Cryptocurrency

Introduction

A new type of currency is trending in this digital world- Cryptocurrency. Recently, the immense increase in the prices of cryptocurrencies has come to the attention of the world in the last few years and has brought this investment product into the limelight. However, most people are not very sure of what it is.

This module has been entirely dedicated to cryptocurrencies. We have covered all the important aspects of this product including how you can buy and sell them and of course how you can use them.

What is a cryptocurrency?

So, let’s come to the basic question, what it is? To put it simply, a cryptocurrency is a virtual medium of exchange to conduct financial transactions through the internet. In other words, it is digital money where there are no physical coins or notes. It can be transferred to someone online, without the use of any bank or financial agency.

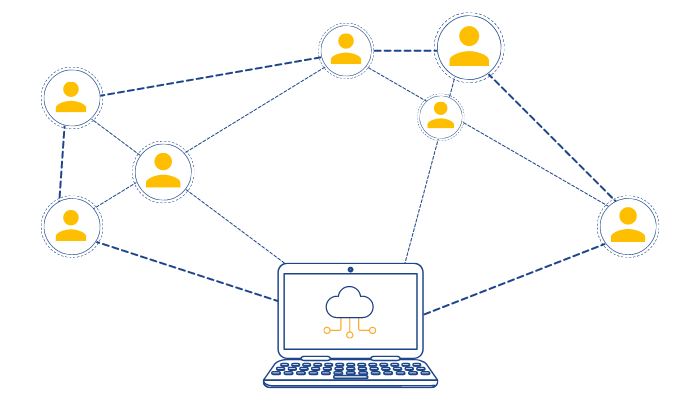

The cryptocurrency market is an alternative to the traditional banking system that is used globally. While in the traditional banking system, a central authority controls and maintains all the transactions, in a crypto-system, the transactions ledger is distributed over millions of computers. Moreover, while the traditional banking system has only a few banks, the crypto-system is much larger having no restriction on anyone entering or exiting the system. Hence, the cryptocurrency system is more open, and where no one controls individuals or their participation in the system.

Now, you must be wondering if there are no banks or financial agencies involved in a cryptocurrency transaction, how does the transaction take place? Well, cryptocurrencies use a technology called Blockchain, which we have explained in section 3 of this module. The use of blockchain brings transparency to the transactions and helps cryptocurrencies to remain decentralized.

Cryptocurrencies are not controlled by any central authority and hence are out of government control and interference. To send and receive cryptocurrency without requiring a third party to verify the transactions with the help of public-key cryptography (PKC) framework which consist of private and public key. Every cryptocurrency has 2 sets of keys – one public key (similar to a bank account number) and a private key (similar to an ATM PIN). When one user sends a cryptocurrency to another individual, these public and private keys are given to the receiver. There’s no third party involved in this entire transaction.

They have minimal processing fees since no third party is involved in the transaction.

Bitcoin is the most popular cryptocurrencies at present. We have discussed it in detail in a later section of this module. There are other popular cryptocurrencies as well such as Ethereum, Litecoin, Tether and others.

Cryptocurrencies are extremely volatile and involve a significant amount of risk. Participate in the cryptocurrency market only after obtaining sufficient knowledge about it.

Cryptocurrency mining

You will often come across the word cryptocurrency mining. Cryptocurrency mining is a term used for the process of earning a cryptocurrency for a work you complete that is by solving cryptographic equations through the use of computers. The process mainly involves validating data blocks and adding transaction records to the blockchain. People participate in crypto mining mainly for income and the freedom to earn money without the interference of any government.

Properties Of Cryptocurrencies

Now let us discuss the properties of cryptocurrencies that will help us to gain a better understanding. The main features of cryptocurrencies:

- Pseudonymous: Cryptocurrencies are completely anonymous. You don’t know who you receive it from and who you send it to. The senders and receivers are identified by a 30 character number and have no connection with their real-world identity.

- Fast transaction: The transactions are carried out within just a couple of minutes and take place on a global network. Since they use state-of-the-art technology, the transactions can take place anytime, anywhere.

- Irreversible: Cryptocurrency transactions are irreversible, which means once a transaction has been confirmed, it cannot be reversed. Once the money has been sent, it has been sent. While this can be advantageous for the person who receives the money, this property makes it susceptible to scams and hacking.

- Secure: The above feature may lead you to think that cryptocurrencies are not secured. Well, that’s not true. Only the owner of a cryptocurrency knows the private key (like a password, similar to an ATM PIN) and can send it to someone else. A private key gives you the ability to prove ownership or spend the funds associated with your public address. These private keys are big numbers (13 digits) and are almost impossible to hack.

