 2022

Pros: Convenient. No need to visit a store to buy or sell.

Cons: The investor is not the direct owner of gold.

Gold Futures & Options

A future is a contract between a buyer and seller to buy/sell a certain asset on a previously decided price at a future date. In the case of gold futures, the underlying asset is gold. In a gold futures contract, a buyer and seller decide to buy and sell gold at a certain price on a future date. You will usually find three future dates for such contract execution at any point of time in the market – at the end of the first month, second month and third month.

Options are contracts, just like futures. However, the parties in the contract do not have the obligation to buy or sell the asset at the end of the contract period which means the asset may or may not be bought and sold upon contract expiry. Gold options are used as a hedge against gold price fluctuations.

Investing in gold futures and options requires more understanding than investing in bullion or ETFs and hence is usually the forte of expert traders. Chicago Mercantile Exchange in the USA is the world’s largest exchange of gold futures and options trading. In India, gold futures and options are traded in Multi Commodity Exchange (MCX).

As on 13th October 2020, 1 gold futures was trading on the MCX exchange with expiry on 4th December 2020. The price was ₹ 50,373.

Pros: No hassle of storage of gold and transportation. Can be very profitable.

Cons: Complex product structure. Needs expertise to trade.

Shares of Gold Mining Companies

Another great way of investing in gold is purchasing shares of gold mining companies. These work as normal share investment. An investor can make a profit when the share prices go up. Like all other companies, mining companies also declare dividends, which can be an additional source of income to the investors.

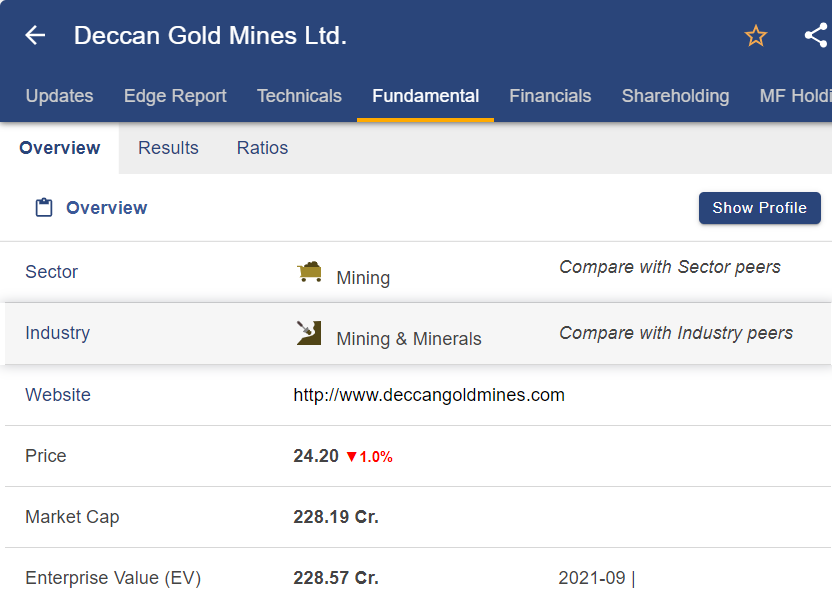

As of June 2022, only one gold mining company in India is publicly listed – Deccan Gold Mines Ltd.

Source: web.stockedge.com

Pros: Not many options of gold mining company shares available to invest in India.

Cons: Can be traded like any other share. Hence, no extra knowledge is required to trade.

Gold Mutual Funds

If you want to invest in a combination of some of the options mentioned above, you can choose to invest in a gold mutual fund. Depending on the fund type, gold mutual funds invest in a combination of gold investment options. They work like normal mutual funds and can be purchased based on their net asset value.

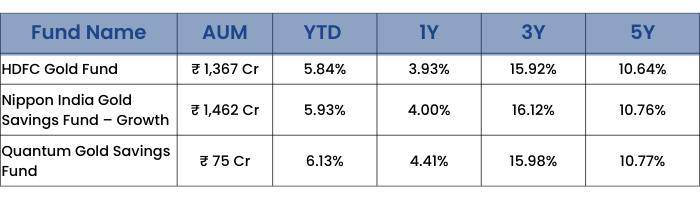

Here are some of the most popular gold mutual funds available in India as of June 2022.

Pros: Ideal for investors who want to participate in the gold price movement but are not aware of how to go about it or do not have a Demat account.

Cons: Costs slightly higher than ETFs

Sovereign Gold Bonds

These are paper gold bonds issued by the Reserve Bank of India on behalf of the Government of India. They were first launched in 2015 as an alternative to investing in physical gold and a method to encourage people to inculcate the habit of investing. Once issued, these bonds are available in the secondary market for buying and selling.

Sovereign Gold Bond 2020-21 Series – VII was open for investment from October 12 to October 16, 2020. The issue price was ₹ 5,051/- ₹ 5,001/ for online investments. An investor could buy minimum of 1 gram and maximum of 4 Kg. The interest rate was 2.50%.

Pros: Safest way to invest in gold since it provides a fixed interest rate to the investors.

Cons: Since the interest rate is pre-decided, an investor cannot participate in the volatility of gold prices.