Get Rich with Dividends

Introduction

About the book

Get Rich with Dividends by Marc Lichtenfeld (author) is the best-selling dividend-investing book that shows investors how to achieve double-digit returns using a time-tested conservative strategy. The book is a priceless guide that shows you how to set up your investments for minimal maintenance and higher returns, so you can accumulate wealth while you focus on the things that matter to you.

It describes a framework that allows investors to reap higher returns with a low-to-no maintenance plan.

- Set up an investment system that requires little to no maintenance

- Achieve double-digit average annualized returns over the long term

- Focus on other things while your money works for you

- Increase returns even with below-average growth in share price

About the author

Marc Lichtenfeld is the Chief Income Strategist of The Oxford Club. A featured speaker at investment conferences and has spoken about dividend investing all over the world. Marc is often featured on national media. He appears regularly on CNBC, and his work has appeared on WSJ.com, Marketwatch, and U.S. News.

Buy the book

This book teaches you to discover the keys to identifying quality dividend-paying stocks so that you can accumulate huge wealth by taking a conservative approach towards the market. We highly recommend you to read the entire book. (affiliate link)

Why Dividend Stocks?

This book is for people who already know how to save money and are trying to make that money work as hard as they can.

Start saving today! Try to save at least 10% of your income, as recommended in the book 'The Richest Man in Babylon'.

Dividends can be reinvested to compound annual returns year-over-year.

You need to know which types of dividend stocks to buy in order to achieve the maximum returns.

The 10-11-12 System:

The 10-11-12 system is designed so that in 10 years, the investor will be generating 11% yields, and will have averaged a 12% annual return on the portfolio.

Example stock referenced: Southern Company (NYSE: SO)

What Is A Perpetual Dividend Raiser?

Typically, a company with an established trend of increasing its dividends will raise them again next year, and the year after unless it becomes impossible to do so.

Lists of dividend raisers:

- Dividend Aristocrats

- Dividend Champions

- Dividend Achievers

- Dividend Contenders

- Dividend Challengers

Dividend Aristocrats:

The bluest of the blue chips. Roughly 50 stocks qualify in a given year.

Four criteria of a dividend aristocrat:

- Be a member of the S&P 500 index

- Have increased its dividend every year for at least 25 years in a row

- Have a market capitalization of at least $3 billion

- Trade a daily average of at least $5 million worth of stock for the prior 6 months

Example stock referenced: Genuine Parts Co. (NYSE: GPC)

At the time of publication, GPC has increased its dividend every year since 1956.

Four companies were added to the Dividend Aristocrats Index in 2013 and one was removed:

- AbbVie Inc (NYSE: ABBV)

- Cardinal Health (NYSE: CAH)

- Chevron Corporation (NYSE: CVX)

- Pentair (NYSE: PNR) [has since been removed]

- Removed: Pitney Bowes (NYSE: PBI)

Dividend Funds:

- At the time of publication, the only fund that tracked the dividend aristocrats index was the ProShares ETF (NASDAQ: NOBL)

- SPDR S&P Dividend ETF (NYSE: SDY) tracks the high yield S&P high yield aristocrats index, consisting of the 60 highest yielding members of the S&P Composite 1500.

The author did not recommend investing in these funds at the time of writing [2014]. Because there is no guarantee the fund will replicate the performance of the index or whether the dividend will consistently increase.

In many cases, you can find higher yields in individual stocks compared to ETFs.

Note, just because a company is on the aristocrat list does not mean it has an attractive dividend yield. This is obviously dependent on the purchase price of the stock.

Example: Sherwin-Williams (NYSE: SHW) has raised its dividend for 42 consecutive years but only yields 1% (depending on purchase price).

Dividend Champions:

The Dividend Investing Resource Center maintains a list called the Dividend Champions, you can download the latest version in excel or PDF formats here. The list is updated monthly.

Champions are also companies that have raised their dividends for 25 years, but are not a part of the S&P 500 and have no liquidity or other restrictions.

Example Comparison:

- Challenger: Tompkins Financial Corporation (NYSE: TMP) has a market cap of $800M and an average trading volume of 50,000.

- Aristocrat: Kimberly-Clark Corporation (NYSE: KMB) has a market cap of $46B and an average trading volume of 2.4M.

The champions list includes all of the aristocrats and typically has twice as many stocks as the aristocrats.