Are you wondering then what were the scams and hacking we were talking about earlier? We have discussed it in the later section of this module.

- Easy to use: Using cryptocurrencies is completely hasslefree. There’s no bank account opening, document uploading, using some payment gateway etc. with cryptocurrencies. All you need to do is download a software for free and install it and you can receive and send cryptocurrencies. No one can stop you.

- Impossible to counterfeit: One of the main reasons why cryptocurrencies are so popular is because they are impossible to counterfeit, thanks to the blockchain technology.

- Counters inflation: All countries in the world have centralized governments where the economy and money control are managed by the government. An individual has no option but to follow the rule of the land. Hence, if a government prints more money and causes inflation, the common people have to bear the brunt. Cryptocurrencies are a good alternative since they do not fall under the purview of any centralized government. They are a good tool to fight inflation.

Blockchain Technology

No discussion of cryptocurrencies is complete without understanding blockchain technology, the backbone of the cryptocurrency world. To put it very simply, blockchain is a digital decentralized database where information is stored in such a way that it is very difficult to change, hack or cheat the system. The goal of blockchain is to record the information but not change it. It is a digital ledger of transactions where information is collected in groups (or blocks) and are held in blocks as well. The information is then duplicated and distributed across the wide range of computer systems.

Hence, each block in the chain contains many transactions. Every time a new transaction takes place, a record of the same is added to every participant in that chain.

Of course, this is a simplistic understanding of blockchain technology. The actual technology is much complex and entails various unknown factors.

Blockchain technology has revolutionized the entire financial industry through its inherent benefits such as increased transparency, cost reduction, accurate tracking mechanisms and others. It is important to remember that the use of blockchain technology is not limited to the financial industry only. It is used for settling trades, voting, and many other activities.

Participants in the blockchain network use this technology to confirm transactions without depending on a central authority to do so.

Being a decentralized digital system, cryptocurrencies use blockchain technology for its operation. In fact, blockchain is the foundation of cryptocurrencies.

How? Let us understand.

Blockchain enables cryptocurrency issuing companies to transparently record ledger of payments. Under any banking system, a user’s data is controlled by the central banking system and the government. If the data is hacked, a user’s private information is at risk. In the case of government instability or a bank’s collapse, millions of user data is susceptible to hacking and misuse.

Blockchain allows cryptocurrencies to operate without the requirement of a central authority and store data in a manner that is impossible to hack. This helps in many ways. It provides a stable financial network for countries with unstable currencies. It also connects a user to a wider range of other users, enabling them to do business internationally.

Using cryptocurrencies instead of physical currencies provides financial freedom to people. Also, elimination of any intermediary removes additional costs such as transaction cost.

A Brief History Of Cryptocurrencies

Taking a quick look at how cryptocurrencies came into being, it is essential to understand the economics behind them. In this section, we will briefly discuss the history of cryptocurrencies.

As we all know, Bitcoin is the most popular cryptocurrency, and the oldest too. It was first introduced in 2008 through a white paper published by Satoshi Nakamoto, a pseudonymous group or a person. In 2009, it was released to the public and was received with much enthusiasm by a group of supporters who soon started mining the currency (Cryptocurrency mining has been explained in Section 6 of this module).

By the end of 2010, dozens of other cryptocurrencies appeared in the market, the most popular among them being Litecoin. Bitcoin started to be exchanged publicly around this time as well.

Soon, companies such as WordPress, Expedia and Microsoft started accepting payment in Bitcoins. This medium of exchange slowly started gaining popularity with more and more companies accepting payment through it.

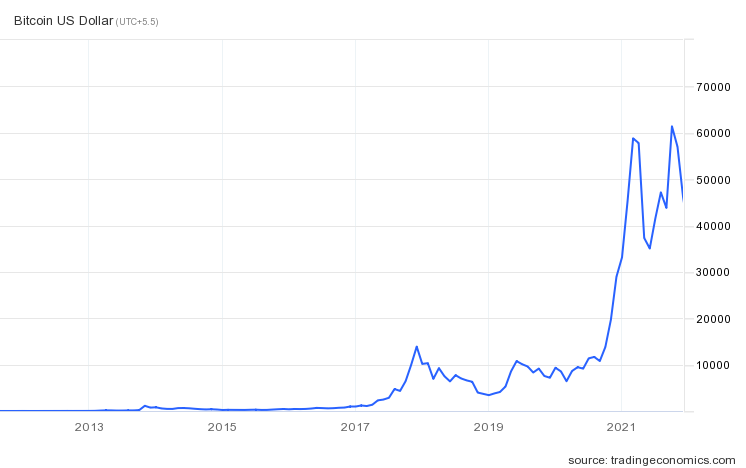

Thus, the value of bitcoins started to rise. However, a turning point came in 2017 when the prices of Bitcoins shot up radically, attracting the world’s attention to Cryptocurrencies.

