What Are Savings?

Savings refer to the excess of income over expenses. This excess is what you have left with you after you’ve incurred all your necessary expenses (bills, groceries, etc.)

Different mode of Saving

Senior Citizen Savings Scheme

National Savings Certificate

Fixed deposits

Savings Bank account

Recurring deposits

Kisan Vikas Patra

Why is Savings Important?

Savings are important because they help you meet future goals, such as buying a house, or even short-term goals, like a short vacation.

Long-Term Security: Saving money is like building a safety net for your future. It helps you handle unexpected expenses and gives you peace of mind.

Financial Independence: Saving money makes you more independent. You can spend on what you like and live comfortably.

Taking Risks: With savings, you can take risks like starting a business or changing careers without worrying too much about money.

Reducing Stress: Having savings means less stress about the future, like retirement or medical expenses.

Compound Interest: Saving allows your money to grow over time with compound interest, helping you beat inflation.

Usually, people utilize their savings in the following way-

-They put it away in a savings account or

-They invest it.

We will discuss both ways of utilizing your savings, one by one.

How do you calculate your Savings?

Your savings rate should be the amount of money you save compared to how much you make.

If we consider the 50/30/20 rule of thumb, almost 20% of what you earn should go into your savings.

However, it is further dependent on various factors like your age, risk appetite, goals, and more.

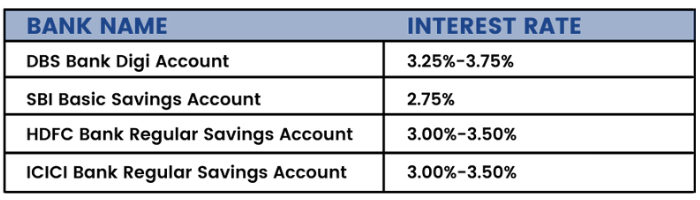

The following interest rates are applicable on the popular savings accounts of India as of November 2021 –