Some stocks on the champions list offer benefits to individual investors that may not be attainable by professional money managers.

- Some companies are small, so an institutional investor would not be able to buy stock without moving the price considerably.

- The manager might have a tough time selling the stock because of liquidity issues.

- Example: California Water Service Group (NYSE: CWT), trades fewer than 140,000 shares per day.

An individual has more flexibility than the money manager with millions to invest.

Dividend Achievers (think of them as Junior Aristocrats):

- Stocks that have raised their dividend for 10-24 consecutive years

- Meet some easy liquidity requirements

- The list is maintained by Nasdaq OMX

- Vanguard Dividend Appreciation Index Fund ETF (NYSE: VIG), tracks the Nasdaq US Dividend Achievers select index.

- Invesco Dividend Achievers ETF (NYSE: PFM), tracks the broad Dividend Achievers index. [This was formerly Proshares but is now Invesco.]

- Invesco High Yield Equity Dividend Achievers ETF (NYSE: PEY), corresponds to the Nasdaq Dividend Achievers 50 index. [This was formerly Proshares but is now Invesco].

- The achievers 50 index consists of the top 50 highest yielding stocks that have raised their dividends for at least 10 straight years. These stocks must also trade a minimum of $500,000 per day in November and December before the list is reconstituted.

An important difference between the dividend achievers index and the broad dividend achievers index is that the broad index can include REITs and MLPs. They are discussed more in the upcoming sections.

Dividend Contenders (think of them as Junior Champions):

The Dividend Investing Resource Center maintains a list called the Dividend Contenders, you can download the latest version in excel or PDF formats here. The list is updated monthly.

The only qualification is to have raised the dividend for 10-24 consecutive years.

Dividend Challengers:

The list is also updated monthly at The Dividend Investing Resource Center.

The only qualification is to have raised the dividend for 5-9 consecutive years.

Yield Figures as of Aug 2014:

- The average yield of a champion is 2.64%

- The average yield of a contender is 2.76%

- The average yield of a challenger is 3%

Example: Atmos Energy Corporation (NYSE: ATO) has raised its dividend for 26 consecutive years.

Challenger Example: Columbia Sportswear Company (NASDAQ: COLM) has raised its dividend for 9 consecutive years. Challengers tend to lift their dividends at a faster pace than champions and contenders.

Survivorship Bias:

Remember that the companies we are examining are ones that have never been cut from the list.

Example:F.N.B. Corporation (NYSE: FNB) has a 35-year history of raising its dividend until 2009. In February 2009 it cut its dividend in half.

Past Performance Is No Guarantee Of Future Results, But It’s Pretty Close

The Sharpe ratio measures the amount of return you are getting versus the amount of risk being taken. The higher the number, the better the risk-adjusted return.

Example stocks looked at:

- Procter & Gamble (NYSE: PG)

- Johnson & Johnson (NYSE: JNJ)

- Colgate-Palmolive Company (NYSE: CL)

- The Clorox Company (NYSE: CLX)

The key to obtaining incredible results is to find companies that raise dividends at a large enough rate so that they keep ahead of inflation and become wealth builders.

Reinvesting dividends protects you and allows you to profit in extended bear markets.

Be wary of the Lake Wobegon Effect, which says it is a natural human tendency to overestimate one’s capabilities. Do not overestimate your own investing capabilities. Trying to trade in and out of the market is a fool’s game. Invest in great companies that raise their dividend every year.

Why Companies Raise Dividends?

Dividends represent a stronger commitment to shareholders than stock buybacks.

Stock buybacks can increase earnings per share (EPS) and is another way of increasing yield to investors, but can also be used to manipulate EPS figures.

Dividends are paid by firms with higher permanent operating cash flow, while repurchases are used by firms with higher temporary non-operating cash flow.

Abbott Laboratories (NYSE: ABT) paid a dividend every year since 1924 and raised it for 42 consecutive years.

Eaton Vance Corp (NYSE: EV) has increased its dividend every year since 1980.

An activist investor is an investor that owns 5% or more of a company’s outstanding shares and files as Schedule 13D form stating it wants to make changes in company management.

For an example of shareholder activism, see Dan Loeb’s letters to the Yahoo board of directors in 2011 demanding the resignation of co-founder Jerry Yang.

