E-Wallets

e-Wallets are secured online wallets held by a customer for using funds online or offline. e-wallets need to be funded once and the balance in the same can be used to make transactions. For example, if an e-wallet is funded with ₹ 2000, it can be used to recharge a mobile phone for ₹500, buy groceries from a physical store for ₹1000 and purchase movie tickets online for ₹500. Once the balance of ₹2000 is used up, the same e-wallet can be funded again and the money can be used for further transactions.

e-wallets have become extremely popular in the last couple of years due to their ease of usage. Several providers offer e-wallets to customers worldwide. The most popular global e-wallet providers are Apple Pay, Samsung Pay, Amazon Pay, and Google Pay. They operate in India as well. India also has domestic e-wallet providers such as PayTM, MobiKwik, Jio Money, and others.

How to open and use an eWallet?

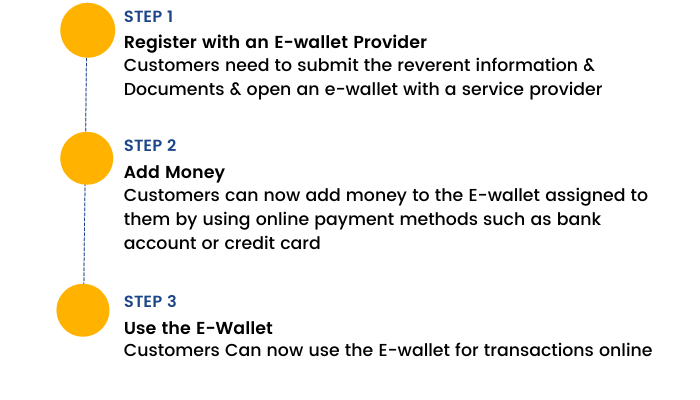

The process of opening and usage is a simple one which can be completed in just 3 steps:

Tapping an e-Wallet

One of the best features of e-wallets is ‘Tap’. e-wallets are specifically designed for usage on mobile devices and have loads of functionalities that work best on mobile phones. While making offline purchases, a person can simply open the barcode of the e-wallet and tap on a specific screen kept at the cashier’s desk and the transaction is completed immediately. There’s no need to exchange cash, swipe cards, or insert a PIN number. All people need to do is tap their mobile phones.

Functions that can be performed using e-Wallets

e-wallets can be used for a range of transactions. Some of the common ones include:

- Recharging mobile phones

- Paying mobile bills

- Paying utility bills such as electricity bills, water bills, broadband, etc.

- Paying school fees for children

- Booking train, bus, flight tickets

- Booking hotel rooms

- Paying insurance premiums

- Purchasing goods online

- Purchasing goods offline