The figure below shows the historical price movement of Bitcoins from 2013 till Dec 2021. The sharp rise in prices in 2017 and 2020 can be visibly noticed here. This price rise has turned multiple Bitcoin holders into millionaires.

Top Cryptocurrencies

Since the introduction of Bitcoins, many cryptocurrencies have come to the forefront. Here is a list of the top cryptocurrencies of the world in terms of market capitalization as on 27th Dec 2021:

Some other popular cryptocurrencies are:

Cryptocurrency Mining

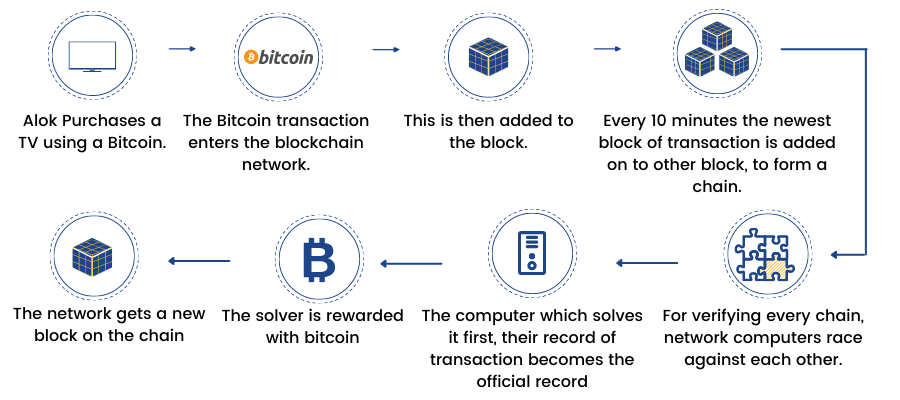

As mentioned before in this module, cryptocurrencies are ‘mined’ through a network of computers which are often known as the peer-to-peer computer. Mining entails solving cryptographic equations by using computers. The process involves validating data blocks and adding transaction records to the blockchain ledger.

Mining generates more cryptocurrencies as well as updates and secures the cryptocurrency network through constant verification of the blockchain ledger.

Who can mine cryptocurrencies?

Well, anyone with a computer and an internet connection can be a miner. However, mining may not always be profitable since it depends on the speed of your computer and the speed of the internet connection available to you. With a slow computer or a slow internet connection, one may end up spending more than what is earned through mining. That is why in most cases mining is done by specialized companies or large groups of individuals. Mining in a group provides the computing power required to make mining profitable.

How are miners encouraged to participate?

Let’s take the example of Bitcoin. The network holds a lottery regularly which encourages miner groups around the world race to solve a math problem first. Each winner gets a bitcoin which finally enters the bigger cryptocurrency network.

The picture below shows the entire mining process.

Why Are Cryptocurrencies So Popular?

These days trading and investing in cryptocurrencies is a hot topic worldwide. But what is the reason behind their popularity? There are many reasons why cryptocurrencies have gained popularity over the years:

- They are an alternative to a traditional banking system.

- They can be used for day to day transactions as well as for investment. Hence, they are a good alternative to holding cash or investing in traditional investment products such as gold and shares.

- They provide an alternative method of investment apart from traditional asset classes.

- They have the potential to become the fastest, cheapest, easiest and safest mode of exchange acceptable universally.

- Cryptocurrencies provide equal opportunity to all, irrespective of a person’s background, country of birth and other such factors. As long as a person has a device connected to the internet network, they can use cryptocurrencies. This provides broader economic freedom to all.

- Since cryptocurrencies are geography agnostic, they provide opportunities for free trade, even in countries with tight economic control.

- For countries affected by inflation fluctuation, cryptocurrencies provide safety of the value of investment and hence are a great option for savings and payments.

