You have reached the end of this category. To continue,view other Face2Face videos.

Watch Vivek Bajaj interacting with ace Indian investor Ramesh Damani, worth over a billion USD. He is someone who started investing in the stock market when Sensex was at 600 points. In this session, Mr Vivke Bajaj asks certain questions to Shri Ramesh Damani, to which he answers with his own experience. Mr Ramesh Damani talks about how to build a successful business and how one can prosper in their professional life.

He explains which sectors will do well for good investments, what stocks one should consider while buying, which ones to avoid and how automation might replace some jobs in the future. Computers, robots, and automation have altered nearly every job's nature and responsibilities in the last few decades. Automation and artificial intelligence are sparked a new revolution, changing jobs in every sector, from manufacturing to IT. It helps traders assess the risk of investing in a particular company. By examining a company's financial health, competitive position, industry trends, and management effectiveness, traders can evaluate the potential risks and make informed decisions about investing or trading in that company's stock.

Business analysis offers perceptions into a company's inherent value. To ascertain whether a company is overvalued or undervalued in the market, traders can examine a variety of financial metrics, including earnings, cash flow, and assets. Traders can use this information to find potential profit opportunities. Let us watch in this video, how he started his journey and what we can learn from his experience, and where we should think of investing for a secure future.

Your Speaker

Ramesh Damani

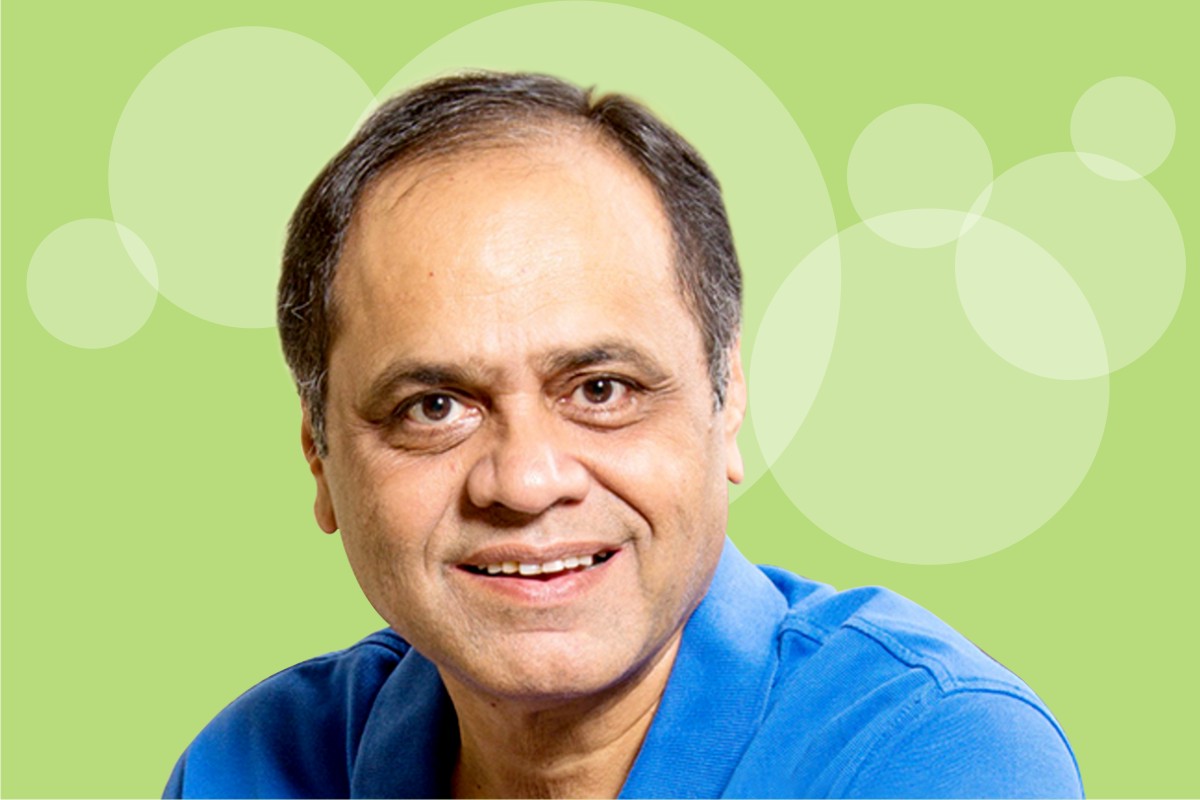

Your Host

Vivek Bajaj

_1743136705.webp)

_1742535703.webp)

_1740741478.webp)

_1740043235.webp)