Serious dividend investors consider the safety of the dividend (the likelihood it will be paid) to be just as important as the yield percentage.

Get Rich With Boring Dividend Stocks

Many studies have shown that lack of financial literacy leads to lower net worth and the likelihood of being unprepared for retirement.

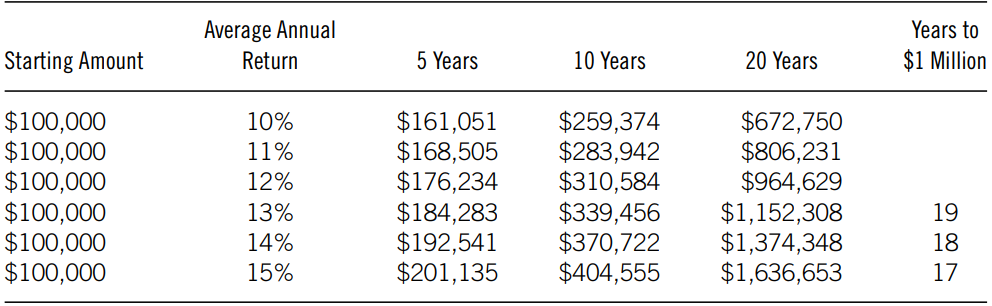

With a 13% average annual total return, $100,000 turns into $1M in 19 years. Check out the below table:

A 21-year-old who invests $2,000 in an IRA for 10 years and then stops investing will make more than someone who starts investing at 31 and continues investing until the age of 60.

Your financial dreams can also come true. All it takes is to set aside a small amount of money and invest it in quality companies that pay a decent yield and grow the dividend yearly by a significant amount.

Get Higher Yields And Maybe Some Tax Benefits

Certain types of stocks pay higher yields than typical dividend stocks.

These include:

- Closed-End Funds

- Real Estate Investment Trusts (REIT)

- Business Development Companies (BDC)

- Master Limited Partnerships (MLP)

- Preferred Stocks

Closed-End Funds:

It is possible for a closed-end fund to sell for less or more than the net asset value(NAV).

When researching a closed-end fund, you always want to know if a fund is trading at a discount or premium to its net asset value.

- Premium = the price an investor pays that is higher than the actual value of the fund’s assets.

- Discount = the price an investor pays that is lower than the actual value of the fund’s assets.

Two places that will show information on the NAVs and other data can be found at the Closed-End Fund Association website, or Morningstar.

Book Value Per Share = the amount the company would be worth if its business were liquidated. Calculate easily by dividing shareholder equity by the number of shares outstanding.

The best scenario is when you buy a fund at a discount, the NAV goes up, and the price eventually closes that discount to trade at a premium.

Example CEFs mentioned in the book:

- DWS Municipal Income Trust (KTF)

- Liberty All-Star Growth Fund (ASG)

Check the funds out carefully before investing.

- Are the assets distressed?

- Is the dividend sustainable?

- Will the fund company remain solvent?

Master Limited Partnerships (MLP):

Here is the Investopedia page on MLPs for an explanation.

An MLP is a company with a special structure that bypasses corporate taxes because it passes along nearly all of its profits to unit holders in the form of a distribution.

Note that an MLPs have units, not shares, and pay distributions, not dividends. There are important differences between the two from a tax perspective.

Read the investor relations page of the website of any MLP you are considering investing in, to get a thorough understanding of the way the company pays distributions.

A lot of MLPs are energy companies with oil and gas pipelines.

Any decrease in earnings can result in a dividend cut. The distribution is usually not as stable as a strong dividend payer such as The Clorox Company.

Plains All American Pipeline (NYSE: PAA) has raised its distribution for 13 consecutive years (at time of publication).

TC Pipelines (NYSE: TCP) has raised its distribution for 15 consecutive years (at time of publication).

An MLP can be good for estate planning because the heirs inherit the units at the market price at the time of death. It allows the unit holder to collect tax deferred income for years.

Real Estate Investment Trusts (REITs):

Here is the Investopedia page on REITs for an explanation.

Example: Tanger Factory Outlet Centers (NYSE: TCP) develops and operates shopping centers, has raised its dividend every year since 1993 (at time of publication).

Business Development Companies (BDCs):

Here is the Investopedia page on BDCs for an explanation.

A BDC is a publicly traded private equity investment firm. They can be somewhat high-risk but also offer high dividend yields.