- They are free from government control. Traditionally, the value of every currency is dependent on various factors, especially the stability of the government. For example, on January 6th, 2021, when rioters stormed the United States Capitol, the value of USD to INR fell to ₹ 73.06 compared to ₹ 73.26 on January 5, 2021. However, USD rose to ₹ 73.58 on January 8th, 2021 once the situation was brought under control. (Please note that USD to INR rate mentions the number of Indian Rupees required to purchase 1 USD. Less amount of Indian rupees means USD is weaker). However, the value of cryptocurrency is not affected by the political and economic events happening in a country.

Why Should You Trade/ Invest In Cryptocurrencies?

Previously we have discussed why cryptocurrencies are becoming a popular investment option. But should you invest too? Let us discuss:

Cryptocurrencies can be bought and sold through online exchanges. Hence, more and more people around the world are investing in them.

Here are a few reasons why they are becoming a popular investment option:

- It is easy to invest in cryptocurrencies. You can open a secure account in just a few minutes and buy a cryptocurrency using a credit or debit card.

- Cryptocurrency like Bitcoin is expensive (₹ 3,154,592.76 as on 14th Jan 2022), and hence not many people can afford to purchase it. The good news is you don’t have to shell out so much to participate in the price movement of a cryptocurrency. You can buy a portion of a coin. Hence, people can invest some amount regularly (like a mutual fund SIP) and build up a portfolio over time.

- Some cryptocurrencies, such as Tezos and USD coins provide active rewards to the holders of the coins.

- You can transfer cryptocurrencies to someone else easily or use it to buy or sell goods or services – something that you cannot do using bonds and shares.

Trade or invest in cryptocurrencies only if you have money that you can risk. The cryptocurrency market is extremely volatile. Buying and selling at the wrong time can lead to a significant loss.

How To Buy And Sell Cryptocurrencies?

Earlier, we have learned that Cryptocurrencies are bought and sold through online exchanges – which serve as a marketplace for trading cryptocurrencies. There are several online exchanges in the world. The most popular ones are:

- Coinbase

- Bitfinex

- Binance

- Robinhood

Coinbase is the most popular and easiest to use. They have a website as well as an app. Hence, you can trade through your computer or your phone.

You can use your debit card or bank account to buy cryptocurrencies. As mentioned earlier, in most cases, you can buy a fraction of a cryptocurrency.

For investing in cryptocurrencies, you will need to open an exchange account from where you can buy and sell cryptos and also store them. The cryptocurrencies are stored in your ‘digital wallet’.

Actually, the entire process is pretty simple and is quite similar to the process of buying and selling shares.

Now that we have understood how to buy/ sell cryptocurrencies, a question arises: can we use cryptocurrencies like physical money? Let us discuss this in the next unit of our module.

Can Cryptocurrencies Be Used Like Physical Money?

Theoretically speaking, cryptocurrencies can be used to pay for goods and services, and in that sense, they are similar to physical currencies. Remember, cryptocurrencies are virtual and hence cannot be held in the physical form.

However, in many countries of the world, cryptocurrencies are not considered a legal mode of transactions and since we are guided by the law of the land we have to obey the same.

In India, cryptocurrencies cannot be used to buy and sell goods and services. However, cryptocurrency trading is legal as of January 2021.

Beware Of Scams

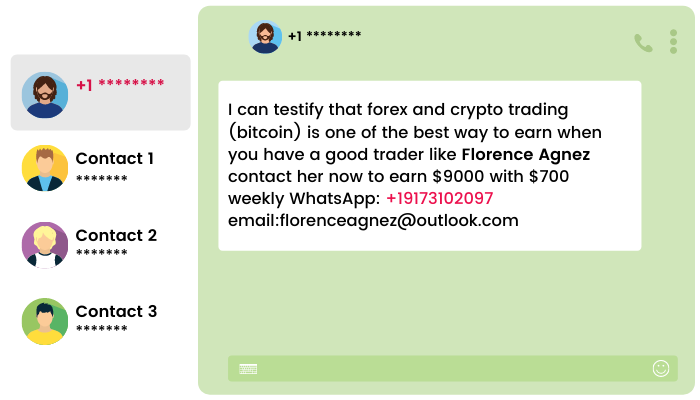

As with other financial markets, the cryptocurrency market is not free from scammers. Although blockchain technology in itself is quite full proof, scammers find out newer and innovative methods to cheat innocent people.

Let’s take an example of a possible crypto scam. Scammers may offer lucrative investment or business opportunities with promises of providing you with financial freedom. Or they may contact you through social media or WhatsApp using posts such as this:

Be very careful of them, they can be potential scams.

Be wary of messages which:

- Promise that you will make money without any hard work

- Assure big payouts in a short time

- Offer free money through cryptocurrencies

- Make claims that are not very clear

Do not enter a website or download a mobile app that looks suspicious. Do not open an email if you don’t know the sender.

Crypto-jacking

This is another type of scam which is typically associated with cryptocurrencies. Crypto-jacking is the process by which scammers use your computer or smartphone to mine cryptocurrencies without your permission or knowledge. When you visit a website, scammers put a code into your device and then use your device’s processor without your knowledge.

If you notice that your device is slower than usual, or is using more battery power or crashing often – be careful – it might be crypto-jacking.

In case you face such an issue, here are a few things you can do:

- Close all sites and apps that slow down your device.

- Install an ad blocker to defend your computer from crypto-jacking. However, ensure that the ad blocker is provided by a legible source.

Here are some preventive measures to avoid crypto-jacking:

- Use a trusted antivirus software.

- Never install software and apps you do not trust.

- Do not click on links which look suspicious.

Bitcoin – The Oldest Cryptocurrency

Finally, in this section, we will discuss the most popular and the oldest cryptocurrency: Bitcoin (BTC)

Bitcoin is the first cryptocurrency which was created in 2009. It is the most popular cryptocurrency and is known by the abbreviation “BTC”. Hundreds of cryptocurrencies were launched after the introduction of Bitcoins. All those cryptocurrencies (other than Bitcoin) are collectively known as “Altcoins”.

As is the nature of cryptocurrencies, Bitcoins are also created, distributed, stored and traded through the use of blockchain technology.

Bitcoin is mined by miners across the world. Balances of bitcoin tokens are stored using public and private keys which are linked to the mathematical algorithm that was used to create them. The public key is the address of the owner of the bitcoin (similar to a bank account number) and the private key is the secret number owned by the owner for using the bitcoin (similar to an ATM PIN).

The historical price movement of Bitcoins

When Bitcoins were introduced in 2009, they were worth nothing. Yes, that’s true. Their value was 0. Since then there was a negligible movement for some time. The first significant price movement happened in July 2010 when the value of 1 bitcoin moved from USD 0.0008 to USD 0.08. And this was the beginning of a success story. The value of Bitcoins has moved up, up and up, turning many early movers into millionaires. As on 27th Dec 2021 (1 Bitcoin = 50,762 USD/ ₹37,48,592 Indian Rupees).

Historical Price Movements of Bitcoin

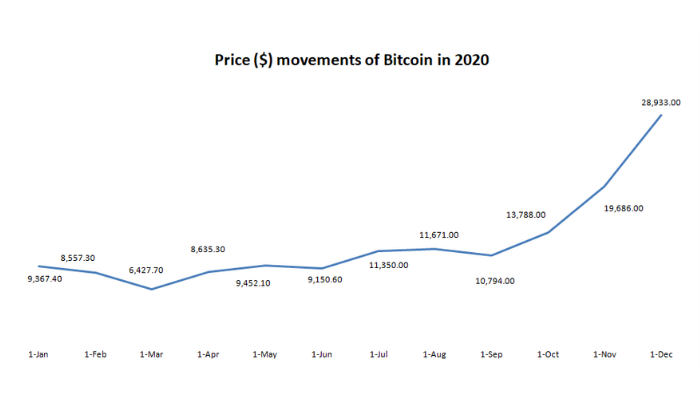

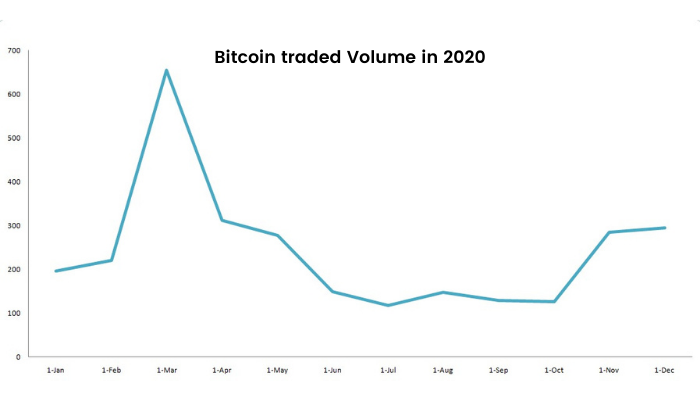

In 2020, when the world was fighting with the deadly Covid-19 pandemic and economies and stock markets from around the world were down, the prices of Bitcoins continued to go up. At the beginning of 2020, Bitcoins were still not considered a popular investment option with experienced investors such as Warren Buffet labelling it as a “no value” investment. But as economies started struggling to cope up with the pandemic and currencies started falling (USD reached its 3-year lows in 2020), people started moving towards Bitcoins since they are relatively unaffected by economic downturns. All in all 2020 proved to be quite a good year for Bitcoins with both prices and volume traded going up sharply.