Example: New Mountain Finance Company (Nasdaq: NMFC)

Example: Main Street Capital Corporation (Nasdaq: MAIN)

It is usually best if you can find a high yielding BDC trading below NAV.

Do your homework on the company and see how consistent the dividend has been, and try to determine if it will be sustainable.

A BDC must pass at least 90% of earnings to shareholders.

BDC can be volatile because they usually invest in one sector.

Preferred Stocks:

Combination of a stock and bond.

Cumulative preferred shareholders get dividends stored for them even in years when companies did not pay dividends.

Issued at par value and the dividend is usually fixed.

Financial institutions make up about 85% of all preferred stock holders.

What You Need To Know To Setup A Portfolio

If you hold only stocks with double-digit yields, it can be very risky.

Diversify your dividend paying stocks across different yields and sectors. Industrials, technology, MLPs, REITs, healthcare, energy, consumer staples, etc. diversify among these groups and more.

You will constantly have some sectors outperforming the market and some underperforming.

Don’t just load up on stocks paying 10% dividends. You need to take into account risk and the growth of the dividend. The author would rather own a stock with a 4% yield that grows its dividend every year by 10%, than a stock with a 6% yield and a dividend growth of 4%.

How to Pick Dividend-paying Stocks:

The first thing you need to do is answer these questions:

1.What is your time frame?

2.What is the purpose of the portfolio, income or wealth creation?

If you need the money back in three years or less, don’t invest in stocks.

The compounding nature of the rising dividend really kicks into gear around year 8 or 9, the longer you can go without touching the principle, the better.

The key criteria you should factor are yield, degree of safety, and potential for dividend growth.

Don’t buy dividend stocks based on when the dividends are expected.

Remember that growth and safety of the dividend are more important than the yield.

Avoid the temptation of adding too many REITs and MLPs because of the high yields.

A stock with a yield of 10% should be a warning sign. If you are going to invest in a stock with that yield, look at it very carefully.

The first thing you should look at is the payout ratio. The payout ratio is the ratio of the dividends paid versus net income.

The payout ratio tells you whether the company has enough profits to maintain or grow the dividend. The lower the payout ratio, the more room there is to grow the dividend.

Avoid investing in companies with a payout ratio over 100%. That is often the scenario when you see a stock with a yield above 10%.

Calculate the payout ratio using free cash flow. It is a more accurate representation of whether a company will be able to pay its dividend than using earnings.

Cash flow is more difficult to manipulate than earnings and net income.

Generally, look for a payout ratio of 75% or less. If it is a utility, REIT, or MLP the payout ratio can be higher.

Dividend Growth Rate

The spreadsheet maintained at The Dividend Investing Resource Center has a column labeled DGR that shows the dividend growth rate of each company. The website Dividata offers the dividend history of most companies.

Companies will occasionally pay special dividends. Don’t include special dividends in any annual growth calculations.

The 10-11-12 System

The three important criteria in picking dividend stocks in the 10-11-12 system are:

1.Yield

2.Dividend Growth

3.Payout Ratio

Do not chase yield, never buy a stock just because the yield is attractive.

The historical average dividend growth of the S&P 500 is 5.5% per year.

Payout ratio is all about safety of the dividend.

Remember, look for payout ratios based on the free cash flow of 75% or less. Unless the stock is a BDC, REIT, or MLP in which case they can be as high as 100%. In those cases the margin of safety is much lower.

Formulas:

These numbers are meant to be a guide, they are not set in stone. These figures are based on the following assumptions:

1.Unless otherwise stated, over the next 10 years the stock will appreciate 7.84% per year. This figure is equal to the historical average of the stock market since 1961.

2.The average stock performance and growth are consistent. Obviously this will not be the case in real life.

There are online calculators available to calculate dividend returns. The author recommends the Wealthy Retirement Dividend Calculator which is the website for his retirement newsletter.

How to Setup Your Own 10-11-12 Portfolio:

Example company: Kimberly-Clark Corporation (NYSE: KMB) has raised dividends for 48 consecutive years.

Three guidelines for setting up your portfolio:

1.Payout ratio 75% or lower

2.Starting yield of 4.7% or higher

3.Dividend growth of 10% or higher

Payout Ratio

Of all the guidelines, payout ratio is the one you’ll want to stick to the closest.