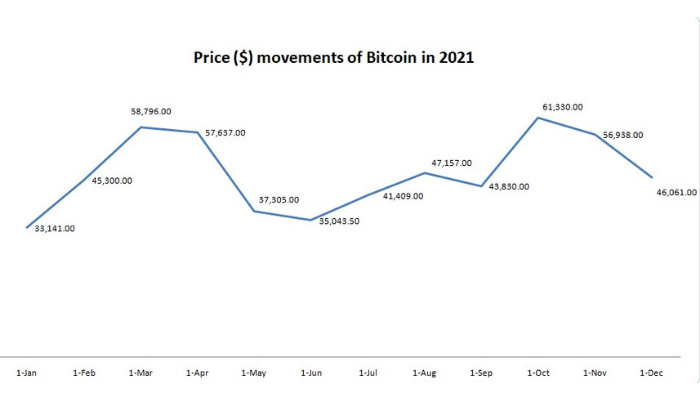

Also in 2021, the prices continued to rise further but the volume started to decrease.

Bitcoin can be bought and sold through exchanges like Coinbase, Binance etc.

Do's And Don'ts

So, are you excited to invest in cryptocurrencies? Then let’s discuss some dos and don’ts that will be helpful for you.

1. Know the risk before you invest: As we mentioned earlier, cryptocurrencies are risky. Hence, ensure that you know the risks before you get into the market. A good idea is to keep in mind a percentage of your investment that you can risk and always keep it in mind.

2. Control your emotions: Fear and greed are two emotions that lead to impulsive decisions while trading. If you want to avoid bad trades, you should control your emotions, especially fear and greed. These are also the reasons why people fall prey to scams. Even the most professional traders feel greedy and fearful. Make a proper trading plan and stick to it, no matter what the situation in the market is.

3. Have a trading plan: Since we have been talking about plans, let us elaborate a little more. A trading plan always works in the long run. Make a meticulous plan and stick to it to avoid making bad trades. Revisit the plan from time to time and re-align the plan to suit the changing market conditions.

4. Follow time-tested strategies: If you are not sure where to start, you can follow established trading strategies. You will find many on the internet. Read trading tips and learn about common mistakes committed by other traders. Then slowly as you get experience in the cryptocurrency market, you will be able to make your own trading strategy.

5. Choose a reliable crypto trading platform: These days, many platforms are available for crypto trading, among which a lot of them are scams. Hence, you need to choose a reliable crypto trading platform before you start trading. When you hear a crypto offering, go online and learn about its legitimacy. You will find discussions on online forums such as Reddit or Quora. Be very sure that the trading platform is reliable before you transfer any funds for trading.

6. Have realistic expectations: Just because Bitcoins have performed extremely well in the past, doesn’t mean it will do so in the future or all other cryptocurrencies will perform in the same way. Don’t expect huge profits overnight and be prepared that the valuation may go down as well.

7. Don’t fall prey to fake news: The crypto market is still evolving. Lots of news arises which make traders act irrationally. This leads to bad decisions and losses. Don’t follow the herd. When you hear a news, check its authenticity first and act only if it is authentic.

Summary

Let us now make a summary of the important things we’ve learned in this module:

- Cryptocurrencies are digital currencies created using Blockchain technology.

- They were first introduced in 2009.

- Bitcoin is the most popular cryptocurrency.

- Cryptocurrencies can be bought, sold, stored and used as a medium of exchange.

- They are decentralized and free from any government control.

- Cryptocurrencies are volatile.

- Cryptocurrencies are an alternative form of investment and are not easily affected by economic and political instabilities.

- Cryptocurrencies can be bought and sold through crypto exchanges such as Coinbase.

- While dealing in cryptocurrencies, be aware of hackers or scammers.

- Investment in cryptocurrencies should be made only after gaining sufficient knowledge about the products. Due to the inherently volatile nature of the market, it is possible to lose a considerable amount of money in a short time. Hence, one should participate in the market only after learning the risks of getting into it.

Inflation

It is the rate of increase in prices over a given period of time.