Payout ratio of 75% or lower not including BDC, REIT, or MLP in which case they can be as high as 100%.

In this entire strategy, the reliability of the dividend is the most important factor.

Keep an eye on the free cash flow and if management has publicly stated a payout ratio goal.

Yield of 4.7% or Higher

A 4.7% yield on a stable company is pretty solid.

A stock with a 4% yield that grows by 10% per year will yield double digits by year 11 and will yield 20% by year 18.

Dividend Growth of 10% or Higher

It is not recommended to buy a stock with a 13% yield with a dividend that is unsustainable.

When to Sell:

At least once a year look at your stocks to see if any of the following has occurred:

- Increased payout ratio

- Decline in cash flow, earnings, or sales

- Change in dividend policy

Any major changes in these three areas may indicate that it is time to sell.

DRIPs And Direct Purchase Plans

DRIP – Dividend Reinvestment Plan

Some companies offer a direct stock purchase plan (DSPP) where you can buy directly from them.

Company DRIPs and DSPPs may have fees involved that are higher than a broker, do your research before purchasing direct instead of through a broker.

Some companies allow you to reinvest your dividends at a discount to the current market price.

Example: Healthcare Realty Trust (NYSE: HR) allows you to reinvest dividends at a 5% discount (at the time of book publication).

Look at all costs involved before making a decision.

Using Options To Turbocharge Your Returns

Most people who lose money trading options do so because they buy options, let’s see how to sell options and be on the winning side.

Two kinds of options are:

- Puts

- Calls

Put: a contract giving the buyer the right, but not the obligation, to sell a stock at a specified price by a specified date.

Call: a contract giving the buyer the right, but not the obligation, to buy a stock at a specified price by a specified date.

Hypothetical example: shares of Microsoft are trading at $25, in July an investor buys the January $30 call for $1. This means the call buyer has the right, but not the obligation, to demand the shares of Microsoft at $30.00 from the call seller at any time between now and the third Friday in January. The $30 price is called the strike price.

Buying a put on a stock you own is like buying insurance.

Covered Call: when an investor owns shares of a company and sells a call option against those shares and agrees to sell those shares to the call buyer at the strike price.

If you sell a call at a strike price that is higher than the price you paid for the stock, you cannot suffer a loss as a result of the call being exercised. You only have a loss of opportunity if the stock goes higher than the strike price.

Stocks that are more volatile have higher priced options.

If you’re looking for current income, selling options is a terrific strategy to boost your returns. But it is not necessarily for long-term investing to build wealth and reinvest dividends.

Selling covered calls is a great way to generate current income.

Selling puts is a great option for dividend investors. It gives you an opportunity to buy stocks cheaply and wait for costs to go down while collecting income. You should only sell a put option if you want to own the stock at the strike price and have the money to purchase it.

Foreign Stocks

Many foreign dividend payers can have considerably higher yields than their American counterparts.

Foreign companies are usually not classified as perpetual dividend raisers because of currency fluctuation.

ADR = American Depository Receipt. Allows you to invest in a foreign stock held in US currency and gives the right to change to foreign currency at any time.

Foreign companies often pay dividends only once or twice a year instead of quarterly like US companies.

Taxes

It's nearly impossible to predict what changes to tax laws might be forthcoming. But if you hear rumours of a rate hike on dividend taxes, look for stocks with strong insider ownership as you might be able to receive a special dividend before the rate increase.

According to Professors Michelle Hanlon at Massachusetts Institute of Technology and Jeffrey L. Hoopes at the Ohio State University, before expected tax increases, companies, especially those with large insider ownership, often pay special dividends before the higher tax rate goes into effect because eventually the owners will be benefited the most in any such scenarios.

Dividends held in an IRA or 401k are not taxed. You can consider holding dividend stocks in your tax deferred IRA or 401k.

There may be foreign taxes on foreign stocks. Consult your tax adviser for advice.

Conclusion

In the final chapter of the book, the author concludes that all of us are trying to achieve our financial goals and the path to achieve is through investing in different financial instruments like stocks, banks deposits, bonds etc. Since many of them attract a significant amount of risk. So what option do we have?

The author urges us to put the 10–11–12 System to work and start getting rich with dividends.

Letting your investments compound over time will enable you to reach your financial objectives. That’s what this book is all about.